Table of Contents

Introduction

Interactive Kiosk Statistics: An Interactive Kiosk serves as a self-help terminal that enables user interaction through touchscreens or similar input means. It usually includes physical elements such as a screen, computer, and input tools, along with dedicated software for specific tasks.

These kiosks find common usage in offering information, facilitating self-checkout in retail, handling ticketing, and assisting with navigation.

They enhance customer service, streamline operations, and reduce costs, although they necessitate regular maintenance and security measures.

Looking ahead, emerging trends encompass the integration of artificial intelligence. Compatibility with mobile devices, and the implementation of touch-free interfaces, making them a versatile technology across various sectors.

Editor’s Choice

- The global Interactive Kiosk market is witnessing steady growth at a CAGR of 6.3%.

- In 2023, the Interactive Kiosk market was valued at USD 31 billion.

- Olea Kiosk Inc. and GLORY Ltd., have managed to establish a strong presence, each commanding a substantial 15% market share.

- The market distribution for Interactive Kiosks is regionally diverse, with North America commanding the largest share at 44.0%.

- By 2027, the Sel-service Kiosk is expected to reach an impressive revenue figure of USD 21,415.4 million. Reflecting the increasing demand and adoption of self-service kiosk solutions across various sectors.

- Based on a research study, approximately 73% of surveyed shoppers have expressed a preference for retail self-service technologies like self-checkout. As opposed to interacting with in-store associates.

- A survey by PYMTS found that 49.4% of retail customers use self-service checkouts for speed. While 34.7% choose them for shorter lines. Hotel guests may also appreciate the flexibility to arrive or depart at their own pace.

Interactive KIOSK Market Statistics

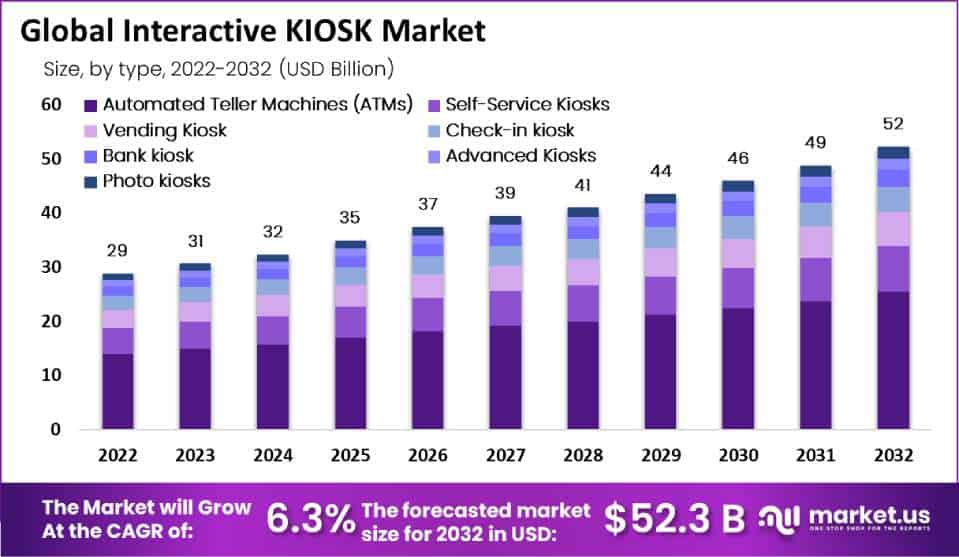

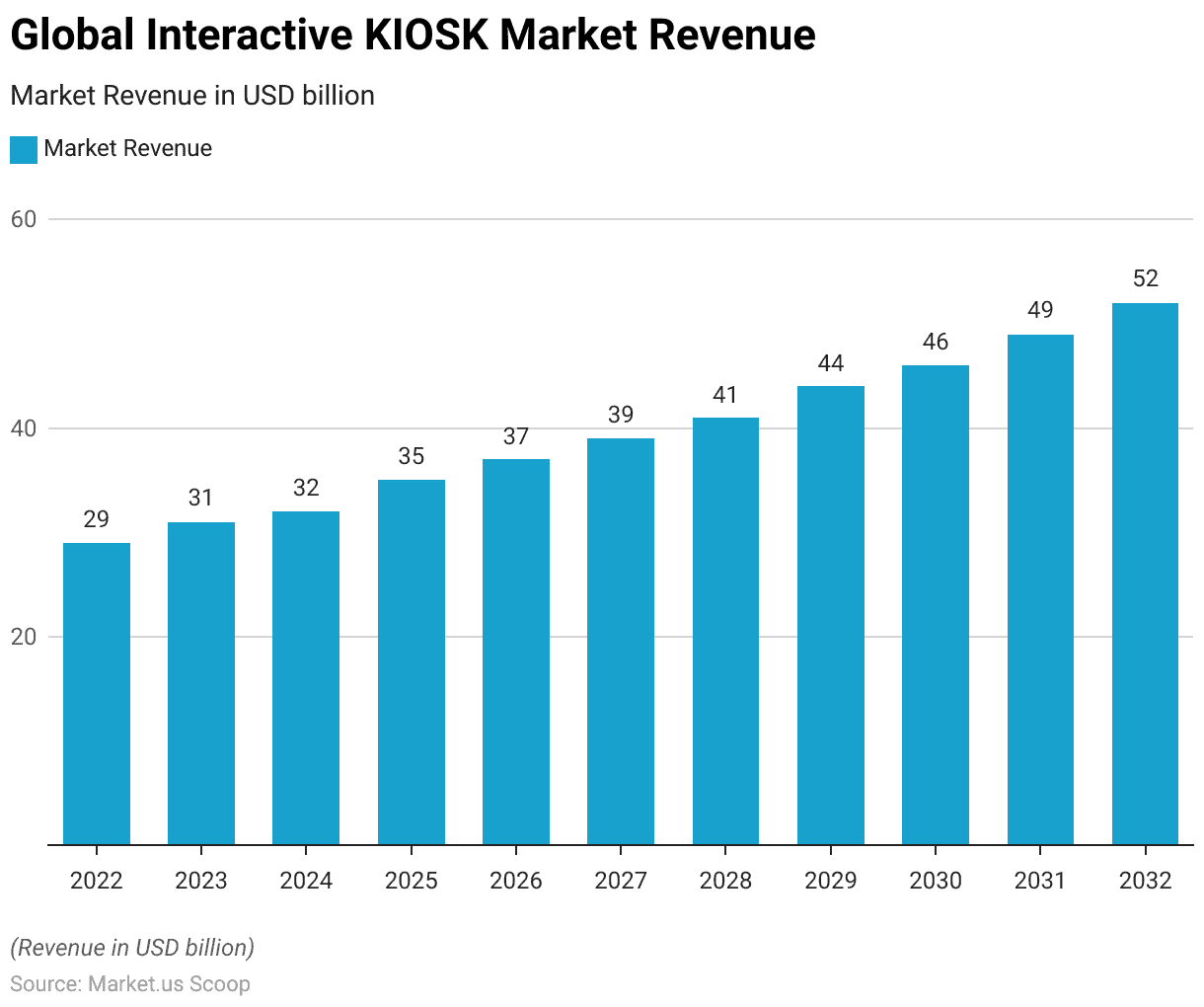

Global Interactive KIOSK Market Size Statistics

- The global Interactive Kiosk market is witnessing steady growth at a CAGR of 6.3%, with revenues projected to increase over the coming years.

- In 2022, the market was valued at USD 29 billion, and this value is expected to rise to USD 31 billion in 2023 and further to USD 32 billion in 2024.

- The growth trend continues, with the market estimated to reach USD 35 billion in 2025 and USD 37 billion in 2026.

- Looking ahead, the market is anticipated to expand even further. Reaching USD 39 billion in 2027, USD 41 billion in 2028, and USD 44 billion in 2029.

- By 2030, the market is forecasted to achieve a value of USD 46 billion, with subsequent years showing continued growth. Potentially reaching USD 49 billion in 2031 and USD 52 billion in 2032.

- These promising figures indicate a robust and optimistic outlook for the global Interactive Kiosk market in the foreseeable future.

(Source: Market.us)

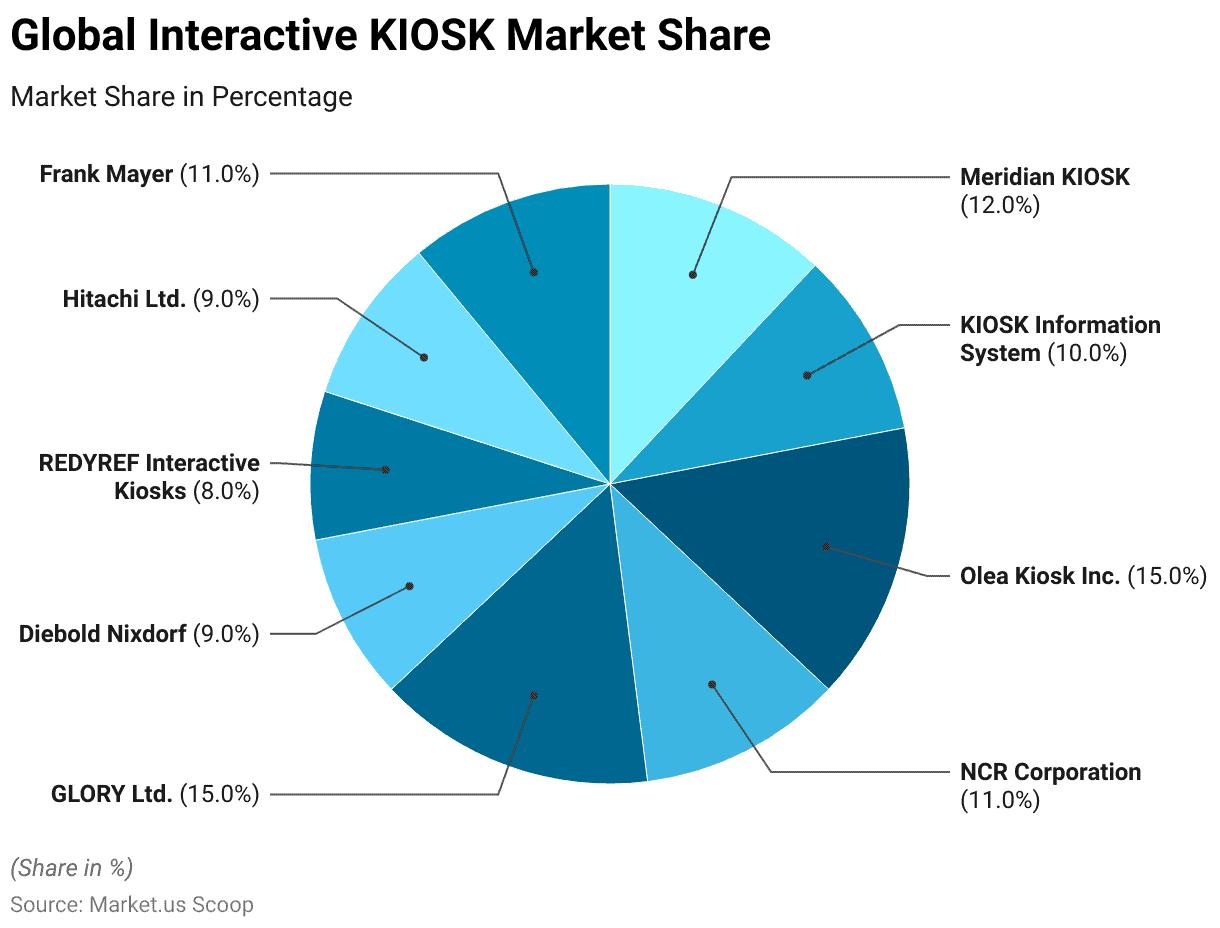

Key Players in the Global Interactive KIOSK Market Statistics

- Within the competitive landscape of the Interactive Kiosk industry, various companies are actively vying for their share of the market.

- Two companies, Olea Kiosk Inc. and GLORY Ltd., have managed to establish a strong presence, each commanding a substantial 15% market share. This indicates their significant market influence and competitive edge.

- Following closely behind, Meridian KIOSK holds a 12% market share, showcasing its position as a key player in the industry.

- NCR Corporation is not far behind with an 11% market share, underlining its competitive strength.

- Hitachi Ltd. and Frank Mayer both contribute significantly, each holding a 9% market share. Which is noteworthy in the context of market dynamics.

- Diebold Nixdorf also holds a 9% share, emphasizing its presence in the market.

- Additionally, KIOSK Information System and REDYREF Interactive Kiosks play a significant role. Accounting for 10% and 8% of the market, respectively.

- Collectively, these companies represent a substantial portion of the Interactive Kiosk market, underscoring their influence and competitiveness within the sector.

- It’s important to note that while these major players hold significant shares. There are also other smaller players in the market, contributing to the overall diversity and competition in the industry.

(Source: Market.us)

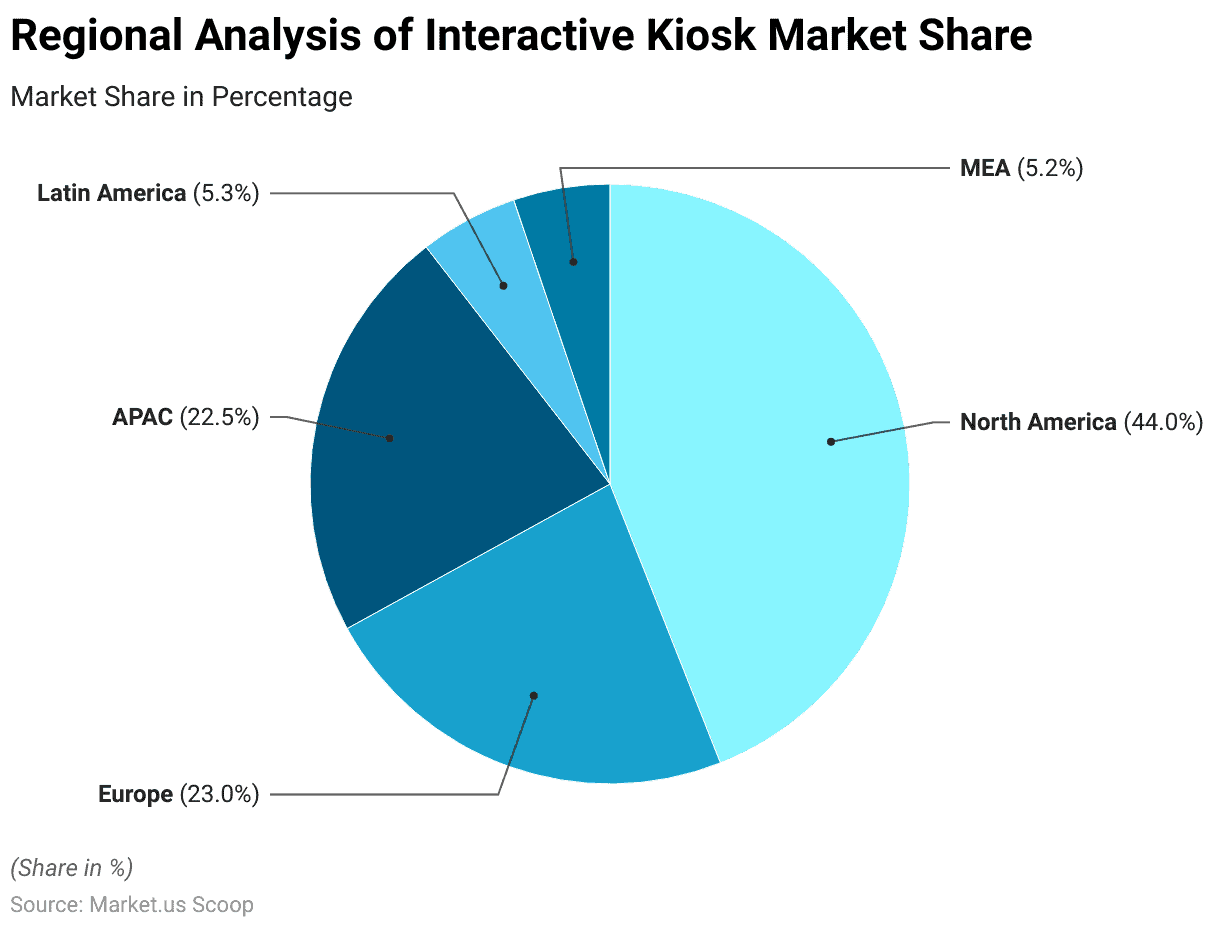

Regional Analysis of the Global Interactive KIOSK Market Statistics

- The market distribution for Interactive Kiosks is regionally diverse, with North America commanding the largest share at 44.0%. This dominance highlights the significant adoption and utilization of Interactive Kiosks in North American markets.

- Europe follows as the second-largest market, holding a substantial 23.0% share. Reflecting its significant presence and demand for these self-service terminals.

- The Asia-Pacific (APAC) region is also a notable player, contributing significantly with a market share of 22.5%. Showcasing the growing popularity and adoption of Interactive Kiosks across various APAC countries.

- Latin America and the Middle East & Africa (MEA) regions account for smaller yet important shares, with Latin America at 5.3% and MEA at 5.2%.

- These regions represent emerging markets with potential for growth and expansion in the Interactive Kiosk sector.

- In summary, the market share distribution indicates a strong foothold in North America and Europe, with APAC showing promising growth prospects. While Latin America and MEA regions exhibit opportunities for further market development.

(Source: Market.us)

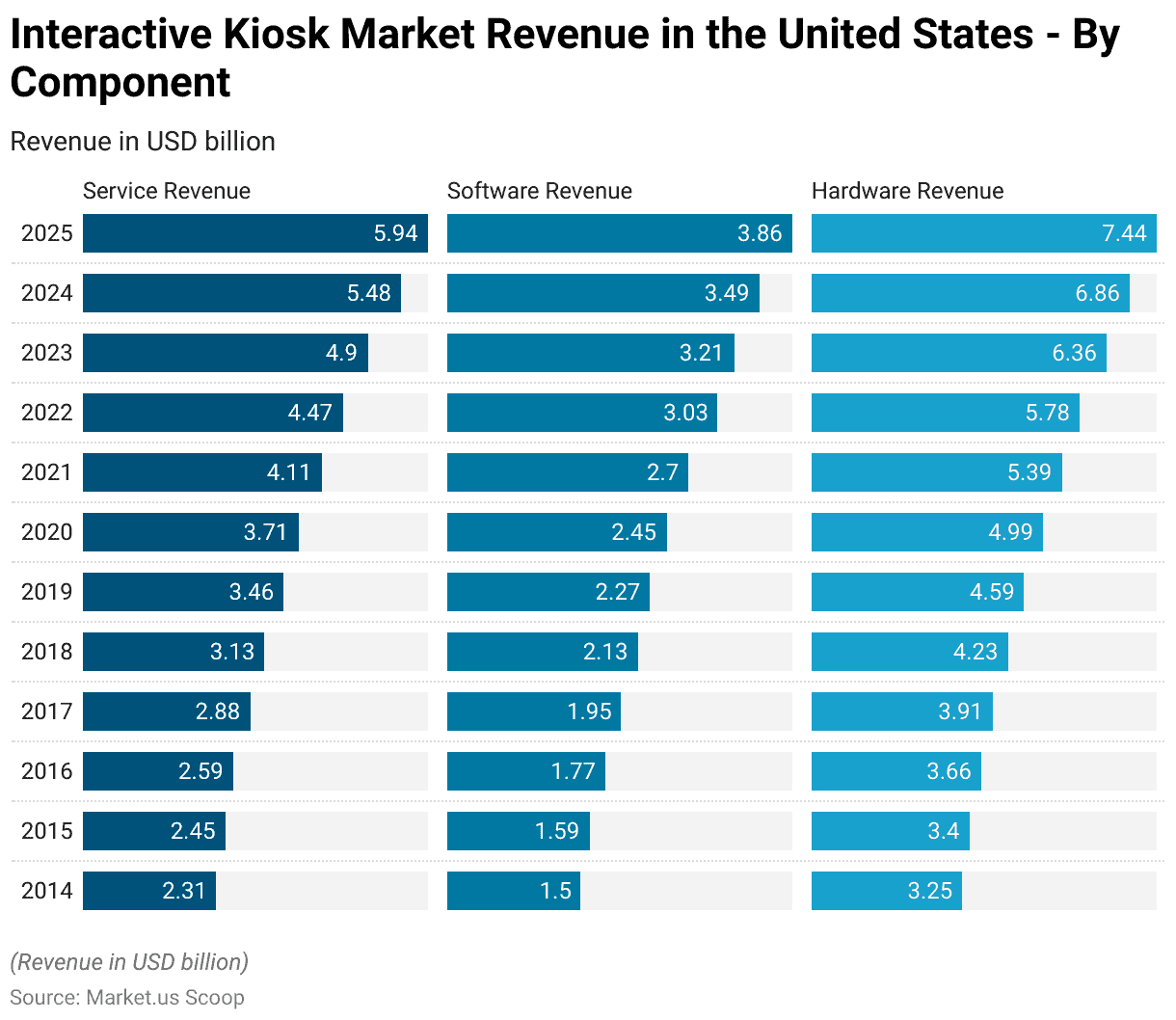

Interactive Kiosk Market Revenue in the United States – By Component Statistics

- From 2014 to 2025, the Interactive Kiosk market in the United States exhibited consistent growth across its key components: Service Revenue, Software Revenue, and Hardware Revenue.

- In 2014, the Service Revenue stood at $2.31 billion, with Software Revenue at $1.5 billion and Hardware Revenue at $3.25 billion.

- Over the years, these figures steadily increased, reflecting the expanding adoption of Interactive Kiosks.

- By 2025, the Service Revenue is projected to reach $5.94 billion. Software Revenue to grow to $3.86 billion, and Hardware Revenue to reach $7.44 billion.

- This sustained growth underscores the enduring demand for Interactive Kiosk solutions in the United States. Driven by the need for efficient self-service options across various industries.

- The increasing revenue across all components signifies a robust and evolving market. Driven by technological advancements and evolving consumer preferences for interactive and convenient services.

(Source: Statista)

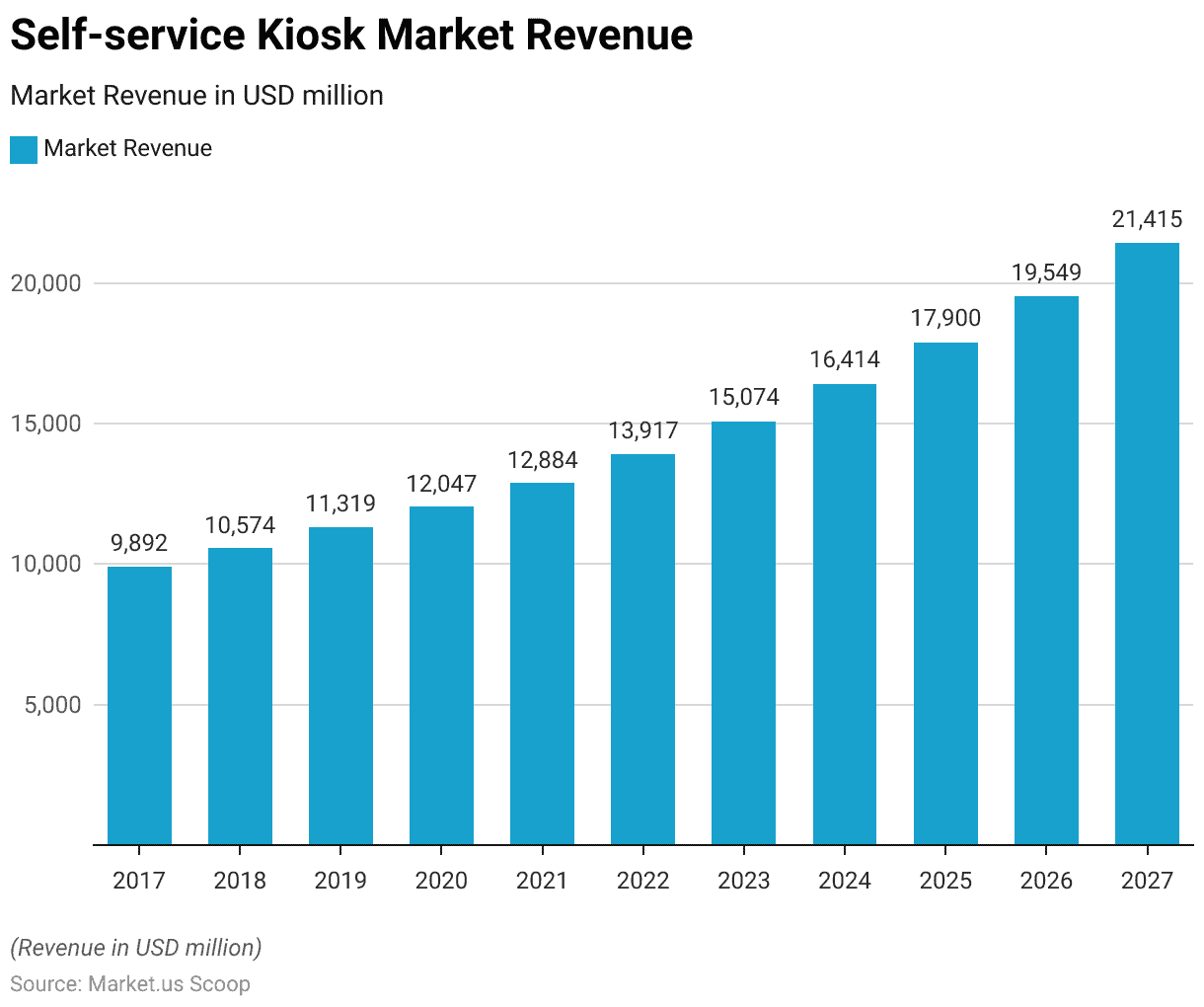

Global Self-service Kiosk Market Size

- The self-service kiosk market has demonstrated a consistent upward trajectory in terms of revenue over the past several years.

- Beginning in 2017 at USD 9,892.3 million, it exhibited steady growth, with revenue figures reaching USD 10,573.8 million in 2018 and USD 11,319.3 million in 2019.

- The market continued its positive momentum, surpassing the USD 12 billion mark in 2020, with a recorded revenue of USD 12,047.1 million.

- In 2021, further expansion was observed, with the market achieving a revenue of USD 12,884.4 million.

- Projections for the future look promising, as the market is expected to continue its growth trajectory. In 2022, it is estimated to reach USD 13,916.5 million, followed by an anticipated revenue of USD 15,074.3 million in 2023.

- Looking ahead to 2024, the self-service kiosk market is forecasted to generate USD 16,414.4 million in revenue, with a promising outlook for subsequent years. Showcasing the industry’s resilience and potential for sustained expansion.

- By 2027, it is expected to reach an impressive revenue figure of USD 21,415.4 million. Reflecting the increasing demand and adoption of self-service kiosk solutions across various sectors.

(Source: Statista)

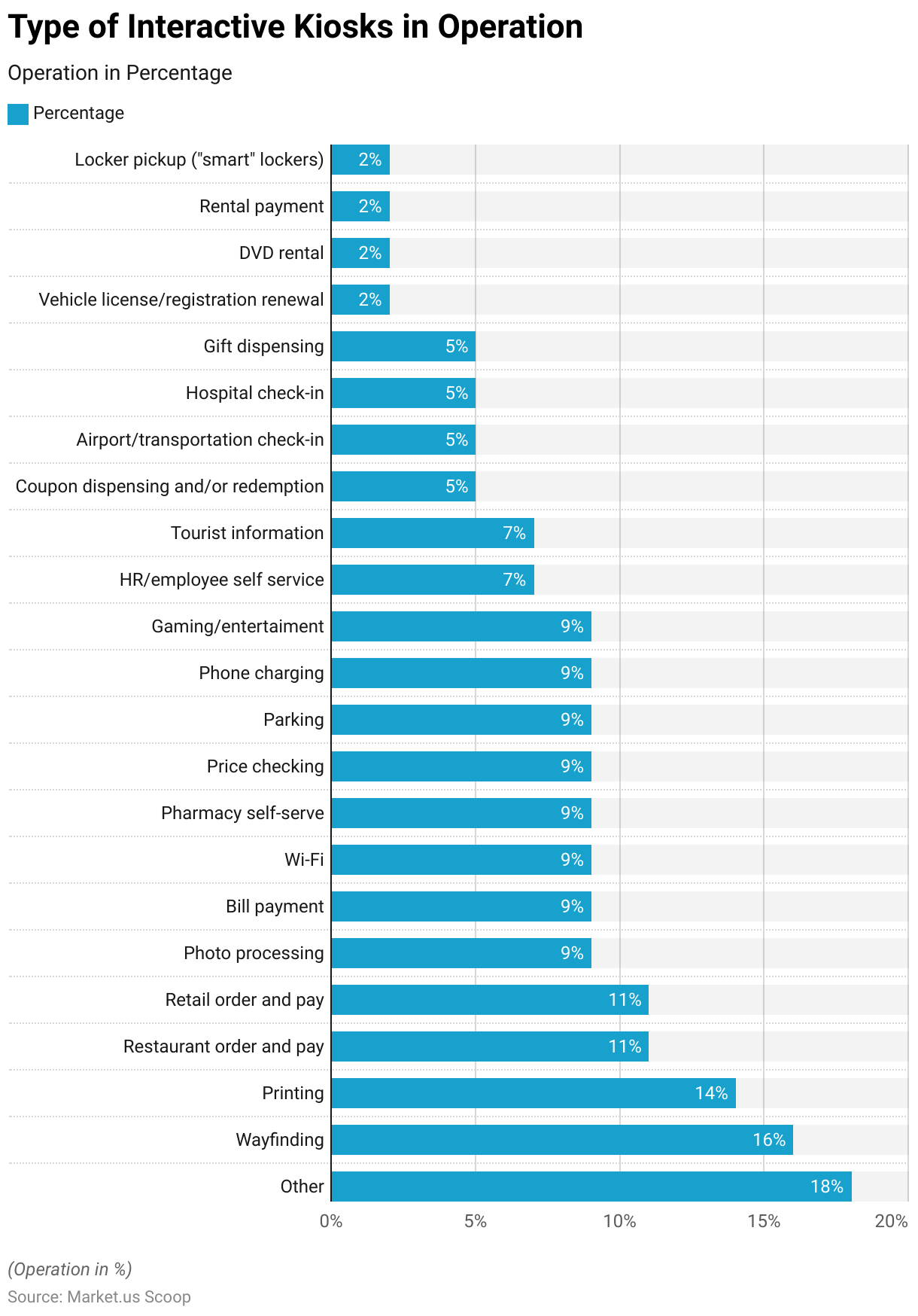

Type of Kiosks in Operation

- Various types of kiosks operate across different sectors, each catering to specific needs.

- These kiosks include Wayfinding kiosks at 16% and printing kiosks at 14%. Restaurant order and pay kiosks at 11%, as well as Retail order and pay kiosks also at 11%.

- Additionally, there are Photo processing, Bill payment, Wi-Fi, Pharmacy self-serve, Price checking, Parking, Phone charging, Gaming/entertainment, HR/employee self-service, Tourist information, and Coupon dispensing and/or redemption kiosks, each making up 9% of the kiosk landscape.

- Furthermore, there are specialized kiosks for Airport/transportation check-in, Hospital check-in, Gift dispensing at 5%, and even Vehicle license/registration renewal, DVD rental, Rental payment, and Locker pickup (“smart” lockers) at 2%.

- This diverse range of kiosks serves various purposes. Enhancing convenience and efficiency in industries spanning from hospitality to retail and beyond.

(Source: Networld Media Group)

Factors Driving the Demand for Interactive Kiosks

- As per the report findings, a significant 86% of customers express frustration when waiting for a refund, while 52% feel anger when faced with payment delays.

- Additionally, 49% of customers reach a point of extreme frustration when they can’t find what they’re looking for.

- The financial impact of these customer grievances is substantial, with an estimated loss of 38 billion dollars in sales attributed to customers leaving stores due to prolonged waiting times.

- In simple terms, it’s evident that long queues are universally disliked by customers, and they have a detrimental effect on sales.

- In August 2021, a historic milestone was reached with 10 million job vacancies available for the first time.

- Self-service kiosks offer a practical solution by automating routine tasks like check-ins. Item pickups and returns, and price verifications. This automation not only improves the overall customer experience but also supports businesses in their quest to recruit skilled personnel.

- Based on a research study, approximately 73% of surveyed shoppers have expressed a preference for retail self-service technologies like self-checkout. As opposed to interacting with in-store associates.

- Self-service kiosks provide a comparable digital shopping experience to what customers enjoy in online retail but within the physical store environment.

(Source: Omnico, Parcel Pending, CNBC, Research Dive)

Consumer Preferences for Interactive Kiosks Statistics

- Introducing automated passport control kiosks at JFK and Newark Airports in 2013 resulted in a remarkable 22% reduction in wait times by 2014.

- In contrast, other airports without these kiosks saw no improvement. This trend can be applied to the hotel industry, where self-service options enhance check-in efficiency and guest satisfaction.

- A 2019 study revealed that in fast-food restaurants, 30% of customers preferred kiosk orders when lines were equal in length. Similarly, hotel guests are likely to embrace self-service options.

- A survey by PYMTS found that 49.4% of retail customers use self-service checkouts for speed. While 34.7% choose them for shorter lines. Hotel guests may also appreciate the flexibility to arrive or depart at their own pace.

- When Dodger Stadium installed kiosks for concessions, the average order value increased by 20%. Implementing kiosks in hotels can boost average spending in F&B outlets and enhance add-on sales.

- In supermarkets, nearly 50% of customers use self-checkout for 75% of their trips, and 30% opt for it half the time. Similarly, in hotels, while many guests may prefer self-service, some may still prefer interactions with front desk agents.

(Source: Hotel Tech Report)

Recent Developments

Acquisitions and Mergers:

- NCR acquires Zynstra: In 2023, NCR Corporation, a leader in financial and retail technology, acquired Zynstra, a company specializing in edge virtualization software for kiosks, for $140 million. This acquisition is aimed at enhancing NCR’s self-service kiosk solutions and improving management and security for retail and banking kiosks.

- Diebold Nixdorf merges with Kiosk Information Systems: In early 2024, Diebold Nixdorf, a global leader in ATMs and financial kiosks, merged with Kiosk Information Systems, a provider of custom kiosk solutions. The deal, valued at $200 million, aims to expand Diebold’s interactive kiosk product line, particularly for retail and healthcare markets.

New Product Launches:

- Samsung launches AI-powered Smart Kiosk: In mid-2023, Samsung introduced a new AI-powered Smart Kiosk designed for retail and hospitality environments. The kiosk features facial recognition, touchless payment options, and personalized content delivery, improving customer experience and reducing wait times by 30%.

- Olea Kiosks launches Healthcare Self-Service Kiosk: In late 2023, Olea Kiosks launched a new Healthcare Self-Service Kiosk, aimed at streamlining patient check-ins, appointment scheduling, and payments. The kiosk also integrates with electronic health record (EHR) systems to reduce administrative tasks and wait times in hospitals.

Funding:

- Zebra Technologies raises $150 million for kiosk innovations: In 2023, Zebra Technologies, known for its smart kiosks and digital signage solutions, raised $150 million to expand its interactive kiosk offerings. The funding will be used to integrate AI and cloud-based management systems for kiosks across multiple industries.

- Frank Mayer and Associates secures $50 million for expanding kiosk manufacturing: In early 2024, Frank Mayer and Associates, a leading kiosk manufacturer, secured $50 million to increase production capacity and expand its product range, focusing on interactive kiosks for banking and retail sectors.

Technological Advancements:

- Touchless kiosk technology: With the rise of touchless technology due to the pandemic, it’s projected that by 2025, 35% of new interactive kiosks will feature touchless interfaces, including voice commands, gesture control, and facial recognition to enhance user experience and safety.

- Integration of AI and machine learning: By 2026, 40% of kiosks in retail and healthcare sectors are expected to leverage AI for personalized experiences, such as tailored recommendations, real-time data analysis, and enhanced customer interactions.

Conclusion

Interactive Kiosk Statistics – Interactive Kiosks have become indispensable assets across diverse sectors, optimizing operations, cutting down on wait times, and elevating customer contentment. Their widespread adoption is evident in the growth of market share and revenue.

Customers are increasingly favoring self-service options, emphasizing the need for businesses to integrate this technology. Nevertheless, it’s important to acknowledge that conventional customer interactions remain relevant.

In a society that values ease and effectiveness, Interactive Kiosks will maintain their central role in transforming various industries by enhancing service and operational efficiency.

FAQs

An Interactive Kiosk is a self-service terminal that allows users to interact with it through touchscreens or other input methods. It typically provides information, performs transactions, or offers various services without the need for human assistance.

Interactive Kiosks find applications in various industries, including retail (self-checkout, price checking), hospitality (hotel check-in/out), healthcare (patient check-in), transportation (ticketing), and more. They can be used for information dissemination, payment processing, and service automation.

Interactive Kiosks can enhance operational efficiency, reduce labor costs, improve customer service, and increase sales. They provide 24/7 availability, reduce wait times, and allow businesses to gather valuable data on user preferences and behavior.

Yes, many Interactive Kiosks incorporate security features to protect user data and prevent tampering. They often use encryption, secure payment processing, and monitoring systems to ensure security.

Yes, many Interactive Kiosk solutions offer customization options to meet the unique requirements of businesses. They can be tailored for specific industries and functions.