Table of Contents

Introduction

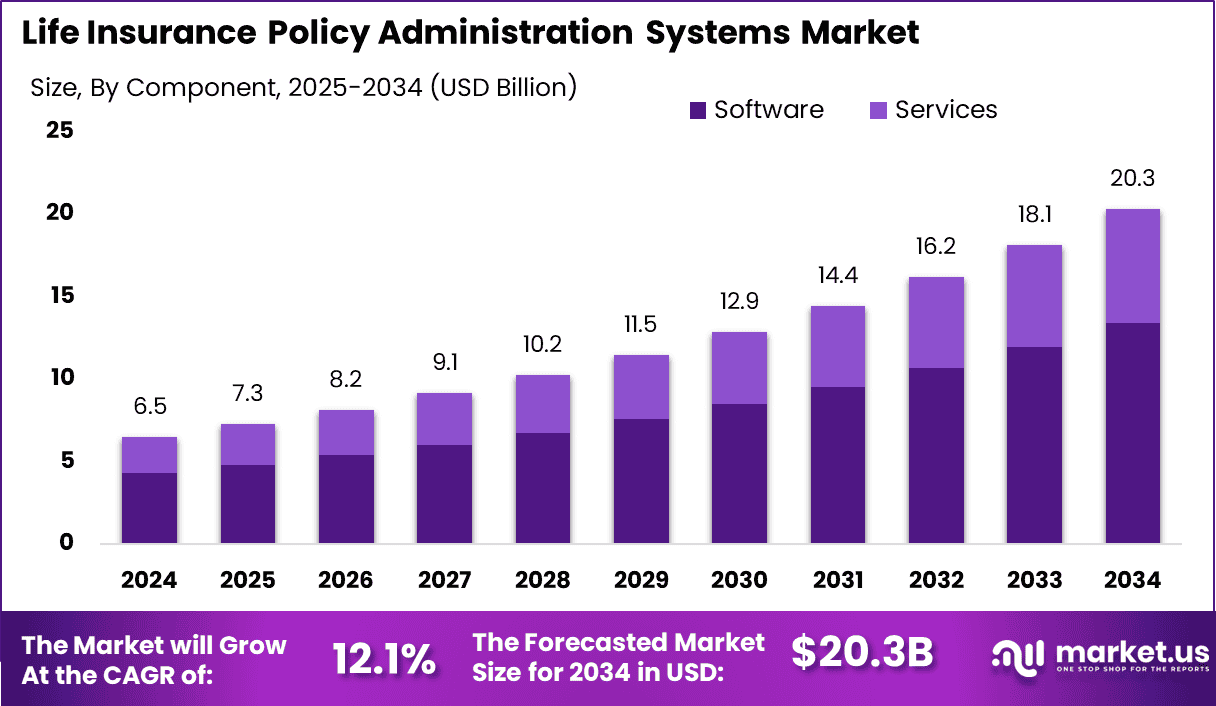

The global life insurance policy administration systems market is poised for substantial growth, projected to increase from USD 6.5 billion in 2024 to USD 20.3 billion by 2034, growing at a robust CAGR of 12.1%. This growth is driven by the increasing adoption of digital technologies in the life insurance sector, aimed at improving operational efficiency, customer experience, and compliance. In 2024, North America led the market with over 35% share, generating USD 2.2 billion in revenue. As insurers adopt advanced policy administration systems, they streamline processes such as underwriting, claims management, and customer service.

How Growth is Impacting the Economy

The growth of the life insurance policy administration systems market is significantly influencing the global economy by enhancing the efficiency of the life insurance sector. Digital transformation is reducing operational costs and improving productivity within the insurance industry. By automating tasks such as policy issuance, claims processing, and customer service, insurers are able to provide quicker and more accurate services.

This reduction in administrative overheads allows insurers to allocate resources more effectively, contributing to cost savings and increasing profitability. Moreover, the adoption of digital platforms helps in reaching underserved populations, providing access to life insurance products and financial security. The market is also driving growth in related sectors such as technology, data security, and cloud computing. As the industry becomes more digitized, new jobs and investment opportunities emerge, boosting economic development, particularly in emerging markets.

➤ Uncover best business opportunities here @ https://market.us/report/global-life-insurance-policy-administration-systems-market/free-sample/

Impact on Global Businesses

The rising costs in the life insurance sector, combined with shifts in supply chain dynamics, are prompting businesses to invest in modern policy administration systems to improve operational efficiency. These systems help companies streamline processes and reduce administrative costs, addressing the pressure of increasing operational expenses. The sector is also undergoing a digital transformation, with insurers adopting cloud-based and AI-powered systems to handle high volumes of transactions and customer data.

The growing need for improved customer experience and compliance with evolving regulations has led insurers to embrace new technologies. Additionally, as more insurers move towards digital platforms, they are enhancing their service offerings, improving scalability, and reducing manual intervention. This has had a positive impact on customer satisfaction, as policyholders enjoy faster services, greater transparency, and simplified access to information. For the broader economy, the sector’s digitalization is also contributing to financial inclusion, as more consumers gain access to life insurance products.

Strategies for Businesses

To capitalize on the growth of the life insurance policy administration systems market, businesses should focus on investing in advanced digital solutions, including cloud platforms, AI-powered systems, and automation tools. These technologies not only streamline operations but also enhance data analytics capabilities, allowing for better customer insights and improved decision-making.

Insurers should prioritize customer-centric innovations that make it easier for policyholders to manage their accounts, access policy information, and make claims. Moreover, businesses must ensure that their systems are secure and compliant with local regulations. Collaborations with tech providers, fintech companies, and cloud service providers will be critical in staying ahead of the competition and driving digital transformation in the life insurance sector.

Key Takeaways

- The global life insurance policy administration systems market is projected to grow from USD 6.5 billion in 2024 to USD 20.3 billion by 2034, with a CAGR of 12.1%.

- North America accounted for over 35% of the market share in 2024, generating USD 2.2 billion in revenue.

- The adoption of digital technologies in life insurance is streamlining processes, improving customer service, and reducing operational costs.

- The market is expected to witness continued growth, fueled by advancements in AI, cloud computing, and digital platforms.

- Businesses must invest in innovative technologies to enhance customer experience and ensure regulatory compliance.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=153418

Analyst Viewpoint

The life insurance policy administration systems market is currently experiencing strong growth, driven by increasing digitalization and the need for more efficient, customer-friendly services. In the present, the market is characterized by the widespread adoption of AI, cloud computing, and automation technologies that are transforming how insurers operate.

Looking to the future, the outlook remains highly positive, as insurers continue to enhance their systems and focus on improving customer experiences. The expected continued growth in demand for automated solutions will drive innovation and market expansion. As the industry moves toward greater digitalization, it will create new opportunities for businesses to innovate and reach more customers worldwide.

Regional Analysis

North America is the dominant player in the global life insurance policy administration systems market, holding more than 35% of the market share in 2024, with USD 2.2 billion in revenue. The region’s growth is driven by the presence of key insurance companies, high rates of digital adoption, and advanced technological infrastructure.

Europe follows closely, with steady growth in the adoption of digital policy management solutions in response to regulatory changes and consumer demand for improved service. The Asia-Pacific region is expected to witness rapid growth, driven by the increasing demand for life insurance and technological advancements in countries like China, India, and Japan. Latin America and Africa, while emerging markets, are also seeing increased adoption of digital platforms as insurers look to tap into new customer bases.

➤ Discover More Trending Research

- AI Complaint Management Market

- Gamified Learning Market

- Digital Ticketing Market

- AI Image Enhancer Market

Business Opportunities

The growth of the life insurance policy administration systems market presents significant opportunities for technology companies, particularly in areas such as AI, cloud computing, and automation. Businesses can capitalize on this trend by offering specialized solutions that help insurers streamline their operations, enhance customer service, and ensure compliance.

Additionally, as insurers move toward digital-first strategies, there are growing opportunities for businesses to provide innovative customer experience solutions, such as self-service portals and mobile apps. The rise of emerging markets, particularly in Asia-Pacific and Africa, also provides untapped potential for companies to offer digital policy management systems and expand their footprint in these regions.

Key Segmentation

Technology

- Cloud-Based Solutions

- AI-Powered Systems

- Automation Tools

End-User Industry

- Life Insurance Providers

- Reinsurers

- Third-Party Administrators

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Africa

Key Player Analysis

Leading companies in the life insurance policy administration systems market are focusing on delivering innovative solutions that streamline operations, reduce costs, and enhance customer service. These companies are investing heavily in AI and cloud computing to enable insurers to better manage policies, improve claims processing, and provide more accurate data analytics.

Additionally, there is a growing focus on integrating automation tools that reduce manual intervention and improve operational efficiency. Collaboration with technology providers is key to remaining competitive, with a strong emphasis on meeting regulatory requirements and offering secure, user-friendly platforms for insurers and policyholders alike.

- Majesco

- Accenture plc Company Profile

- Oracle Corporation

- Insurity

- EXL

- Infosys

- FAST Technology

- Edlund

- EIS Group Inc.

- AgencySmart

- DXC Technology Company

- Sapiens International Corporation

- Concentrix Corporation

- Others

Recent Developments

- In January 2024, a major life insurance provider launched an AI-powered policy administration system for faster claims processing and customer support.

- In March 2024, a leading insurer partnered with a cloud service provider to enhance the scalability and security of its policy management platform.

- In June 2024, an insurance tech company introduced a new mobile app to help policyholders manage their life insurance policies and access information.

- In August 2024, a life insurance provider adopted an automation system for underwriting to reduce operational costs and improve efficiency.

- In October 2024, a technology company developed a new data analytics platform to help insurers enhance decision-making and customer personalization.

Conclusion

The life insurance policy administration systems market is experiencing strong growth, driven by the increasing demand for digital solutions in the life insurance industry. As insurers continue to adopt AI, cloud computing, and automation technologies, businesses have significant opportunities to innovate and provide value-added solutions to enhance efficiency and customer satisfaction. The market is expected to continue growing, providing long-term growth prospects for technology providers and insurers alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)