Table of Contents

Market Overview

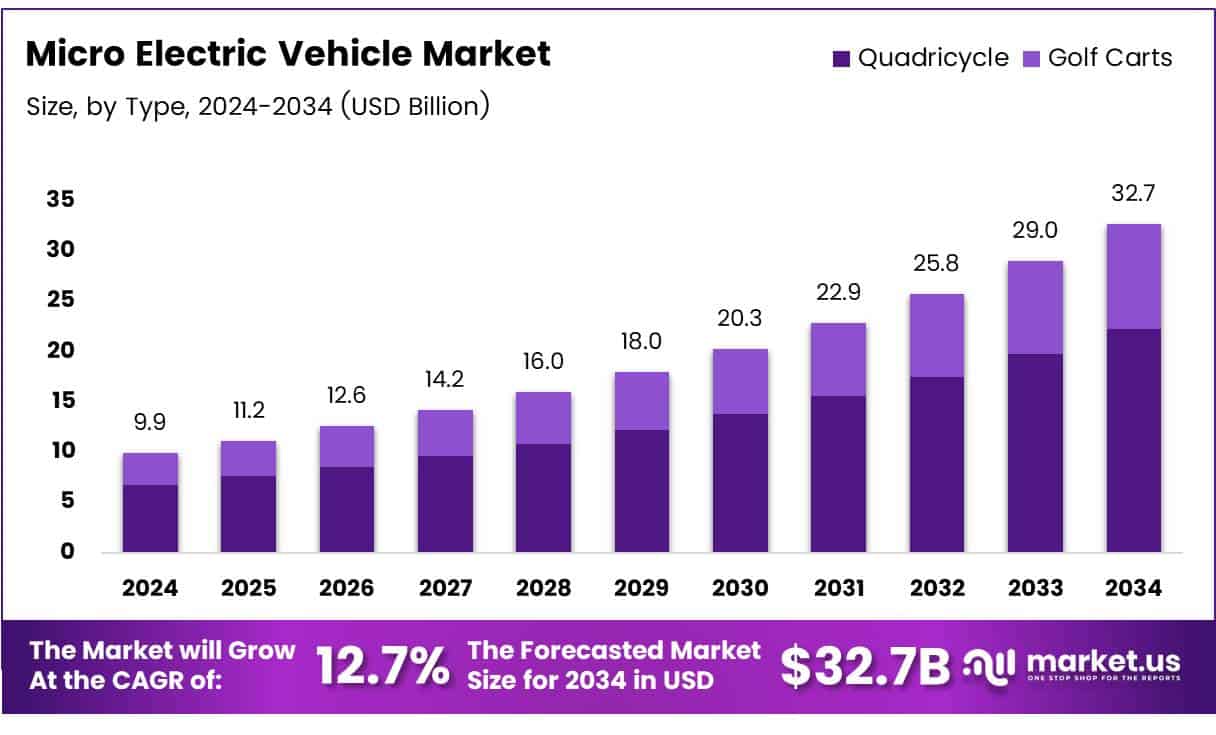

The Global Micro Electric Vehicle Market size is expected to be worth around USD 32.7 Billion by 2034, from USD 9.9 Billion in 2024, growing at a CAGR of 12.7% during the forecast period.

The Micro Electric Vehicle (Micro EV) market is growing fast. Rising fuel prices drive Micro EV demand. Urban traffic congestion boosts compact EV use. Micro EVs suit short trips and small roads. Consumers prefer low-cost transport options. In 2024, demand surged across Asia and Europe. Micro EVs offer clean, affordable mobility. Their size fits narrow city streets.

Governments support Micro EV adoption. Many offer subsidies and tax benefits. Registration charges are often reduced. India and China push EV policies strongly. Europe enforces strict CO₂ regulations. These rules favor smaller EV models. Urban transport plans include Micro EV goals. EV infrastructure investment is rising globally.

Shared mobility boosts Micro EV use. Rental fleets adopt small EVs fast. Delivery businesses use Micro EVs widely. Startups enter the Micro EV market. Consumers like the low running cost. Battery tech is improving steadily. This lowers charging time and cost.

Micro EVs help cities meet green targets. Investors see big potential in this segment. The market offers high growth opportunity. More cities plan zero-emission zones. Compact EVs meet these goals well. With rising demand and government backing, the Micro EV market shows strong future promise.

Key Takeaways

- Global Micro Electric Vehicle Market to reach USD 32.7 Billion by 2034, up from USD 9.9 Billion in 2024.

- Market to grow at a CAGR of 12.7% during the forecast period.

- Quadricycle segment dominated By Type with a 60.2% market share in 2024.

- Lithium-ion Battery led the Battery Type segment in 2024.

- Commercial Use held the largest share in Vehicle Application segment in 2024.

- North America led the market with a 40.7% share, valued at USD 4.1 Billion in 2024.

Market Drivers

- Rising environmental awareness is encouraging consumers to switch from traditional cars to greener options like micro EVs. Their zero tailpipe emissions significantly reduce carbon footprints.

- Government policies and subsidies are actively promoting electric mobility. Many countries offer tax benefits, rebates, and regulatory support to both EV manufacturers and consumers.

- Increasing urbanization has led to a surge in traffic congestion and parking issues. Micro EVs, being smaller in size, offer easier parking and navigation through dense city traffic.

- Surging fuel prices have made electric alternatives more cost-effective in the long run. Micro EVs offer lower operating and maintenance costs compared to internal combustion engine (ICE) vehicles.

- Expansion of charging infrastructure is also facilitating faster adoption. As the availability of fast-charging stations increases, range anxiety among users is gradually diminishing.

Market Restraints

- Limited range and speed restrict their use to short-distance commutes, making them unsuitable for long-range travel.

- High initial costs of EV components and batteries can be a barrier, although long-term savings often offset the upfront investment.

- Lack of standardization in EV infrastructure across countries creates logistical challenges for cross-border manufacturing and distribution.

- Battery disposal and recycling issues pose environmental concerns, especially with the growing number of electric vehicles in use.

Key Trends and Opportunities

- Integration of smart features like app-based vehicle control, GPS navigation, and IoT connectivity is enhancing user experience.

- Vehicle sharing and micro-mobility platforms are incorporating micro EVs into their fleets, especially in urban centers.

- Battery technology advancements are enabling better performance, longer life, and quicker charging.

- Emergence of solar-powered and hybrid micro EVs is opening new growth avenues, especially in regions with abundant sunlight.

- Corporate fleets and last-mile delivery services are increasingly adopting micro EVs to reduce emissions and operational costs.

Market Segmentation

Type Analysis

In 2024, quadricycles held 60.2% share due to their compact size, low cost, and fit for city travel. Golf carts remain niche, used mainly in resorts and private areas.

Battery Type Analysis

Lithium–ion batteries dominated in 2024 for their long life, fast charging, and lightweight design. Lead-acid batteries are cheaper but less efficient and slowly declining in demand.

Vehicle Application Analysis

Commercial use led the market in 2024, driven by last-mile delivery, fleet use, and low running costs. Personal use is growing but still behind due to infrastructure and awareness gaps.

Regional Insights

North America

North America leads the micro electric vehicle market. It holds 40.7% share, worth USD 4.1 billion. Growth is driven by EV demand. Government gives strong incentives. Charging network is well developed. Urban buyers prefer sustainable options.

Europe

Europe ranks second in market share. Emission laws boost micro EV use. Cities focus on reducing traffic. Western Europe adopts EVs fast. Public-private projects support growth. Smart mobility drives market demand.

Asia Pacific

Asia Pacific sees rapid EV growth. Urbanization increases vehicle need. China and India invest in EVs. Governments support electric mobility. Local manufacturing boosts adoption. Micro EVs suit dense cities well.

Middle East & Africa

The region grows slowly but steadily. UAE and South Africa lead adoption. Smart cities boost EV demand. Renewable energy supports growth. Infrastructure gaps limit expansion. More investment is still needed.

Latin America

Latin America shows early EV progress. Brazil and Mexico push EV policies. Awareness of pollution is rising. Cities face mobility issues. Infrastructure is still developing. Market has long-term potential.

Competitive Landscape

- Launching new models with innovative features

- Expanding their geographic presence

- Collaborating with tech firms to enhance connectivity and performance

- Improving battery efficiency and reducing vehicle costs

Recent Developments

In March 2025, micromobility startup Also spun out from EV maker Rivian. It raised $105 million from Eclipse Ventures. The fund will boost product design. Also plans to expand in urban EV markets. The move supports clean mobility goals. Demand for compact EVs continues to rise.

In September 2024, Sonalika announced a ₹1,000 crore investment in electric microcars. It will set up a new EV plant. The move strengthens Sonalika’s EV portfolio. It targets India’s growing small EV market. The plant will increase production. It aligns with India’s electric mobility vision.

In April 2025, Remsons Industries acquired 51% stake in Astro Motors. Astro makes electric three-wheelers. The deal expands Remsons’ EV presence. It helps enter last-mile transport space. The acquisition will boost production capacity. Remsons targets fleet and commercial buyers. Demand for electric three-wheelers is growing fast.

Conclusion

The Global Micro Electric Vehicle Market is on a transformative growth path, fueled by environmental awareness, urban mobility needs, and supportive government policies. Despite certain limitations, the industry is poised for long-term success. With continuous innovation, expanding infrastructure, and changing consumer behavior, micro EVs are set to become a crucial part of the future of clean urban transportation.