Table of Contents

Market Overview

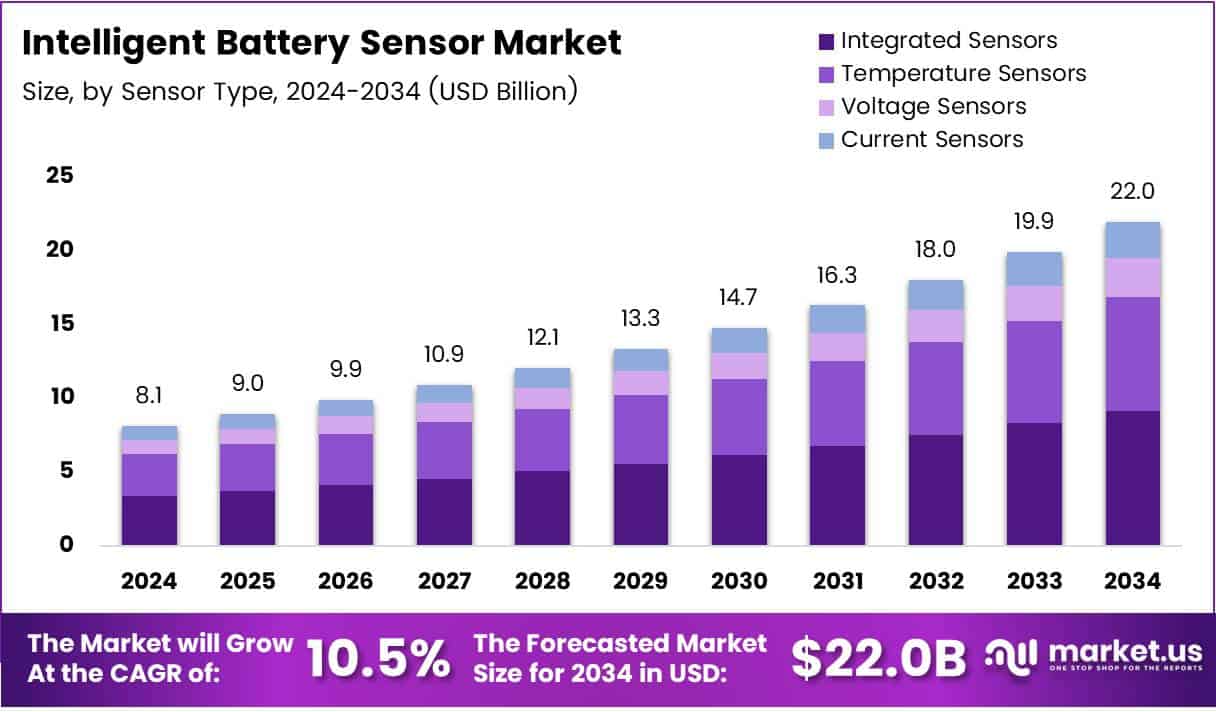

The Global Intelligent Battery Sensor Market size is expected to be worth around USD 22.0 Billion by 2034, from USD 8.1 Billion in 2024, growing at a CAGR of 10.5% during the forecast period.

The Intelligent Battery Sensor Market is witnessing strong growth due to the rapid rise of electric vehicles (EVs) and the increasing need for battery safety and efficiency. EV batteries degrade at only 2.3% per year, and most lithium-ion batteries last for about 10 years, making real-time battery monitoring essential. Intelligent Battery Sensors (IBS) play a key role in tracking battery health, temperature, voltage, and current, which helps extend battery life. In commercial electric vehicles, which face 3,000–6,000 charging cycles over their lifespan, IBS technology ensures consistent performance and prevents costly failures.

This market offers significant growth opportunities as more automakers adopt EV technology. Government support for electric mobility is also a major factor. Many countries are investing heavily in EV infrastructure and offering incentives for electric vehicle adoption. Regulatory policies that promote clean energy and reduce carbon emissions are boosting demand for advanced battery monitoring solutions. Moreover, smart cities and connected vehicles are driving the need for intelligent energy management systems. With OEMs integrating IBS systems early in production and aftermarket demand also rising, the intelligent battery sensor market is expected to grow steadily. This is the right time for businesses to invest in smart battery technologies and gain a competitive edge in the EV value chain.

Key Takeaways

- The Global Intelligent Battery Sensor Market is projected to reach USD 22.0 Billion by 2034, growing from USD 8.1 Billion in 2024 at a CAGR of 10.5%.

- Integrated Sensors led the sensor type segment in 2024, capturing 42.3% of the market share.

- OEM dominated the sales channel segment in 2024 due to early integration advantages in vehicles.

- Battery Management Systems (BMS) topped the application segment in 2024, utilizing intelligent sensors extensively.

- The Passenger Vehicle segment led in 2024, driven by the demand for fuel-efficient and advanced cars.

- Automotive Manufacturers were the top end users in 2024, due to rising production of electric and hybrid vehicles.

- Asia Pacific dominated the regional market with a 34.1% share, valued at USD 2.7 Billion in 2024, driven by EV adoption and favorable policies.

Key Growth Drivers

- EVs and hybrid vehicles are gaining popularity. They depend heavily on reliable batteries. IBS ensures safe and efficient battery operations. It reduces energy loss and extends battery life.

- Governments are pushing for low-emission vehicles. Automakers are focused on efficiency and sustainability. IBS helps reduce fuel use in conventional cars. It also improves the performance of electric models.

- Another driver is advanced vehicle electronics. Modern cars have more sensors and connected systems. IBS fits well into this shift. It supports smart diagnostics and predictive maintenance.

Market Challenges

- IBS systems can be costly. High price limits adoption in budget vehicle segments. This is a major barrier in price-sensitive regions.

- Sensor calibration and integration are complex. Compatibility with older systems is limited. This creates installation and maintenance issues.

- Global supply chain issues also affect the market. Shortages in semiconductors and key parts cause delays. This impacts production and availability.

Growth Opportunities

- Emerging markets offer big potential. Rising vehicle production and EV demand will boost IBS sales. Government support for electric mobility helps too.

- Aftermarket demand is also rising. Many users want to upgrade old vehicles. IBS helps monitor battery life and save on repairs.

- New technologies like IoT and AI will transform IBS. Smart features like predictive analytics will add value. These systems will soon work with cloud platforms for real-time updates.

- Miniaturized IBS devices are also trending. They save space and reduce energy use. This supports the design of compact vehicles.

Market Segmentation

Sensor Type Analysis

Integrated sensors lead with 42.3% share due to their compact, multi-function design. Temperature, voltage, and current sensors follow, each vital for battery safety, charge monitoring, and efficient power flow.

Sales Channel Analysis

OEMs dominate as sensors are built into vehicles during production. Aftermarket sales grow from demand for replacements and upgrades in older vehicles.

Application Analysis

Battery Management Systems (BMS) are the top application, using sensors to monitor and control battery health. Telematics and start-stop systems also adopt sensors for better efficiency and real-time insights.

Vehicle Type Analysis

Passenger vehicles lead in sensor use, driven by demand for efficiency and safety. Commercial and electric vehicles follow, using sensors to enhance reliability and manage complex battery needs.

End Use Analysis

Automotive manufacturers dominate due to rising EV adoption. Aerospace, fleet operators, electronics, telecom, and renewable energy sectors also use sensors for safety, power management, and performance.

Regional Insights

Asia Pacific

Asia Pacific leads the intelligent battery sensor market with the highest share, thanks to rapid EV adoption in China, Japan, and South Korea. Government support for clean energy and strong local manufacturing boost the market further.

North America

North America is growing steadily due to tech innovations and increasing use of advanced battery systems in EVs and industry. The U.S. drives this growth with a strong auto sector and heavy R&D spending.

Europe

Europe’s growth is driven by tough environmental laws and a major push for electric transport. Efforts to reach carbon neutrality and partnerships between carmakers and tech firms support rising sensor demand.

Middle East and Africa

The region is growing slowly, with more focus on clean energy and smart technology in industries. Though EV use is still new here, interest in energy storage and smart cities is creating new market potential.

Latin America

Latin America is making moderate progress as awareness of battery efficiency rises. Countries like Brazil and Mexico are improving auto production and investing in EV and energy projects, pushing demand for smart sensors.

Competitive Landscape

Competition is strong in the IBS market. Many global players are active. Companies are focusing on R&D and innovation. Product upgrades and strategic partnerships are common.

Market leaders offer custom IBS solutions. These products support advanced functions and are integrated into larger battery management systems.

Some firms are also focusing on cloud-based IBS platforms. These systems help monitor battery health remotely. Others are developing wireless sensor modules.

Mergers and acquisitions are shaping the market. Companies are working to expand their reach and product line.

Key Market Trends

- There is a shift toward connected vehicles. IBS supports telematics and smart diagnostics. This adds value to vehicle safety and maintenance.

- AI is now part of modern IBS. Sensors can now predict failures before they happen. This allows proactive servicing and longer battery life.

- Miniaturization is also important. Small sensors are in demand. They are easier to install and consume less power.

- Regenerative braking and energy-saving features are on the rise. IBS plays a key role in managing these systems.

- As EV charging infrastructure grows, IBS will become more essential. It ensures safe and optimized charging cycles.

Future Outlook

- The future looks promising for the IBS market. EVs, connected cars, and smart mobility trends are driving growth.

- Innovation will shape the next phase. AI-based sensors and real-time analytics will lead the way. These features will attract automakers and end users alike.

- Affordability and scalability will be key. Players who offer cost-effective, flexible systems will win. Regions like Asia-Pacific and Europe will remain top markets.

- The demand for clean and smart transportation will keep rising. This will keep the IBS market on a strong growth path.

Recent Developments

Oct 2024: Electrovaya received a C$2 million ($1.45 million) investment from the Canadian government to boost lithium-ion battery tech and local manufacturing.

Jun 2024: igus acquired a sensor company to expand its smart tech offerings and strengthen its position in industrial automation.

Conclusion

In conclusion, the Intelligent Battery Sensor market is set to grow steadily, fueled by rising demand for electric vehicles, smarter energy management, and advanced automotive electronics. As vehicles become more connected and energy-efficient, IBS will play a vital role in optimizing battery performance and ensuring safety. While challenges like high costs and integration issues remain, ongoing innovation and supportive government policies are opening new opportunities. With trends such as AI integration, miniaturization, and cloud-based diagnostics gaining momentum, the future of the IBS market looks promising and essential for next-generation mobility.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)