Table of Contents

- Introduction

- Editor’s Choice

- Laboratory Information Management System Market Overview

- History of Laboratory Information Management Systems

- Components of Laboratory Information Management Systems

- Technical Requirements of Laboratory Information Management Systems

- Factors Considered While Selecting Laboratory Information Management Systems Software

- Regulations for Laboratory Information Management Systems

- Recent Developments

- Conclusion

- FAQs

Introduction

Laboratory Information Management System Statistics: A Laboratory Information Management System (LIMS) is a software solution that optimizes laboratory operations and data management across various industries.

It tracks samples from collection to disposal, organizes laboratory data securely, and automates workflows, reducing errors and enhancing productivity with laboratory informatics.

LIMS integrates with laboratory instruments to streamline data exchange and improve accuracy. It enforces quality assurance measures and regulatory compliance, generating customizable reports and analytical insights for decision-making.

LIMS ensures sample traceability, facilitates collaboration, and supports regulatory requirements, making it indispensable for efficient and compliant laboratory operations.

Editor’s Choice

- In 2023, the global Laboratory Information Management System (LIMS) market revenue was recorded at USD 1.8 billion.

- By 2033, the market is forecasted to reach USD 4.7 billion. With software revenue at USD 1.89 billion and services revenue at USD 2.81 billion.

- Thermo Fisher Scientific leads the market with a 14% share.

- The global Laboratory Information Management System (LIMS) market is geographically segmented. With North America commanding the largest share at 47.0%.

- In 1982, the first Laboratory Information Management Systems (LIMS) debuted, using centralized minicomputers for automated reporting.

- When selecting a Laboratory Information Management System (LIMS), several key factors are crucial for effective decision-making. Vendor reputation and brand awareness are paramount, with 67.79% of decision-makers considering these aspects vital.

- When selecting Laboratory Information Management System (LIMS) software, various factors play significant roles in the decision-making process. The primary consideration is the specific requirements of the laboratory, which account for 49% of the decision criteria.

Laboratory Information Management System Market Overview

Global Laboratory Information Management System Market Size Statistics

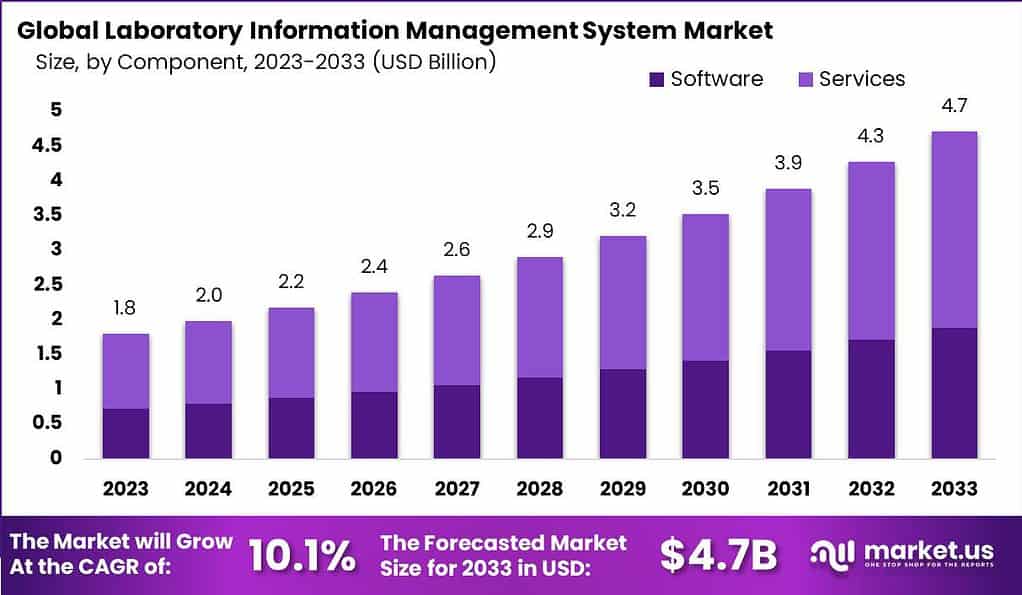

- The global Laboratory Information Management System (LIMS) market has demonstrated a steady growth trajectory over the years at a CAGR of 10.1%.

- In 2023, the market revenue was recorded at USD 1.8 billion.

- This upward trend is expected to continue, with projections indicating that the market will reach USD 2.0 billion in 2024 and further increase to USD 2.2 billion in 2025.

- The market is anticipated to grow progressively, reaching USD 2.4 billion in 2026, USD 2.6 billion in 2027, and USD 2.9 billion in 2028.

- By 2029, the market revenue is expected to climb to USD 3.2 billion, and it is projected to continue its growth to USD 3.5 billion in 2030.

- The market is forecasted to expand to USD 3.9 billion in 2031, USD 4.3 billion in 2032, and USD 4.7 billion by 2033.

- This sustained growth underscores the increasing adoption and importance of LIMS in various industries.

(Source: market.us)

Laboratory Information Management System Market Size – By Component Statistics

- The global Laboratory Information Management System (LIMS) market is segmented by component, encompassing both software and services.

- In 2023, the total market revenue was USD 1.8 billion. With software revenue accounting for USD 0.72 billion and services revenue at USD 1.08 billion.

- This trend of balanced growth between software and services is expected to persist. By 2024, the total market revenue is projected to reach USD 2.0 billion. With software contributing USD 0.80 billion and services USD 1.20 billion.

- In 2025, the market is anticipated to grow to USD 2.2 billion. With software and services revenues of USD 0.88 billion and USD 1.32 billion, respectively.

- This steady growth continues in subsequent years. With total market revenues reaching USD 2.4 billion in 2026 (software: USD 0.96 billion; services: USD 1.44 billion), USD 2.6 billion in 2027 (software: USD 1.05 billion; services: USD 1.55 billion), and USD 2.9 billion in 2028 (software: USD 1.17 billion; services: USD 1.73 billion).

- By 2029, the market is expected to attain USD 3.2 billion. With software at USD 1.29 billion and services at USD 1.91 billion.

- The upward trajectory continues with projections of USD 3.5 billion in 2030 (software: USD 1.41 billion; services: USD 2.09 billion), USD 3.9 billion in 2031 (software: USD 1.57 billion; services: USD 2.33 billion), and USD 4.3 billion in 2032 (software: USD 1.73 billion; services: USD 2.57 billion).

- By 2033, the market is forecasted to reach USD 4.7 billion, with software revenue at USD 1.89 billion and services revenue at USD 2.81 billion.

- This detailed segmentation underscores the robust growth and critical role of both software and services in driving the overall LIMS market expansion.

(Source: market.us)

Laboratory Information Management System Market Size – By End-user Statistics

2018-2019

- The annual value of the global Laboratory Information Management System (LIMS) market. Segmented by the end user, has shown a consistent upward trend from 2018 to 2028.

- In 2018, pharmaceutical and biotechnology companies led the market with a value of USD 332.6 million. Followed by contract research organizations (CROs) at USD 225.2 million, hospitals and clinics at USD 112.2 million, and other end users at USD 74.6 million.

- By 2019, these values increased to USD 364.9 million for pharmaceutical and biotechnology companies, USD 251.1 million for CROs, USD 121.8 million for hospitals and clinics, and USD 79.5 million for others.

(Source: Statista)

2020-2022

- In 2020, the market saw further growth, with pharmaceutical and biotechnology companies reaching USD 369.1 million, CROs at USD 254.7 million, hospitals and clinics at USD 122.9 million, and others at USD 79.9 million.

- The upward trend continued in 2021, with values of USD 387.1 million, USD 269.2 million, USD 128.2 million, and USD 82.4 million, respectively.

- By 2022, the market values rose to USD 416.2 million for pharmaceutical and biotechnology companies, USD 294.4 million for CROs, USD 136.3 million for hospitals and clinics, and USD 86.2 million for other end users.

(Source: Statista)

2023-2025

- In 2023, pharmaceutical and biotechnology companies accounted for USD 451.5 million, CROs for USD 325.2 million, hospitals and clinics for USD 146 million, and others for USD 90.9 million.

- Projections for 2024 indicate continued growth, with values reaching USD 490.7 million, USD 360 million, USD 156.7 million, and USD 95.8 million, respectively.

- The trend is expected to persist, with 2025 values estimated at USD 534.1 million for pharmaceutical and biotechnology companies, USD 399.2 million for CROs, USD 168.4 million for hospitals and clinics, and USD 101.1 million for others.

(Source: Statista)

2026-2028

- By 2026, the market is anticipated to grow to USD 582.3 million for pharmaceutical and biotechnology companies, USD 443.4 million for CROs, USD 181.3 million for hospitals and clinics, and USD 106.7 million for other end users.

- The forecast for 2027 shows values of USD 636.1 million, USD 493.7 million, USD 195.3 million, and USD 112.7 million, respectively.

- In 2028, pharmaceutical and biotechnology companies are projected to reach USD 696 million, CROs USD 550.6 million, hospitals and clinics USD 210.8 million, and other end users USD 119.3 million.

- This data underscores the robust and sustained growth of the LIMS market across various end-user segments.

(Source: Statista)

Competitive Landscape of Global Laboratory Information Management System Market Statistics

- Several key players dominate the global Laboratory Information Management System (LIMS) market, each holding a significant market share.

- Thermo Fisher Scientific leads the market with a 14% share, followed closely by Siemens, which holds a 13% share.

- LabVantage Solutions Inc. and Autoscribe Informatics each command a 12% share of the market. Reflecting their strong presence and competitive offerings.

- LabWare accounts for 11% of the market, demonstrating its robust position among industry leaders.

- PerkinElmer Inc. captures 10% of the market share. While Abbott Laboratories holds a 9% share, highlighting their substantial contributions to the LIMS landscape. Illumina, Inc. has an 8% share, underscoring its influence in the sector.

- The remaining 11% of the market is distributed among other key players. Indicating a diverse and competitive environment within the LIMS market.

(Source: market.us)

Regional Analysis of Global Laboratory Information Management System Market Statistics

- The global Laboratory Information Management System (LIMS) market is geographically segmented. With North America commanding the largest share at 47.0%. This dominance is attributed to the region’s advanced technological infrastructure and significant investment in healthcare IT.

- Europe follows with a 23.0% market share, driven by stringent regulatory requirements and a growing emphasis on laboratory automation.

- The Asia-Pacific (APAC) region accounts for 20.0% of the market, reflecting rapid industrialization. Increased research activities, and expanding healthcare infrastructure.

- South America holds a 6.0% share, with growth propelled by rising healthcare expenditure and the adoption of advanced laboratory systems.

- The Middle East and Africa (MEA) region, although holding the smallest share at 4.0%, is experiencing gradual growth due to improving healthcare facilities and increasing awareness of laboratory management systems.

- This regional distribution highlights the varied adoption rates and market dynamics across different parts of the world.

(Source: market.us)

History of Laboratory Information Management Systems

- Before the late 1970s, managing laboratory samples and analyses was labor-intensive and error-prone, prompting efforts to streamline processes. Initially, individual labs developed custom solutions, while some pursued commercial options using specialized systems.

- In 1982, the first Laboratory Information Management Systems (LIMS) debuted, using centralized minicomputers for automated reporting. Interest grew, leading figures like Gerst Gibbon to advocate through LIMS-focused conferences.

- By 1988, second-generation LIMS with relational databases emerged, expanding into specialized applications alongside International LIMS Conferences.

- The 1990s saw a third generation of LIMS leveraging client/server architecture for improved data processing.

- By 1995, these systems enabled network-wide data processing, with web-enabled LIMS introduced the following year, extending operations beyond labs.

- From 1996 to 2002, LIMS evolved further, adding features like wireless networking, georeferencing, XML standards, and internet purchasing.

- As of 2012, LIMS development continued, integrating clinical functionalities, electronic laboratory notebooks (ELNs), and transitioning to the software as a service (SaaS) model.

(Source: ScienceDirect)

Components of Laboratory Information Management Systems

- Laboratory Information Management Systems (LIMS) consist of several critical components, including software and services. Which collectively enhance laboratory efficiency, data management, and compliance.

- The software segment, which accounts for a substantial portion of the market, includes applications for sample tracking, instrument integration, and data analysis.

- Recent advancements have seen software evolve from simple SaaS to more advanced PaaS and community networks. Providing greater flexibility and scalability for laboratories.

- Services, which dominated the market with over 58% of global revenue in 2023, encompass implementation, integration, maintenance, and validation. The increasing need for LIMS outsourcing drives this segment due to resource constraints in pharmaceutical research labs.

- Notable recent developments include LabVantage Solutions’ launch of an innovative analytics solution and Thermo Fisher Scientific‘s introduction of the EXENT solution for mass spectrometry.

(Source: Agaram Technologies)

Technical Requirements of Laboratory Information Management Systems

- The technical requirements of Laboratory Information Management Systems (LIMS) are multifaceted, ensuring the efficient management of laboratory data, compliance, and operational workflows.

- Key components include robust software that integrates seamlessly with various laboratory instruments. Supporting data import and export to streamline sample processing and analysis.

- The software must also be highly configurable, allowing labs to customize workflows and business processes without extensive coding.

- Moreover, compliance with regulatory standards such as ISO 17025, GLP, and 21 CFR Part 11 is critical. Necessitating features like electronic signatures and audit trails to maintain data integrity and security.

- Modern LIMS also prioritize user-friendly interfaces and mobile accessibility to facilitate ease of use and remote access. The need for scalability is paramount as laboratories grow, requiring systems that can handle increasing data volumes and user demands.

- Recent advancements include the transition from traditional SaaS models to more advanced Platform as a Service (PaaS) and Container as a Service (CaaS) frameworks. Enhancing flexibility and integration capabilities.

- Companies like LabVantage and Thermo Fisher Scientific are leading the market with innovations such as new analytics solutions and automated mass spectrometry systems. Further advancing the capabilities of modern LIMS.

(Source: Software Connect)

Factors Considered While Selecting Laboratory Information Management Systems Software

Aspects That Describe the Best Decision-Making in Terms of LIMS Selection

- When selecting a Laboratory Information Management System (LIMS), several key factors are crucial for effective decision-making.

- Vendor reputation and brand awareness are paramount, with 67.79% of decision-makers considering these aspects vital. This reflects the importance of choosing a trusted and well-known vendor to ensure reliability and quality.

- Application support is another significant factor, valued by 62.67% of respondents. Robust application support ensures that users can rely on consistent, expert assistance. Which is essential for maintaining smooth operations and resolving any issues that arise.

- The most critical factor, with a value of 74.45%, is the compatibility and value of the vendor’s product with the current system. This underscores the need for a LIMS that seamlessly integrates with existing laboratory systems, enhancing overall efficiency and reducing disruption.

- These factors collectively guide laboratories in selecting a LIMS that meets their specific needs and supports their operational goals.

(Source: Ezovion)

Points Considered While Selecting LIMS Software

- When selecting Laboratory Information Management System (LIMS) software, various factors play significant roles in the decision-making process.

- The primary consideration is the specific requirements of the laboratory, which account for 49% of the decision criteria. This highlights the importance of ensuring the software meets the lab’s unique needs and workflows.

- Cloud-based solutions are also a notable factor, valued by 15% of decision-makers, reflecting the growing trend towards leveraging cloud technology for its scalability and accessibility benefits.

- Price is a consideration for 8% of respondents, indicating that cost-effectiveness is important but not the overriding concern.

- A flexible IT platform is critical for 5% of users, emphasizing the need for software that can adapt to evolving technological landscapes and integrate with various systems.

- Scalability, also at 5%, underscores the necessity for a system that can grow with the laboratory’s needs.

- Recommendations and ease of installation are each valued by 4% of decision-makers, highlighting the influence of peer reviews and the need for straightforward deployment processes.

- Other factors, making up 10%, include various additional considerations that might be specific to individual laboratories’ circumstances.

- Together, these points provide a comprehensive framework for laboratories to evaluate and select the most suitable LIMS software for their needs.

(Source: Ezovion)

Regulations for Laboratory Information Management Systems

- Laboratory Information Management Systems (LIMS) must comply with various regulations that ensure data integrity, security, and operational efficiency.

- In the United States, the Clinical Laboratory Improvement Amendments (CLIA) of 1988 set federal standards for all facilities that test human specimens, emphasizing the need for accurate, reliable, and timely test results. Compliance with CLIA is essential for laboratories to maintain certification and provide quality laboratory services.

- Globally, the International Health Regulations (IHR 2005), coordinated by the World Health Organization (WHO), encourage member states to develop robust laboratory quality management systems. These systems are critical for detecting and responding to potential public health emergencies.

- WHO supports laboratories with training, guidance, and tools to assess and improve their quality management capabilities.

- Recent developments in LIMS include advancements in software that enhance compliance with various regulatory requirements.

- Modern LIMS platforms offer features such as electronic signatures, complete audit trails, and real-time data exchange with electronic health records (EHRs), ensuring that laboratories meet stringent standards such as 21 CFR Part 11, GMP, and ISO 17025.

- The global LIMS market continues to grow, driven by the increasing need for compliance and advanced data management capabilities in laboratories.

(Source: CDC, WHO, Thermofisher Scientific)

Recent Developments

Acquisitions:

- Thermo Fisher Scientific’s Acquisition of Core Informatics: Thermo Fisher Scientific, a leader in scientific services, acquired Core Informatics in 2017.

- This acquisition aimed to expand Thermo Fisher’s capabilities in cloud-based LIMS, Electronic Lab Notebooks (ELN), and other informatics solutions, enhancing its position in the digital lab market.

New Product Launches:

- LabWare 8: LabWare launched LabWare 8, an updated version of its LIMS and ELN platform.

- LabWare 8 offers enhanced user interfaces, mobile capabilities, and improved integration with other laboratory instruments and software.

- The new version focuses on increasing laboratory efficiency and data integrity.

Funding:

- LabLynx’s Investment in Cloud LIMS: LabLynx received significant funding to develop and expand its cloud-based LIMS solutions.

- The investment aims to enhance the scalability and accessibility of LIMS for laboratories of all sizes, promoting the adoption of cloud technology in laboratory management.

Market Growth:

- Global LIMS Market Expansion: The growth is driven by the increasing demand for automation in laboratories, regulatory compliance requirements, and advancements in technology.

Innovation in LIMS Technology:

- Integration with IoT and AI: Recent advancements in LIMS include the integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies.

- These integrations allow for real-time data collection from laboratory instruments, predictive analytics, and enhanced decision-making processes, improving overall laboratory efficiency and accuracy.

Strategic Partnerships and Collaborations:

- Siemens Healthineers and SoftMax Pro Software: Siemens Healthineers partnered with Molecular Devices to integrate SoftMax Pro Software with Siemens’ LIMS solutions.

- This collaboration aims to streamline data management and analysis in clinical and research laboratories, providing a comprehensive solution for laboratory workflows.

Conclusion

Laboratory Information Management Systems (LIMS) are crucial for modern laboratories, enhancing efficiency, data integrity, and regulatory compliance.

The global LIMS market, projected to reach USD 3.5 billion by 2030, is driven by the need for robust data management and compliance capabilities.

Key components include software and services that integrate with laboratory instruments, provide real-time data visualization, and offer customizable workflows.

Regulations like CLIA in the U.S. and WHO’s IHR globally highlight the importance of maintaining high laboratory standards.

Recent advancements in cloud-based solutions and enhanced compliance features make LIMS indispensable for ensuring laboratory accuracy and efficiency.

FAQs

A LIMS is a software solution designed to manage laboratory operations, data, and workflows. It enhances efficiency, ensures data integrity, and supports regulatory compliance by automating sample tracking, data collection, and reporting processes.

Benefits include improved data accuracy, enhanced operational efficiency, streamlined workflows, better compliance with regulatory standards, and comprehensive data tracking and reporting capabilities.

A LIMS improves efficiency by automating data entry, reducing manual errors, integrating with laboratory instruments, providing real-time data access, and facilitating workflow management. This leads to faster turnaround times and optimized resource utilization.

Recent advancements include the adoption of cloud-based solutions, enhanced data visualization tools, improved compliance features, and the integration of advanced analytics. These innovations make LIMS more adaptable, scalable, and user-friendly.

LIMS is used across various industries, including pharmaceuticals, biotechnology, environmental testing, food and beverage, clinical research, and petrochemicals. Each industry benefits from improved data management, streamlined workflows, and enhanced compliance with industry-specific regulations.