Table of Contents

Report Overview

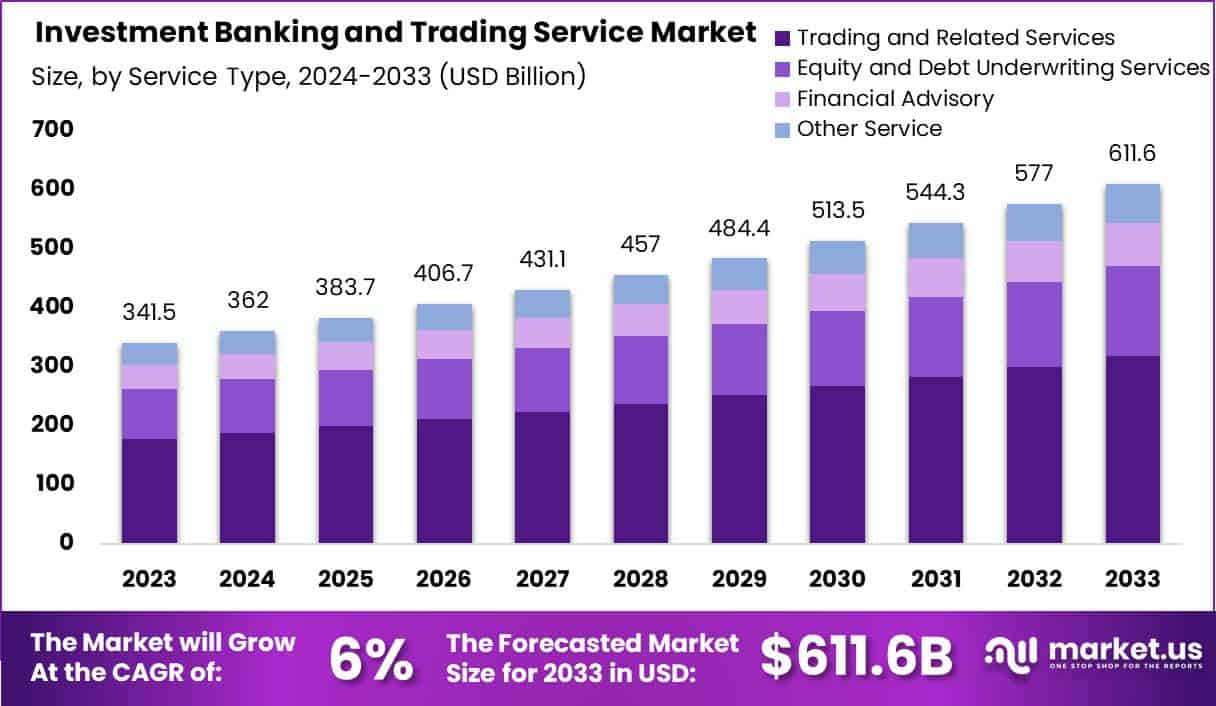

The global investment banking and trading services market is projected to grow steadily, reflecting increasing capital market activities, corporate financing needs, and heightened investor participation. The market is expected to reach approximately USD 611.6 billion by 2033, advancing at a CAGR of 6.00% between 2024 and 2033. This growth is underpinned by sustained mergers and acquisitions, rising demand for structured financial products, and the integration of digital trading platforms enhancing market accessibility and transaction efficiency.

The investment banking and trading services market represents a critical segment of the global financial services industry, providing capital raising, mergers and acquisitions advisory, securities trading, and risk management solutions to corporate, institutional, and government clients. The market plays a vital role in facilitating liquidity, capital allocation, and market efficiency. Its growth is underpinned by the increasing complexity of global financial markets, rising cross-border investment flows, and heightened demand for sophisticated financial products.

The top driving factors of this market include growing corporate restructuring activities, increasing globalization of capital markets, and the expansion of equity and debt issuance. Heightened investor appetite for diversified portfolios and the growing need for advisory in managing market risks also contribute significantly. In particular, emerging economies have fueled demand through active capital raising and infrastructure funding, which has created substantial opportunities for investment banking and trading services.

The increasing adoption of technologies such as algorithmic trading, artificial intelligence, and blockchain is transforming the operational and strategic landscape of this market. These technologies enable faster trade execution, improved risk modeling, and enhanced client analytics. The move toward digital platforms and cloud-based infrastructures has also been notable, allowing firms to scale operations and deliver personalized client experiences efficiently.

Market Scope & Forecast

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 341.5 Bn |

| Forecast Revenue (2033) | USD 611.6 Bn |

| CAGR (2024-2033) | 6% |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Service Type (Trading and Related Services, Equity Underwriting and Debt Underwriting Services, Financial Advisory, Other Service Types), By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Other Industry Verticals) |

The key reasons for adopting these technologies are rooted in the need to enhance operational efficiency, reduce trading errors, and comply with stringent regulatory standards. Advanced analytics and automation support better decision-making, while digital channels help expand reach and improve transparency. Furthermore, these innovations enable firms to stay competitive in a fast-evolving financial ecosystem marked by low margins and high client expectations.

The investment opportunities in this market remain significant, particularly in niche areas such as sustainable finance, emerging market advisory, and digital asset trading. Growing investor interest in ESG-focused products and alternative investments creates new avenues for advisory and trading services. Additionally, rising demand for risk hedging in volatile markets offers opportunities to expand derivative and structured product offerings.

The business benefits of investment banking and trading services are substantial for both providers and clients. Providers benefit from fee-based income streams, cross-selling opportunities, and long-term client relationships. Clients gain access to capital, tailored risk solutions, and strategic insights that improve financial performance and competitiveness. These benefits reinforce the indispensable role of this market in the broader economy.

Key Takeaways

- The global investment banking and trading services market is projected to reach USD 611.6 billion by 2033, rising from USD 341.5 billion in 2023, with a CAGR of 6.00% from 2024 to 2033, reflecting steady industry growth.

- In 2023, the trading and related services segment led with over 52.1% share, driven by rising market activity and demand for execution and clearing services.

- The BFSI sector dominated with more than 27.0% share, as financial institutions remain the primary users of investment banking and trading solutions.

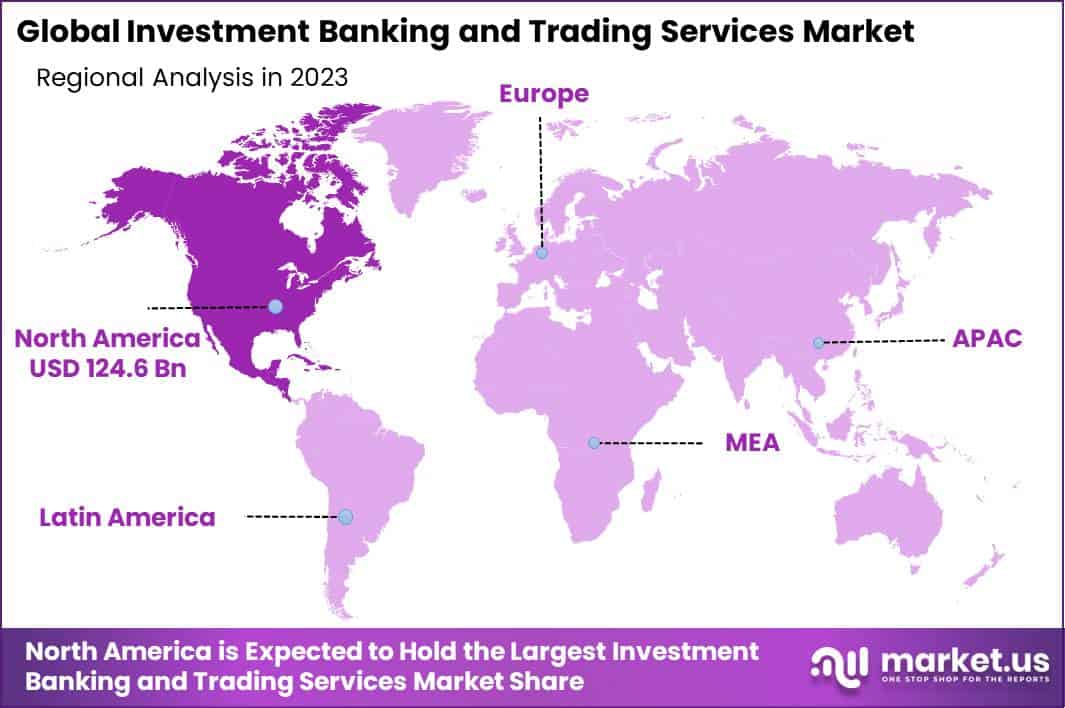

- North America held the largest regional share at 36.5%, generating approximately USD 124.6 billion in revenue, supported by mature capital markets and institutional participation.

Regional Analysis

In 2023, North America held the dominant position in the global market, capturing over 36.5% share and generating around USD 124.6 billion in revenues. This leadership is attributed to the region’s sophisticated financial infrastructure, high levels of institutional investment, and the presence of major global investment banks. Strong equity and derivatives trading volumes, coupled with innovation in financial instruments, continue to drive the market in North America, supported by favorable regulatory frameworks and evolving client demand for complex advisory and trading solutions.

Emerging Trend Analysis

Digital Trading Platforms and Algorithmic Execution

An emerging trend in investment banking and trading services is the accelerated adoption of digital trading platforms combined with algorithmic execution strategies. Technology driven solutions are transforming the way trades are executed, improving speed, precision, and transparency across asset classes. Market participants increasingly rely on sophisticated algorithms to minimize slippage, optimize pricing, and manage liquidity more efficiently. This evolution is supported by growing demand for low latency systems and electronic communication networks that enhance market access and competitiveness.

Driver Analysis

Demand for Diversified Investment Products

The growing appetite for diversified investment products has been a major driver for both investment banking and trading services. Investors are seeking exposure beyond traditional equities and bonds, embracing instruments such as derivatives, structured products, and commodities. This trend has encouraged banks and trading desks to develop innovative offerings tailored to risk adjusted return profiles. The ability to provide customized and varied products strengthens client relationships and generates fee based revenue streams in dynamic markets.

Restraint Analysis

Regulatory Burdens and Compliance Costs

Stringent regulatory frameworks continue to restrain the growth of investment banking and trading activities. Increased scrutiny over capital requirements, trading practices, and reporting standards has escalated compliance costs significantly. Firms are compelled to allocate substantial resources to maintain regulatory adherence, which can reduce profitability and limit flexibility in strategy execution. Additionally, frequent regulatory changes create operational uncertainties that complicate long term planning.

Opportunity Analysis

Growth in Emerging Market Trading

Rising capital flows into emerging markets present a compelling opportunity for investment banks and trading services. Economic development and market liberalization in regions such as Asia Pacific, Latin America, and Africa are boosting demand for sophisticated financial services. Firms that establish early presence in these markets can benefit from first mover advantage, capturing new client segments and expanding their global trading footprint. This growth potential aligns with the increasing investor focus on geographic diversification.

Challenge Analysis

Technological Disruption and Talent Shortage

The rapid pace of technological innovation presents a significant challenge as firms must continuously invest in infrastructure upgrades to remain competitive. Emerging technologies such as blockchain, decentralized finance, and AI are reshaping traditional trading models. At the same time, attracting and retaining talent with expertise in both finance and advanced technology has become increasingly difficult. Balancing technology investments with human capital development remains a critical challenge for sustaining operational excellence.

Key Player Analysis

Citigroup, JPMorgan Chase, and Morgan Stanley remain leading players in the investment banking and trading services market. Their strong global presence, advanced digital platforms, and client-focused advisory services have reinforced their positions. Continuous investments in technology and regulatory compliance have enabled them to adapt to changing market dynamics while maintaining operational resilience and customer trust.

Bank of America, Deutsche Bank, and Barclays have strengthened their market roles through cross-border services, sustainable finance solutions, and innovative product offerings. Strategic cost optimization and improved risk management practices have supported their growth. These players continue to attract corporate clients by aligning with the rising demand for diversified and efficient financial instruments.

HSBC, Wells Fargo, Nomura, and Goldman Sachs have focused on expanding into emerging markets and advancing digital trading capabilities. By integrating wealth management and alternative investments, they have diversified their revenue streams. Their adaptability to regional demands, combined with technological innovation, has helped sustain their competitive edge in the global investment banking and trading landscape.

Top Key Players in the Market

- Citigroup, Inc.

- JPMorgan Chase & Co.

- Morgan Stanley

- Bank of America Corporation

- Deutsche Bank AG

- Barclays PLC

- HSBC Holdings plc

- Wells Fargo

- Nomura Holdings, Inc.

- The Goldman Sachs Group, Inc.

Key Market Segments

By Service Type

- Trading and Related Services

- Equity Underwriting and Debt Underwriting Services

- Financial Advisory

- Other Service Types

By Industry Vertical

- IT and Telecommunications

- BFSI

- Manufacturing

- Retail

- Healthcare

- Other Industry Verticals

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)