Table of Contents

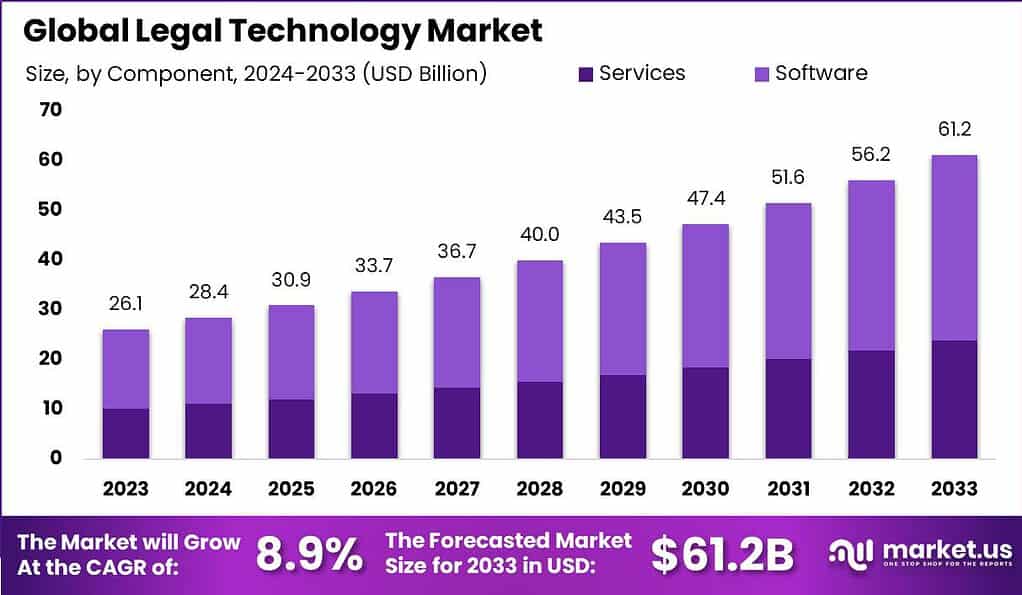

The Global Legal Technology Market is undergoing a significant transformation, driven by the integration of artificial intelligence, cloud computing, and automation into legal workflows. The market is expected to grow from USD 26.09 Billion in 2023 to approximately USD 61.2 Billion by 2033, expanding at a compound annual growth rate (CAGR) of 8.90% during the forecast period. This growth reflects increasing demand for digital tools that streamline legal research, case management, e-discovery, and contract analytics, particularly among law firms and corporate legal departments seeking greater efficiency and compliance.

The legal technology market refers to digital tools used by law firms, corporate legal departments, and individual practitioners to enhance efficiency, access, and compliance in legal workflows. Historically, legal organizations resisted major digital shifts. However, the surge in electronic data and remote work has accelerated the adoption of cloud-based platforms, AI-powered analytics, and automation routines.

A primary driver is the mounting complexity of legal workloads and cross-border regulations. An increasingly intricate regulatory environment has led to an exponential rise in digital case materials, e‑discovery needs, and compliance obligations. Cloud solutions, AI platforms, and machine‑learning tools are being deployed to streamline these processes . Additionally, competitive pressure is pushing law firms to deliver faster and more transparent services.

Sample Report Request: Unlock Valuable Insights for Your Business: https://market.us/report/legal-technology-market/free-sample/

Demand for legal technology is driven by a combination of internal and external pressures. Firms require systems that can manage large volumes of data securely and support remote collaboration. Clients now expect transparency and speed, prompting investment in analytics and case management modules. Corporate legal teams are similarly allocating budgets toward automation to control costs while managing commercial complexity.

Artificial intelligence, blockchain, cloud computing, and e‑discovery systems represent the leading technology segments. AI is being used for legal research, predictive analytics, and contract review. Blockchain supports smart contracts and enhanced data integrity. Cloud platforms enable remote access and collaboration. E‑discovery suites help manage massive document sets.

Key Takeaways

- The Global Legal Technology Market is projected to reach USD 61.2 Billion by 2033, growing from USD 26.09 Billion in 2023, at a steady CAGR of 8.90% during the forecast period.

- In 2023, the Software segment led the market, capturing more than 61% share, driven by the need for digital legal tools and workflow automation.

- The Law Firms segment held a strong position, accounting for over 55% share, as firms increasingly adopted legal tech for client management and case efficiency.

- The E-discovery segment played a key role in 2023, securing more than 25% share, reflecting the growing demand for automated document analysis and compliance.

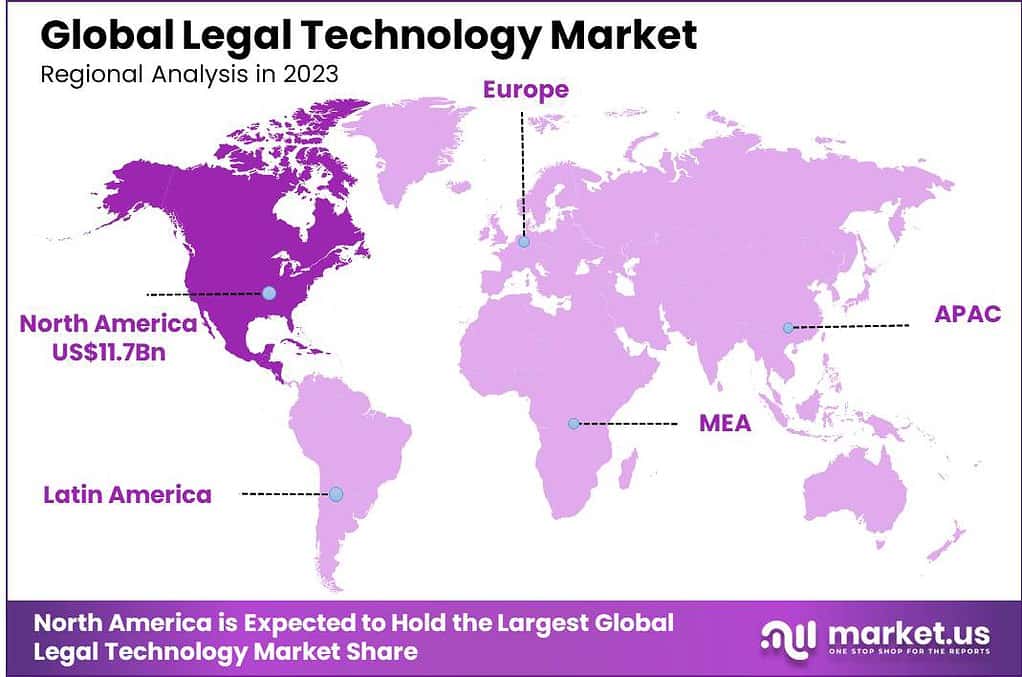

- North America remained the leading region, contributing 45% share and generating about USD 11.7 Billion in revenue, supported by early adoption and strong legal infrastructure.

Regional Analysis

In 2023, North America held a leading position in the legal technology market, capturing over 45% of the global share and generating about USD 11.7 Billion in revenue. The region’s dominance is driven by early adoption of legal tech solutions, strong presence of legal service providers, and growing investments in AI-powered legal platforms. Regulatory reforms, increasing volumes of litigation data, and pressure to reduce legal costs have further encouraged U.S. and Canadian firms to digitize their legal operations and embrace tech-enabled service delivery models.

Emerging Trend Analysis

AI-Powered Contract Lifecycle Management

Legal technology is increasingly shaped by the integration of artificial intelligence into contract lifecycle management. The trend is gaining momentum as law firms and corporate legal departments prioritize automation to manage complex documentation more efficiently. AI tools are being trained to extract key terms, identify risk clauses, and recommend language based on prior decisions, thereby reducing the burden on legal staff.

The growth of AI in CLM is also enabling proactive compliance by flagging outdated or non-compliant contract terms before execution. As digital contracting becomes more prevalent, early adopters of AI-based solutions are reporting significant time savings and accuracy improvements. The trend is expected to continue as legal departments seek strategic value beyond traditional document review.

Driver Analysis

Need for Operational Efficiency in Legal Workflows

Legal operations are increasingly under pressure to streamline workflows, reduce costs, and deliver faster turnaround. This has emerged as a major driving factor for adopting legal technology platforms. Tools that automate repetitive tasks such as document review, legal research, and e-discovery are becoming essential in enabling leaner legal teams to handle higher workloads.

Firms are now optimizing their resources by deploying software that eliminates time-consuming manual work. This shift not only enhances productivity but also aligns with client expectations for faster and more transparent legal services. As budgets tighten, efficiency gains through technology adoption are being treated as a strategic necessity.

Restraint Analysis

Concerns Over Data Privacy and Security

A key restraint facing the legal technology market is the heightened concern surrounding data privacy and cybersecurity. Legal service providers handle highly confidential client information that must be protected from unauthorized access or misuse. Storing this data in cloud environments or feeding it into algorithmic models often triggers hesitation, especially in regions with strict data protection laws.

Many firms lack internal policies and infrastructure to ensure full compliance with regulations such as GDPR or national legal confidentiality requirements. As a result, adoption is delayed or limited to non-sensitive areas. Until vendors can offer solutions with strong encryption, access control, and audit trails, security concerns will continue to restrain full-scale adoption.

Opportunity Analysis

Untapped Potential in Emerging Legal Markets

Emerging economies represent a strong opportunity for legal technology providers due to rising demand for accessible and cost-effective legal services. Small firms and solo practitioners in developing countries are increasingly exploring cloud-based tools to manage case files, automate document creation, and conduct legal research without heavy infrastructure costs.

These markets are often underserved by traditional legal service models, making technology-driven platforms an attractive solution for expanding access to justice. In addition, digital transformation initiatives by governments and increased smartphone penetration further support tech adoption in legal processes. This presents a major growth opportunity for companies ready to localize solutions for diverse legal systems.

Challenge Analysis

Difficulties Integrating Legal Tech with Legacy Systems

One of the most persistent challenges in legal tech adoption is the difficulty of integrating modern tools with outdated systems. Many legal organizations continue to operate on legacy software that was not designed for interoperability. As a result, onboarding AI, blockchain, or cloud-based platforms often requires complex middleware solutions or costly system overhauls.

This integration gap not only demands significant time and IT investment but also increases the risk of workflow disruption. Legal teams may resist change due to fear of data loss, downtime, or usability issues. Unless legal tech vendors provide plug-and-play compatibility or migration support, integration complexity will remain a critical barrier to adoption.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 26.09 Bn |

| Forecast Revenue (2033) | USD 61.2 Bn |

| CAGR (2024-2033) | 8.9% |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Component (Software, Services), By End-User (Law Firms, Corporate Legal Departments), By Application (E-discovery, Legal Research, Practice and Compliance Management, Document Management, Billing and Time Tracking,Others) |

Top Key Players

- My CaseThomson Reuters

- ProfitSolv, LLC

- Icertis, Inc.

- Filevine Inc.

- Clio

- DocuSign, Inc.

- Mystacks, Inc.

- Casetext Inc.

- Knovos, LLC

- Other Key Players

Explore More Reports

- PC Gaming Accessories Market

- Medium and Low Voltage MOSFET Market

- Logistics Insurance Market

- Personal Safety App Market

- Optical Design Software Market

- Secure Web Gateway Market

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)