Table of Contents

Market Overview

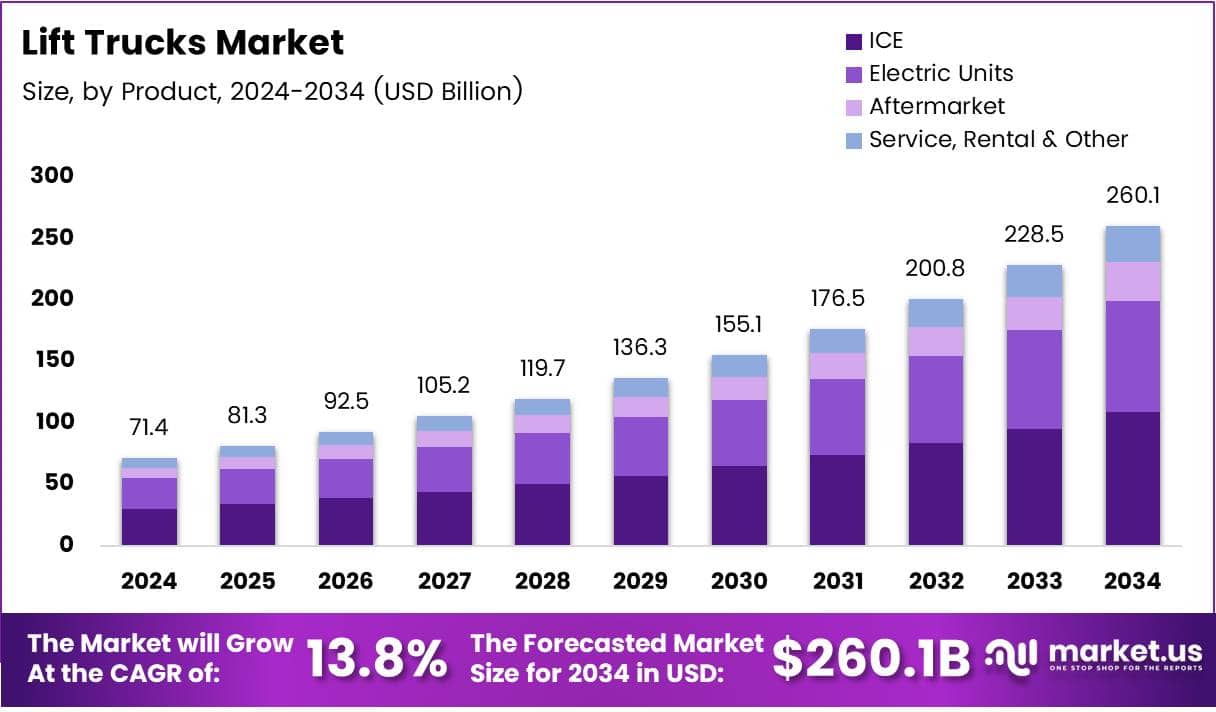

The Global Lift Trucks Market size is expected to be worth around USD 260.1 Billion by 2034, from USD 71.4 Billion in 2024, growing at a CAGR of 13.8% during the forecast period.

The Lift Trucks Market is growing due to rising demand in warehouses and logistics. Industries need better material handling solutions for efficiency. Lift trucks help reduce manual labor and save time. Small businesses prefer hydraulic models that lift up to 3 meters. These models are cost-effective and ideal for tight storage spaces.

Governments are investing in smart logistics and infrastructure. This boosts lift truck demand across industrial zones. Policies now support automation in warehouses. This trend is fueling growth in electric and autonomous lift trucks. Safety is a major concern in the market. The OSHA reports 34,900 serious injuries every year from forklift accidents. This has increased demand for trucks with advanced safety tech. Features like driver assist and load sensors are now standard.

Regulations are pushing companies to meet strict safety norms. Electric models also meet new emission and noise standards. Businesses choosing these models gain long-term benefits and cost savings. Lift trucks now come with smart features for better operation. This includes AI-based monitoring and real-time tracking. Companies that invest in such tech gain a market edge. Overall, the lift truck market has high growth potential. Innovation, safety, and government support are driving demand in 2025 and beyond.

Key Takeaways

- The Global Lift Trucks Market is projected to reach USD 260.1 billion by 2034, growing from USD 71.4 billion in 2024 at a CAGR of 13.8%.

- In 2024, ICE units led the product segment with a 46.1% market share, due to their strength in heavy-duty applications.

- Independent Dealers held an 81.2% market share in the distribution channel segment in 2024, offering greater flexibility and personalized service.

- The Retail and Durable Goods sector accounted for the largest end-use share of 37.1% in 2024, driven by efficiency needs in retail logistics.

- Asia Pacific dominated the market with a 41.9% share in 2024, valued at USD 29.9 billion, supported by rapid industrialization and e-commerce expansion.

Market Drivers

- E-commerce Boom: Rising online shopping fuels demand for efficient warehouse operations using lift trucks.

- Smart Logistics: Automation and IoT tech increase need for intelligent, autonomous lift trucks.

- Urban Growth: Infrastructure development boosts demand for durable material handling equipment.

- Eco Regulations: Policies favor electric lift trucks over diesel/gas models.

- Labor & Safety: High labor costs and safety needs drive investment in mechanized handling solutions.

Challenges

High Initial Investment: Advanced lift trucks with automation and electric features can be expensive, which may deter smaller businesses from adoption.

Maintenance and Downtime Risks: The cost of maintenance and potential downtime due to technical issues can impact operations, especially in time-sensitive industries.

Operator Training Needs: The growing complexity of lift trucks, especially automated models, necessitates skilled operators and regular training, which adds to operational costs.

Market Competition and Price Pressure: The presence of numerous manufacturers has intensified competition, resulting in price pressure and the need for product differentiation.

Segmentation Insights

Product Analysis

ICE lift trucks led with 46.1% share in 2024, preferred for heavy-duty use. Electric models are cleaner but costlier. Aftermarket and rental services continue to grow.

Distribution Channel Analysis

Independent Dealers held 81.2% share, favored for flexible service and local support. Major Accounts had smaller impact.

End Use Analysis

Retail & Durable Goods led with 37.1% share, followed by Logistics. Food & Beverage and Industrials showed steady demand.

Regional Insights

Asia Pacific led in 2024 with 41.9% market share (USD 29.9 Billion), driven by booming e-commerce, industrialization, and infrastructure growth in China and India.

North America’s strong demand in automotive and warehousing keeps North America competitive. The U.S. leads with advanced logistics and rising automation needs.

Europe is growing steadily, fueled by demand for electric and eco-friendly lift trucks. Germany and the UK are focusing on clean tech and carbon reduction.

Middle East & Africa is moderate, supported by construction and warehousing expansion. Infrastructure investments help, but economic and political challenges remain.

Latin America’s gradual growth seen, especially in Brazil and Mexico, as automation increases in manufacturing and food sectors despite economic fluctuations.

Recent Developments

- In January 2025, Cyngn Inc. (Nasdaq: CYN) announced that it had successfully secured $33 million in funding. The investment will support the company’s expansion into autonomous industrial vehicle solutions and further R&D efforts.

- In July 2025, Seegrid unveiled the industry’s first Autonomous Lift-Truck, marking a major innovation in material handling automation. This breakthrough product aims to enhance warehouse safety and efficiency through intelligent, driverless operation.

- In February 2024, Big Lift LLC, a leading distributor of Big Joe Forklifts, acquired ePicker LLC, a key player in material handling equipment. The acquisition strengthens Big Lift’s product portfolio and expands its market presence across North America.

Future Outlook

The future of the lift trucks market is closely tied to automation, sustainability, and digital transformation. The shift from internal combustion to electric and autonomous lift trucks is accelerating, driven by environmental goals and cost-saving imperatives. Demand for smart, connected, and energy-efficient lift trucks will likely continue to grow, especially as industries aim to future-proof their logistics and material handling operations.

Manufacturers who focus on innovation, user safety, and sustainable solutions are expected to lead the market in the coming years. The combination of rising demand, supportive regulations, and technology integration ensures a promising outlook for the global lift trucks market.

Conclusion

The global lift trucks market is set to grow significantly, reaching USD 260.1 billion by 2034. Growth is driven by rising demand in e-commerce, smart logistics, and infrastructure projects. Electric and autonomous models are gaining traction due to safety, emission, and cost-saving benefits.

Asia Pacific leads the market, while North America and Europe are pushing toward eco-friendly and tech-driven solutions. Despite challenges like high costs and training needs, the future is strong for lift trucks powered by innovation, automation, and government support.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)