Table of Contents

Report Overview

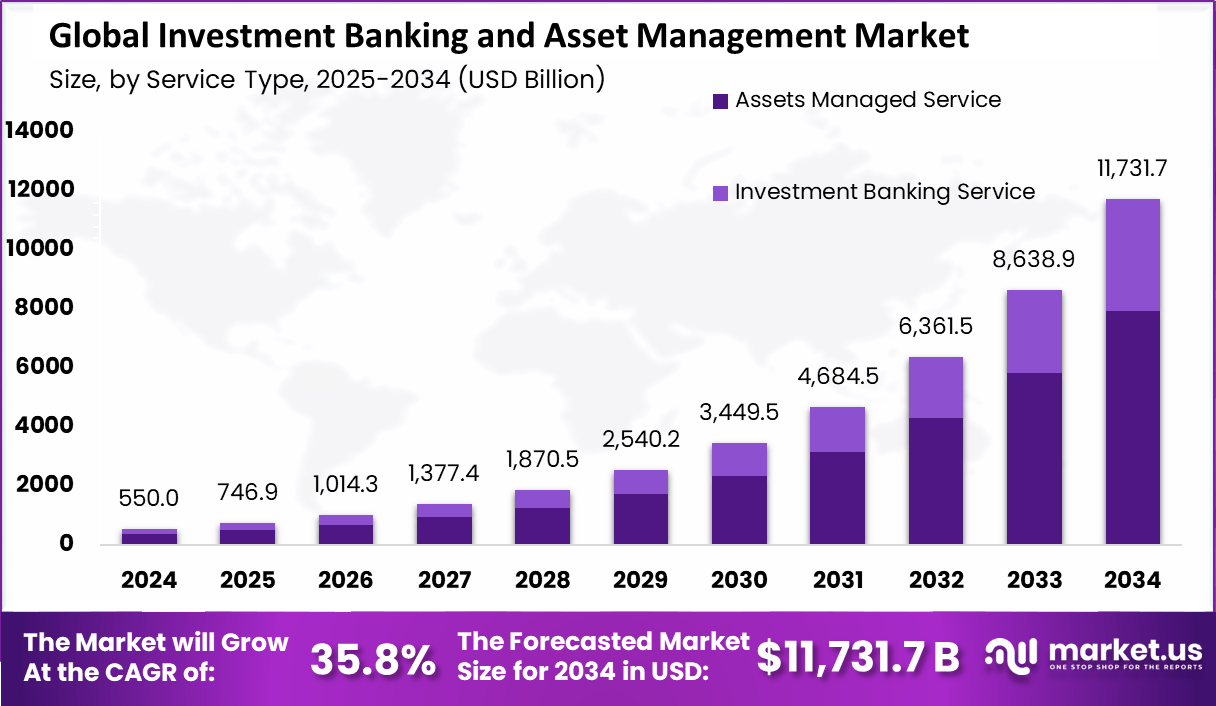

According to Market.us, The global investment banking and asset management market is experiencing robust growth, driven by increasing demand for sophisticated financial advisory services and diversified investment solutions. The market is projected to reach approximately USD 11,731.7 billion by 2034, growing at a strong CAGR of 35.8% during 2024-2034. This expansion is being supported by rising institutional investments, growing adoption of technology-driven asset management platforms, and heightened interest in alternative investments among high-net-worth individuals and institutional clients.

The combined investment banking and asset management market integrates services such as capital raising, mergers and acquisitions advisory, portfolio management, and wealth planning. Investment banks support corporate and institutional clients in executing strategic transactions and fundraising, while asset managers cater to retail investors, high‑net‑worth individuals, pension funds, and institutions by managing diversified portfolios. This dual market is underpinned by evolving capital markets and increasing investor demand across multiple asset classes.

Demand remains strong across regions. Corporates seek advisory services for M&A, while investors are increasing allocations to wealth and institutional mandates. Asset management firms are focusing on private market strategies and incorporating ESG criteria to retain assets and meet client expectations . Regulatory adjustments in key markets such as India and the UK are broadening service scope and enabling tailored advisory offerings.

Market Scope and Forecast

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 550 Bn |

| Forecast Revenue (2034) | USD 11,731.7 Bn |

| CAGR (2025-2034) | 35.8% |

Key insights Summary

- In 2024, the global investment banking and asset management market was valued at USD 550.0 billion and is forecasted to reach nearly USD 11,731.7 billion by 2034, growing at a remarkable CAGR of 35.8%, indicating accelerated expansion.

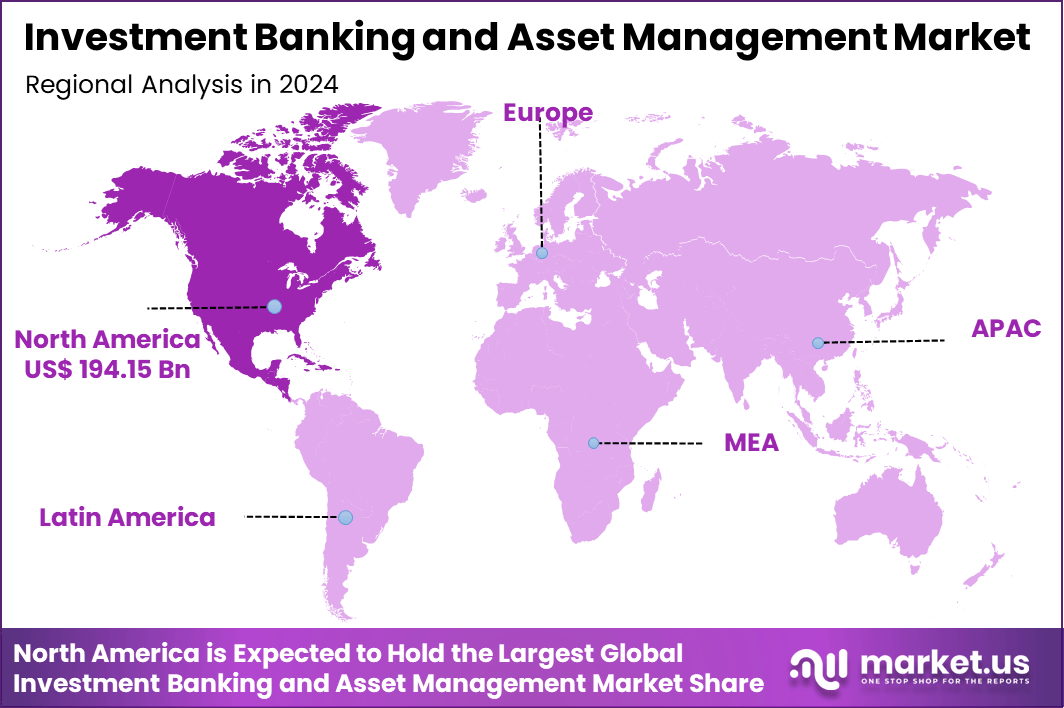

- North America led the market with over 35.3% share, generating about USD 194.15 billion, reflecting strong institutional and corporate participation.

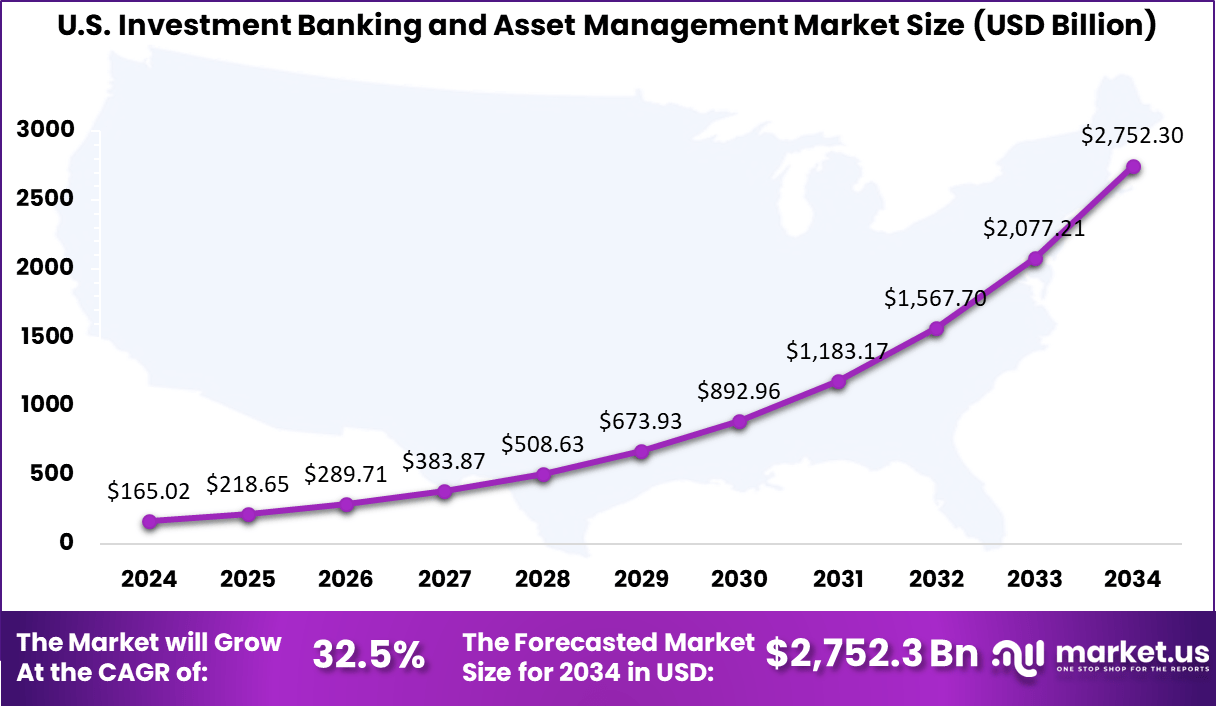

- The United States alone contributed approximately USD 165.02 billion, growing at a CAGR of 32.5%, driven by a robust financial ecosystem.

- By service type, assets managed service dominated with 67.5% share, as demand for professionally managed investment solutions continues to increase.

- Among enterprise sizes, large enterprises accounted for 74.8% share, underscoring their pivotal role in driving market activity.

- By end use, corporations held 35.6% share, highlighting businesses as key adopters of investment banking and asset management services.

- Market growth is being fueled by rising corporate investments, growing institutional demand, and heightened focus on financial portfolio optimization.

Regional Analysis

The U.S. investment banking and asset management market was valued at USD 165.02 billion in 2024 and is projected to reach nearly USD 2,752.3 billion by 2034. This remarkable expansion is expected to occur at a compound annual growth rate (CAGR) of 32.5% over the forecast period from 2025 to 2034, reflecting strong demand for financial advisory, capital raising, and portfolio management services amid evolving economic and regulatory landscapes.

In 2024, North America maintained its leading position in the global market, capturing more than 35.3% share with revenues of about USD 194.15 billion. This dominance can be attributed to the region’s mature financial ecosystem, high concentration of leading investment banks, and the strong presence of institutional investors driving demand for advanced asset management services. The growth in North America is also reinforced by continuous innovation in financial products and the accelerated adoption of digital platforms enhancing client engagement and operational efficiency.

Emerging Trend Analysis

AI Driven Task Automation

The adoption of artificial intelligence is reshaping front and back office operations within investment banking and asset management. A recent study estimates that by 2030, AI will redefine approximately 33 percent of investment banking tasks and 42% of wealth management functions. This trend reflects the integration of machine learning models for tasks such as valuations, risk analytics, and portfolio construction. By automating routine processes, firms can redirect human resources toward higher value strategic activities, resulting in efficiency gains and enhanced decision making.

Driver Analysis

Expansion of Private Credit Platforms

Institutional and retail investors are increasingly allocating capital to private credit structures, driven by higher yield expectations and market dislocations. Firms in both banking and asset management are scaling up origination, underwriting, and distribution capabilities in this segment. The resulting diversification of revenue streams strengthens fee based income and helps firms differentiate their product offerings in a competitive environment.

Restraint Analysis

Market Volatility and Economic Uncertainty

Market instability and macroeconomic shifts such as interest rate fluctuations and geopolitical tensions have constrained new deal activity and asset flows. This uncertainty has impacted underwriting, mergers and acquisitions mandates, and advisory revenues during volatile periods. Furthermore, risk averse client behavior often leads to a shift toward lower return instruments, compressing fee margins and affecting revenue predictability.

Opportunity Analysis

Climate Finance and Sustainable Assets

Climate adaptation investments are gaining traction as central banks and regulators integrate environmental financial risks into asset evaluation . Investors are allocating significant capital toward resilience oriented assets, supported by returns as high as 43 dollars per dollar spent. The integration of ESG criteria into portfolios presents a meaningful opportunity for the sector to develop innovative green products, advisory services, and stewardship practices aligned with global sustainability goals.

Challenge Analysis

Infrastructure and Regulatory Complexity

While AI and private credit present clear advantages, they also intensify demands on legacy infrastructure, data governance, and compliance frameworks. Firms face the dual challenge of modernizing operational platforms and investing in real time analytics while ensuring adherence to evolving cybersecurity, third party oversight, and transparency regulations. These factors increase operational overhead and require substantial investment without immediate revenue uplift.

Key Player Analysis

Brookfield Asset Management, WSP Global, and AssetWorks focus on diversified investments and sustainable asset strategies. They prioritize infrastructure, real estate, and digital platforms to attract institutional clients. Strategic acquisitions and analytics-driven decisions enhance their ability to manage complex portfolios effectively. These approaches strengthen their global presence in investment banking and asset management.

ABB, Honeywell, Siemens, and General Electric integrate industrial expertise with asset management services. Their offerings combine IoT, predictive analytics, and energy optimization to improve asset value. This focus on intelligent infrastructure and efficient capital allocation positions them strongly in industrial investment solutions.

Adobe, IBM, Oracle, SAP, Rockwell Automation, Hitachi, Zebra Technologies, Bentley Systems, and Hexagon provide advanced software for investment and asset management. They enable automation, AI-driven insights, and regulatory compliance. Their cloud-based platforms improve operational efficiency and decision-making, supporting sustainable growth and client trust in financial and industrial sectors.

Top Key Players in the Market

- ABB Inc.

- Adobe Systems Inc.

- Brookfield Asset Management Inc.

- Honeywell International Inc.

- IBM Corp.

- Oracle Corp.

- Rockwell Automation, Inc.

- Siemens AG

- WSP Global Inc.

- Zebra Technologies Corp.

- Hitachi, Ltd.

- General Electric Company

- Bentley Systems, Incorporated

- Hexagon AB

- AssetWorks, Inc.

- SAP SE

- Others

Key Market Segments

By Service Type

- Assets Managed Service

- Equities (stocks)

- Fixed Income (bonds)

- Real Estate

- Commodities

- Alternative Investments

- Others

- Investment Banking Service

- Mergers and Acquisitions (M&A) Advisory

- Capital Raising Advisory

- Restructuring

- Risk Management

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End Use

- Corporations

- Governments

- High-net-worth individuals

- Retail investors

- Others

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)