Table of Contents

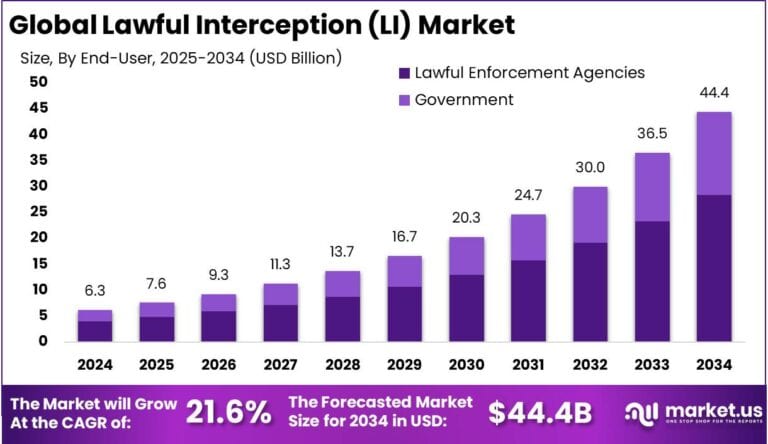

In 2024, the global lawful interception (LI) market reached a valuation of USD 6.28 billion and is projected to expand to approximately USD 44.4 billion by 2034, growing at a CAGR of 21.60% during 2025–2034. North America held a 34.8% market share, generating roughly USD 2.18 billion, while the U.S. accounted for USD 2.07 billion, with an expected CAGR of 19.8%. The rise of cyber threats, national security concerns, and stringent regulatory frameworks is fueling market demand. Increasing use of IP-based communication, cloud platforms, and encrypted messaging apps also accelerates the deployment of lawful interception solutions globally.

How Tariffs Are Impacting the Economy

U.S. tariffs have become a double-edged sword, particularly impacting tech-driven markets like lawful interception. As of 2024, tariffs on semiconductors, servers, and communication components—mainly imported from Asia—have raised hardware acquisition costs by 8–15% for U.S.-based intelligence solution providers. These cost increases strain budgets for law enforcement and surveillance technology firms, delaying deployment timelines.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/lawful-interception-li-market/free-sample/

Furthermore, retaliatory tariffs from key trade partners have limited access to foreign-built network infrastructure, complicating interoperability across jurisdictions. The higher cost of compliance and procurement not only reduces public sector contract margins but also challenges innovation in private firms. While designed to protect national tech sectors, these tariffs have inadvertently slowed down deployment of real-time surveillance tools—affecting both urban safety infrastructure and digital law enforcement strategies.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: Global interception solution providers are being forced to shift manufacturing from heavily tariffed countries like China to regions such as Vietnam, Taiwan, and Eastern Europe. This restructuring involves high capital costs and delays in global expansion.

Sector-Specific Impacts:

- Telecom Equipment: Tariffs on routers and network probes affect service provider integration.

- Cloud Surveillance: Costs for data storage and cloud access rise due to trade restrictions.

- Encryption Analysis: Tariffs on advanced chips hinder real-time decryption capabilities.

- Public Safety Infrastructure: Budget cuts occur due to inflated procurement and installation costs.

Strategies for Businesses

To remain competitive, lawful interception providers are employing several strategies:

- Supply Chain Diversification to minimize tariff exposure.

- Investments in Domestic Manufacturing to qualify for local government contracts.

- Open-Standard Platforms to avoid reliance on foreign proprietary tech.

- Strategic Partnerships with cloud providers for scalable storage and access.

- AI-Enhanced Interception Tools to offset high operational costs with automation.

These actions are helping firms reduce risk, improve compliance efficiency, and maintain long-term profitability.

Key Takeaways

- Global LI market to grow at 21.60% CAGR, reaching USD 44.4 billion by 2034.

- The U.S. leads North America with USD 2.07 billion market value in 2024.

- Tariffs are increasing hardware and deployment costs.

- Shifts in sourcing and tech stack are altering supply chains.

- Businesses are leveraging AI and domestic production to adapt.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148136

Analyst Viewpoint

The present lawful interception market is undergoing a digital transformation accelerated by compliance pressures and emerging threats. Despite the short-term impact of tariffs and geopolitical tensions, analysts foresee a positive long-term outlook, driven by smart city development, rising cybercrime, and real-time data analytics. Firms that adapt with modular, cloud-native, and AI-powered platforms are poised to lead the next phase of market evolution. As governments invest more in national security infrastructure, the lawful interception market will benefit from sustained public sector funding and cross-border collaborations.

Regional Analysis

North America dominates the LI market due to advanced digital infrastructure and strict security mandates. Europe follows closely, with GDPR and telecom compliance driving demand. The Asia-Pacific region is poised for significant growth owing to expanding telecom networks and national surveillance programs in countries like India and China. Latin America is showing traction as governments modernize public safety. Meanwhile, the Middle East & Africa are adopting lawful interception for counterterrorism and cyber policing, despite slower infrastructure readiness.

➤ Discover More Trending Research

- AI in Quick Service Restaurants Market

- Predictive Policing in Smart Cities Market

- Solar Powered UAVs Market

- AI in ESG and Sustainability Market

Business Opportunities

The evolution of 5G, cloud communications, and IoT opens fresh avenues for lawful interception vendors. Real-time monitoring of encrypted messaging, VoIP traffic, and digital payment systems is gaining priority. Opportunities are strong in cybersecurity firms, telecom service providers, government surveillance programs, and compliance automation platforms. Demand is rising for cloud-based lawful interception-as-a-service (LIaaS), especially among emerging economies with limited infrastructure. Vendors can also benefit from developing region-specific solutions tailored to local compliance and surveillance frameworks.

Key Segmentation

The lawful interception market is segmented by solution type, network type, component, end-user, and region.

- Solution Type: Voice Communication, Text Messaging, Digital Data, Video Surveillance

- Network Type: PSTN, VoIP, Mobile Networks, WLAN, DSL

- Component: Software, Hardware, Services

- End-User: Government Agencies, Law Enforcement, Service Providers

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

These segments define deployment priorities across public security, telecom, and data compliance landscapes.

Key Player Analysis

Leading vendors in the LI space focus on developing scalable, modular, and multi-jurisdictional interception platforms. They invest heavily in R&D to enhance data parsing, traffic filtering, and real-time monitoring. These players also collaborate with telecom providers to integrate lawful interception capabilities within core and edge networks. Strategic priorities include expanding into emerging markets, securing government contracts, and upgrading analytics engines to decode complex digital signals. Their resilience depends on regulatory agility, secure infrastructure, and a future-proof product roadmap aligned with evolving compliance laws.

Recent Developments

Recent trends include cloud-native interception systems, AI-powered traffic pattern analysis, and integration of lawful surveillance in 5G and IoT ecosystems, improving real-time threat detection capabilities.

Conclusion

The lawful interception market is entering a dynamic growth phase, propelled by digital threats and regulatory expansion. Businesses that invest in AI, supply chain agility, and secure cloud deployment will be best positioned to capitalize on emerging global opportunities.