Table of Contents

Introduction

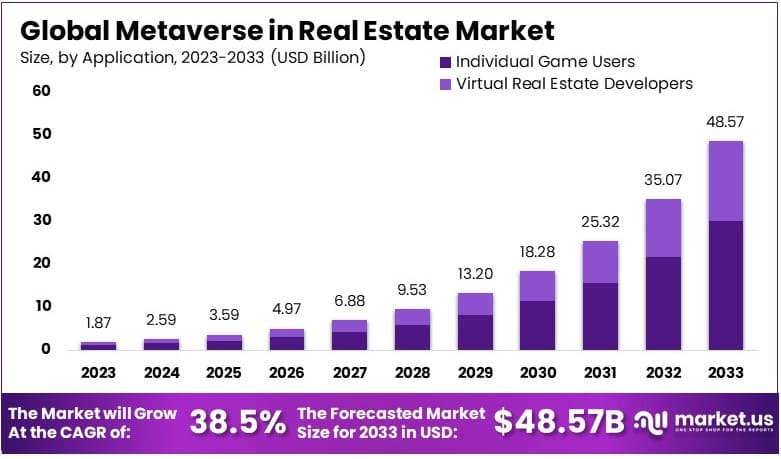

According to the Market.us reports, the worldwide Market for Metaverse in Real Estate is projected to expand significantly, with an estimated value of USD 48.57 billion by 2033, up from USD 1.87 billion in 2023. This represents a compound annual growth rate (CAGR) of 38.5% from 2024 to 2033.

The Metaverse is rapidly transforming the landscape of real estate, offering a digital parallel to the physical world where users can buy, sell, and manage properties. In this virtual environment, properties aren’t just digital constructs but assets that can appreciate in value, generate rental income, and provide immersive experiences. Real estate in the Metaverse is facilitated through platforms that replicate real-world interactions, allowing users to tour properties, attend open houses, and even negotiate deals in a fully virtual setting.

The Metaverse real estate market is witnessing a surge in interest and investment, prompting a new economic dynamic within the digital space. As of now, the market involves various stakeholders including developers, investors, and end-users who engage through cryptocurrencies and blockchain technology. The commercial opportunities in the Metaverse real estate market are vast, ranging from advertising and branding to virtual leasing and direct sales. Analysts predict significant growth as more businesses and individuals recognize the potential for capital gains and innovative marketing strategies within these digital realms.

The demand for real estate in the Metaverse is being driven by a unique combination of factors. Foremost among these is the growing interest in virtual experiences and digital ownership fueled by advancements in VR and AR technologies. Users are drawn to the Metaverse for the opportunity to own digital assets that are not bound by physical limitations, offering a new form of investment that is both accessible and potentially lucrative. The appeal of exclusive virtual events, branded spaces, and the allure of pioneering a new digital frontier are further driving demand, making Metaverse real estate a sought-after commodity.

Several key growth factors are propelling the Metaverse real estate market. The increasing adoption of blockchain technology ensures secure transactions and ownership, making digital assets more trustworthy. Improvements in virtual reality technology enhance the user experience, making virtual spaces more realistic and engaging.

Additionally, the COVID-19 pandemic has accelerated the shift towards remote interactions, pushing more businesses and consumers to explore digital spaces for both work and leisure. The integration of social media platforms with Metaverse environments also fosters a more connected and interactive community, broadening the user base and deepening investment in virtual properties.

The market opportunity in Metaverse real estate is vast and varied. For businesses, it offers a new avenue for branding and marketing, allowing companies to create immersive brand experiences that engage consumers in ways not possible in the physical world. For investors, the speculative nature of these digital assets presents potential for high returns, especially as the market is still in its early stages.

There is also significant potential for developers to create new types of virtual properties and services, from luxury virtual homes to commercial spaces designed for virtual commerce. As the technology and platform capabilities continue to evolve, the scope for innovative real estate ventures in the Metaverse will expand, making it a prime area for investment and development.

Key Takeaways

- The Metaverse in Real Estate Market was valued at USD 1.87 billion in 2023 and is projected to reach USD 48.57 billion by 2033, growing at a CAGR of 38.5%.

- Buy Metaverse Real Estate was the leading type segment in 2023, accounting for 40% of the market, driven by increasing investments in virtual properties.

- Individual Game Users constituted the largest application segment in 2023, with a 61.7% share, due to the rising popularity of virtual worlds among gamers.

- North America held the highest market share in 2023 at 30.6%, indicative of the region’s strong embrace of metaverse technologies

Metaverse in Real Estate Statistics

- The Global Metaverse Market size is projected to reach USD 2,346.2 billion by 2032, increasing from USD 94.1 billion in 2023, with a CAGR of 44.4% during the forecast period from 2024 to 2033.

- The Generative AI in Real Estate Market size is expected to be worth around USD 1,177.7 Million by 2033, from USD 393 Million in 2023, growing at a CAGR of 11.6% during the forecast period from 2024 to 2033.

- A significant $1.9 billion worth of virtual land has been sold across the top ten virtual world platforms.

- The most expensive metaverse land sale recorded was $5 million, which took place in TCG World, a relatively lesser-known virtual platform.

- There are a total of 622,436 parcels of land available across the ten largest metaverses.

- 44% of potential metaverse users express the most excitement about using the metaverse to communicate with friends and family in a more immersive way.

- 77% of Americans believe that the metaverse poses a risk of “serious harm” to life in physical reality.

- At its peak, metaverse real estate transactions reached over $500 million, though there has been a slowdown in transactions due to declining interest.

- Despite the slowdown, the Metaverse market is still expected to reach $936.57 billion by 2030, assuming an annual growth rate of 41.6%.

- Digital land within the metaverse typically sells for between $6,000 to $100,000, with some properties fetching even higher prices. Notably, a property adjacent to Snoop Dogg’s virtual estate in The Sandbox sold for $450,000.

- The Sandbox currently dominates the metaverse real estate market, commanding approximately 62% of the entire market share.

- Republic Realm made headlines by paying a record $4.3 million for virtual land to develop 100 islands, known as Fantasy Islands, each featuring its own villas and jet skis.

- Metaverse Group, a subsidiary of Tokens.com, invested $2.4 million in 116 plots measuring 52.5 sq. ft. each, totaling 6,090 virtual sq. ft..

- Genesis Land plots in Axie Infinity sold for $2.3 million.

Emerging Trends

- Integration with AR and VR: The lines between virtual and physical real estate are blurring, with augmented reality (AR) and virtual reality (VR) increasingly integrated into the metaverse, enhancing mixed-reality experiences like property tours and digital showrooms.

- Rising Investment from Tech Firms: There’s a growing interest from venture capitalists and technology companies in metaverse real estate projects. This is leading to more funding for metaverse platforms and virtual real estate marketplaces, signaling strong confidence in the sector’s potential.

- High Transaction Values: Sales in the metaverse real estate market have been impressive, with instances of land initially bought for thousands being resold for over a hundred thousand dollars. This showcases the significant capital gains potential within this space.

- Expansion of Use Cases: Beyond just buying and selling virtual land, the metaverse is evolving into a space for hosting virtual offices, retail storefronts, and even cultural events, which adds diverse functionality to virtual properties.

- Increasing Mainstream Interest: As more individuals and companies learn about and explore the metaverse, its integration into mainstream real estate and business strategies is increasing, making it a more commonly accepted part of the digital economy.

Top Use Cases

- Virtual Offices and Headquarters: Companies are setting up virtual spaces in the metaverse to function as offices, including complete operational capabilities like meeting rooms and auditoriums. This allows for a remote yet interactive work environment.

- Retail and Commercial Spaces: Businesses are purchasing virtual lands to set up shop in high-traffic areas within popular metaverses, leveraging the brand exposure and customer engagement opportunities that the virtual world offers.

- Cultural and Entertainment Venues: Artists and producers are utilizing the metaverse to create and monetize virtual exhibition spaces and performance venues, providing new ways for audiences to experience art and entertainment.

- Educational and Training Facilities: Educational institutions and companies are exploring the metaverse for virtual learning and training environments, where they can simulate real-world scenarios or provide immersive learning experiences that are not constrained by physical space.

- Real Estate Investment and Speculation: The speculative buying and selling of virtual properties continue to be a major use case, with investors seeking to capitalize on the rapid appreciation in property values due to the limited availability and high demand in popular metaverses.

Major Challenges

- Market Volatility: The metaverse real estate market is highly unpredictable with prices that can fluctuate wildly. This instability is driven by changing platform popularity, technological advancements, and speculative investments.

- Regulatory Uncertainty: The nascent nature of metaverse real estate means it currently exists in a largely unregulated space, which can lead to complications with property rights, intellectual property, and potential for fraudulent activities. There’s a pressing need for clear legal frameworks to be established as the market evolves.

- Technological Barriers: Participation in the metaverse requires specific technology such as VR headsets or advanced computers, which can be a barrier for widespread adoption. This technological requirement may limit market accessibility and growth, especially in regions with less developed digital infrastructure.

- Security Risks: The digital-only nature of metaverse real estate exposes it to cybersecurity threats such as hacking and digital theft. This vulnerability necessitates robust security measures to protect investments.

- Integration with Traditional Systems: The metaverse challenges conventional real estate practices, requiring professionals to adapt to a digital-first approach. Integrating traditional real estate concepts with the virtual dynamics of the metaverse presents both logistical and strategic challenges.

Top Opportunities

- Global Reach: Metaverse real estate allows for showcasing and marketing properties to an international audience without geographical constraints. This capability greatly expands the potential customer base beyond local or national borders.

- Innovative Marketing: The immersive nature of the metaverse provides novel ways to advertise and market properties. Virtual tours and interactive property showcases can attract buyers and investors by providing a unique, engaging user experience.

- New Investment Avenues: Virtual real estate offers a new asset class for investors, characterized by potentially high returns. As the metaverse grows, early investments in virtual properties could appreciate significantly.

- Diverse Revenue Streams: Owners of virtual properties can explore various monetization options such as leasing digital space for events, selling or renting virtual assets, and advertising, thereby diversifying income sources.

- Creative and Architectural Freedom: Without the physical limitations of the real world, the metaverse offers unprecedented creative freedom in architectural and environmental design. This aspect attracts a new wave of creators and investors interested in crafting unique and innovative spaces.

Recent Developments

- In 2023, Decentraland maintained its position as a leading platform for virtual real estate. The platform saw a major acquisition in which a piece of land was sold for over $2.43 million. Decentraland continues to be a hub for virtual events, with brands and companies increasingly using the platform to host immersive experiences.

- In late 2023, Tokens.com, a significant player in metaverse real estate investment, expanded its portfolio by purchasing additional virtual land parcels in Decentraland and The Sandbox. This move is part of their strategy to capitalize on the increasing value of metaverse properties as more brands enter the space

- In January 2023, SuperWorld partnered with Metaverse Group to enhance its virtual property marketplace. This collaboration aims to increase the presence of Metaverse Group within SuperWorld, with an investment plan of up to $1 million.

Conclusion

In summary, the Metaverse in Real Estate market represents a transformative and rapidly expanding sector, where digital real estate in virtual worlds is bought, sold, and developed, much like physical property but with distinct advantages and challenges. The market offers unique investment opportunities, as properties in the Metaverse can be developed and monetized through advertising, virtual events, and leasing. Additionally, the integration of blockchain technology ensures security and transparency in transactions, attracting both individual investors and corporate entities.

Despite facing substantial challenges such as the lack of standardization in virtual property rights, the potential for market volatility and technological barriers for non-technical users, the market is also seeing increasing involvement from traditional real estate players and tech companies, indicating a strong belief in its long-term viability and success.The Metaverse in Real Estate market holds promising potential for revolutionizing how property is viewed and transacted. With ongoing technological advancements and increasing global connectivity, this market is poised to become a significant component of the broader real estate industry, offering innovative ways for property development, investment, and management in the digital age.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)