Table of Contents

- Introduction

- Editor’s Choice

- Lead Acid Battery Market Statistics

- Specifications of Lead Acid Battery Statistics

- Comparison of Lead Acid Batteries and Other Batteries

- Global Lead-Acid Battery Demand Statistics

- Characteristics of Lead Acid Battery Statistics

- Lead Acid Battery Statistics by Cost

- Environmental Impact of Lead Acid Battery Statistics

- Lead Acid Battery Statistics New Trends

- Recent Developments

- Conclusion

- FAQs

Introduction

Lead Acid Battery Statistics: Lead-acid batteries, are among the oldest and most widely used rechargeable battery types.

Operate through a chemical reaction involving lead dioxide, sponge lead, and sulfuric acid in various designs. Including flooded and sealed varieties like Absorbent Glass Mat (AGM) and Gel batteries.

Due to their cost-effectiveness and reliability, they deliver 2 volts per cell and find application in diverse areas like automotive. Uninterruptible power supplies (UPS), renewable energy storage, and telecommunications.

However, they have downsides, such as their heavy weight, limited depth of discharge, and maintenance requirements. Proper recycling is crucial to mitigate environmental concerns regarding lead pollution.

Despite their enduring significance, lead-acid batteries face competition from emerging battery technologies. With ongoing research aiming to enhance their cycle life and energy density.

Editor’s Choice

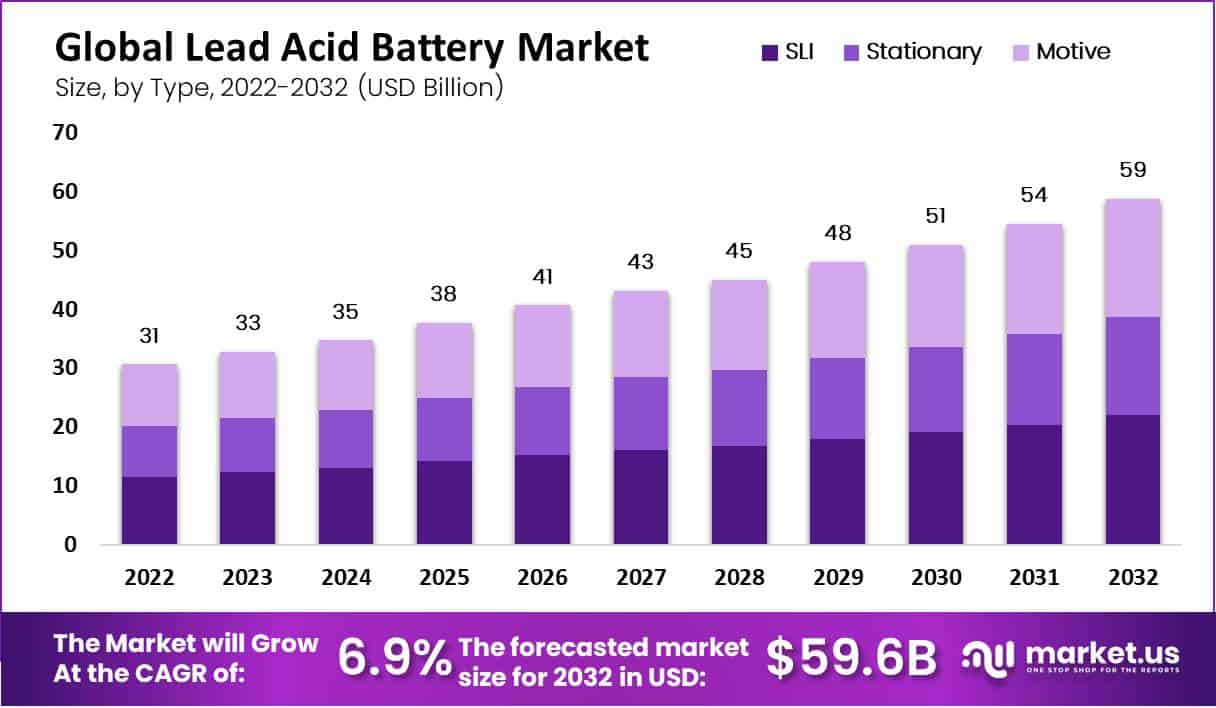

- The lead-acid battery market has displayed a consistent upward trajectory at a CAGR of 6.9% over the forecasted period from 2022 to 2032.

- The lead-acid battery market revenue is expected to reach 59.0 billion USD by 2032.

- Lead-acid batteries have a nominal voltage of 2.0V per cell, and when combined in a series of 6 cells, they provide a total voltage of 12.0V.

- Projections suggest that by 2025, the lead-acid batteries demand will rise to 476 GWh. Reflecting the growing use of lead-acid batteries in electric vehicles and related applications.

- Lead-acid batteries require a slow and extended charging process. Typically taking 8 to 10 hours, often performed overnight for safety and efficiency.

- Manufacturers of lead-acid batteries generally assert that their products have a cycle life ranging from 400 to 550 cycles.

- Lead-acid batteries shine as environmentally responsible products, boasting an impressive recycling rate of over 97%.

- The disposal of lead-acid batteries in landfills is minimal, accounting for only 60,000 tons, or less than 0.1% of discarded municipal solid waste, as 41 states prohibit their disposal in landfills.

Lead Acid Battery Market Statistics

Global Lead-Acid Battery Market Size Statistics

- The lead-acid battery market has displayed a consistent upward trajectory at a CAGR of 6.9% over the forecasted period from 2022 to 2032.

- Starting at 31.0 billion USD in 2022, the market revenue has steadily grown, with subsequent years marking significant increases.

- In 2023, it reached 33.0 billion USD, followed by 35.0 billion USD in 2024, and continued to climb, reaching 38.0 billion USD in 2025.

- This upward trend persisted throughout the projection period, with revenues expected to reach 59.0 billion USD by 2032.

- The sustained growth can be attributed to the enduring demand for lead-acid batteries across various industries and applications.

- Including automotive, telecommunications, and renewable energy storage, highlighting their continued relevance in the evolving energy storage landscape.

(Source: Market.us)

Specifications of Lead Acid Battery Statistics

- Lead-acid batteries, known for their reliability and widespread use, come with specific specifications that define their performance characteristics.

- They typically have a specific energy range of 35 to 40 Wh/kg and an energy density of 80 to 90 Wh/L. Reflecting their ability to store electrical energy efficiently.

- These batteries provide a specific power of around 180 W/kg, ensuring a steady release of power when needed.

- Charge and discharge efficiency can vary significantly, ranging from 50% to 95%, depending on factors like design and use case.

- Regarding cost-effectiveness, they offer an energy-to-consumer-price ratio of 7 (for sealed lead-acid) to 18 (for flooded lead-acid) Wh/US$.

- However, they exhibit a self-discharge rate ranging from 3% to 20% per month, which may require periodic recharging.

- Their cycle durability is typically limited to fewer than 350 cycles, making them suitable for applications without frequent deep cycling.

- The nominal cell voltage of lead-acid batteries stands at 2.1 V, ensuring compatibility with various systems.

- Moreover, they can be charged within a temperature range of –35°C (minimum) to 45°C (maximum). Making them adaptable to different environmental conditions.

(Source: Science Direct)

Comparison of Lead Acid Batteries and Other Batteries

- Several key characteristics stand out when comparing lead-acid, nickel-metal hydride (Ni-MH), and lithium polymer battery technologies.

- Lead-acid batteries have a nominal voltage of 2.0V per cell, and when combined in a series of 6 cells, they provide a total voltage of 12.0V.

- With a capacity of 100Ah, they offer an energy capacity of 1,200 Wh, making them suitable for various applications.

- However, lead-acid batteries are relatively heavy, weighing in at 34.3 kilograms, and occupy a significant volume of 13.4 liters.

- In contrast, Ni-MH batteries have a lower nominal voltage of 1.25V per cell. Requiring ten cells in series to reach 12.5V.

- These batteries also offer a capacity of 100Ah and an energy capacity of 1,250 Wh.

- While Ni-MH batteries are more lightweight at 15.6 kilograms, they still have a relatively substantial volume of 5.2 liters.

- Lithium polymer batteries, on the other hand, have a higher nominal voltage of 3.7V per cell, and when combined in a series of 4 cells, they yield a total voltage of 14.8V. With the same 100Ah capacity, they excel in energy capacity, providing 1,480 Wh.

- Lithium polymer batteries are notably lightweight at 8.2 kilograms and occupy a comparatively compact volume of 3.5 liters.

- In summary, lead-acid batteries offer moderate voltage and energy capacity but are heavy and bulky. Ni-MH batteries provide a slightly higher voltage but are still relatively heavy and have a moderate volume.

- Lithium polymer batteries stand out with their high voltage and excellent energy capacity. Lightweight nature, and compact size, make them a preferred choice for applications where weight and space constraints are critical.

(Source: Asian Development Bank)

Global Lead-Acid Battery Demand Statistics

Lead-acid Battery Demand by Application

- The global demand for lead-acid batteries varies significantly across different applications, showing distinct trends over the years.

- In 2018, the demand for lead-acid batteries in electric mobility was approximately 446 GWh, which increased to 470 GWh by 2020.

- Projections suggest that by 2025, the demand will rise to 476 GWh. Reflecting the growing use of lead-acid batteries in electric vehicles and related applications.

- Similarly, lead-acid batteries were in demand in energy storage, with 393 GWh required in 2018 and 413 GWh in 2020.

- However, it’s worth noting that the demand is expected to plateau and remain relatively stable at 407 GWh in 2025 and 406 GWh in 2030.

- On the other hand, lead-acid batteries used in consumer electronics saw a steady increase in demand from 53 GWh in 2018 to 57 GWh in 2020. With a significant projected jump to 69 GWh by 2025 and a further increase to 85 GWh by 2030.

- These trends reflect the evolving landscape of lead-acid battery applications. Electric mobility and consumer electronics experiencing notable growth while energy storage demand stabilizes.

(Source: World Economic Forum)

Lead-acid Battery Demand- by Region

- Global demand for lead-acid batteries varies by region, reflecting changing dynamics and needs.

- In 2018, China demonstrated the highest demand for lead-acid batteries. Consuming approximately 95 GWh, slightly increasing to 98 GWh by 2020.

- However, by 2025, the demand in China will decrease to 93 GWh but is expected to rebound significantly, reaching 114 GWh by 2030.

- In the European Union (EU), demand was relatively stable at 100 GWh in 2018 and 98 GWh in 2020, but it is projected to decline to 89 GWh by 2025 and further to 81 GWh by 2030.

- In the United States, demand increased from 65 GWh in 2018 to 75 GWh in 2020, and it is anticipated to remain relatively constant at 72 GWh by 2025 and 2030.

- The rest of the world, encompassing various regions, saw demand grow from 185 GWh in 2018 to 199 GWh in 2020. With further increases expected to reach 222 GWh by 2025 and 223 GWh by 2030.

- These regional variations reflect factors such as economic development, industrial growth, and technological advancements. Influencing the demand for lead-acid batteries on a global scale.

(Source: World Economic Forum)

Characteristics of Lead Acid Battery Statistics

Charging Capability

- Lead-acid batteries require a slow and extended charging process. Typically taking 8 to 10 hours, often performed overnight for safety and efficiency.

- In contrast, lithium batteries can undergo a slower charging cycle of about 3 hours or even a rapid charging process, taking just an hour. Without compromising their service life, charging efficiency, or safety.

- For early inventions, back in March 2011, Mitsubishi introduced two Level 3 Electric Vehicle DC Fast Charge stations in Australia. Enabling a 50% charge for the i-MIEV lithium battery within 12 minutes and reaching 80% charge in just 30 minutes.

- Additionally, Dr. Paul Braun and his research team at the University of Illinois, Urbana-Champaign. Achieved a breakthrough with prototype batteries that could be charged in under two minutes, as reported in The Economist’s March 2011 issue.

- This fast charging capability minimizes vehicle downtime for recharging and extends the vehicle’s operational time on the road.

(Source: Asian Development Bank)

Battery Capacity

- Lead-acid batteries are typically categorized into two primary types: deep-cycle and shallow-cycle.

- Deep-cycle batteries can endure discharges of over 50%, and sometimes even as much as 80%, which allows for extended energy utilization.

- Conversely, suppose one opts for a shallow-cycle battery bank to achieve the same usable capacity. In that case, it necessitates having a larger overall capacity when compared to a deep-cycle battery bank.

- Beyond just considering the depth to which the battery can be discharged and its rated capacity. The actual usable battery capacity is profoundly influenced by the rate at which we discharge the battery and the operating temperature of the battery.

- When the temperature drops below approximately 20°C, the battery’s capacity begins to decline. Typically decreasing by around 1% for each degree of temperature drop. These factors are crucial in ensuring the effectiveness and longevity of a battery bank in a PV system.

(Source: PV Education)

Battery Life-cycle

- In the context of batteries, a cycle signifies the complete process of charging and discharging a battery. The longevity of a battery hinges on how many of these cycles it can undergo before its capacity to store and deliver energy experiences a significant decline.

- Manufacturers of lead-acid batteries generally assert that their products have a cycle life ranging from 400 to 550 cycles.

- However, when subjected to independent testing by an undisclosed manufacturer. Four brands of lead-acid batteries were found to have a cycle life of only 300 to 400 cycles.

- On the other hand, E-bike manufacturers typically offer warranties that span just 1 to 1.5 years, equivalent to roughly 110 to 170 cycles.

- In contrast, Chinese manufacturers producing Lithium Ferro Phosphate (LiFePO4) batteries make bold claims regarding cycle life. Touting figures of more than 2,000 to 3,000 cycles when the depth of discharge reaches 80%.

- This impressive cycle life extends even further, surpassing 5,000 cycles when the depth of discharge is reduced to 70%.

- A Korean company conducted tests that showcased their lithium battery retaining 70% of its capacity after enduring 2,000 cycles with almost 100% depth of discharge.

- Additionally, a Japanese battery manufacturer boasts a cycle life of up to 6,000 cycles for its lithium battery.

- These data unquestionably underscore that lithium batteries, particularly when discharged to a depth of 80%. Exhibit a cycle life of at least 2,000 cycles, four times longer than the average cycle life claimed by lead-acid battery manufacturers.

(Source: Asian Development Bank)

Discharge Rate

- The provided data represents the maximum discharge duration in hours for both flooded tubular Lead-acid batteries and VRLA (Valve-Regulated Lead-Acid) batteries. Along with the corresponding output percentages and discharge rates for a 100Ah battery.

- For flooded tubular Lead-acid batteries, the maximum discharge durations range from 10 hours at 100% output, gradually decreasing to 1 hour at 50% output.

- Regarding discharge rates, the battery starts at 10 Amps and decreases to 1 Amp as the discharge duration extends.

- On the other hand, for VRLA batteries, the maximum discharge durations also range from 10 hours at 100% output to 1 hour at 50% output.

- However, the discharge rates for VRLA batteries are slightly higher. Starting at 11.9 Amps and decreasing to 50 Amps as the discharge duration increases.

- These data points provide valuable information for understanding the discharge characteristics of these battery types. Which is essential for designing and managing power systems that rely on them.

- It’s evident that as the discharge duration increases, the output percentage decreases, and the discharge rate varies accordingly. Highlighting the trade-offs between battery capacity and discharge rate in different scenarios.

(Source: The Clean Network)

Lead Acid Battery Statistics by Cost

- The cost analysis here compares Lead-Acid AGM batteries with Lithium-Ion batteries regarding installed capacity, usable capacity, lifespan, number of installations, and associated costs.

- In this scenario, the installed capacity for Lead-Acid AGM is 100 KWh, whereas Lithium-Ion has a capacity of 50 KWh. Both types offer a usable capacity of 50 kWh.

- However, the lifespan of Lead-Acid AGM is 500 cycles at a 50% Depth of Discharge (DoD). While Lithium-Ion boasts an impressive 3000 cycles at 100% DoD.

- Regarding the number of installations, Lead-Acid AGM requires six installations (one initial installation and five replacements), whereas Lithium-Ion only requires one.

- The battery cost for Lead-Acid AGM totals 60,000€, calculated at 100€ per KWh, multiplied by 100 KWh, and then multiplied by the six installations.

- In contrast, Lithium-Ion costs 20,000€, calculated at 400€ per KWh, multiplied by 50 KWh, for a single installation.

- Additionally, installation costs for Lead-Acid AGM amount to 12,000€, calculated at 2,000€ per installation, multiplied by the six installations.

- Transportation costs for Lead-Acid AGM come to 6,000€, calculated at 1,000€ per transport, multiplied by six installations. On the other hand, Lithium-Ion incurs a one-time installation cost of 2,000€ and a transportation cost of 1,000€.

- In summary, the total cost for Lead-Acid AGM is 78,000€, while Lithium-Ion costs 23,000€.

- When evaluating the cost per usable KWh per cycle, Lead-Acid AGM comes to 0.42€ per usable KWh (calculated as 78,000€ divided by 3000 cycles and 50 KWh).

- In contrast, Lithium-Ion is more cost-efficient at 0.15€ per usable KWh (calculated as 23,000€ divided by 3000 cycles and 50 KWh).

- This analysis helps to highlight the cost disparities between the two battery types, considering their capacities, lifespans, and associated expenses.

(Source: PowerTech Systems)

Environmental Impact of Lead Acid Battery Statistics

Environmental Benefits

- Lead-acid batteries shine as environmentally responsible products, boasting an impressive recycling rate of over 97%.

- This recycling rate outperforms other consumer goods. Including aluminum soft drink cans and beer cans at 55%, newspapers at 45%, glass bottles at 26%, and tires at 26%.

- The secret behind the environmental success of lead-acid batteries lies in their closed-loop life cycle.

- A typical new lead-acid battery incorporates 60 to 80% recycled lead and plastic materials. When used batteries are collected, they undergo recycling at carefully regulated facilities. Where the lead and plastic components are meticulously reclaimed.

- These reclaimed materials are then supplied to new battery manufacturers while adhering to stringent environmental standards.

- This commitment to recycling and sustainability makes lead-acid batteries a shining example of eco-friendly products.

(Source: Grin)

Environmental Challenges

- Sealed Lead-Acid (SLA) batteries primarily consist of lead (71-76%), sulfuric acid electrolyte (16-19%), and around 8-10% other components, including the casing and vents.

- The production of batteries remains the largest lead consumer in the United States. Accounting for 88% of the country’s lead consumption.

- The International Agency for Research on Cancer (IARC) and the Environmental Protection Agency (EPA) classify lead as a potential human carcinogen.

- Approximately 3 million metric tons of lead ore are mined annually. With six countries—Australia, Canada, China, Mexico, Peru, and the USA—contributing 75% of the total production.

- Lead mining has numerous ecological effects, with much of it occurring underground or near the surface, often resulting in open mine shafts.

- Around 50% of the world’s lead used in production is derived from recycling existing lead products. Developed countries, especially the USA, excel in lead recycling, with over 80% of domestic lead expenditure recovered from used batteries.

- However, it’s worth noting that not all SLA batteries are recycled, particularly smaller Uninterruptible Power Supplies (UPS) used in various applications, which accounted for 37% of North American UPS deliveries in 2002.

- Remarkably, about 1.88 million tons of batteries in municipal solid waste are recycled each year, achieving an impressive recycling rate of 96.9%.

- This high rate is bolstered by legislation in 37 states in the U.S. requiring retailers to collect old lead-acid batteries when customers purchase new ones.

- The disposal of lead-acid batteries in landfills is minimal, accounting for only 60,000 tons, or less than 0.1% of discarded municipal solid waste, as 41 states prohibit their disposal in landfills.

(Source: Grin)

Lead Acid Battery Statistics New Trends

- Recently, alternative battery technologies have gained attention, with sodium-ion (Na-ion) batteries emerging as a notable option.

- What sets Na-ion batteries apart is their reliance on more affordable materials compared to traditional Li-ion batteries, resulting in cost-effective battery production.

- Furthermore, Na-ion batteries have a distinctive advantage because they do not require critical minerals, making them the sole viable chemistry lacking lithium.

- For instance, China’s CATL has developed a Na-ion battery estimated to be 30% cheaper than a Lithium Iron Phosphate (LFP) battery.

- However, it’s essential to note that Na-ion batteries do not match the energy density of their Li-ion counterparts, offering a range of 75 to 160 Wh/kg compared to Li-ion’s 120 to 260 Wh/kg.

- This makes Na-ion batteries well-suited for urban vehicles with shorter ranges or stationary storage applications. Nevertheless, they may face challenges in areas where consumers prioritize extended-range autonomy or where convenient charging infrastructure is less accessible.

- Currently, nearly 30 Na-ion battery manufacturing facilities are in operation, planning, or construction, primarily in China.

- These facilities have a combined capacity exceeding 100 GWh. To provide context, the existing manufacturing capacity for Li-ion batteries stands at approximately 1,500 GWh.

(Source: International Energy Agency)

Recent Developments

Acquisitions and Mergers:

- Enersys acquires Alpha Technologies: In early 2023, Enersys acquired Alpha Technologies, a leading provider of power solutions, for $750 million. This acquisition aims to enhance Enersys’s product portfolio in lead-acid batteries and expand its market presence in telecommunications and industrial applications.

- Clarios acquires A123 Systems: Clarios, a global leader in advanced energy storage solutions, completed its $500 million acquisition of A123 Systems in late 2023. This merger is expected to strengthen Clarios’s capabilities in the lead-acid battery market by integrating A123’s expertise in lithium-ion technology.

New Product Launches:

- Exide Technologies’ Marathon M12V190FT: In mid-2023, Exide Technologies launched the Marathon M12V190FT, a new lead-acid battery designed for high energy density and long life in telecommunication and UPS applications. This product aims to provide reliable and efficient power solutions for critical infrastructure.

- East Penn’s Deka HRC: East Penn Manufacturing introduced the Deka HRC (High Rate Commercial) series in early 2024, featuring enhanced performance and durability for commercial and industrial applications. This series targets high-demand environments requiring robust power solutions.

Funding:

- Trojan Battery secures $100 million: In 2023, Trojan Battery, a leading manufacturer of deep-cycle batteries, raised $100 million to expand its production facilities and invest in research and development for advanced lead-acid battery technologies.

- Johnson Controls raises $200 million: Johnson Controls secured $200 million in early 2024 to develop next-generation lead-acid batteries and improve manufacturing processes, aiming to increase efficiency and sustainability in battery production.

Technological Advancements:

- Enhanced Recycling Processes: Advances in recycling technology are enabling more efficient and environmentally friendly recycling of lead-acid batteries, reducing waste, and recovering valuable materials for reuse in new batteries.

- Improved Battery Management Systems (BMS): Developments in Battery Management Systems are enhancing the performance and lifespan of lead-acid batteries by providing better monitoring, control, and optimization of battery charging and discharging cycles.

Market Dynamics:

- Growth in Lead Acid Battery Market: The global lead-acid battery market is projected to grow at a CAGR of 4.5% from 2023 to 2028, driven by increasing demand for energy storage, automotive, and industrial applications.

- Rising Adoption in Renewable Energy: Lead-acid batteries are seeing increased adoption in renewable energy systems for applications such as solar and wind energy storage, contributing to market growth due to their reliability and cost-effectiveness.

Regulatory and Strategic Developments:

- EU Battery Directive Update: The European Union updated its Battery Directive in early 2024 to include stricter regulations on the production, recycling, and disposal of lead-acid batteries, promoting sustainability and reducing environmental impact.

- US EPA Recycling Initiatives: The US Environmental Protection Agency (EPA) launched new recycling initiatives in 2023 to encourage the safe and efficient recycling of lead-acid batteries, aiming to reduce hazardous waste and promote resource recovery.

Research and Development:

- Advanced Lead-Alloy Grids: R&D efforts are focusing on developing advanced lead-alloy grids to improve the performance, efficiency, and lifespan of lead-acid batteries, making them more competitive with alternative energy storage technologies.

- Nanotechnology in Lead Acid Batteries: Researchers are exploring the use of nanotechnology to enhance the electrochemical properties of lead-acid batteries, potentially increasing their energy density and reducing charging times.

Conclusion

Lead Acid Battery Statistics – In conclusion, lead-acid batteries have been a dependable and cost-effective energy storage solution across various industries.

They boast a remarkable recycling rate, making them one of the most recycled consumer products. Despite newer battery technologies like lithium-ion gaining popularity. Lead-acid batteries remain relevant in specific applications due to their proven reliability and affordability.

However, they have limitations, such as lower energy density and shorter cycle life, which may restrict their suitability for high-performance applications like electric vehicles.

Nonetheless, lead-acid batteries continue to serve as a sustainable and dependable choice in many sectors, emphasizing their lasting importance in energy storage.

FAQs

A lead-acid battery is a type of rechargeable battery that uses lead dioxide and sponge lead to store electrical energy. It is widely used in various applications, including automotive, industrial, and backup power systems.

Lead-acid batteries operate on the principle of chemical reactions between lead dioxide and sponge lead in a sulfuric acid electrolyte. During discharge, these materials react to produce electrical energy, and during charging, the process is reversed.

Lead-acid batteries are commonly used in vehicles (such as cars, trucks, and motorcycles), uninterruptible power supplies (UPS), renewable energy systems (like solar and wind power), forklifts, and backup power sources.

Lead-acid batteries are known for their affordability, reliability, and ease of recycling. They have a long history of use and are well-suited for applications where cost-efficiency is crucial.

Lead-acid batteries have lower energy density and a shorter cycle life than newer battery technologies like lithium-ion. They are also relatively heavy and require regular maintenance, including topping up with distilled water.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)