Table of Contents

Introduction

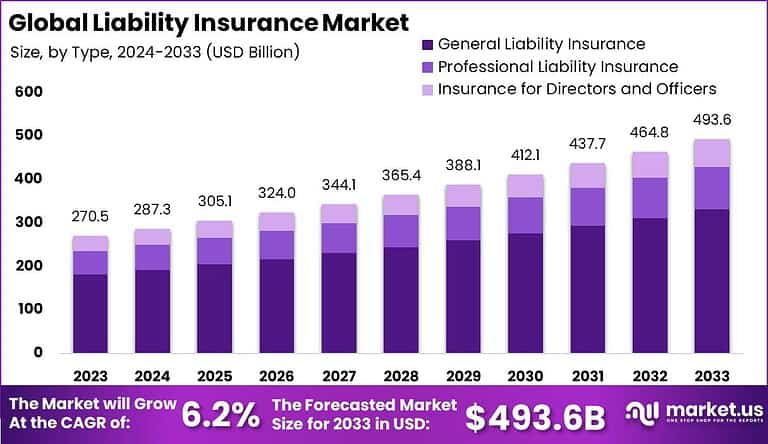

The Global Liability Insurance Market is expected to grow from USD 270.5 billion in 2023 to USD 493.6 billion by 2033, achieving a CAGR of 6.20%. North America dominates the market, capturing 42.3% share and generating USD 144.4 billion in revenue in 2023. This growth is driven by the increasing complexity of global business operations, heightened awareness of liability risks, and the growing need for businesses and individuals to protect themselves from potential lawsuits and legal claims. As industries become more interconnected and regulatory frameworks tighten, the demand for comprehensive liability insurance solutions continues to rise.

How Growth is Impacting the Economy

The expansion of the liability insurance market is having a significant impact on the global economy by providing essential risk management tools for businesses, governments, and individuals. Liability insurance mitigates financial risks, ensuring that organizations can recover from potential legal and financial claims. This stability fosters economic growth by promoting confidence in business operations and encouraging investments across various industries.

Moreover, the increasing uptake of liability insurance is driving job creation in the insurance sector, expanding service offerings, and contributing to overall financial system resilience. It also supports the smooth functioning of sectors like healthcare, manufacturing, and construction by reducing the financial impact of potential legal challenges.

➤ Unlock growth! Get your sample now! – https://market.us/report/liability-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: As liability risks become more complex, businesses are seeing rising premiums for insurance policies, especially in sectors prone to high liability claims, such as healthcare, construction, and manufacturing. However, liability insurance helps businesses mitigate the financial impact of claims, ensuring continuity and stability. Additionally, the shift towards global supply chains has led to an increase in cross-border liability issues, making comprehensive insurance coverage crucial.

Sector-Specific Impacts: In healthcare, liability insurance covers medical malpractice and patient-related claims. Construction companies benefit from coverage against accidents and property damage. The automotive industry uses liability insurance to cover accidents and injuries caused by vehicles. Technology companies are increasingly adopting cyber liability insurance to protect against data breaches and cyberattacks. As the scope of risks grows, the demand for specialized liability insurance solutions across sectors is expected to rise.

Strategies for Businesses

- Invest in comprehensive liability insurance coverage to protect against evolving risks and claims.

- Work with brokers to customize liability policies that address specific industry needs and regulatory requirements.

- Focus on risk management practices to reduce liability claims and lower premiums.

- Explore bundled insurance policies that cover multiple risks, offering cost savings and broader protection.

- Stay informed about changes in global regulations that could impact liability exposure, such as data protection laws and environmental regulations.

Key Takeaways

- The market is expected to reach USD 493.6 billion by 2033.

- CAGR of 6.20% from 2024 to 2033.

- North America leads with 42.3% share and USD 144.4 billion revenue in 2023.

- Growth driven by increasing business complexities, awareness of risks, and regulatory requirements.

- Key sectors benefiting: healthcare, construction, technology, automotive, and manufacturing.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=130616

Analyst Viewpoint

The liability insurance market is expected to continue growing steadily as businesses face increasing liability risks due to complex global operations and stricter regulations. As the scope of liability expands into emerging areas such as cybersecurity and environmental damage, liability insurance providers are diversifying their offerings to meet these challenges. The future of liability insurance will see more tailored solutions that align with industry-specific risks, providing businesses with greater protection and mitigating financial losses. Companies that adapt to these changing risks with specialized, scalable coverage will be well-positioned in the evolving market.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Healthcare | Increasing medical malpractice claims and healthcare liability risks. |

| Construction | Need for accident and property damage protection in high-risk environments. |

| Automotive | Rising accident rates and liability claims in the automotive sector. |

| Technology | Growing demand for cyber liability insurance due to data breach concerns. |

| Manufacturing | Protection against product-related liability claims and workplace accidents. |

Regional Analysis

North America dominates the market with 42.3% share and USD 144.4 billion revenue in 2023, driven by a strong insurance ecosystem, advanced risk management systems, and regulatory frameworks. Europe follows with steady growth due to stringent regulations in healthcare, construction, and environmental protection. Asia-Pacific is projected to experience the fastest growth, especially in China and India, where rising industrial activity and regulatory changes are increasing the demand for liability insurance. Latin America and the Middle East & Africa are emerging markets, seeing rising demand due to growing business activities and an increasing focus on risk management.

Business Opportunities

The growing demand for liability insurance presents opportunities for businesses to expand their offerings in niche markets such as cyber liability, environmental liability, and product liability. The rise of startups and SMEs also creates potential for customized liability solutions that cater to smaller-scale businesses with unique risks. Additionally, the increasing complexity of cross-border business transactions provides opportunities for global insurers to offer comprehensive liability coverage that spans multiple jurisdictions. Companies that innovate with tailored products, flexible pricing models, and digital solutions will thrive in this expanding market.

Key Segmentation

The market is segmented by Type (General Liability, Professional Liability, Product Liability, Cyber Liability, Others), End-User Industry (Healthcare, Manufacturing, Construction, Technology, Automotive, Others), Policy Type (Comprehensive, Limited, Single-Risk), and Region (North America, Europe, APAC, Latin America, Middle East & Africa). The general liability segment dominates due to its broad coverage across various industries, while the cyber liability segment is expected to grow rapidly as businesses become more exposed to digital risks.

Key Player Analysis

Key players in the liability insurance market are focusing on offering industry-specific solutions to meet the unique needs of sectors such as healthcare, technology, and construction. These companies are expanding their product portfolios to include coverage for emerging risks like cyber threats and environmental liabilities. Additionally, insurers are increasingly adopting digital platforms to streamline the process of policy management, claims handling, and customer engagement, making it easier for businesses to access customized coverage and reduce their overall exposure to liability risks.

- Allianz SE Company Profile

- AXA SA

- Zurich Insurance Group

- Chubb Limited

- American International Group, Inc.

- Liberty Mutual Insurance Company

- The Hartford

- Berkshire Hathaway Specialty Insurance

- Munich Re Group

- Aviva plc

- Other Key Players

Recent Developments

- Introduction of new liability insurance policies tailored for emerging risks like cybersecurity and environmental damage.

- Increased focus on digital transformation in the insurance industry to enhance customer experience and policy management.

- Expansion of liability insurance offerings to cover small and medium-sized enterprises (SMEs).

- Partnership between insurers and technology firms to develop AI-driven risk assessment models.

- Growth in the demand for cyber liability insurance as businesses face increasing data breach threats.

Conclusion

The Global Liability Insurance Market is expected to continue its growth trajectory as businesses and individuals increasingly recognize the importance of comprehensive coverage in managing evolving risks. With continued innovation in specialized policies and the increasing complexity of liability risks, the market offers significant opportunities for both insurers and businesses to ensure long-term stability and protection.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)