Table of Contents

Introduction

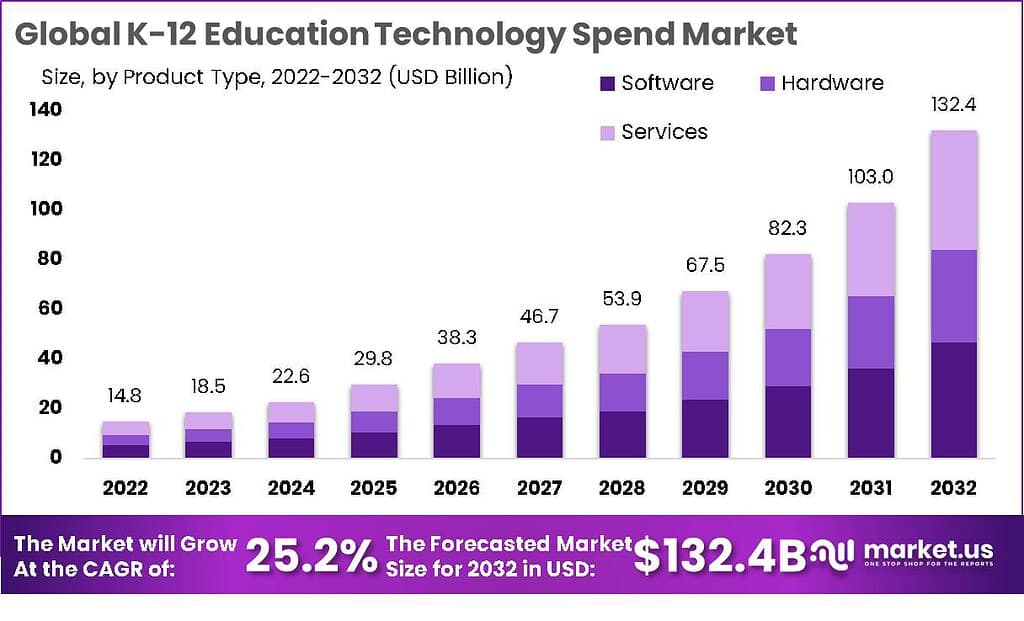

The K-12 Education Technology Spend Market is expected to reach approximately USD 132.4 billion by 2032, showcasing a robust CAGR of 25.2% from its 2023 value of USD 18.5 billion.

The expenditure in K-12 education technology has been witnessing a significant surge, driven by the increasing adoption of digital learning tools and platforms. This investment can be attributed to the growing need for interactive and personalized learning experiences, aimed at enhancing student engagement and improving educational outcomes. The market for K-12 education technology encompasses a wide array of products and services, including learning management systems (LMS), student information systems (SIS), classroom assessment tools, and educational apps and games. These technologies facilitate a more collaborative, accessible, and flexible learning environment, catering to the diverse needs of students.

The growth of the K-12 education technology spend market can be attributed to several factors. Firstly, the rapid advancement of technology has transformed the way education is delivered, making digital tools and resources essential for modern classrooms. Schools are investing in technology infrastructure, such as devices and high-speed internet connectivity, to facilitate digital learning environments. Secondly, there is a growing recognition of the benefits of personalized learning and adaptive educational platforms that can cater to the individual needs and learning styles of students. This has led to increased investments in educational software and learning management systems that provide personalized learning experiences. Additionally, the focus on STEM education has fueled the demand for technology solutions that support coding, robotics, and other STEM-related subjects.

To learn more about this report – request a sample report PDF

The K-12 education technology spend market offers significant opportunities for technology vendors and service providers. With the increasing digitization of educational content and the shift towards online learning, there is a growing demand for digital curriculum materials, interactive learning platforms, virtual reality tools, and other educational technology solutions. Vendors can capitalize on these opportunities by offering innovative and effective products that enhance student engagement, improve learning outcomes, and facilitate teacher productivity.

Government initiatives and funding, alongside private sector investments, play a crucial role in supporting the growth of this market. Educational institutions are increasingly partnering with technology providers to implement and integrate digital solutions into their curricula. The demand for remote and hybrid learning solutions, accelerated by the COVID-19 pandemic, has underscored the importance of technology in education, further boosting market growth.

Facts and Latest Statistics

- U.S. K-12 Education Technology Spending Pre-Pandemic: Estimates suggest annual spending on education technology was between $26 billion and $41 billion.

- Future EdTech Market Projections: The market is expected to grow to approximately USD 549.6 billion by 2033, from USD 146.0 billion in 2023, at a Compound Annual Growth Rate (CAGR) of 14.2%.

- K-12 Education Technology Market Growth: Predicted to reach USD 8,794.2 million by 2032, growing from USD 1,623.6 million in 2023 at a CAGR of 21.3%.

- Increased Technology Spending: 66% of K-12 district leaders plan to increase their technology spending in the 2022-23 school year.

- Rise in Digital Tools Usage: 80% of K-12 teachers in the U.S. reported more frequent use of digital tools and resources compared to the period before the COVID-19 pandemic.

- Federal Funding for K-12 EdTech: The U.S. federal government allocated $7.5 billion through the Emergency Connectivity Fund as part of the American Rescue Plan Act of 2021.

- CARES Act Allocation for K-12 Education: Approximately $13.2 billion was allocated for K-12 education under the CARES Act, including funds for technology and distance learning.

- UK Government Investment in EdTech: A ~£120 million investment was announced in 2021, targeting remote learning and digital devices.

- Venture Capital Funding for EdTech Startups: In 2021, EdTech startups focusing on K-12 attracted $3.2 billion in funding.

- Spending Distribution: The largest share of K-12 education technology spending is on hardware and devices, followed by software and digital content.

- Major Companies’ Involvement: Companies like Google, Microsoft, and Apple have dedicated education products targeting the K-12 market.

- Adoption of Personalized Learning Technologies: There is a significant shift towards personalized and competency-based learning, driving the adoption of adaptive learning technologies and Learning Management Systems (LMS).

- AI and Machine Learning Integration: The use of artificial intelligence and machine learning is expected to enhance personalized learning experiences and data-driven decision-making.

- Emergence of VR and AR Technologies: Virtual reality and augmented reality technologies are providing new possibilities for immersive learning experiences.

- Blended and Hybrid Learning Models: The trend towards blended and hybrid learning models is accelerating the adoption of LMS, video conferencing tools, and collaborative platforms.

- ESSA Provisions for Technology Use: The Every Student Succeeds Act includes provisions for the promotion and funding of technology use in education, including digital resource development and professional development for teachers.

- Assistive Technologies for Special Needs: The integration of assistive technologies is crucial in supporting students with special needs and disabilities, ensuring equitable access to education.

- Based on Region, North America dominates the market with major revenue share of 34.3%.

Emerging Trends

- Increased Personalization through Technology: Schools are leveraging adaptive learning platforms and AI-driven analytics to tailor education to individual student needs, enhancing engagement and academic performance.

- Integration of Artificial Intelligence: AI is increasingly used in classrooms to support teachers, offering solutions to repetitive administrative tasks and enabling personalized learning models.

- Hybrid and Remote Learning: The COVID-19 pandemic accelerated the adoption of hybrid and remote learning models, a trend that is expected to continue. Investments are flowing into technology infrastructure to support seamless online and hybrid education.

- Software Dominates Product Type: The software segment, including educational gaming software and assessment platforms, dominates the market due to the widespread adoption of digital learning solutions.

Recent Developments

- February 2023: Microsoft Corporation launched “Minecraft Education: Chemical Reactions”, a new learning module within the Minecraft environment, aimed at teaching students about chemistry concepts. This initiative highlights Microsoft’s ongoing efforts to integrate gaming with education, providing an engaging and interactive platform for students to explore complex subjects.

- March 2023: Google LLC introduced “Applied Digital Skills”, a comprehensive, free online curriculum designed to equip students with essential digital skills. This program is part of Google’s broader commitment to making digital education accessible to all, emphasizing critical thinking, problem-solving, and the practical application of digital tools.

- July 2023: Amazon Web Services (AWS) announced a strategic collaboration with “Moodle”, an EdTech platform widely used by schools and universities. This partnership aims to offer a cloud-based solution that enhances the learning experience, offering scalable, secure, and efficient access to educational resources.

- August 2023: Adobe Inc. rolled out updates to its education software suite, including “Adobe Spark” and “Adobe Creative Cloud”, incorporating new features tailored for teachers and students. These updates are designed to foster creativity and collaboration in the classroom, enabling learners to express their ideas in more innovative and visually appealing ways.

- November 2023: Oracle Corporation made a significant expansion into the education technology space by acquiring “Amplify Education”, a provider of K-12 curriculum and assessments. This acquisition demonstrates Oracle’s intent to broaden its offerings in the education sector, providing comprehensive solutions that support teaching and learning

Conclusion

In conclusion, the K-12 education technology spend market is experiencing robust growth due to the increasing adoption of digital learning, the need for personalized educational experiences, and the emphasis on STEM education. Schools are investing in technology solutions that enhance teaching and learning, and vendors have the opportunity to provide innovative products and services to meet these needs. As technology continues to play a vital role in education, the K-12 education technology spend market is poised for further expansion in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)