Table of Contents

Introduction

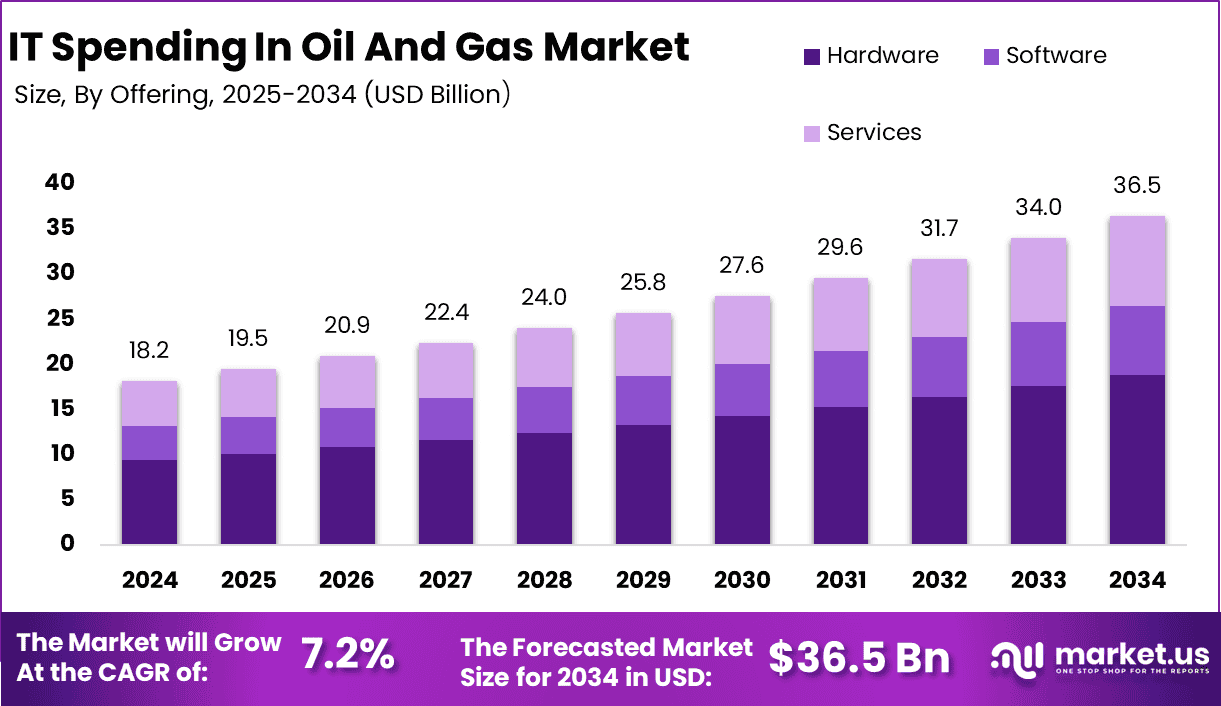

The Global IT Spending in Oil and Gas Market is projected to grow significantly, reaching USD 36.5 billion by 2034, up from USD 18.2 billion in 2024, with a CAGR of 7.2% during the forecast period from 2025 to 2034. North America held the largest market share in 2024, with 36.1% of the market, generating USD 6.6 billion in revenue.

The growing adoption of digital technologies like AI, IoT, and cloud computing in oil and gas operations is driving this expansion. These technologies enable better exploration, production, and operational efficiency, which is contributing to the industry’s digital transformation.

How Growth is Impacting the Economy

The growth of IT spending in the oil and gas sector is having a substantial impact on the global economy by driving innovation and enhancing operational efficiency. As energy companies increasingly invest in IT solutions like automation, data analytics, and cloud technologies, they are able to streamline production processes, reduce costs, and improve decision-making capabilities. These technological advancements lead to higher productivity and more sustainable practices, which can help address energy demand concerns while minimizing environmental impact.

Furthermore, the rise in IT spending is fostering job creation in IT infrastructure, software development, and cybersecurity. The adoption of digital technologies also drives investment in infrastructure and service providers, boosting the technology sector’s contribution to the economy. With growing demand for energy and the increasing complexity of oil and gas operations, IT spending is set to play a crucial role in optimizing energy production and supporting economic growth in related industries, including manufacturing and logistics.

➤ Uncover best business opportunities here @ https://market.us/report/it-spending-in-oil-and-gas-market/free-sample/

Impact on Global Businesses

Rising costs associated with implementing advanced IT solutions in the oil and gas industry are influencing global businesses. The need for infrastructure investments in AI, IoT, and cloud computing is driving up capital expenditures. Additionally, supply chain disruptions in sourcing advanced technologies and hardware components are causing delays in the deployment of IT solutions.

Sector-specific impacts include oil and gas companies needing to adapt to digital transformation by retraining their workforce while simultaneously managing the complexities of cybersecurity and data management. Furthermore, technological advancements in IT are enabling greater efficiency and precision in exploration, drilling, and production processes, offering opportunities to reduce operational costs in the long run.

Strategies for Businesses

To capitalize on the growing IT spending in the oil and gas sector, businesses must focus on investing in automation, predictive analytics, and cloud-based solutions. These technologies can help improve efficiency, reduce downtime, and enhance decision-making across operations. Additionally, businesses should prioritize cybersecurity investments to safeguard valuable data and ensure the security of critical infrastructure.

Collaborating with IT service providers and technology vendors will allow oil and gas companies to leverage cutting-edge solutions that align with industry-specific needs. Developing a skilled workforce capable of managing and optimizing these technologies will also be essential in ensuring long-term success and maximizing ROI from IT investments.

Key Takeaways

- IT spending in the oil and gas market is projected to reach USD 36.5 billion by 2034.

- North America accounted for 36.1% of the market share in 2024.

- Growth is driven by the adoption of AI, IoT, and cloud technologies in oil and gas operations.

- Rising IT infrastructure costs and supply chain challenges affect global businesses.

- Companies must focus on automation, predictive analytics, and cybersecurity to thrive.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=152779

Analyst Viewpoint

Currently, the IT spending market in oil and gas is experiencing steady growth, driven by the increasing need for automation and digital transformation. With the ongoing adoption of AI, cloud computing, and IoT solutions, the market is expected to continue evolving at a strong pace.

The future of IT in the oil and gas industry looks promising, as these technologies enable companies to optimize operations, reduce costs, and improve decision-making capabilities. As digital solutions become more integrated into operations, businesses are poised to benefit from improved efficiency and reduced risk, ensuring sustainable growth in the long term.

Regional Analysis

North America held the dominant position in the Global IT Spending in Oil and Gas Market in 2024, with a market share of 36.1% and USD 6.6 billion in revenue. The region’s dominance is driven by advanced technological infrastructure and high levels of investment in energy-efficient and digital solutions.

Europe and the Asia-Pacific region are also experiencing strong growth, with increasing investment in digital technologies for energy production and management. As demand for energy grows, emerging markets in the Asia-Pacific region are expected to see higher IT spending as companies aim to optimize production processes and increase operational efficiency.

Business Opportunities

The growing IT spending in the oil and gas sector presents numerous business opportunities. Companies can explore advancements in automation, data analytics, and machine learning to optimize production efficiency and reduce operational costs. Additionally, businesses specializing in cybersecurity, cloud solutions, and IoT can benefit from rising demand for these services in the oil and gas industry.

There is also a growing opportunity in developing tailored IT solutions for oil and gas operations, including predictive maintenance and real-time monitoring. Partnering with technology providers and offering specialized services will help businesses capture a share of this rapidly expanding market.

Key Segmentation

- By Technology: AI & Automation, IoT Solutions, Cloud Computing, Big Data Analytics.

- By Application: Exploration, Production, Refining, Distribution, Health & Safety.

- By End-User: Oil & Gas Operators, Service Providers, Equipment Manufacturers.

- By Region: North America, Europe, Asia-Pacific, Rest of the World.

Key Player Analysis

Key players in the IT spending market for oil and gas are focusing on providing integrated digital solutions, including AI, IoT, and cloud-based platforms, to optimize production processes. These companies are investing heavily in research and development to offer tailored solutions that address specific challenges within the oil and gas sector.

Additionally, partnerships with service providers and technology firms enable these players to expand their offerings and capture new market opportunities. By focusing on automation and predictive analytics, they aim to enhance the efficiency of oil and gas operations while maintaining high standards of cybersecurity and data protection.

- Microsoft Corporation Company Profile

- Amazon Web Services (AWS)

- Siemens Aktiengesellschaft Company Profile

- Schlumberger

- Baker Hughes Company

- Halliburton

- SAP SE Company Profile

- Schneider Electric SE. Company Profile

- Honeywell International, Inc. Company Profile

- Emerson Electric Co. Company Profile

- GE Oil & Gas

- Orstec

- Bentley Systems

- AVEVA

- Others

Recent Developments

- In 2024, leading tech firms introduced cloud-based AI solutions for predictive maintenance in oil and gas operations.

- In early 2025, oil companies increased investment in IoT devices for real-time data monitoring and improved decision-making.

- In mid-2025, new partnerships formed between oil and gas operators and technology providers to integrate AI-driven solutions.

- In late 2025, cybersecurity solutions were enhanced to better protect sensitive data from rising cyber threats in the sector.

- In 2025, several companies introduced blockchain-based solutions for transparent and efficient supply chain management.

Conclusion

The Global IT Spending in Oil and Gas Market is set to experience strong growth, driven by advancements in AI, IoT, and cloud computing. As the sector embraces digital transformation, businesses must focus on automation, data analytics, and cybersecurity to capitalize on new opportunities and drive operational efficiency.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)