Table of Contents

Introduction

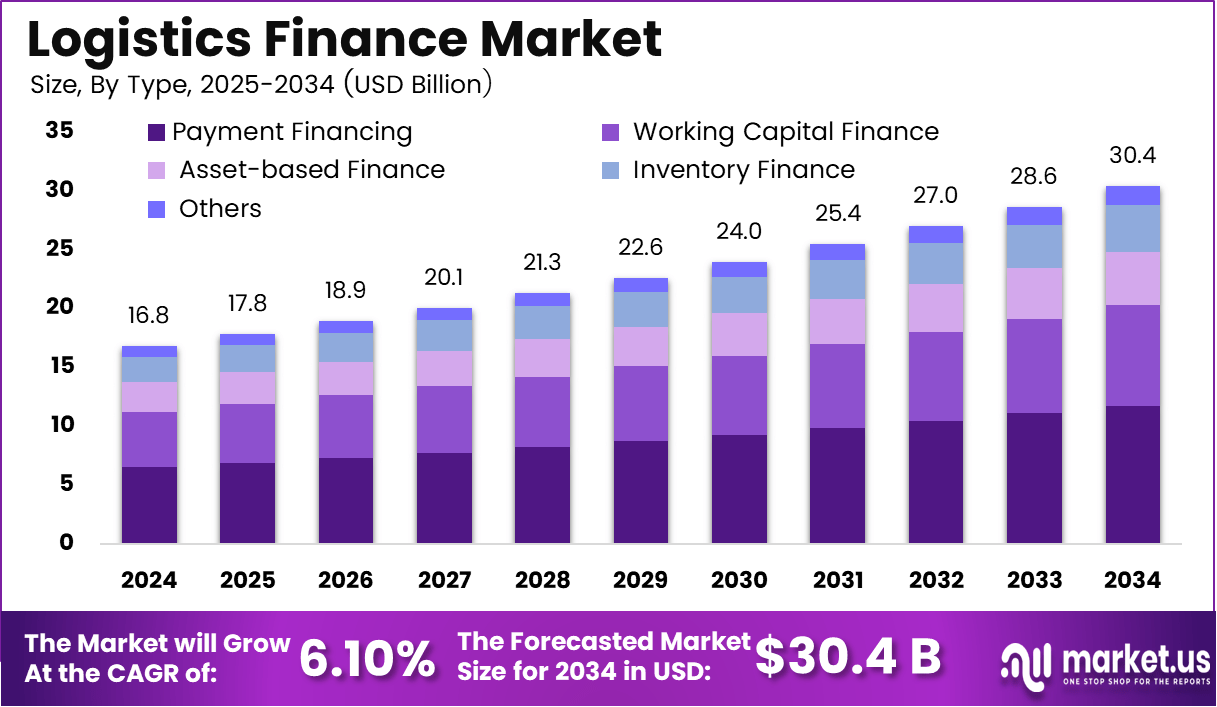

The global Logistics Finance Market is projected to reach USD 30.4 billion by 2034, growing at a CAGR of 6.10% between 2025 and 2034. Asia-Pacific leads with USD 6.5 billion in 2024, while North America is expected to capture the largest share due to its advanced logistics infrastructure and high demand for asset-based and payment financing. The China Logistics Finance Market is forecast to expand at a CAGR of 6.80%, reaching USD 5.1 billion by 2034. The market’s expansion is driven by e-commerce growth, supply chain digitalization, and the rising need for liquidity and risk management solutions.

How Growth is Impacting the Economy

The growth of logistics finance is reshaping global trade economics by bridging the gap between logistics providers and financial institutions. The market’s expansion enhances liquidity for small and mid-sized logistics firms, supporting the smooth flow of goods and improving cross-border payment systems. By facilitating faster settlements and reducing transaction risks, logistics finance helps stabilize supply chains and strengthen global trade efficiency.

Economically, this sector contributes to GDP growth by fostering trade volumes, supporting SMEs, and enhancing financial inclusivity in developing markets. As digitalization advances, AI-driven credit assessments and blockchain-based trade financing are improving transparency, reducing fraud, and optimizing working capital cycles across logistics ecosystems. The sector’s overall growth boosts financial resilience and trade competitiveness for exporting economies, particularly in Asia-Pacific, where logistics infrastructure investments continue to surge.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/logistics-finance-market/free-sample/

Impact on Global Businesses

Rising Costs and Supply Chain Shifts: Inflationary pressures, increasing fuel prices, and interest rate fluctuations are driving up logistics and financing costs. Businesses are responding by diversifying financing portfolios, adopting digital platforms for invoice factoring, and seeking flexible funding models. Supply chains are shifting toward integrated financial ecosystems where logistics operators collaborate directly with fintech companies.

Sector-Specific Impacts: In e-commerce, logistics finance supports timely vendor payments and delivery assurance. In manufacturing, asset-backed loans improve production continuity. The retail and food sectors leverage logistics financing for inventory optimization, while exporters rely on credit guarantees and risk-mitigation instruments to ensure cross-border trade flow stability.

Strategies for Businesses

- Embrace fintech partnerships for digital lending and blockchain trade financing.

- Diversify working capital strategies to mitigate risk from delayed payments.

- Adopt AI-based credit scoring for logistics vendors and partners.

- Implement integrated ERP systems linking logistics, finance, and procurement.

- Focus on sustainable financing to align with green supply chain initiatives.

Key Takeaways

- Global logistics finance to reach USD 30.4 billion by 2034.

- CAGR of 6.10% driven by e-commerce and trade globalization.

- Asia-Pacific and North America remain top growth regions.

- Digitalization and AI enhancing credit efficiency.

- Fintech collaboration emerging as a core growth enabler.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=159239

Analyst Viewpoint

The current logistics finance landscape is undergoing a structural transformation driven by digital payments, blockchain integration, and global trade expansion. Presently, Asia-Pacific dominates due to the scale of its logistics operations, while North America is experiencing rapid fintech integration. Future growth will depend on regulatory harmonization, cross-border financing innovation, and sustainability-linked credit systems. Analysts anticipate strong long-term potential as digital ecosystems reshape financial inclusion and transparency within logistics operations worldwide.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Supply Chain Financing | Growing need for liquidity among logistics and manufacturing firms |

| Cross-Border Trade | Expansion of e-commerce and global trade activities |

| Invoice Factoring | Rising demand for quick capital turnaround for logistics SMEs |

| Fleet Leasing and Asset Finance | Increasing vehicle ownership costs and fleet expansion |

| Digital Payment Integration | Adoption of blockchain and AI for secure, real-time settlements |

Regional Analysis

Asia-Pacific remains the largest market, led by China, India, and Japan, due to massive logistics infrastructure investments and strong SME participation. North America is expected to dominate in share, supported by digitized freight finance solutions and fintech collaborations. Europe shows steady growth as trade finance regulations modernize. Meanwhile, Latin America and the Middle East are adopting logistics finance models to strengthen cross-border trade and mitigate payment risks across expanding supply networks.

➤ More data, more decisions! see what’s next –

- Application Centric Infrastructure Market

- Haptic Technology Market

- Kidnap & Ransom Insurance Market

- Zero UI Technologies Market

Business Opportunities

Rising cross-border trade and the proliferation of digital supply chains create major opportunities for logistics finance providers. Emerging areas such as sustainable logistics funding, blockchain-based trade finance, and AI-driven credit evaluation offer profitable pathways. The integration of embedded finance within logistics management software can help companies improve liquidity and reduce payment friction. Firms that develop region-specific, compliance-friendly financial platforms will gain a competitive edge in supporting global logistics operations.

Key Segmentation

The market is segmented by Service Type (Inventory Financing, Invoice Financing, Fleet Financing, Trade Credit, Others), Provider (Banks, Non-Banking Financial Institutions, Fintech Companies, Logistics Service Providers), End-User (Manufacturing, E-Commerce, Retail, Automotive, Food & Beverage), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). Invoice and fleet financing hold the largest share, while fintech-based credit solutions are projected to experience the fastest growth through 2034.

Key Player Analysis

Market participants are investing in digital platforms that combine real-time logistics tracking with financial analytics. Focus areas include AI-based credit scoring, cloud-driven trade documentation, and blockchain-led transparency in invoice financing. Companies are prioritizing ESG-aligned finance solutions and integrated payment gateways for logistics providers. Strategic collaborations with banks and fintechs enhance liquidity access, while innovations in cross-border risk management tools position them favorably for long-term growth in the evolving global logistics landscape.

- A.P. Møller-Mærsk A/S

- Logistics Finance

- First Financial

- Equity Release Council

- Chinlink

- The Zambian Agricultural Commodity Agency Ltd

- CMSTD

- Sinotrans

- Cosco Shipping Logistics

- Others

Recent Developments

- March 2025: Launch of AI-driven trade financing platform improving credit access for logistics SMEs.

- February 2025: Collaboration between fintech and logistics firms for blockchain-based invoice processing.

- January 2025: Expansion of digital lending infrastructure across North America’s logistics sector.

- December 2024: Introduction of green logistics finance program supporting low-emission fleets.

- October 2024: Investment in cross-border trade finance solution integrating AI risk assessment tools.

Conclusion

The logistics finance market is evolving as digital transformation, fintech integration, and global trade expansion reshape traditional supply chain funding models. Its sustained growth supports economic resilience, operational efficiency, and innovation across global logistics ecosystems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)