Table of Contents

Report Overview

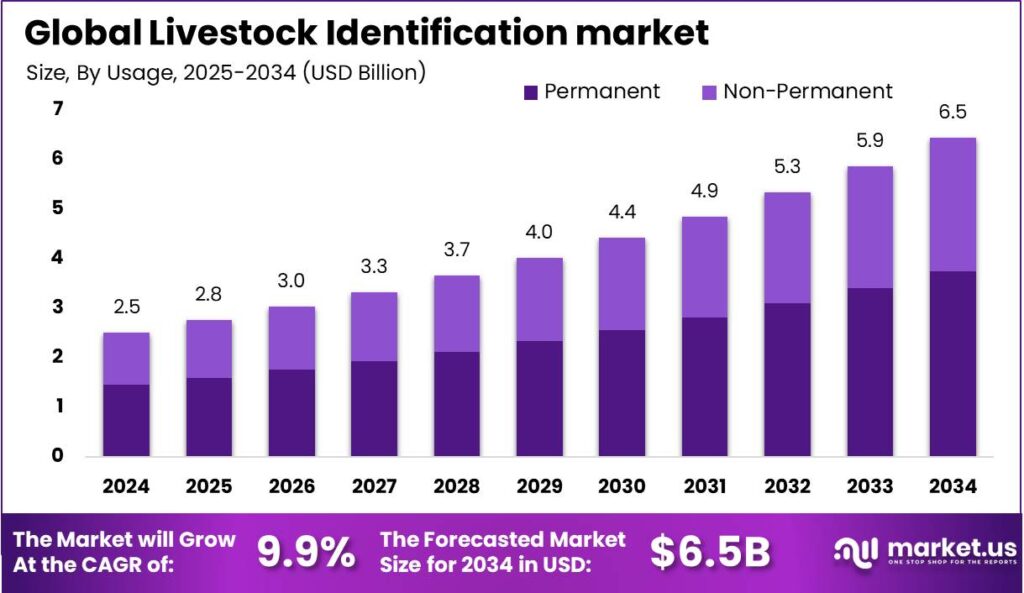

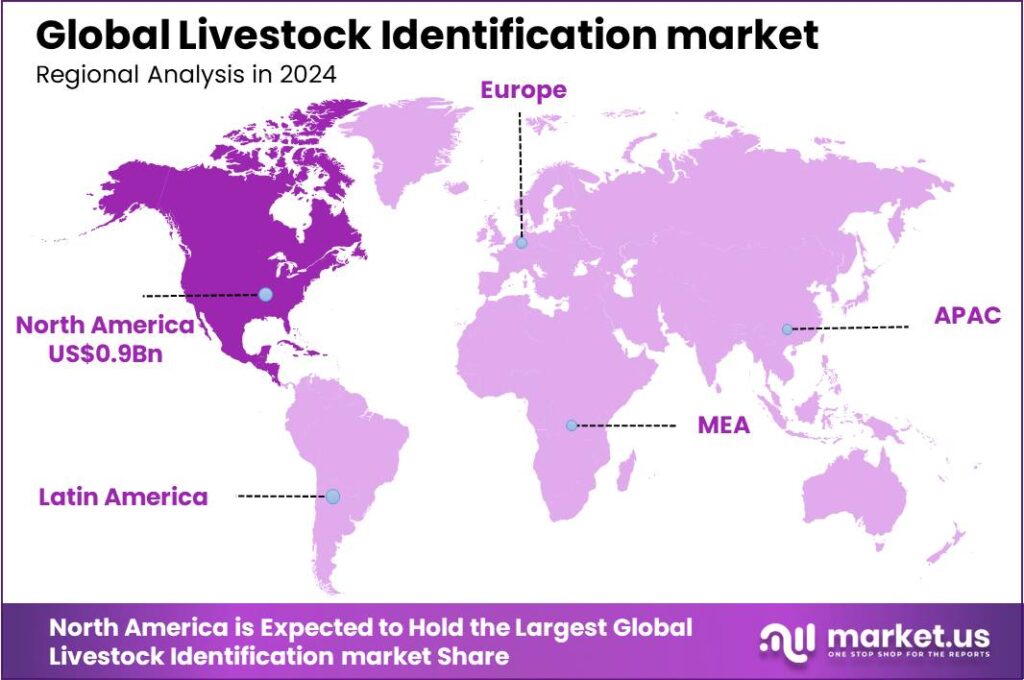

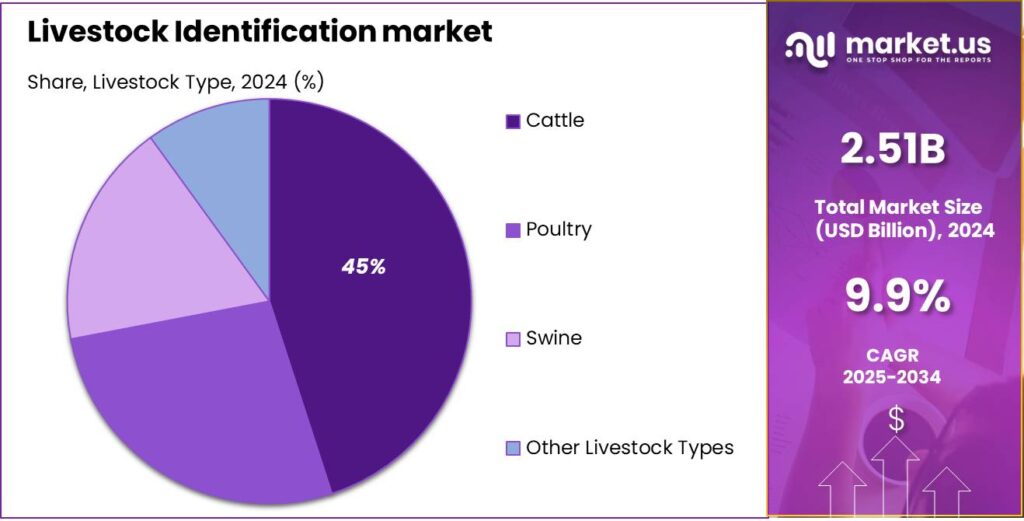

The Global Livestock Identification market is projected to reach a value of approximately USD 6.5 billion by 2034, up from USD 2.51 billion in 2024, reflecting a robust compound annual growth rate (CAGR) of 9.90% from 2025 to 2034. In 2024, North America led the market, capturing over 37% of the total share, with revenues surpassing USD 0.9 billion. This growth signals a rapidly expanding industry as livestock identification technology becomes increasingly vital across the globe.

Livestock identification systems are essential tools for managing animal populations, ensuring traceability, and supporting public health initiatives. These systems encompass various methods and technologies designed to track and record individual animals throughout their life cycles. The adoption of such systems is driven by the need for enhanced biosecurity, food safety, and compliance with national and international regulations regarding animal health.

The growth of the livestock identification market is driven by three main factors: the rising global demand for meat and dairy, which requires efficient herd management systems; stricter government regulations to ensure food safety and animal welfare, which mandate identification systems; and the growing need for advanced solutions to manage and control animal disease outbreaks.

The livestock identification market is evolving with key trends, including the integration of advanced technologies like RFID and GPS for real-time tracking and data collection, enhancing management efficiency. Furthermore, the rise of mobile apps and cloud-based platforms for data management is improving accessibility and enabling better decision-making for farmers and stakeholders.

The sector presents numerous opportunities for growth and innovation. The development of more cost-effective, durable, and easy-to-use identification devices opens up markets in developing regions where such technologies were previously unaffordable. Moreover, partnerships between technology providers and agricultural stakeholders can enhance product offerings and expand market reach. There is also significant potential in integrating identification data with other farm management systems to provide holistic solutions that offer greater value to livestock owners.

Despite the opportunities, several challenges impede market growth. Technical limitations and the high cost of advanced identification systems can be prohibitive for small-scale farmers. Furthermore, concerns regarding data privacy and the security of information collected through livestock identification systems are growing. Addressing these challenges requires ongoing technological advancements and robust regulatory frameworks that balance efficacy with ethical considerations and privacy concerns.

The livestock identification market is poised for expansion, driven by technological innovations and increasing awareness of its benefits. Expansion is particularly notable in developing countries, where the modernization of agriculture and livestock management practices is becoming a priority. This growth is supported by government initiatives aimed at improving national livestock management and ensuring compliance with global standards, which further encourages the adoption of advanced identification systems.

Key Takeaways

- The Global Livestock Identification market is set to reach USD 6.5 Billion by 2034, growing from USD 2.51 Billion in 2024, with a CAGR of 9.90% from 2025 to 2034.

- In 2024, the Hardware segment led the market, holding over 64% of the market share.

- The Breeding Record segment captured more than 30% of the market share in 2024, securing its dominant position.

- Permanent identification was the leading method in 2024, with a market share exceeding 58%.

- Cattle dominated the livestock identification market in 2024, claiming over 45% of the market share.

- North America held the largest market share in 2024, accounting for more than 37% of the global market, with revenues reaching around $0.9 billion.

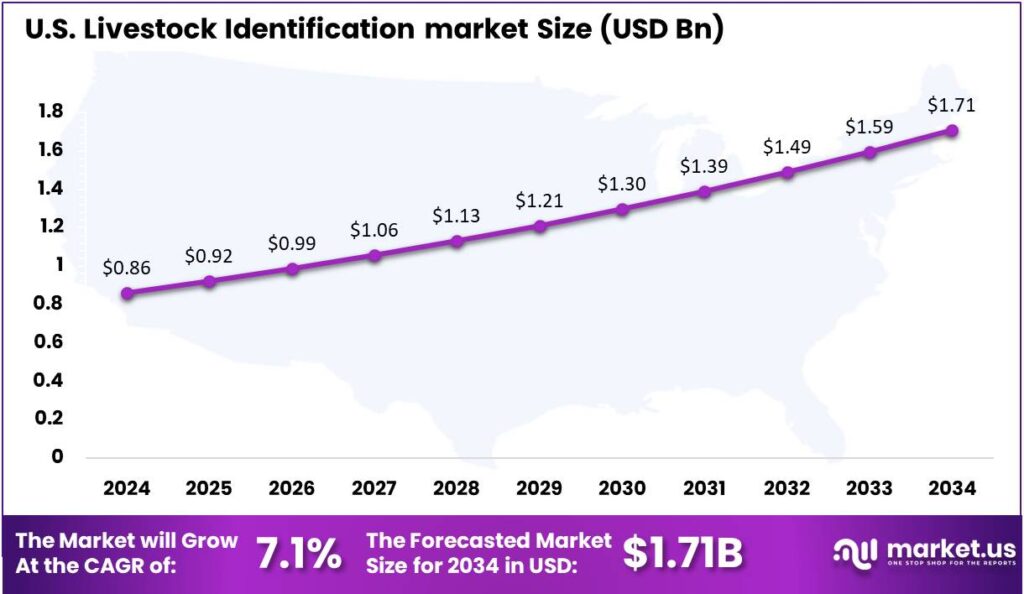

- The U.S. livestock identification market in 2024 was valued at $0.86 billion, with a projected CAGR of 7.1%.

Impact Of AI On The Market

- Enhanced Animal Welfare: AI technologies help in monitoring the health and behavior of livestock more accurately and non-invasively. By detecting early signs of disease or distress, interventions can be made sooner, which improves the overall welfare of the animals.

- Improved Efficiency in Farm Management: AI-driven systems automate and optimize various tasks such as feeding, health monitoring, and breeding. This not only saves time but also reduces the labor costs associated with managing large herds. Precision livestock farming facilitated by AI ensures that animals receive the appropriate nutrients and care tailored to their specific needs.

- Accurate Livestock Tracking and Traceability: Through advanced sensor technologies and biometric identification methods, AI enables precise tracking of individual animals. This is crucial for maintaining records on health history, breeding, and productivity, ensuring that each animal is monitored throughout its lifecycle.

- Data-Driven Breeding and Genetics: AI can analyze genetic and phenotypic data to predict desirable traits in offspring, leading to more informed breeding decisions. This application of AI not only enhances the genetic quality of herds but also contributes to the sustainability of livestock production by optimizing the breeding process.

- Support for Long-Distance Transportation: AI and IoT technologies are particularly beneficial in the context of dairy livestock export, where they help manage the logistics of long-haul transportation. AI systems ensure the health and welfare of animals during transit by monitoring their behavior and physical conditions, thus addressing both logistical and ethical challenges.

U.S. Market Size

In 2024, the market for livestock identification in the United States was valued at approximately $0.86 billion. It is projected to grow at a compound annual growth rate (CAGR) of 7.1%.

The growth of this market can be attributed to several factors including advancements in technology, increased regulations, and a growing emphasis on livestock tracking for disease control and management. Innovations in identification technologies such as electronic tags, RFID devices, and GPS tracking systems are enhancing the efficiency and accuracy of livestock management. These developments are expected to drive market expansion by facilitating better traceability and data collection practices across the agricultural sector.

In 2024, North America maintained a dominant position in the livestock identification market, securing over 37% of the market share with revenues amounting to approximately $0.9 billion.

This significant market share can be largely attributed to the robust agricultural infrastructure and stringent regulatory frameworks in place across the region, particularly in the United States and Canada. These countries have implemented comprehensive livestock tracking and identification systems to ensure food safety and disease management, which has fostered the adoption of advanced identification technologies.

Moreover, the ongoing efforts to enhance supply chain transparency and the increasing consumer demand for traceable food sources are expected to drive continued investment in livestock identification systems. As stakeholders in the agricultural sector seek to meet these demands, the market in North America is poised for sustained growth, leveraging innovative technologies to enhance operational efficiencies and compliance with regulatory standards.

Market Segmentation

Solution Analysis

In 2024, the hardware segment played a dominant role in the livestock identification market, accounting for more than 64% of the total market share. This growth can be attributed to the increasing adoption of various hardware technologies, such as RFID (Radio Frequency Identification) tags, ear tags, and collars, which are essential for accurately tracking and identifying livestock.

Application Analysis

The breeding record segment also held a significant share in the livestock identification market in 2024, capturing more than 30% of the market. This dominance is due to the critical importance of maintaining detailed breeding records for optimizing livestock productivity and genetic performance. The use of livestock identification systems in breeding management helps farmers track lineage, predict genetic traits, and improve herd quality over time.

Usage Analysis

The permanent identification segment held a commanding position in the livestock identification market in 2024, with a share surpassing 58%. Permanent identification methods, such as tattoos, ear notches, or microchipping, are highly valued for their durability and long-term tracking ability.

Livestock Type Analysis

In 2024, the cattle segment dominated the livestock identification market, capturing more than 45% of the market share. This dominance is a reflection of the large-scale presence of cattle farming globally and the increasing need for efficient livestock management. Cattle identification plays a critical role in improving herd management, disease control, and tracking the movement of animals for trade and health purposes.

Emerging Trends

- Biometric Identification: Advanced systems now utilize unique physical traits, such as muzzle patterns or retinal scans, to accurately identify individual animals. This method improves precision and reduces the need for external tags.

- Blockchain Technology: Incorporating blockchain ensures secure and transparent recording of livestock data, enhancing traceability and food safety by providing an immutable history of each animal’s information.

- Artificial Intelligence (AI) Integration: AI algorithms analyze data from various sensors to monitor health, behavior, and productivity, enabling early disease detection and efficient livestock management.

- Wearable Devices: Internet-connected wearables, such as smart collars and ear tags, monitor health indicators and activity levels, aiding in early illness detection and improving overall herd management.

- Regulatory Developments: Governments are implementing stricter regulations requiring electronic identification of livestock to enhance biosecurity and traceability. For instance, Tasmania mandates electronic ID devices for sheep, goats, and calves starting January 1, 2025.

Top Use Cases

- Disease Control and Biosecurity: By assigning unique identifiers to each animal, authorities can swiftly trace and manage disease outbreaks, minimizing spread and protecting public health.

- Food Safety and Quality Assurance: Accurate tracking of livestock from birth to consumption ensures the integrity of the food supply chain, enhancing consumer confidence in meat and dairy products.

- Theft Prevention and Ownership Verification: Permanent identification methods, such as ear tags and tattoos, deter livestock theft and aid in verifying ownership, thereby reducing economic losses for farmers.

- Breeding and Production Management: Individual animal identification allows farmers to monitor health records, reproductive history, and productivity metrics, facilitating informed decisions to improve herd performance.

- Regulatory Compliance and Market Access: Adherence to national identification systems, like Australia’s NLIS, ensures compliance with domestic and international regulations, maintaining and expanding market opportunities for livestock products.

Attractive Opportunities

- Market Expansion in Developing Regions: The market is expanding significantly in Asia-Pacific, with countries like China, India, and Australia leading the way due to increased livestock production and governmental support for advanced tracking systems. This regional growth is backed by a rise in demand for meat and dairy products, bolstering the need for effective livestock management systems.

- Expansion of Dairy and Meat Traceability: There is a growing demand for traceability in the dairy and meat sectors to ensure food safety and quality from farm to table. Livestock identification systems play a crucial role in meeting these consumer demands by enabling detailed tracking of the animal’s origin and health history.

- Increased Focus on Disease Control: Effective disease management and control are critical in maintaining the health of livestock populations. Identification systems are essential for timely detection and response to disease outbreaks, helping to prevent widespread animal health crises.

- Adoption in Commercial Farms: Commercial farms represent the largest market segment, driven by the need for efficient animal management and regulatory compliance. These farms utilize advanced identification technologies to enhance operational efficiency and meet market standards for product quality and safety.

- Growth Driven by Consumer Preferences: The increasing consumer preference for transparency in food production processes is influencing market dynamics. Consumers demand clear information on the origins and handling of food products, which in turn drives advancements in livestock identification technologies to ensure compliance with these expectations.

Major Challenges

- High Implementation Costs: Advanced identification systems, such as electronic identification devices, require substantial investment, which can be a barrier for small-scale farmers.

- Data Privacy Concerns: The adoption of digital tracking systems raises issues regarding data breaches and the potential loss of control over sensitive information by farmers.

- Resistance to Technological Adoption: Traditional farmers may be hesitant to adopt new technologies due to unfamiliarity or skepticism, hindering the widespread implementation of modern identification methods.

- Operational Challenges in Farming Environments: In practical farming settings, capturing accurate data for livestock identification is often hampered by poor lighting conditions, complex backgrounds, and occlusions, making reliable identification difficult.

- Inconsistent Internet Access: Many livestock farms are located in remote areas with unreliable internet connectivity, posing challenges for the real-time data transmission required by modern identification systems.

Recent Developments

- In April 2024, Phibro agreed to acquire Zoetis’ medicated feed additive product portfolio, certain water-soluble products, and related assets for $350 million, expanding its capabilities in high-growth pet treat categories.

- In September 2024, Nedap introduced the SmartTag Ear, a device providing dairy farm managers with real-time health data on herd productivity and health.

- In October 2024, Allflex, a subsidiary of Merck, released handheld RFID readers in two models: APR650 and APRFR250. Additionally, in July 2024, Merck Animal Health completed the acquisition of Elanco’s aqua business, enhancing its position in the aquaculture sector.

- In November 2024, Elanco acquired a contract manufacturing facility in Speke, UK, securing a critical component of its global supply chain for key farm animal products.

Conclusion

In summary, the livestock identification market is experiencing significant growth driven by advancements in technology, increasing demand for traceability, and the need for better animal health management. Innovations such as RFID, GPS, and biometric identification methods are enhancing the accuracy and efficiency of livestock tracking, providing farmers with valuable data to improve productivity and meet regulatory requirements. These developments are also contributing to more sustainable farming practices, ensuring better animal welfare and food safety.

The market’s expansion is further supported by increasing consumer demand for transparency in food sourcing, which has pushed governments and industries to implement stricter regulations. As these trends continue, the livestock identification market is poised for continued innovation and adoption, offering promising opportunities for companies that provide smart and scalable solutions to the agricultural sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)