Table of Contents

Introduction

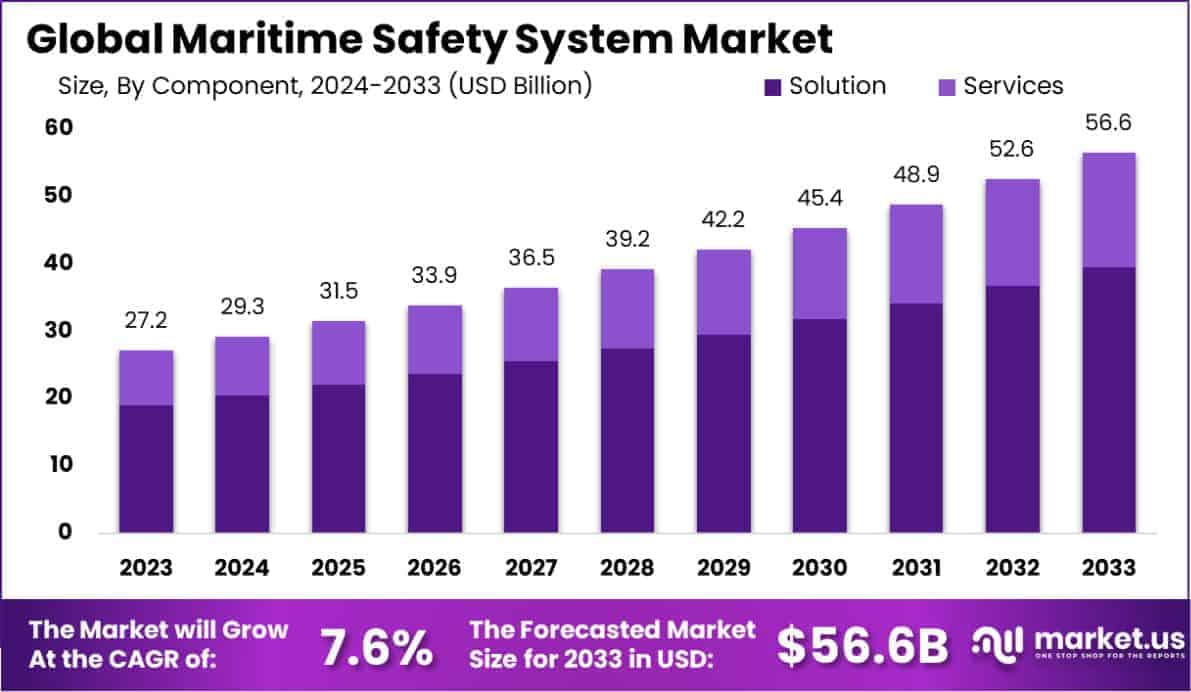

The Global Maritime Safety System Market is projected to expand from USD 27.2 billion in 2023 to USD 56.6 billion by 2033, registering a CAGR of 7.6% during 2024–2033. Growth is being propelled by rising global seaborne trade, stricter international safety regulations, and technological advancements in navigation and communication systems. In 2023, North America dominated the market, securing a 45% share with revenues of USD 12.24 billion, supported by strong naval infrastructure, government investments in maritime security, and rapid adoption of advanced monitoring and emergency response systems.

How Growth is Impacting the Economy

The maritime safety system industry is playing a vital role in ensuring uninterrupted global trade, which accounts for over 80% of international goods transportation. Rising investments in vessel traffic services, GPS navigation, and emergency response systems are boosting economic efficiency by minimizing accidents, reducing cargo loss, and ensuring safe maritime operations.

The sector is creating jobs across shipbuilding, defense, software development, and port management, strengthening economic resilience. Moreover, government funding for modernizing maritime infrastructure, particularly in North America and Europe, is spurring local technology industries and service providers. This growth directly supports international commerce, safeguards supply chains, and enhances national security, all of which have measurable contributions to GDP.

➤ Unlock growth! Get your sample now! – https://market.us/report/maritime-safety-system-market/free-sample/

Impact on Global Businesses

Global businesses dependent on maritime transport are increasingly impacted by stricter safety mandates and higher compliance costs. Shipping companies are adopting digital safety systems, including real-time monitoring and automated distress alerts, to meet regulatory requirements and protect assets. Energy companies transporting oil and gas rely on maritime safety systems to reduce spill risks and environmental liabilities.

Logistics providers are using integrated safety systems for route optimization, reducing delays and operational costs. Insurance firms are also leveraging maritime data to assess risks more accurately, reshaping policies and premiums for global businesses. These shifts are redefining how enterprises approach risk management in maritime operations.

Strategies for Businesses

Businesses are prioritizing investments in digital safety solutions, integrating IoT, AI, and satellite communication for real-time monitoring. Strategic collaborations between ship operators, port authorities, and tech providers are expanding. Companies are adopting compliance-driven strategies to meet IMO (International Maritime Organization) safety standards. Cybersecurity frameworks are being integrated into safety systems to address risks of digital breaches. Sustainability-focused approaches, such as eco-friendly navigation technologies and spill-prevention measures, are becoming key business strategies to align with international environmental mandates while maintaining competitiveness.

Key Takeaways

- Global market expected to reach USD 56.6 billion by 2033 at 7.6% CAGR

- North America led with 45% share, valued at USD 12.24 billion in 2023

- Seaborne trade and safety regulations are primary growth drivers

- Integration of IoT, AI, and satellite systems shaping industry growth

- Compliance, cybersecurity, and sustainability are strategic priorities

Analyst Viewpoint

The maritime safety system market is evolving as a backbone of secure global trade. Currently dominated by North America, the market is benefitting from strong investments in naval infrastructure and regulatory compliance. Looking ahead, Asia-Pacific is poised for rapid growth due to rising seaborne trade and modernization of port facilities. Emerging technologies like AI-driven navigation, predictive maintenance, and cyber defense will redefine industry standards. With international pressure to enhance safety and environmental sustainability, the market outlook remains highly positive, offering long-term opportunities for innovators and technology providers.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Vessel traffic monitoring | Rising seaborne trade volumes and congestion management |

| Emergency response systems | Increasing need for rapid accident and spill control |

| Cargo and crew safety | Regulatory push for safety compliance in shipping |

| Oil spill prevention | Rising energy transport across oceans |

| Cybersecurity in maritime systems | Growing digitalization of vessel and port operations |

Regional Analysis

North America held a 45% share in 2023 with USD 12.24 billion in revenue, driven by strong naval investments and adoption of advanced safety systems in commercial shipping. Europe is growing steadily, supported by strict maritime safety directives and funding for port modernization. Asia-Pacific is emerging as the fastest-growing region due to heavy trade activity, expanding fleets in China, India, and Japan, and rising government initiatives for maritime safety. The Middle East, with its strategic oil shipping routes, is adopting spill-prevention and emergency response systems, while Latin America is gradually upgrading maritime safety infrastructure to support export-driven economies.

Business Opportunities

Significant opportunities lie in the development of AI-powered navigation systems, advanced satellite communication platforms, and eco-friendly maritime technologies. Vendors offering integrated compliance-ready solutions stand to gain traction among shipping firms seeking efficiency and regulatory adherence. Growing demand for managed safety services from mid-sized fleets is opening new avenues. Investment opportunities are expanding in smart port technologies, combining safety with operational efficiency. As sustainability becomes central to maritime operations, innovations in emission monitoring and spill-prevention systems will create long-term value for solution providers and investors.

Key Segmentation

By system type, the market includes ship security alert systems, long-range tracking, automatic identification systems (AIS), vessel traffic services (VTS), and fire safety systems. By application, it spans cargo vessels, passenger ships, naval ships, and offshore oil & gas platforms. End-users include commercial shipping operators, defense forces, port authorities, and energy companies. Each segment contributes uniquely to market expansion, with cargo vessels and oil & gas platforms accounting for major demand due to their critical role in global energy and goods transportation.

Key Player Analysis

Industry participants are focusing on expanding digital safety portfolios, integrating AI and satellite-based communication for advanced monitoring. Companies are forming joint ventures with port authorities and naval organizations to secure long-term contracts. R&D investment in eco-friendly spill-prevention technologies and advanced cybersecurity is rising. Vendors are prioritizing scalable solutions that can be customized for both large fleets and small vessel operators. Competitive positioning is increasingly built around compliance with IMO regulations, system reliability, and the ability to integrate with legacy infrastructure seamlessly.

Recent Developments

- Adoption of AI-driven navigation systems for real-time vessel safety

- Expansion of satellite-based tracking platforms for global coverage

- Strategic collaborations between tech providers and naval forces

- Launch of cybersecurity frameworks for maritime safety systems

- Government funding programs for port and fleet modernization

Conclusion

The maritime safety system market is expanding steadily, driven by global trade growth, safety regulations, and digital transformation. With North America at the forefront and Asia-Pacific rising, the industry presents strong opportunities for technology-driven innovation, compliance solutions, and sustainable maritime safety practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)