Table of Contents

Market Overview

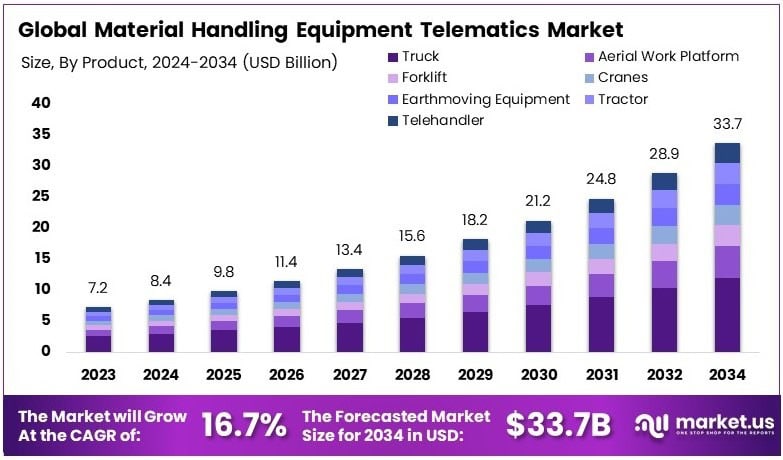

The Global Material Handling Equipment Telematics Market size is expected to be worth around USD 33.7 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 16.7% during the forecast period.

The Material Handling Equipment Telematics Market is growing fast. Safety and automation drive this demand. Over 30,000 forklift injuries happen yearly in the U.S. Telematics helps reduce accidents and save lives. Companies want better safety and control.

Telematics tracks operator behavior and machine use. It cuts insurance costs and boosts efficiency. Safety rules push businesses to adopt smart tools. Cranes with telematics can lower carbon emissions by 3.5 kg. This supports eco-friendly operations and compliance.

Governments invest in smart infrastructure and logistics. Funding helps companies adopt telematics faster. Truck-mounted systems raise output by up to 30%. This means better use of space and faster work. Strict rules on safety and emissions increase demand. Telematics helps meet these rules with real-time data. It improves fleet health and reduces downtime.

Firms see strong ROI with these systems. Telematics boosts productivity and lowers costs. It ensures safety and performance in daily tasks. The market offers growth, safety, and green benefits. Smart equipment is now a business need. Companies must invest to stay ahead. The future of logistics is smart, safe, and connected.

Key Takeaways

- The Material Handling Equipment Telematics Market was valued at USD 7.2 billion in 2024 and is projected to reach USD 33.7 billion by 2034, growing at a CAGR of 16.7%.

- In 2024, Trucks led the product segment with a 35.6% share, driven by rising fleet management demand.

- Forklifts captured a significant share in 2024 due to warehouse automation and logistics sector growth.

- Cranes saw wide adoption in 2024, especially in construction and shipping industries.

- Telematics software gained popularity in 2024, enabling real-time equipment monitoring.

- Mining and construction were the top end-use industries in 2024, supported by safety compliance and operational efficiency.

- North America dominated in 2024 with 43.2% market share, valued at USD 3.11 billion, driven by strong IoT adoption.

Market Drivers

- Operational Efficiency: Telematics tracks usage, fuel, and idle time to cut costs and boost performance.

- Safety & Compliance: Monitors operator behavior and equipment health to enhance safety and meet standards.

- Predictive Maintenance: Detects early faults to prevent breakdowns and extend equipment life.

- E-commerce Growth: Rising online retail boosts demand for smart fleet management in warehouses.

- Sustainability: Tracks emissions and energy use to support green goals and regulatory compliance.

Challenges

High Installation and Integration Costs: For some businesses, especially smaller ones, the initial investment in telematics hardware and software can be a barrier.

Data Security and Privacy Concerns: With the increasing volume of equipment and operator data being transmitted, ensuring data security is a growing concern.

Lack of Standardization: Different manufacturers use varying protocols, making it harder to integrate telematics solutions across mixed fleets.

Skilled Workforce Requirements: Operating and interpreting telematics data requires trained personnel, which can add to operational costs and complexity.

Segmentation Insights

Product Analysis

Trucks hold 35.6% share, driven by their flexibility and use in transport. Telematics improves tracking and fleet control. Forklifts, cranes, and others support lifting, loading, and site work.

End-Use Industry Analysis

Logistics leads due to high transport needs. Telematics cuts costs and boosts delivery speed. Warehousing, manufacturing, construction, and mining use it for safety and efficiency.

Regional Insights

North America leads the market with a 43.2% share, valued at USD 3.11 billion, driven by strong tech adoption, IoT investment, and safety regulations. Telematics helps boost efficiency and decision-making in logistics and manufacturing.

Europe focuses on safety, efficiency, and regulatory compliance, pushing steady telematics growth

Asia Pacific sees fast growth due to industrial expansion and rising logistics demand, especially in China and Japan.

Middle East & Africa are growing slowly, backed by infrastructure and logistics investments.

Latin America shows modest growth as firms modernize to stay competitive.

Recent Developments

- In Jul 2024, UgoWork raised $51 million in a funding round led by Fonds de Solidarité FTQ to accelerate the development of its lithium-ion energy solutions for industrial vehicles. The funds will support product innovation and North American market expansion.

- In Apr 2025, Ballymore Safety acquired Valley Craft Industries, a prominent material handling supplier. This acquisition enhances Ballymore’s product portfolio and strengthens its footprint in workplace safety and ergonomic handling equipment.

- In Sept 2024, Dedicated Material Handling Solutions was acquired as part of an expansion into Atlanta, GA. The move aims to broaden geographic reach and improve service capabilities in the Southeastern U.S. region.

Future Outlook

The future of the material handling equipment telematics market is bright, with growing adoption expected across industries. As digital transformation accelerates, telematics will play a crucial role in enabling predictive maintenance, operational transparency, and sustainability. The integration of AI, IoT, and cloud computing is set to further enhance system capabilities, making telematics indispensable in modern logistics and industrial operations.

Companies that focus on user-friendly solutions, scalable platforms, and strong data security will be best positioned to lead in this evolving market.

Conclusion

The Material Handling Equipment Telematics Market is set to grow from USD 7.2 billion (2024) to USD 33.7 billion (2034) at a 16.7% CAGR. Growth is driven by the need for safety, efficiency, and real-time data. Telematics helps reduce costs, improve fleet management, and meet compliance. North America leads, while Asia-Pacific shows fast growth. Despite challenges like high costs and data security, the benefits offer strong ROI. As AI and IoT integrate, smart handling becomes essential. Companies must invest now to stay ahead.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)