Table of Contents

Introduction

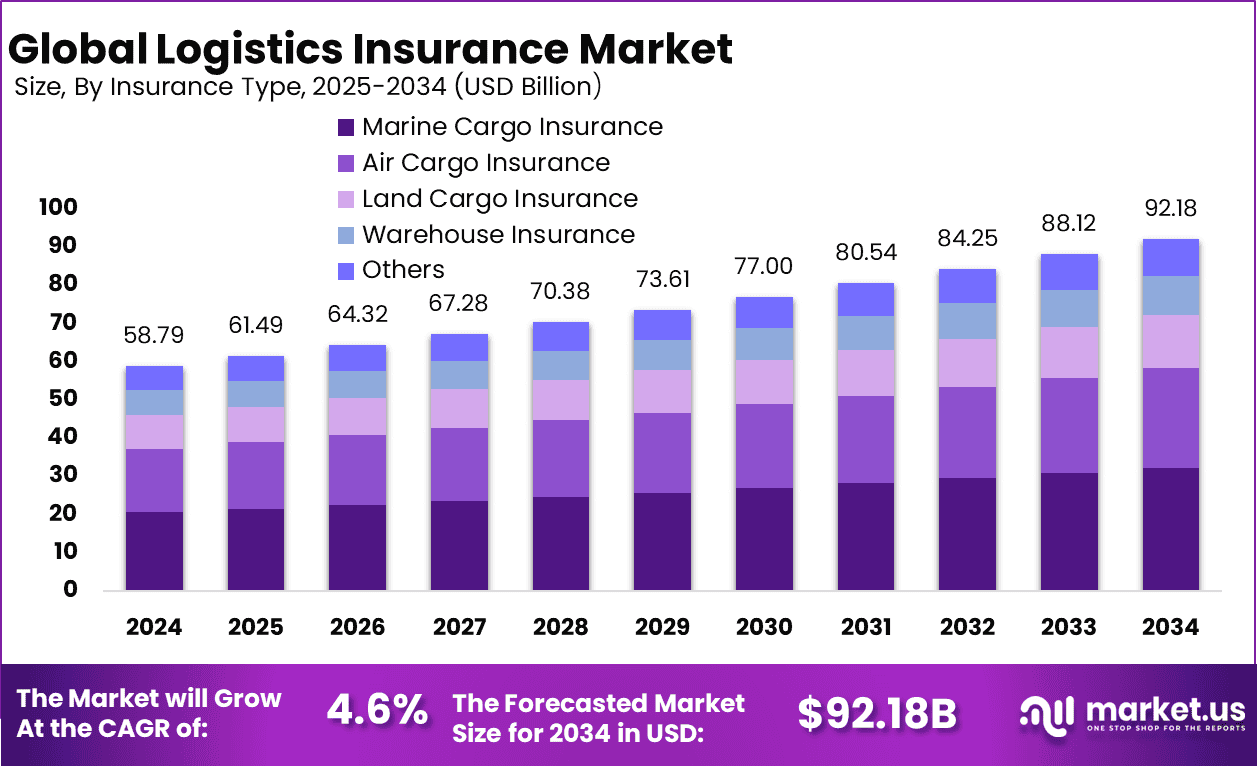

The Global Logistics Insurance Market was valued at USD 58.79 billion in 2024 and is projected to reach USD 92.18 billion by 2034, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034. Logistics insurance plays a critical role in safeguarding goods and ensuring financial protection against risks such as theft, damage, and delays during transit. The market’s growth is driven by the rising global trade, increased e-commerce activities, and the expanding demand for supply chain resilience. North America dominates the market in 2024, holding 32% of the market share, generating USD 18.81 billion in revenue.

How Growth is Impacting the Economy

The growth of the logistics insurance market is driving significant economic development by supporting the global supply chain and trade infrastructure. As businesses expand their reach internationally, the demand for logistics insurance is increasing to mitigate risks during transit and storage. This creates new job opportunities in insurance, logistics, and risk management sectors. The rising demand for insurance products tailored to logistics also fosters technological advancements in real-time tracking, monitoring, and analytics, helping businesses optimize supply chain operations and reduce losses.

The expanding logistics insurance market is also encouraging international trade by providing businesses with the confidence to move goods across borders, fostering economic growth. With globalization and e-commerce continuing to rise, logistics insurance becomes integral to maintaining the stability and continuity of the global supply chain, which is essential for both small and large enterprises looking to tap into global markets.

➤ Research uncovers business opportunities here @ https://market.us/report/logistics-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: The logistics insurance market is seeing a rise in premiums due to global disruptions like supply chain bottlenecks, geopolitical tensions, and climate-related risks. As logistics companies face these growing risks, businesses are paying higher premiums to ensure the protection of goods in transit. This results in a shift in how businesses manage risk, often investing in more comprehensive insurance policies.

Sector-Specific Impacts: In the e-commerce sector, the surge in online shopping and global trade is fueling the demand for logistics insurance to protect the growing volume of goods being shipped internationally. The manufacturing sector is also seeing increased demand for logistics insurance, as supply chains become more complex with the integration of just-in-time inventory and cross-border production. Similarly, automotive and pharmaceuticals industries are relying more on logistics insurance to ensure the safe and timely delivery of their products.

Strategies for Businesses

To capitalize on the growing logistics insurance market, businesses must focus on creating customized insurance solutions that meet the specific needs of their clients. Leveraging technology such as IoT, blockchain, and AI for real-time tracking and monitoring of shipments will enhance service offerings and customer trust.

Insurance companies should also expand their presence in emerging markets, where international trade is expanding rapidly. Fostering strategic partnerships with logistics providers can help companies gain deeper insights into supply chain risks and create more targeted insurance products. Furthermore, businesses should invest in risk management solutions to reduce premiums and offer value-added services, such as risk mitigation strategies, to their customers.

Key Takeaways

- The logistics insurance market is expected to grow from USD 58.79 billion in 2024 to USD 92.18 billion by 2034, with a CAGR of 4.6%.

- North America is the dominant market, holding 32% market share in 2024, with USD 18.81 billion in revenue.

- The rise in global trade, e-commerce, and supply chain complexities is driving the demand for logistics insurance.

- Businesses need to focus on creating tailored insurance products and leveraging technology to enhance their service offerings.

- Premiums are rising due to supply chain disruptions, climate risks, and global geopolitical tensions, which affect the logistics sector.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=152006

Analyst Viewpoint

The logistics insurance market is expected to continue expanding, driven by the increasing complexity of global supply chains and the rising need for secure, insured transportation of goods. The market is seeing more demand for customized insurance products that address the unique risks associated with logistics operations.

As companies adopt more advanced risk management tools, the market will likely witness increased competition and product innovation. With the growing integration of technology in logistics, insurers will have opportunities to offer more dynamic and personalized services, enhancing their competitive edge. The future is promising for businesses that adapt to these trends and invest in technology-driven solutions.

Regional Analysis

North America currently holds a dominant position in the logistics insurance market, capturing over 32% of the market share in 2024, driven by a well-established logistics infrastructure and strong trade partnerships. The Europe market follows closely, with increasing demand for logistics insurance due to the region’s extensive network of goods movement.

Asia-Pacific is expected to experience the highest growth during the forecast period, fueled by rising global trade activities, especially in China and India. Latin America and Middle East & Africa are emerging markets, where logistics insurance is growing in demand as trade and e-commerce activities expand.

Business Opportunities

The logistics insurance market presents opportunities for companies involved in the development of advanced insurance solutions tailored to the evolving needs of global businesses. There is an increasing demand for real-time tracking and monitoring systems, which opens opportunities for companies that provide integrated solutions combining logistics management and insurance coverage.

Additionally, insurers can tap into emerging markets where international trade is expanding, creating tailored policies for businesses in industries like e-commerce, manufacturing, and automotive. Companies that leverage digital tools such as IoT, blockchain, and data analytics will have a competitive edge in offering more dynamic and transparent logistics insurance products.

Key Segmentation

The logistics insurance market can be segmented as follows:

- By Coverage Type: Cargo Insurance, Marine Insurance, Freight Insurance, Warehouse Insurance.

- By End-User: E-commerce, Manufacturing, Automotive, Pharmaceuticals, Others.

- By Distribution Channel: Direct Sales, Brokers, Online Platforms.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Key Player Analysis

Key players in the logistics insurance market are focusing on providing tailored solutions to address the growing complexity of global supply chains. Many of these players are integrating technology like blockchain, IoT, and AI into their offerings to enhance the monitoring of goods in transit and improve risk management processes. Strategic partnerships with logistics companies are helping insurance providers gain a better understanding of supply chain risks, enabling them to offer more customized insurance products. Additionally, many players are expanding their footprint in emerging markets to capitalize on the rising demand for logistics insurance due to increased trade and e-commerce activities.

- Allianz SE Company Profile

- AXA XL (AXA Group)

- Zurich Insurance Group

- AIG (American International Group)

- Chubb Ltd.

- Tokio Marine Holdings

- The Travelers Companies, Inc.

- Munich Re

- RSA Insurance Group

- Liberty Mutual Insurance

- Atrium Underwriters (Lloyd’s)

- Others

Recent Developments

- A major insurance provider launched a new line of customized cargo insurance policies to address the specific needs of the e-commerce sector.

- A logistics company partnered with an insurer to integrate real-time tracking and monitoring capabilities into their insurance offerings.

- A global insurance firm introduced a blockchain-based platform to streamline the claims process and reduce fraud in logistics insurance.

- A leading provider of marine insurance expanded its services to include comprehensive warehouse insurance for logistics companies.

- Several logistics insurance companies invested in AI-driven risk management tools to better assess and mitigate supply chain risks.

Conclusion

The logistics insurance market is poised for substantial growth, driven by the increasing complexity of global trade, e-commerce, and supply chain management. With rising premiums and shifting supply chains, businesses that innovate and invest in digital solutions will be well-positioned to meet the growing demand for logistics insurance products.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)