Table of Contents

- Introduction

- Editor’s Choice

- Global LiDAR Market Size

- Global LiDAR System Sensor Sales

- Automotive LiDAR Shipments Statistics

- Global LiDAR for Robotic Car Market

- Patents Filed by Key Companies in the LiDAR Industry

- LiDAR Technology Regional Statistics

- Price and Growth Rate Trends

- Challenges in Using LiDAR Technology

Introduction

According to LiDAR Statistics, LiDAR, an abbreviation for Light Detection and Ranging, is a remote sensing tool. Its functioning involves emitting laser pulses and subsequently gauging the time taken for their return, resulting in the development of intricate 3D representations of the nearby surroundings.

This technology boasts a broad spectrum of applications, encompassing the generation of intricate topographical charts, the management of forested areas, urban planning, the investigation of historical sites, the navigation of self-driving vehicles, environmental surveillance, support for mining operations, and the examination of critical infrastructure.

LiDAR’s exactitude in distance measurement and its capacity to record characteristics such as object dimensions, form, and reflectivity are of immense value, making substantial contributions to progress in diverse sectors.

Editor’s Choice

- The LiDAR market is experiencing remarkable growth at a CAGR of 22.5%.

- In 2022, the LiDAR market generated USD 1.6 billion in revenue, which is projected to rise to USD 11.6 billion in 2032.

- In 2022, the total revenue for the LiDAR market was USD 1.6 billion, with airborne LiDAR contributing USD 1 billion, terrestrial Li-DAR accounting for another USD 1 billion, and mobile & UAV LiDAR bringing in no revenue.

- Notably, corridor mapping accounts for the largest market share at 34%, reflecting the technology’s crucial role in creating detailed 3D maps for transportation and infrastructure planning.

- The LiDAR market catering to automotive and industrial applications is on the brink of substantial expansion. Its projected growth trajectory will take it from $2.1 billion in 2021 to a robust $6.3 billion by 2027.

- In 2022, the market size for solid-state and flash LiDAR systems amounted to USD 7 million, while mechanical LiDAR systems dominated with a market size of USD 2,225 million, underscoring their established presence.

- Between 2010 and 2019, General Motors led the pack with 103 LiDAR patents published during this period, underlining their commitment to autonomous vehicle development.

Global LiDAR Market Size

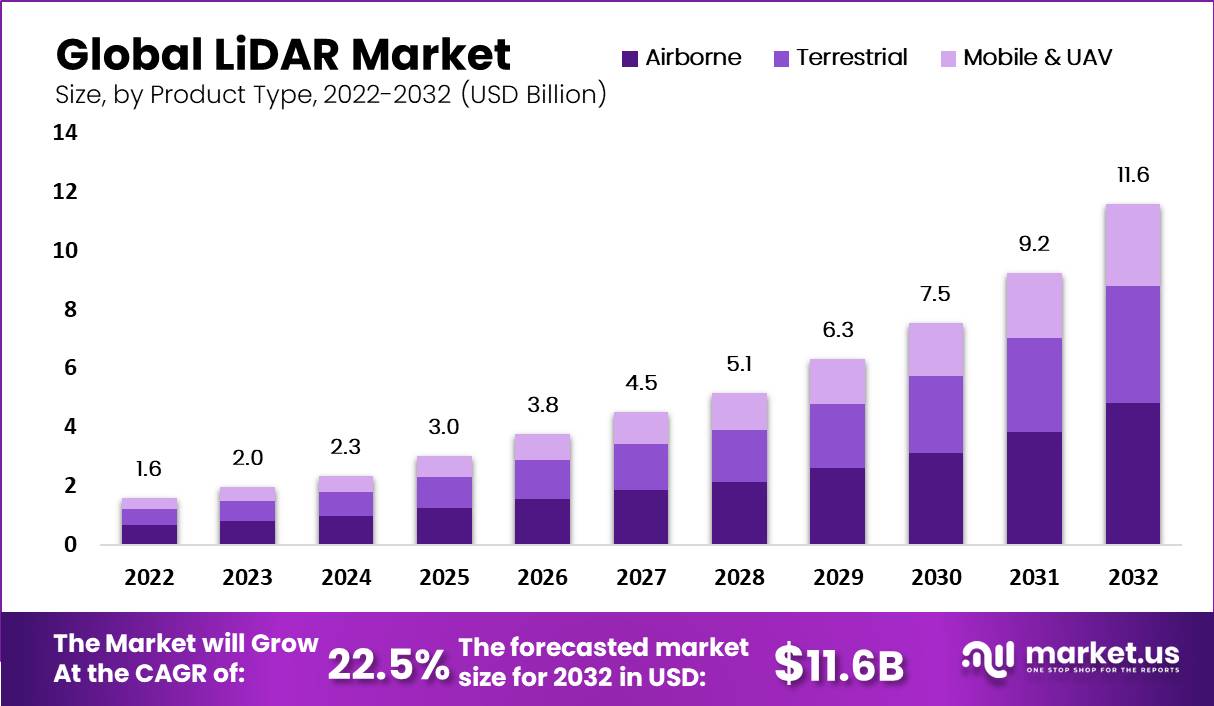

- The LiDAR market is experiencing remarkable growth at a CAGR of 22.5%, with revenues steadily increasing yearly.

- In 2022, the market generated USD 1.6 billion in revenue, projected to rise to USD 2.0 billion in 2023.

- The trend continues with anticipated revenues of USD 2.3 billion in 2024 and USD 3.0 billion in 2025.

- The most striking growth is anticipated in 2032, when the LiDAR market is expected to reach a staggering USD 11.6 billion, underscoring the increasing importance of LiDAR technology in various industries.

LiDAR Market Revenue- by Product Type

- In 2022, the total revenue for the LiDAR market was USD 1.6 billion, with airborne Li-DAR contributing USD 1 billion, terrestrial Li-DAR accounting for another USD 1 billion, and mobile & UAV Li-DAR bringing in no revenue.

- As we move into 2027 and beyond, the Li-DAR market is expected to expand, with total revenues reaching USD 4.5 billion in 2027 and steadily climbing to USD 11.6 billion in 2032.

- Airborne and terrestrial Li-DAR revenues will grow significantly during this period, reaching USD 5 billion and USD 4 billion by 2032.

- The mobile & UAV LiDAR segment is also poised for substantial growth, reaching USD 3 billion in revenue by 2032.

Global LiDAR Market Revenue- by Application

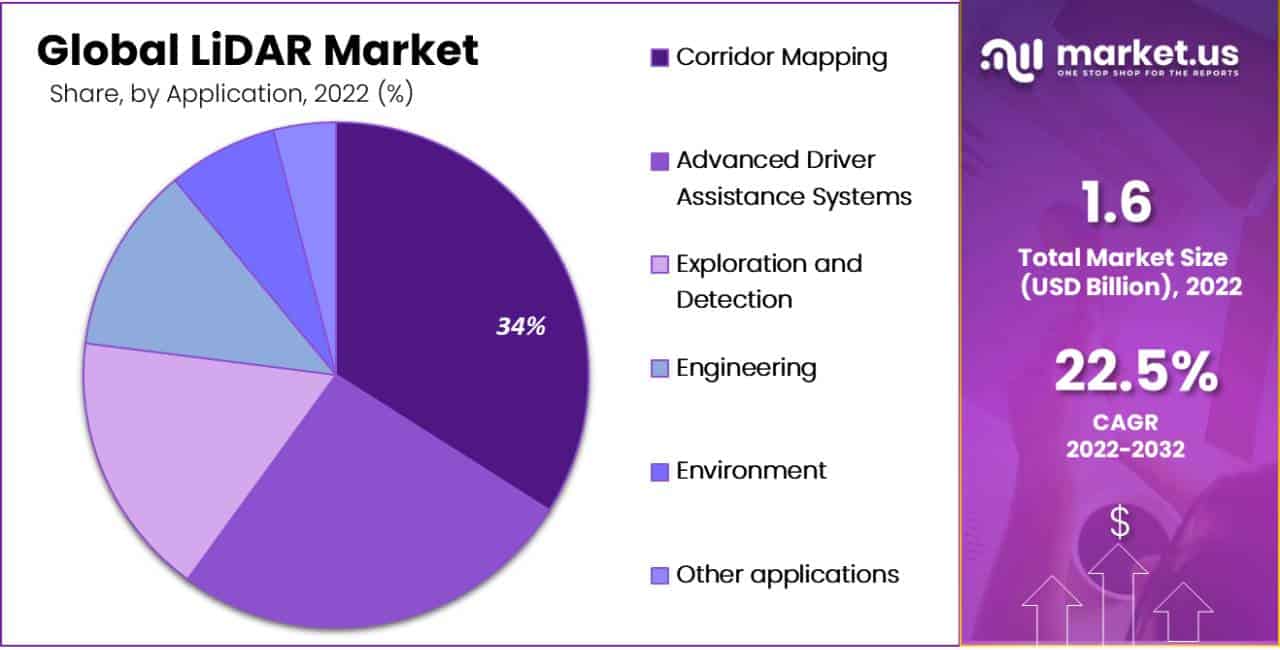

- The LiDAR market exhibits diverse revenue distribution across various applications, with each sector contributing uniquely to its growth.

- Notably, corridor mapping accounts for the largest market share at 34%, reflecting the technology’s crucial role in creating detailed 3D maps for transportation and infrastructure planning.

- Advanced Driver Assistance Systems (ADAS) closely follows at 26%, underlining Li-DAR’s integral position in the automotive industry for enhancing vehicle safety and autonomy.

- Exploration and detection applications claim a 17% market share, illustrating Li-DAR’s value in geological surveys, archaeological research, and forestry.

- Engineering applications contribute 12% of the market, emphasizing its use in construction and civil engineering projects.

- At 7%, environmental applications showcase LiDAR’s role in monitoring and conserving natural ecosystems.

LiDAR Market for Automotive and Industrial Applications

- The LiDAR market catering to automotive and industrial applications is on the brink of substantial expansion. Its projected growth trajectory will take it from $2.1 billion in 2021 to a robust $6.3 billion by 2027.

- This growth is underpinned by a strong compound annual growth rate (CAGR) of 22% from 2022 to 2027.

- The automotive sector will be the primary driver of this expansion, with the automotive LiDAR market expected to witness remarkable growth, escalating from a modest $38 million in 2021 to an impressive $2.0 billion in 2027.

- This is anticipated to drive the Li-DAR market for smart infrastructure to a substantial $1.1 billion by 2027, a substantial increase from its $108 million valuation in 2021.

- Additionally, the automation of logistics operations is contributing to Li-DAR’s growth, with the logistics LiDAR market projected to reach $344 million in 2027, reflecting a notable escalation from its $92 million worth in 2021.

Global LiDAR System Sensor Sales

- The global LiDAR system sensor sales have significantly increased over the past decade, underscoring the technology’s expanding role in various industries.

- In 2014, the total sales amounted to USD 268.5 million, reflecting a modest but growing interest in LiDAR applications.

- However, by 2022, the Li-DAR market had experienced remarkable growth, with total sensor sales reaching a substantial USD 944.3 million.

- This substantial increase, nearly quadrupling the 2014 figures, underscores the increasing demand for LiDAR technology.

Automotive LiDAR Shipments Statistics

- The global automotive LiDAR market is poised for substantial growth between 2022 and 2032, driven by the increasing adoption of Li-DAR technology in the automotive industry.

- In 2022, automotive Li-DAR shipments stood at 1.4 million units, signaling the technology’s early presence in the sector.

- However, as autonomous vehicles and advanced driver assistance systems (ADAS) gain momentum, the demand for LiDAR sensors is projected to surge.

- By 2027, shipments are estimated to reach 10.9 million units, representing a significant increase in just five years.

- Looking further ahead to 2032, the market is forecasted to experience exponential growth, with automotive LiDAR shipments expected to reach a staggering 34 million units.

Global LiDAR for Robotic Car Market

- In 2022, the market size for solid-state and flash LiDAR systems amounted to USD 7 million, while mechanical Li-DAR systems dominated with a market size of USD 2,225 million, underscoring their established presence.

- However, as solid-state and flash LiDAR technology advances and gains prominence, the market landscape is projected to shift dramatically.

- By 2032, the market size for solid-state and flash Li-DAR is anticipated to soar to USD 1,492 million, indicating a remarkable increase driven by their compactness and efficiency.

- Concurrently, the market size for all mechanical LiDAR systems is expected to reach USD 6,719 million, reflecting sustained demand.

Patents Filed by Key Companies in the LiDAR Industry

- Between 2010 and 2019, the United States saw a surge in LiDAR patents published by various companies and entities, reflecting the growing importance of this technology in numerous industries.

- Several notable companies and organizations contributed significantly to this patent landscape.

- General Motors led the pack with 103 Li-DAR patents published during this period, underlining their commitment to autonomous vehicle development.

- Ford followed closely with 130 patents, emphasizing their investment in Li-DAR technology.

- Waymo and Bosch were also prolific contributors, each publishing 64 patents, showcasing their dedication to advancing LiDAR for self-driving cars and related applications.

LiDAR Technology Regional Statistics

- Between 2018 and 2022, LiDAR supply agreements for Advanced Driver Assistance Systems (ADAS) vehicles have seen varying distribution levels across different countries.

- China has dominated this landscape, accounting for a substantial 50% of these agreements, reflecting the nation’s significant investment in ADAS technology and its rapid growth in the automotive sector.

- Meanwhile, France and the USA secured 18% of these supply agreements, underlining their strong presence in the ADAS market.

- Germany, Japan, and Israel claimed smaller but noteworthy shares at 6%, 4%, and 4%, respectively.

Price and Growth Rate Trends

- The pricing and growth rate trends in the Li-DAR industry over the past decade reveal a remarkable evolution.

- In 2007, LiDAR technology was relatively nascent and came with a hefty price tag of $80,000.

- However, as technological advancements and increased adoption unfolded, the cost of Li-DAR systems witnessed a substantial decline.

- By 2014, the price had dropped to $8,000, marking a significant 90% reduction.

- This trend continued, with prices plummeting to $375 in 2017, reflecting a 95% decrease from 2014.

- The following years saw a consistent downward trajectory, with prices reaching $100 in 2020, representing a 33% reduction from the previous year.

Challenges in Using LiDAR Technology

Cost of Technology

- It’s imperative to take a comprehensive view of all the associated expenses to accurately assess the total costs and potential benefits of integrating LiDAR technology into your business operations.

- Firstly, the selection of the right tools is of paramount importance. An entry-level Li-DAR system with robust capabilities typically comes with a price tag of $23,000 (in USD).

- If you opt to complement this with a drone, you should anticipate an additional investment ranging from $10,000 to $16,000.

- There are additional expenses to account for, such as acquiring accessories for your drone, procuring batteries, a base station, and a GPS rover, all of which are collectively contributing.

Resource Challenges

- Another substantial facet to consider is the human resources required for successful implementation. You will need an individual holding a drone piloting license to gather the requisite data. In Canada, obtaining an “advanced drone license,” which includes study materials and examination fees, typically incurs an expenditure of approximately $550.

- In the United States, the FAA commercial drone pilot test, which is mandatory for those operating within the U.S., involves a fee of $200, with an associated preparation period spanning approximately one week, totaling 15-30 hours.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)