Table of Contents

Introduction

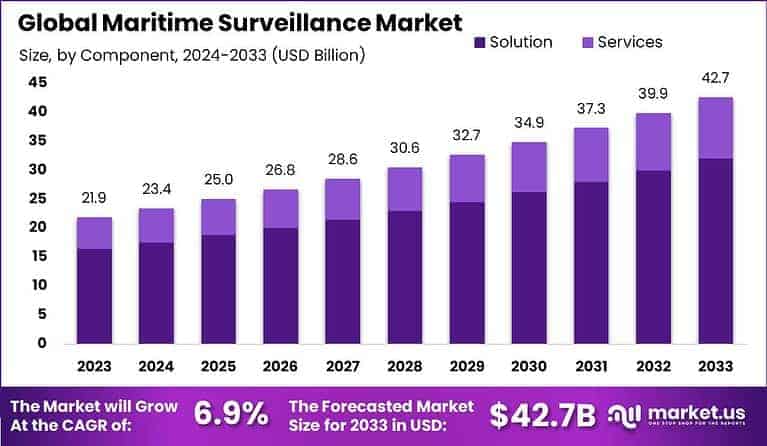

The global maritime surveillance market is projected to grow from USD 21.9 billion in 2023 to USD 42.7 billion by 2033, reflecting a CAGR of 6.90%. This growth is driven by increasing global trade, maritime security concerns, and the adoption of advanced surveillance technologies like radars, drones, and satellite monitoring systems. In 2023, North America led the market with a 34.1% share, generating USD 7.9 billion in revenue. As maritime security becomes a top priority for governments and industries worldwide, the demand for advanced surveillance systems is expected to continue expanding across both commercial and military sectors.

How Growth is Impacting the Economy

The growth of the maritime surveillance market is contributing to the global economy by improving maritime security and operational efficiency in key industries such as shipping, fishing, oil & gas, and naval defense. As global trade continues to increase, the need for effective surveillance systems to monitor shipping lanes and detect illegal activities (such as piracy and smuggling) is growing.

This has led to increased investments in advanced surveillance technologies, creating job opportunities in areas like system development, maintenance, and data analytics. Furthermore, the market’s expansion is supporting the growth of maritime logistics and naval defense sectors, boosting the economy through infrastructure development and technological advancements. As governments and corporations ramp up their security efforts, the maritime surveillance sector will continue to play a crucial role in ensuring the safe flow of goods and services worldwide.

➤ To Elevate Your Business – Request Sample Here @ https://market.us/report/maritime-surveillance-market/free-sample/

Impact on Global Businesses

The growth of the maritime surveillance market is having a substantial impact on businesses, especially in sectors like shipping, fishing, and oil & gas, where security concerns are high. Companies in these industries are increasingly investing in advanced surveillance technologies to ensure safe operations and secure trade routes. However, rising costs associated with cutting-edge systems, including radars, satellites, and drones, are a significant concern for businesses looking to upgrade their systems.

Furthermore, businesses are experiencing supply chain shifts, as the demand for maritime surveillance hardware and software puts pressure on global supply chains, particularly in sectors like electronics and communication technologies. These market dynamics are compelling businesses to focus on efficiency, cost management, and security improvements to stay competitive in the growing maritime security landscape. Additionally, sector-specific impacts include increased regulations and compliance requirements, particularly in the naval defense and shipping industries, as the need for comprehensive monitoring solutions increases globally.

Strategies for Businesses

To capitalize on the growth in the maritime surveillance market, businesses should:

- Invest in advanced surveillance systems that integrate AI and machine learning to improve real-time monitoring and threat detection

- Develop strategic partnerships with technology providers to stay at the forefront of innovative surveillance technologies

- Focus on cost-effective solutions that balance security requirements with budget constraints

- Expand into emerging markets, where maritime activity and demand for surveillance solutions are increasing

- Enhance compliance with international security regulations to meet the rising demand for legal and operational standards

By implementing these strategies, businesses can ensure they stay competitive in an evolving market while addressing emerging threats and security needs in the maritime industry.

Key Takeaways

- The maritime surveillance market is set to grow from USD 21.9 billion in 2023 to USD 42.7 billion by 2033, with a CAGR of 6.90%.

- North America held 34.1% market share in 2023, generating USD 7.9 billion in revenue.

- Advanced surveillance technologies are essential to securing global trade routes and ensuring maritime safety.

- Rising costs and supply chain shifts are significant challenges for businesses adopting new technologies.

- The market’s future is promising, driven by the growing need for security and efficiency in the maritime industry.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=133679

Analyst Viewpoint

The maritime surveillance market is experiencing steady growth, driven by increasing demand for advanced security technologies in the face of rising global trade and maritime threats. North America is expected to continue dominating the market due to its technological advancements and strong defense infrastructure.

However, Europe and Asia-Pacific are expected to experience significant growth, particularly as emerging markets in shipping and oil & gas seek to enhance their security capabilities. With a projected CAGR of 6.90%, the market’s outlook is positive, driven by advancements in AI, data analytics, and satellite technologies that will redefine maritime safety in the coming years.

Regional Analysis

North America currently dominates the maritime surveillance market, holding 34.1% market share in 2023, generating USD 7.9 billion in revenue. The market’s strength in this region is driven by the U.S. Navy’s modernization efforts, private sector investments, and advanced technology adoption in maritime security.

Europe follows closely, with a rising demand for integrated surveillance solutions in shipping and border patrol activities. Asia-Pacific is expected to grow rapidly, driven by increased maritime activities in countries like China, India, and Japan, as well as the expanding naval defense sector in the region. The Middle East and Latin America are also showing growth, particularly in oil & gas security and anti-piracy operations.

Business Opportunities

The maritime surveillance market presents a range of business opportunities:

- Technology providers can develop AI-driven surveillance systems to enhance real-time detection of threats at sea.

- Shipping companies can invest in integrated security platforms to ensure safe trade routes and cargo protection.

- Governments and militaries can enhance border security and anti-piracy operations by implementing advanced surveillance systems.

- Oil & gas companies can implement maritime security solutions for offshore drilling platforms and transportation routes.

- Startups can explore innovative applications of drones and satellite-based systems for cost-effective monitoring in emerging maritime markets.

These opportunities provide a wealth of potential for businesses to participate in the expanding maritime security sector and contribute to global trade safety and security infrastructure.

Key Segmentation

The maritime surveillance market is segmented as follows:

By Application

- Coastal Surveillance (monitoring maritime borders, detection of illegal activities)

- Port Security (security of commercial ports, shipping terminals)

- Offshore Oil & Gas Security (protection of offshore platforms and routes)

- Defense and Military Surveillance (border control, anti-piracy operations)

By Technology - Radar Systems (long-range detection, surveillance)

- Satellites (remote monitoring, real-time data)

- Drones (aerial surveillance, real-time imagery)

- Infrared & Thermal Imaging (night vision, heat detection)

By Region - North America (leading market share, high demand for defense solutions)

- Europe (growing demand in shipping and port security)

- Asia-Pacific (rapid expansion in shipping and oil sectors)

This segmentation reflects the diverse applications of maritime surveillance, highlighting the growing integration of advanced technologies like radars, satellites, and drones to enhance maritime security.

Key Player Analysis

Key players in the maritime surveillance market are focusing on integrating advanced radar systems, satellite surveillance, and drones to improve real-time monitoring. These companies are expanding their portfolio of security solutions to cover a wide range of sectors, including military defense, port security, and oil & gas. Through partnerships with governments, defense agencies, and private sector firms, these players aim to provide comprehensive maritime surveillance solutions that address both commercial and security needs. They are also investing in AI-driven analytics to offer more accurate threat detection and incident response capabilities in the maritime domain.

- Thales Group

- RTX Corporation

- Northrop Grumman Corporation Company Profile

- Leonardo S.p.A.

- Indra Sistemas S.A.

- Saab AB

- BAE Systems Plc Company Profile

- Elbit Systems Ltd.

- Kongsberg Defence & Aerospace

- L3Harris Technologies, Inc.

- Other Key Players

Recent Developments

- 2023: Launch of AI-enhanced maritime surveillance systems to improve real-time threat detection

- 2023: Integration of drones and satellite technologies for remote monitoring of maritime borders

- 2022: Expansion of maritime surveillance solutions for offshore oil platforms and shipping routes

- 2022: Collaboration with governments for anti-piracy surveillance and security operations

- 2021: Deployment of advanced radar systems for port and coastal security

Conclusion

The maritime surveillance market is set for significant growth, driven by the increasing demand for advanced security solutions to protect shipping lanes, offshore platforms, and coastal areas. With a CAGR of 6.90%, the market presents substantial opportunities for businesses to innovate in AI-powered monitoring, satellite surveillance, and drone technologies, ensuring the security of global trade and vital maritime infrastructure.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)