Table of Contents

- Report Overview

- Key Takeaways

- Market Analysis

- U.S. IoT in Oil and Gas Market Size

- Market Segmentation

- Component Analysis

- Operations Analysis

- Application Analysis

- Emerging Trends

- Top Use Cases

- Major Challenges

- Business Benefits

- Competitive Landscape

- Market Opportunities for Key Players

- Recent Developments

- Conclusion

Report Overview

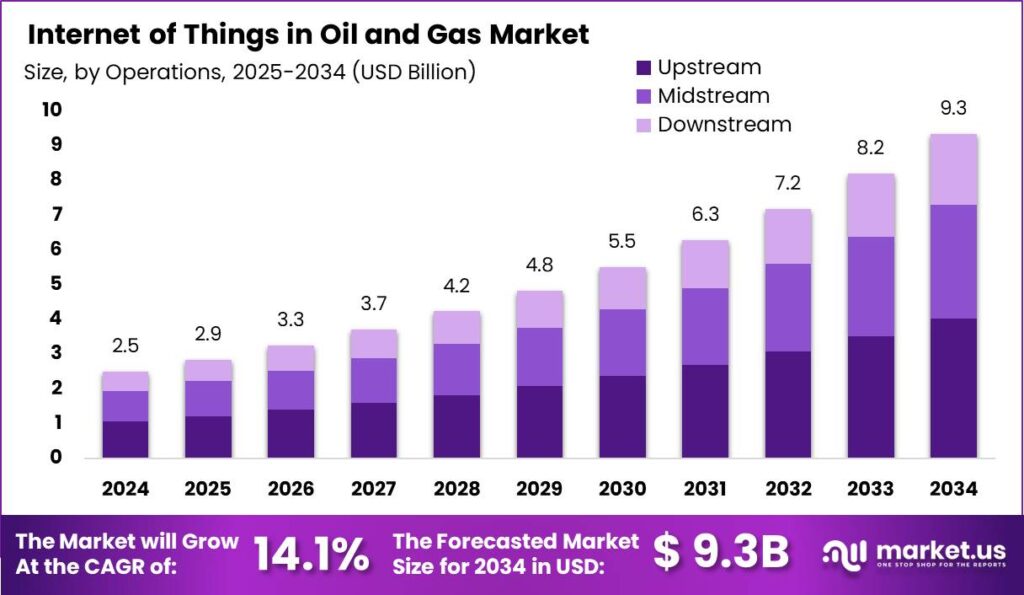

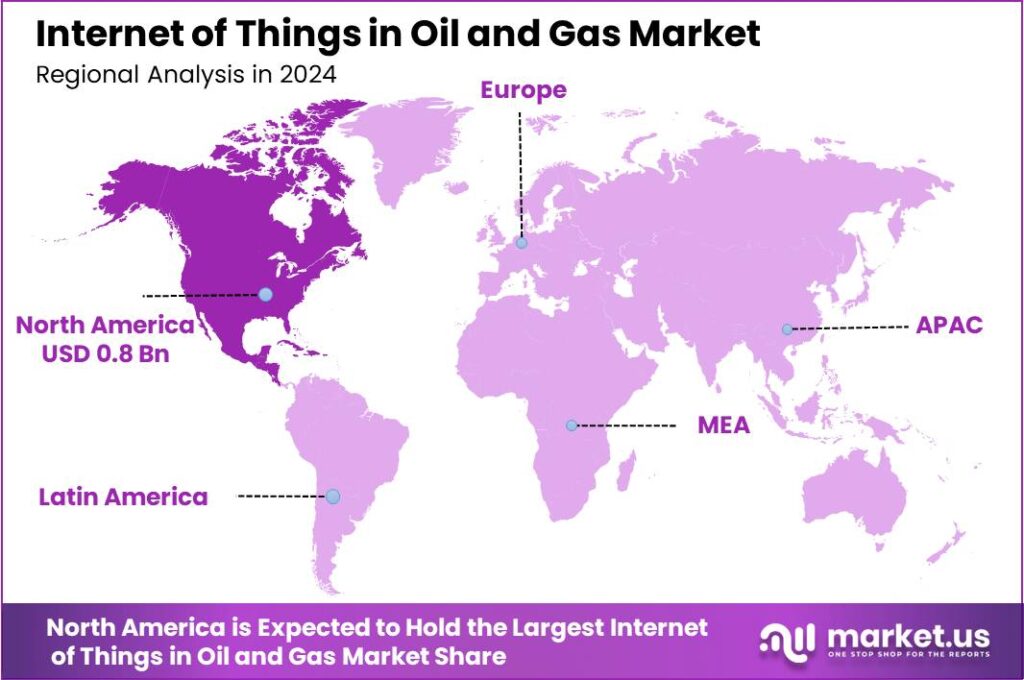

The Global IoT in Oil and Gas Market sector is projected to soar to approximately USD 9.3 billion by 2034, up from USD 2.5 billion in 2024, reflecting a robust compound annual growth rate (CAGR) of 14.10% from 2025 to 2034. North America currently leads the market, commanding more than 34.1% of the share in 2024, with revenues estimated at USD 0.8 billion. This growth highlights the increasing integration of IoT technologies in enhancing operational efficiencies and optimizing processes within the oil and gas industry.

In the oil and gas industry, the Internet of Things (IoT) plays a transformative role by integrating smart devices, sensors, and connectivity systems to gather and analyze real-time data. IoT applications are transforming the sector by improving monitoring, control, and optimization across exploration, drilling, production, transportation, and refining, leading to reduced inefficiencies, enhanced safety, and lower operational costs.

The adoption of IoT in the oil and gas industry is driven by the need for improved efficiency amidst fluctuating oil prices and complex operations. IoT enables real-time monitoring to reduce costs and optimize processes. Additionally, stricter environmental regulations are pushing companies to use IoT for better compliance, emissions monitoring, and waste management, promoting sustainability. Additionally, the aging workforce in the oil and gas sector is creating a push towards digital solutions like IoT.

Key Applications of IoT in the oil and gas industry span several critical areas. In drilling operations, IoT devices monitor key parameters such as pressure and temperature, helping to optimize the process and improve safety. IoT sensors monitor equipment performance and predict maintenance needs, reducing downtime and extending asset lifespan. In pipeline monitoring, they detect leaks and structural issues, enabling prompt maintenance and mitigating environmental and financial risks.

The implementation of IoT in the oil and gas industry faces several challenges, including data security concerns, integration with outdated systems, high initial costs, and a shortage of skilled workers. These issues require robust cybersecurity, system upgrades, significant investment in infrastructure, and specialized expertise in areas like data analytics and cybersecurity.

The market for IoT in the oil and gas sector is expanding as companies recognize the long-term benefits and return on investment IoT brings, including substantial cost reductions, improved safety, and enhanced decision-making capabilities. Technological innovations continue to evolve, with newer, more efficient sensors and devices being developed, which are smaller, more energy-efficient, and capable of more complex data analysis.

Key Takeaways

- The Global Internet of Things (IoT) market in oil and gas is anticipated to grow significantly, reaching USD 9.3 billion by 2034, a sharp rise from USD 2.5 billion in 2024. This represents a compound annual growth rate (CAGR) of 14.10% from 2025 to 2034.

- In 2024, the solution segment commanded a dominant position in the market, securing over 74.8% of the total market share.

- The Upstream sector was the largest contributor in the IoT oil and gas market in 2024, accounting for more than 43.0% of the market share.

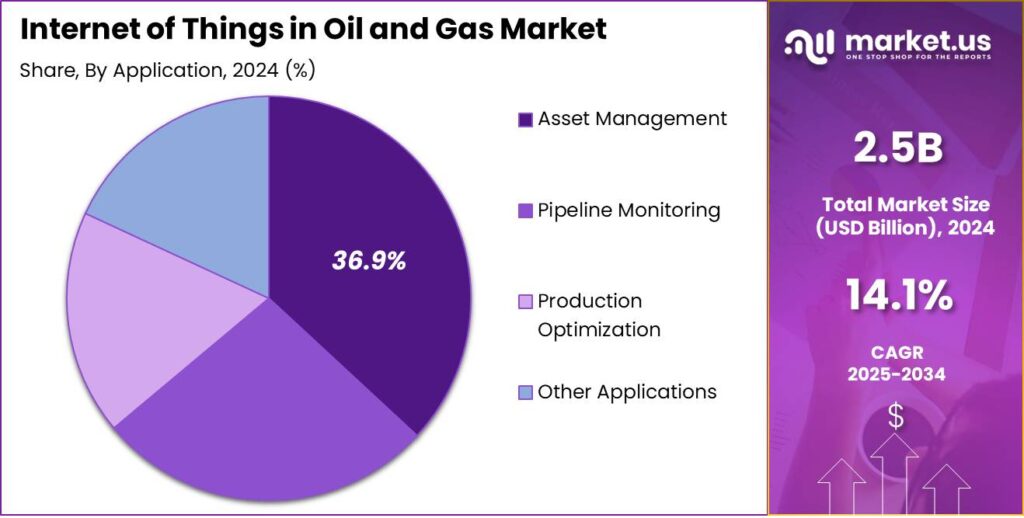

- Within the IoT oil and gas industry, the Asset Management segment led with a substantial share of over 36.9% in 2024.

- North America was the leading region in 2024, holding the largest market share of more than 34.1%, with revenues amounting to USD 0.8 billion.

Market Analysis

The oil and gas industry is experiencing a significant shift toward advanced connectivity and IoT solutions, driven by the need for operational efficiency and sustainability. According to Digi International, the use of cellular, satellite, and LPWA (Low-Power Wide-Area) devices in the sector is expected to more than double by 2028, growing to over 18 million units. This reflects a clear trend of increasing reliance on technology to streamline operations and enhance productivity.

At the same time, environmental considerations are becoming a top priority. A study by Inmarsat reveals that 80% of oil and gas companies consider IoT critical for reducing their carbon footprint. This demonstrates how companies are increasingly using technology not only to improve operational outcomes but also to meet sustainability goals.

Despite these advances, there is a noticeable gap in the adoption of predictive maintenance technologies. Currently, fewer than 25% of operators are utilizing these tools, even though they hold significant potential for cost savings. A report by Deloitte highlights that unplanned maintenance can consume up to 20% of an organization’s operational budget, making predictive maintenance a key area for improvement.

U.S. IoT in Oil and Gas Market Size

In 2024, the United States demonstrated a leading role in the adoption of Internet of Things (IoT) technologies within the oil and gas sector, with the market valued at USD 0.67 billion. This valuation is a testament to the country’s pioneering efforts in integrating advanced IoT solutions across its oil and gas industries. Overall, North America maintained a dominant position in the global IoT oil and gas market, capturing more than a 34.1% share, with revenues reaching approximately USD 0.8 billion.

The substantial investment in IoT within the U.S. oil and gas sectors is driven by the need to optimize operations, enhance safety, and reduce environmental impact. IoT technologies enable real-time monitoring of equipment and processes, predictive maintenance, and automated control systems, all of which contribute to increased efficiency and reduced operational costs. U.S. companies are increasingly leveraging these technologies to gain a competitive edge in a market that demands innovation and sustainability.

Market Segmentation

Component Analysis

The solution segment in the IoT oil and gas market held a dominant position in 2024, capturing over 74.8% of the total market share. This dominance is largely attributed to the growing adoption of IoT technologies in the sector to optimize operations, improve efficiency, and reduce costs. Solutions, including sensors, data analytics, and cloud-based platforms, play a crucial role in monitoring and controlling various aspects of oil and gas operations. As companies focus on digital transformation and automation, the demand for these IoT solutions continues to rise, further solidifying the segment’s leadership in the market.

Operations Analysis

The upstream segment, which encompasses exploration and production (E&P) activities, was the largest contributor to the IoT oil and gas market in 2024, accounting for more than 43.0% of the market share. The increasing reliance on IoT technologies for asset monitoring, predictive maintenance, and real-time data collection in oilfields has propelled the growth of this segment. IoT solutions in upstream activities help optimize drilling processes, improve safety, and increase overall operational efficiency. As oil and gas companies look to enhance production capabilities and reduce downtime, the adoption of IoT in upstream operations is expected to remain a key driver.

Application Analysis

In 2024, the asset management segment led the IoT oil and gas industry, holding a significant market share of over 36.9%. The adoption of IoT-enabled asset management systems is driven by the need for better monitoring and maintenance of equipment and infrastructure, reducing the risk of failures and unplanned downtime. IoT sensors and tracking systems allow for continuous monitoring of assets, providing real-time data on their health and performance. This enables companies to perform predictive maintenance, optimize asset lifecycles, and enhance overall operational efficiency, making the asset management segment a crucial focus for the industry in the context of digital transformation.

Emerging Trends

- Real-Time Monitoring and Predictive Maintenance: IoT devices enable companies to monitor equipment and pipelines in real time, identifying potential issues before they lead to failures. This proactive approach enhances safety and reduces downtime.

- Enhanced Asset Management: By integrating IoT solutions, firms can track and manage assets more efficiently, optimizing production processes and ensuring environmental compliance. This leads to improved operational performance and sustainability.

- Improved Safety Measures: IoT technologies facilitate better safety protocols by providing real-time data on equipment health and environmental conditions, allowing for swift responses to potential hazards. This contributes to a safer working environment.

- Operational Efficiency and Cost Reduction: The adoption of IoT in oil and gas operations leads to increased efficiency and cost savings by automating processes and optimizing resource utilization. This results in more streamlined operations and reduced expenses.

- Environmental Monitoring and Compliance: IoT-enabled sensors allow companies to monitor emissions and environmental parameters in real time, ensuring adherence to regulations and promoting sustainable practices. This helps in minimizing environmental impact and achieving sustainability goals.

Top Use Cases

- Predictive Maintenance: By installing sensors on equipment like pumps and valves, companies can monitor performance indicators such as vibrations and temperature. This real-time data helps predict potential failures, allowing for maintenance before issues cause costly downtime.

- Pipeline Monitoring and Leak Detection: IoT-enabled systems use sensors to track pressure and flow rates in pipelines. This continuous monitoring helps detect leaks early, reducing environmental risks and maintenance costs.

- Remote Operations and Control: IoT allows for the remote monitoring and control of offshore platforms and remote drilling sites. Operators can access real-time data on equipment health and production status, improving safety and reducing the need for on-site personnel.

- Enhanced Safety and Environmental Monitoring: Wearable devices equipped with sensors can monitor workers’ vital signs and environmental conditions like gas leaks in real-time. This enables quicker responses to emergencies, enhancing worker safety and environmental protection.

- Logistics and Supply Chain Optimization: IoT solutions with GPS and RFID tags provide real-time location data on assets, optimizing transportation routes and inventory management. This ensures timely delivery of supplies to drilling sites and refineries, improving operational efficiency.

Major Challenges

- Security Concerns: Connecting numerous devices increases the risk of cyberattacks. Unauthorized access could disrupt operations or lead to data theft. Robust cybersecurity measures are essential to protect sensitive information and maintain operational integrity.

- Data Management: IoT devices generate vast amounts of data that require efficient storage and analysis. Handling this data demands advanced management systems and skilled personnel. Without proper infrastructure, valuable insights may be lost, hindering decision-making.

- Integration with Legacy Systems: Many oil and gas companies operate with outdated infrastructure. Integrating new IoT technologies with these legacy systems can be complex and costly. Ensuring seamless communication between old and new systems is crucial for successful implementation.

- Standardization Issues: The lack of standardized communication protocols across different IoT devices can hinder interoperability. This fragmentation makes it challenging to integrate various technologies smoothly. Industry-wide standardization efforts are needed to facilitate cohesive IoT ecosystems.

- Skilled Personnel Shortage: Implementing and maintaining IoT solutions requires a workforce with expertise in data analytics, cybersecurity, and IoT technologies. The oil and gas industry faces a shortage of such skilled professionals. Investing in training programs or recruiting specialized talent is necessary to effectively manage IoT systems.

Business Benefits

- Improved Operational Efficiency: IoT devices monitor equipment performance in real-time, allowing companies to predict maintenance needs and prevent breakdowns. This proactive approach reduces downtime and boosts productivity.

- Enhanced Safety Measures: Sensors detect gas leaks and monitor environmental conditions, providing early warnings of potential hazards. This real-time monitoring helps protect workers and the environment.

- Cost Reduction: By optimizing maintenance schedules and improving asset utilization, IoT solutions help lower operational costs. Predictive maintenance minimizes expensive emergency repairs and extends equipment lifespan.

- Better Decision-Making: IoT systems collect vast amounts of data, offering valuable insights into operations. Analyzing this data supports informed decision-making, leading to more effective strategies and improved performance.

- Regulatory Compliance and Environmental Protection: IoT technologies monitor emissions and ensure adherence to environmental regulations. This capability helps companies reduce their environmental impact and avoid legal penalties.

Competitive Landscape

- Siemens AG is a major player in the IoT space for oil and gas, providing cutting-edge solutions to enhance digital transformation. The company offers a comprehensive range of IoT-enabled technologies, including advanced sensors, automation systems, and data analytics platforms. Siemens focuses on improving operational efficiency, safety, and sustainability within the sector.

- Rockwell Automation is another key player transforming the oil and gas industry with IoT solutions. Known for their expertise in industrial automation and control systems, Rockwell provides technologies that enable real-time data collection, analysis, and control of operations. Their IoT solutions support predictive maintenance, reduce operational risks, and streamline processes, allowing companies to maximize production while minimizing waste and inefficiency.

- Cisco Systems, Inc. stands out in the oil and gas sector with its robust IoT networking solutions. By offering secure and reliable networking infrastructure, Cisco ensures that connected devices can communicate efficiently across a wide range of operations. Their IoT technology enables seamless connectivity for remote monitoring and control, helping companies gather valuable data from every part of their operations. Cisco’s solutions are key in enhancing collaboration, ensuring cybersecurity, and improving overall system performance.

- Emerson Electric Co. is a leading provider of IoT solutions for the oil and gas industry, offering advanced automation and control technologies that help companies optimize their processes. Emerson’s IoT solutions help monitor equipment conditions, predict failures, and ensure smooth operations. Their focus on digital transformation enables operators to make data-driven decisions that enhance performance, reduce operational costs, and improve safety standards across the industry.

Market Opportunities for Key Players

- Real-Time Pipeline Monitoring: IoT devices enable continuous surveillance of pipeline conditions, detecting potential leaks, corrosion, or pressure anomalies. This real-time data helps prevent environmental hazards and ensures efficient transportation of oil and gas. The integration of IoT in pipeline monitoring is anticipated to register significant growth, driven by the increasing demand for real-time monitoring and predictive analytics to ensure the safe and efficient operation of pipeline infrastructure.

- Asset Management: IoT solutions provide a centralized platform to track and manage assets across various locations. This integration enhances operational efficiency, optimizes resource allocation, and reduces operational costs. Asset management includes asset maintenance that further helps regulate the operations of assets and achieves an organizational strategic plan.

- Environmental Monitoring: With increasing environmental regulations, IoT sensors monitor emissions and discharges in real-time. This capability ensures compliance with environmental standards and helps in minimizing the industry’s ecological footprint. The adoption of digital technologies is also expected to deliver intangible value in the form of emission reductions.

- Enhanced Safety Protocols: IoT devices can detect hazardous conditions, such as gas leaks or equipment malfunctions, in real-time. Immediate alerts allow for swift action, thereby improving worker safety and reducing the risk of accidents. Technologies are also aiding in overseeing the vast infrastructure to prevent accidents or unplanned shutdowns.

- Production Optimization: By analyzing data from IoT sensors, companies can optimize production processes, adjust to demand fluctuations, and enhance overall productivity. This data-driven approach leads to more efficient operations and better decision-making. The integration of IoT in oil and gas operations is expected to drive significant advancements in operational optimization and real-time monitoring.

Recent Developments

- In January 2024, Schneider Electric introduced EcoStruxure Power & Process, an IoT-enabled platform designed to enhance efficiency and profitability in the oil and gas sector. This solution integrates power management with process control, aiming to reduce capital expenditures (CapEx) and operational expenditures (OpEx) by 20-30% through improved connectivity and real-time data analytics.

- In March 2024, Siemens launched its IoT Well Surveillance solution, which connects previously unintegrated assets across oil fields. This scalable system enables predictive maintenance and real-time monitoring of.

Conclusion

In conclusion, The Internet of Things (IoT) is revolutionizing the oil and gas industry by enhancing operational efficiency, safety, and sustainability. IoT devices, such as sensors and connected equipment, provide real-time data that helps monitor critical operations like drilling, production, and pipeline integrity. This technology enables predictive maintenance, reducing equipment downtime, and ensuring better resource management. IoT also facilitates the optimization of energy consumption and enhances environmental monitoring, contributing to more sustainable practices in the sector.

The integration of IoT into the oil and gas industry offers significant benefits, from cost savings to improved safety and environmental stewardship. As the technology continues to evolve, its role in the sector will expand, driving further innovations and transforming traditional operational models. IoT is poised to be a key enabler of digital transformation in oil and gas, creating opportunities for more efficient and sustainable practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)