Table of Contents

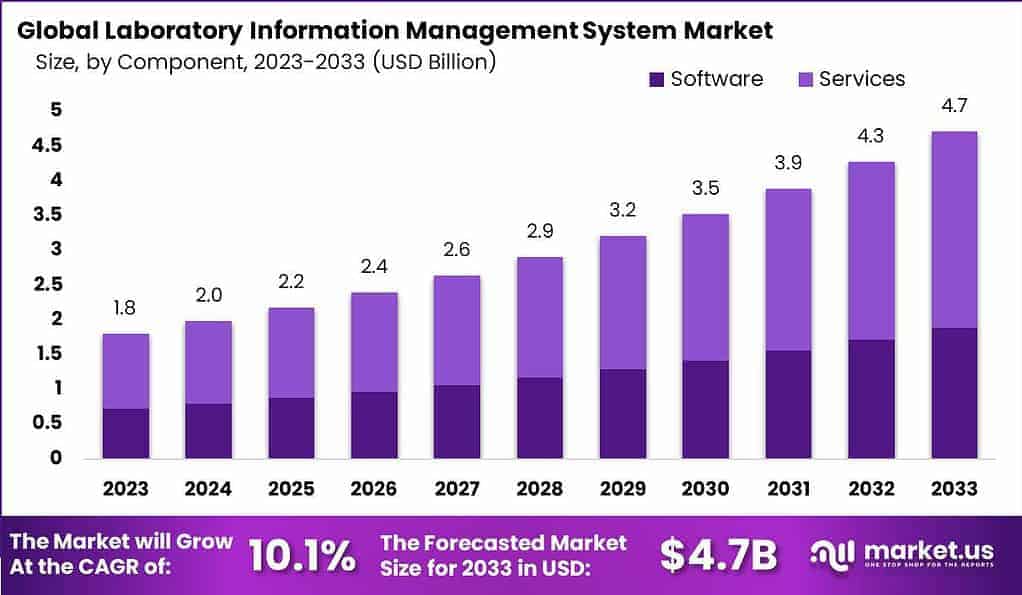

In 2023, the Global Laboratory Information Management System (LIMS) Market was valued at approximately US$ 2.0 billion. It is projected to reach around US$ 4.7 billion by 2033, expanding at a robust CAGR of 10.1% during the forecast period from 2024 to 2033.

This growth is driven by increased demand for digital workflow solutions, data compliance, and operational efficiency across healthcare, life sciences, and environmental testing sectors. However, economic dynamics such as tariffs are reshaping cost structures, influencing international trade flows, and impacting growth trajectories within the LIMS ecosystem and its broader supply chain.

How Tariffs are Impacting the Economy

Tariffs, particularly those enacted between major economies like the U.S. and China, have introduced significant inflationary pressures and disrupted global trade equilibrium. In 2024, U.S. tariff policies on semiconductors, electronics, and lab equipment components have increased input costs for manufacturers. These tariffs lead to higher import prices, which are often passed down to end users, resulting in reduced consumer spending and capital investment.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/laboratory-information-management-system-market/free-sample/

Moreover, tariffs have caused currency fluctuations and increased market uncertainty, limiting foreign direct investments. Industries reliant on cross-border components—such as biotechnology and healthcare—face reduced margins and delayed project timelines. The broader economy experiences a ripple effect, where employment and production cycles are pressured by fluctuating import-export balances, diminishing overall economic efficiency and competitiveness. For technology-driven markets like LIMS, tariffs hinder the seamless movement of high-tech instruments and software, impacting R&D timelines and laboratory productivity across borders.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Global businesses are witnessing elevated operational expenses due to tariffs on raw materials, electronic modules, and diagnostic components. These rising costs compel enterprises to reassess pricing strategies, often leading to higher product prices for consumers.

Sector-Specific Impacts

Healthcare, pharmaceuticals, and laboratory diagnostics sectors are particularly affected, as critical components and testing systems depend on international suppliers. Delays and increased compliance checks at borders disrupt project timelines and research operations.

Supply Chain Shifts

In response, firms are pivoting from China-centric models to diversify sourcing across Southeast Asia, India, and Eastern Europe. This realignment, though costly initially, aims to reduce long-term geopolitical risk exposure and enhance supply chain resilience.

Strategies for Businesses

To counteract tariff-induced disruptions, companies are adopting several strategies:

- Supply Chain Diversification: Relocating sourcing and manufacturing to tariff-free or low-tariff countries.

- Technological Investments: Automating operations and integrating AI into LIMS for cost optimization.

- Local Partnerships: Collaborating with regional vendors to avoid tariff barriers.

- Tariff Engineering: Structuring product designs to fit lower-duty categories.

- Scenario Planning: Forecasting future trade policy risks and maintaining flexible logistics networks.

➤ Get full access now @ https://market.us/purchase-report/?report_id=32885

Key Takeaways

- LIMS market poised to exceed US$ 4.7 billion by 2033 with 10.1% CAGR.

- Tariffs raise costs and delay imports of lab-related equipment and software.

- Businesses are restructuring global supply chains to minimize exposure.

- Diversification and tech upgrades offer sustainable paths forward.

- Healthcare and life sciences sectors remain most vulnerable to tariff pressures.

Analyst Viewpoint

Presently, the LIMS market is navigating a complex trade environment influenced by global tariff policies. While current challenges—rising costs, supply volatility, and compliance burdens—are impacting short-term performance, future prospects remain promising. The increasing reliance on data-driven lab operations, automation, and compliance software ensures that the LIMS sector will experience robust demand. As businesses adapt to trade shifts, digital transformation will serve as a key enabler of resilience and long-term growth, especially in emerging markets and precision medicine applications.

Regional Analysis

North America remains the largest contributor to the LIMS market, driven by advanced healthcare infrastructure and strong R&D activity. Tariff policies in the U.S. have prompted firms to shift sourcing to Canada and Mexico under the USMCA agreement. In Europe, regulatory harmonization and laboratory automation are fueling adoption. Asia-Pacific is the fastest-growing region, supported by investments in biotech research and digital labs in India, China, and South Korea. Meanwhile, Latin America and the Middle East are seeing increased adoption due to public health modernization and international funding initiatives. Regional policy alignment and trade route diversification are shaping deployment strategies.

➤ Discover More Trending Research

- Rocket And Missile Market

- Hypersonic Missiles Market

- Database Security Market

- Cross-Border E-Commerce Logistics Market

Business Opportunities

Amid tariff challenges, the LIMS market presents lucrative opportunities in cloud-based platforms, mobile access modules, and AI-driven data analytics integration. Companies offering localized solutions or customized compliance modules tailored to regional regulations are gaining traction. There is growing demand for LIMS in pharmaceutical batch release, environmental testing, and food safety management. Furthermore, emerging economies are increasingly adopting digital lab systems to meet global certification standards. Vendors offering end-to-end automation and interoperability with instruments and ERP systems are positioned for competitive advantage. Capitalizing on precision medicine and personalized diagnostics further expands the market potential globally.

Key Segmentation

The global LIMS market is segmented by Component (Software and Services), Deployment (Cloud-Based and On-Premise), End-Use (Life Sciences, CROs, Chemical, Food & Beverage, Agriculture, and Environmental Testing Labs), and Geography (North America, Europe, Asia-Pacific, Latin America, and MEA). Software remains the dominant segment due to the shift toward SaaS-based LIMS platforms, while service offerings are expanding rapidly due to demand for integration, maintenance, and customization. Cloud-based deployment is gaining popularity, particularly among SMEs, due to cost efficiency and scalability. Life sciences and CROs remain key end-users driving innovation and LIMS modernization.

Key Player Analysis

Major companies in the LIMS market are focusing on expanding product capabilities through AI, interoperability, and cloud migration. These firms invest heavily in R&D and maintain strategic partnerships with healthcare institutions, regulatory bodies, and research organizations. Competitive advantages stem from proprietary platforms, robust security features, global customer support, and compliance with ISO and FDA guidelines. Businesses are also acquiring niche players to broaden their portfolio and enhance regional penetration. Sustainable innovation, pricing flexibility, and scalability remain critical factors differentiating leading players in this high-growth market.

Top Key Players

- Thermo Fisher Scientific Inc.

- Siemens AG

- Abbott Laboratories

- LabWare, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- LabVantage Solutions, Inc.

- Autoscribe Informatics

- Illumina, Inc.

- Waters Corporation

- RURO, Inc.

- Blaze Systems Corporation

- Other Key Players

Recent Developments

Several companies have introduced next-gen LIMS solutions with AI integration and real-time analytics, aiming to improve lab accuracy and workflow automation amid rising global compliance demands.

Conclusion

Despite challenges posed by global tariffs, the Laboratory Information Management System market continues to expand, driven by digital innovation, regulatory compliance needs, and lab efficiency demands. Adaptive strategies and diversified operations are key to navigating future trade uncertainties.