Table of Contents

Introduction

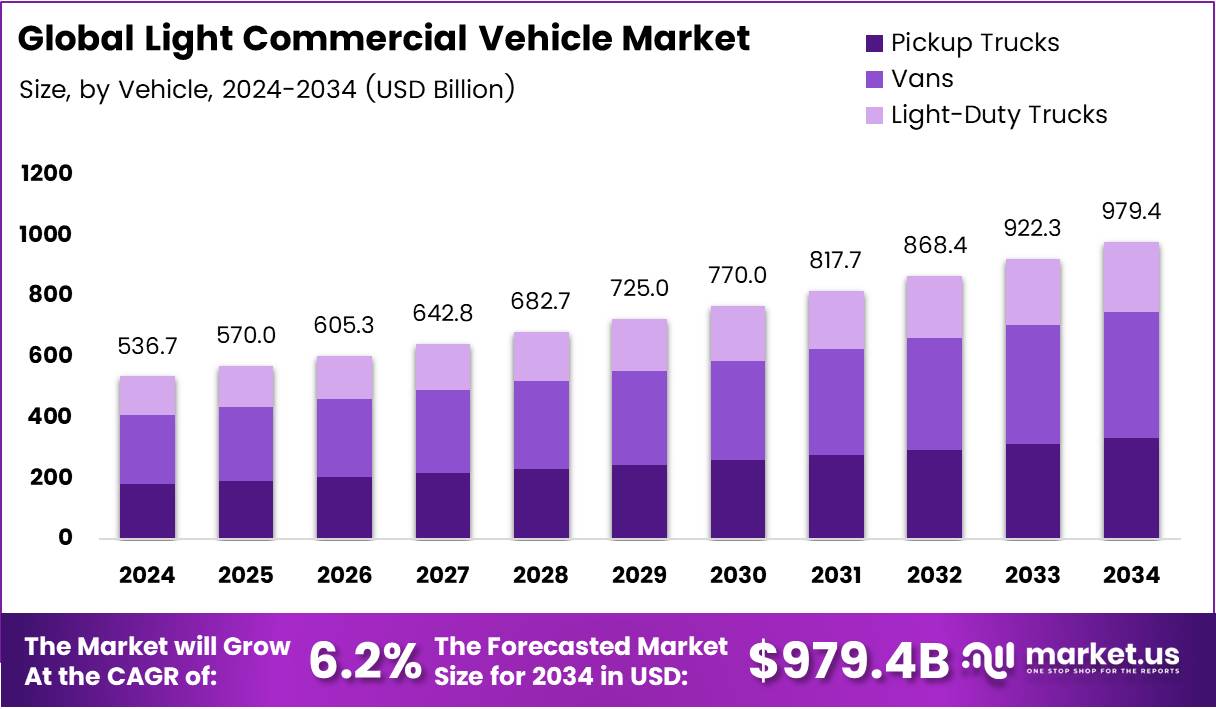

The Global Light Commercial Vehicle (LCV) Market is projected to grow significantly, reaching USD 979.4 Billion by 2034, up from USD 536.7 Billion in 2024, at a CAGR of 6.2%. This expansion underscores rising demand for efficient and versatile transportation solutions across various business sectors.

Furthermore, the ongoing shift toward sustainability and electrification is reshaping market dynamics. Businesses increasingly prioritize fuel efficiency and operational flexibility, driving manufacturers to innovate and diversify their offerings. As e-commerce and logistics continue expanding, the LCV market is positioned for sustained long-term growth.

Additionally, supportive government policies, infrastructure development, and evolving consumer preferences are accelerating market adoption. With electric LCVs gaining traction, global players are seizing opportunities to align with regulatory goals and capitalize on emerging technologies.

Key Takeaways

- The Global Light Commercial Vehicle Market size is expected to reach USD 979.4 Billion by 2034, growing from USD 536.7 Billion in 2024, at a CAGR of 6.2%.

- Vans lead the market with a 42.5% share, driven by adaptability for urban logistics and last-mile delivery.

- The 6000-9000 lbs gross weight category dominates with a 53.8% market share, offering optimal payload and fuel efficiency.

- Gasoline-powered light commercial vehicles hold 52.3% of the market share due to lower costs and widespread refueling infrastructure.

- Logistics and transportation applications account for the largest market share at 46.1%, fueled by e-commerce growth and urbanization.

- Asia Pacific holds the largest share of the LCV market at 53.8%, valued at USD 288.7 Billion, driven by urbanization and green technology adoption.

Market Segmentation Overview

Vans dominate the global LCV landscape, holding a 42.5% share due to their superior versatility and space optimization. These vehicles are essential for last-mile delivery, urban logistics, and service operations, meeting the growing need for agile, compact, and efficient transportation in densely populated cities.

By gross weight, the 6000-9000 lbs segment leads with 53.8%, offering the ideal balance between load capacity and fuel economy. This range supports diverse commercial operations, from e-commerce deliveries to small business logistics, providing optimal cost-efficiency and reliability.

Gasoline vehicles maintain leadership with 52.3% of the market, thanks to affordability, accessibility, and ease of maintenance. However, rising environmental awareness is boosting demand for electric alternatives, supported by expanding charging infrastructure and regulatory incentives.

By application, Logistics and Transportation holds a 46.1% share, reflecting the booming e-commerce sector and the need for quick, reliable deliveries. Other applications, including construction, utilities, and leasing, continue to gain traction as businesses seek specialized and flexible fleet solutions.

Drivers

1. Urbanization and Last-Mile Connectivity

Rapid urbanization worldwide is driving demand for efficient delivery systems within crowded cityscapes. Businesses are adopting LCVs to navigate congested roads, ensure timely deliveries, and meet consumer expectations for same-day or next-day shipping. This urban focus fuels consistent market growth.

2. Government Incentives and Environmental Policies

Stricter emission norms and financial incentives, such as tax credits and subsidies, are encouraging businesses to invest in cleaner vehicles. These supportive measures make adopting fuel-efficient and electric LCVs economically viable while aligning with global sustainability targets.

Use Cases

1. E-Commerce and Retail Deliveries

The exponential growth of online shopping has amplified the need for reliable delivery fleets. LCVs are the backbone of e-commerce logistics, offering cost-effective, flexible, and timely last-mile delivery solutions that support both large-scale distributors and small businesses.

2. Construction and Field Services

In construction, mining, and utility sectors, LCVs serve as mobile workstations and transport units. Their durability, load capacity, and ability to handle rough terrains make them indispensable for material transport, tool carriage, and on-site operational support.

Major Challenges

1. Limited Charging Infrastructure for Electric LCVs

Despite growing interest in electrification, insufficient charging stations hinder large-scale adoption. Fleet operators remain cautious about transitioning to EVs due to concerns over charging availability, downtime, and operational disruptions in long-haul routes.

2. Rising Production and Compliance Costs

Meeting evolving environmental regulations increases manufacturing expenses. The integration of advanced emission-reduction technologies raises vehicle costs, impacting affordability for small and medium enterprises aiming to expand their fleets.

Business Opportunities

1. Expansion of Shared Mobility and Fleet Leasing

The rise of shared mobility, ride-hailing, and vehicle leasing platforms is unlocking new opportunities for LCV manufacturers. Businesses can now access vehicles on demand, reducing capital expenditure while ensuring flexible, scalable transportation solutions.

2. Technological Advancements and Connectivity

Integration of telematics and IoT-enabled systems offers real-time monitoring, predictive maintenance, and optimized route planning. These advancements enhance operational efficiency, providing fleet managers with actionable insights to reduce costs and improve service quality.

Regional Analysis

1. Asia Pacific Market Dominance

Asia Pacific commands 53.8% of the global market, valued at USD 288.7 Billion, propelled by rapid urbanization, e-commerce growth, and government-led green initiatives. China and India remain pivotal, leveraging large-scale manufacturing and technological innovation to meet growing domestic demand.

2. Europe and North America’s Sustainable Transition

Europe is accelerating electric LCV adoption amid stringent emission laws and sustainability goals. Meanwhile, North America, led by the U.S., is focusing on fuel efficiency, electric integration, and infrastructure expansion, positioning itself as a key market for clean commercial mobility.

Recent Developments

- In July 2025, Tata Motors acquired Iveco Group in a €3.8 billion deal, enhancing global presence and expanding product portfolios.

- In August 2025, Mahindra & Mahindra secured a 58.96% stake in SML Isuzu, strengthening its position in light and medium truck markets.

- In June 2023, Wiers acquired LTM Auto Truck & Trailer, boosting service capabilities in fleet maintenance and repair.

- In May 2024, AURELIUS Private Equity acquired Dayco’s Propulsion Solutions Business, expanding its footprint in advanced automotive propulsion systems.

Conclusion

The Global Light Commercial Vehicle Market is undergoing a transformative phase, driven by urbanization, e-commerce expansion, and environmental mandates. With robust growth projected through 2034, opportunities abound in electrification, shared mobility, and connected technologies. As businesses prioritize efficiency and sustainability, LCVs will remain central to modern logistics and transportation ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)