Table of Contents

- Introduction

- Editor’s Choice

- Data Center Market Overview

- Data Center Storage Capacity Worldwide

- Revenue Obtained from Data Centers by Major Companies

- Micro Mobile Data Center Market Overview

- Rack Power Density Rising Fast Across Major Data Center Segments

- Trends in Server Rack Density Deployment

- Sustainability Factors

- Key Investments in Different Regions

- Power Usage Effectiveness (PUE)

- Key Challenges and Concerns

- Methods Used by Operators of Data Center Infrastructure to Measure Success

- Innovations and Developments in Micro Mobile Data Centers Statistics

- Regulations for Micro Mobile Data Centers

- Recent Developments

- Conclusion

- FAQs

Introduction

Micro Mobile Data Center Statistics: Micro Mobile Data Centers (MMDCs) are compact, self-contained units designed for flexibility, mobility, and scalability.

These modular data centers are portable, energy-efficient, and equipped with integrated power, cooling, and networking systems.

Ideal for applications such as edge computing, disaster recovery, and temporary deployments, MMDCs offer cost-effective and rapid deployment in remote or underserved areas.

Their rugged design allows them to withstand harsh environments, making them suitable for industries like telecommunications, defense, and IoT.

As demand for edge computing and resilient infrastructure grows, MMDCs are becoming an increasingly important solution for businesses seeking agile and efficient data processing capabilities.

Editor’s Choice

- In 2023, the global micro mobile data center market size reached USD 4.9 billion.

- By 2032, the market is projected to reach USD 14.3 billion, with above 40 RU units accounting for USD 6.65 billion, 20 RU to 40 RU units at USD 4.15 billion, and up to 20 RU units at USD 3.50 billion.

- In 2022, the global micro mobile data center market was dominated by the edge computing application segment, which accounted for the largest share at 44%.

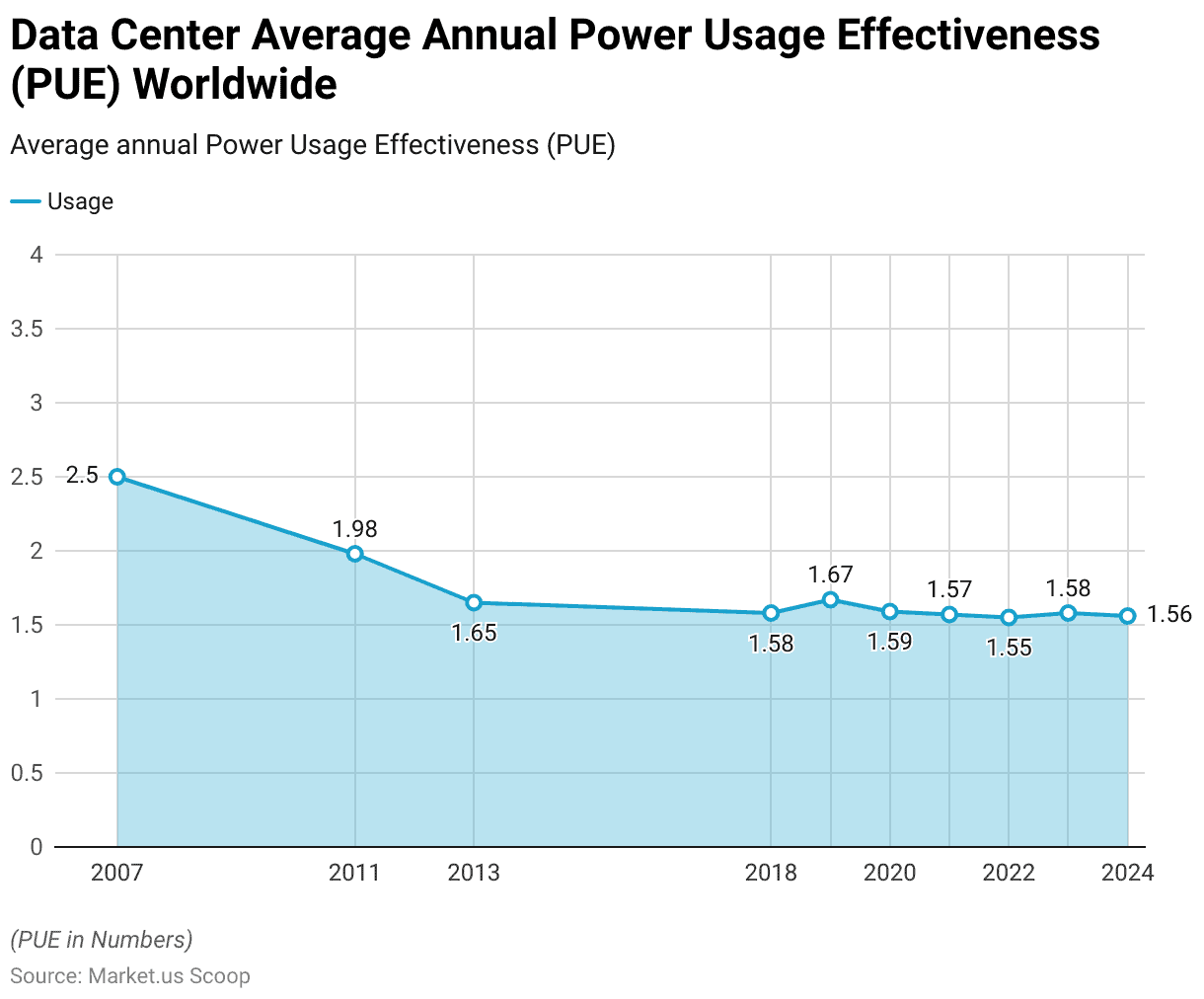

- The average annual Power Usage Effectiveness (PUE) of data centers worldwide is projected to reach 1.56 in 2024.

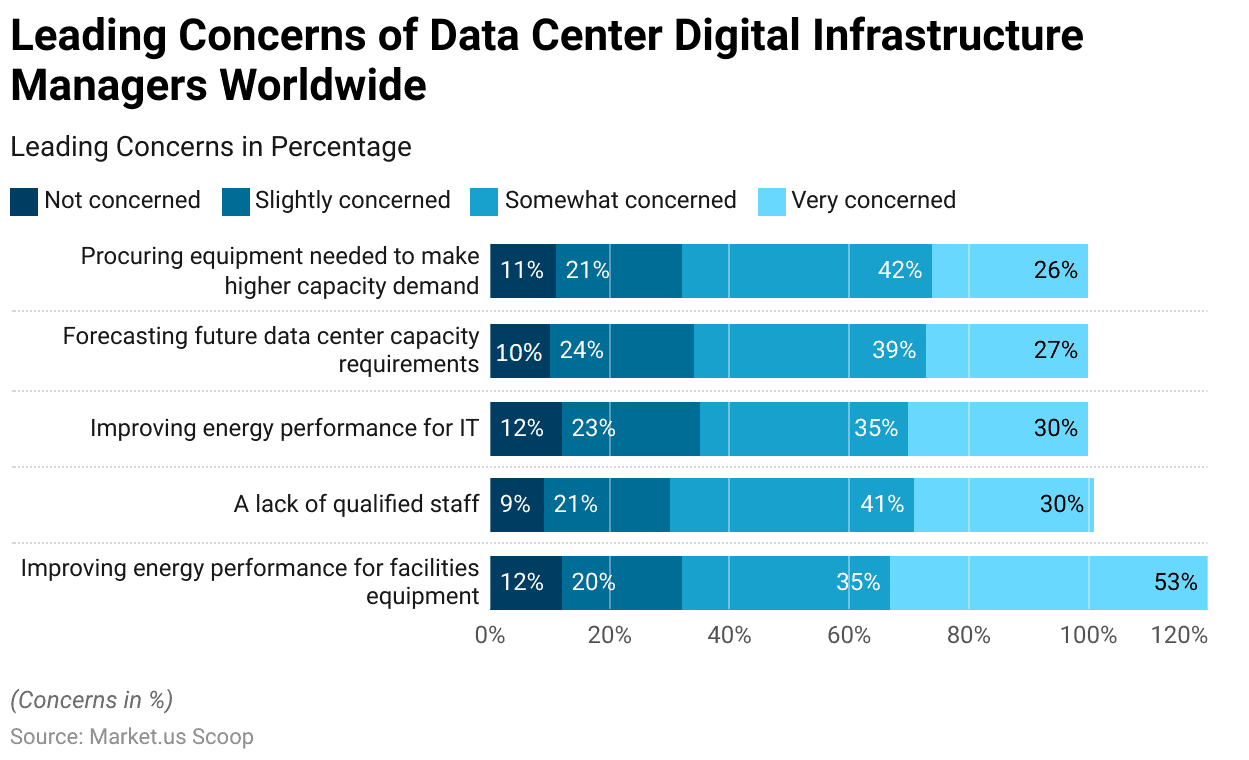

- In 2023, digital infrastructure managers identified improving energy performance for facilities as the top concern, with 53% being very concerned and 35% somewhat concerned.

- Companies such as Schneider Electric and Dell EMC have introduced modular, scalable solutions that facilitate rapid deployment in diverse environments.

- In the United States, standards like SSAE 18 and HIPAA are essential for data centers handling financial reporting and health-related information, ensuring that they have stringent controls and security measures in place.

Data Center Market Overview

Global Data Center Market Revenue

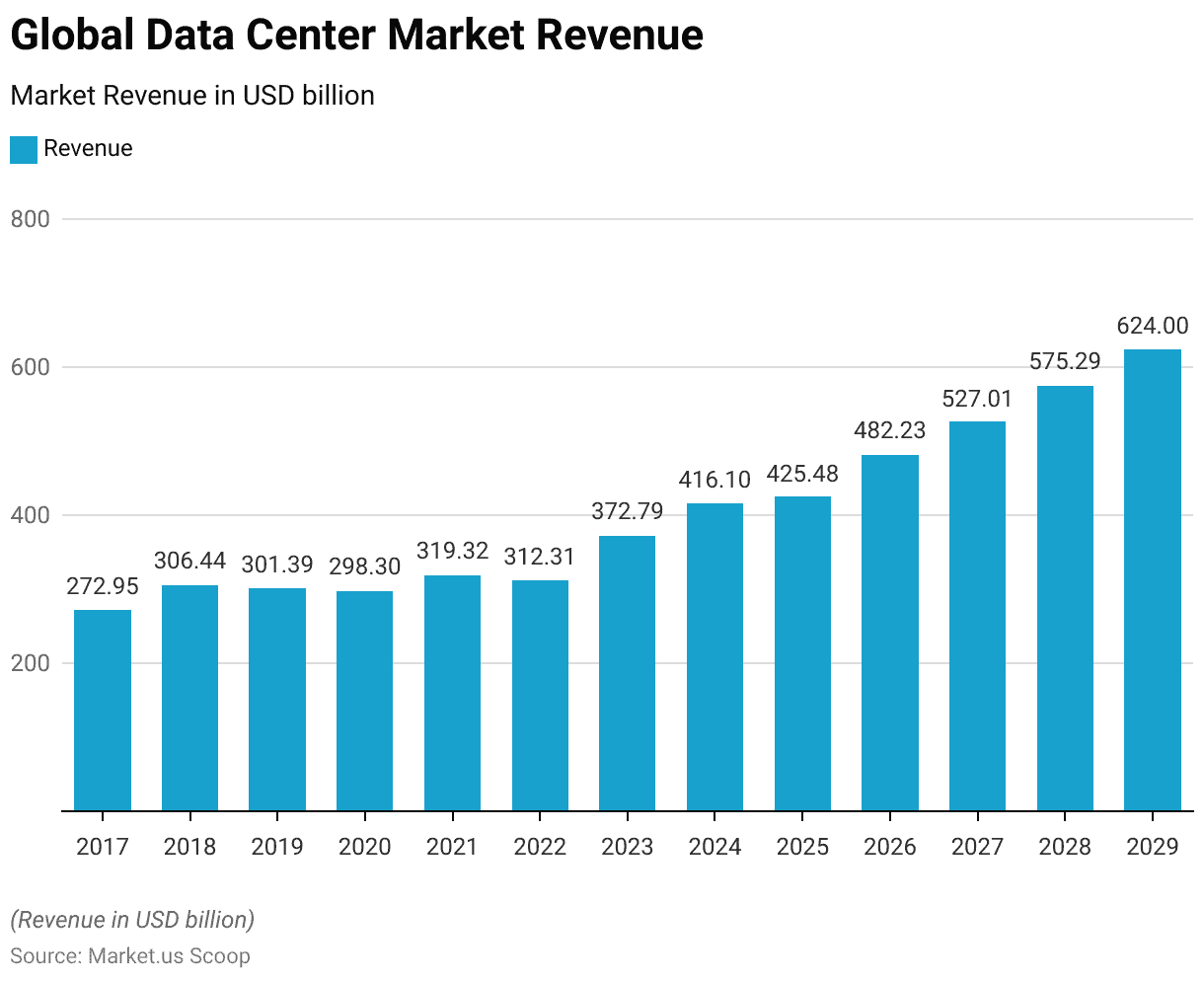

- The global data center market has demonstrated a dynamic growth trajectory from 2017 to 2029, reflecting evolving technological demands and infrastructure investments.

- In 2017, the market revenue stood at USD 272.95 billion and saw an increase to USD 306.44 billion in 2018.

- However, a slight decline was observed in 2019 and 2020, with revenues recorded at USD 301.39 billion and USD 298.3 billion, respectively.

- The market rebounded in 2021, reaching USD 319.32 billion, although 2022 experienced a minor dip to USD 312.31 billion.

- From 2023 onwards, the market entered a robust growth phase, with revenues projected to climb steadily.

- In 2023, the market size is expected to reach USD 372.79 billion, growing significantly to USD 416.1 billion in 2024 and USD 425.48 billion in 2025.

- This upward momentum continues, with forecasts indicating revenues of USD 482.23 billion in 2026, USD 527.01 billion in 2027, USD 575.29 billion in 2028, and USD 624.00 billion by 2029.

- The overall growth reflects increased adoption of cloud computing, data-intensive applications, and a surge in global digital transformation initiatives.

(Source: Statista)

Revenue in the Global Data Center Market for Different Segments

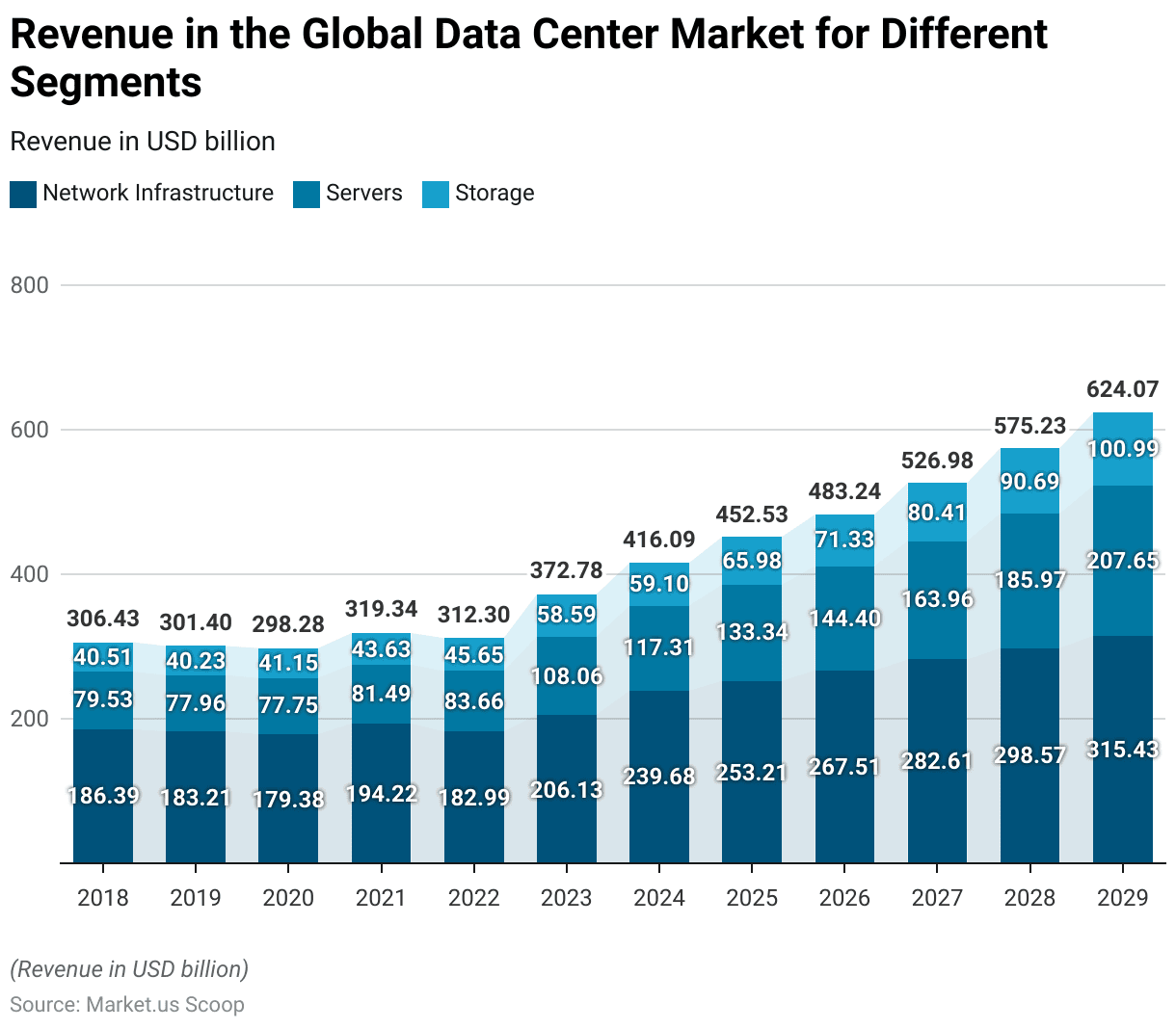

- The global data center market revenue, segmented by network infrastructure, servers, and storage, has exhibited notable growth between 2018 and 2029.

- In 2018, network infrastructure accounted for USD 186.39 billion, servers contributed USD 79.53 billion, and storage generated USD 40.51 billion.

- A slight decline in network infrastructure and servers was observed in 2019 and 2020, with network infrastructure revenue falling to USD 183.21 billion and USD 179.38 billion, respectively, while servers saw a decrease to USD 77.96 billion and USD 77.75 billion. However, storage revenue remained relatively stable during this period, with minor fluctuations.

- From 2021 onwards, the market showed consistent growth across all segments. Network infrastructure revenue increased to USD 194.22 billion in 2021, followed by USD 182.99 billion in 2022 and USD 206.13 billion in 2023.

- Servers also expanded significantly, growing to USD 81.49 billion in 2021, USD 83.66 billion in 2022, and USD 108.06 billion in 2023. Similarly, storage saw steady growth, rising from USD 43.63 billion in 2021 to USD 45.65 billion in 2022 and USD 58.59 billion in 2023.

- Projections for subsequent years indicate accelerated growth across all segments. By 2029, network infrastructure revenue is expected to reach USD 315.43 billion, servers are projected to grow to USD 207.65 billion, and storage is anticipated to rise to USD 100.99 billion.

- The overall growth reflects increasing investments in data center infrastructure, driven by the rapid adoption of cloud computing, data-intensive technologies, and the expansion of digital ecosystems globally.

(Source: Statista)

Data Center Market Revenue – By Country

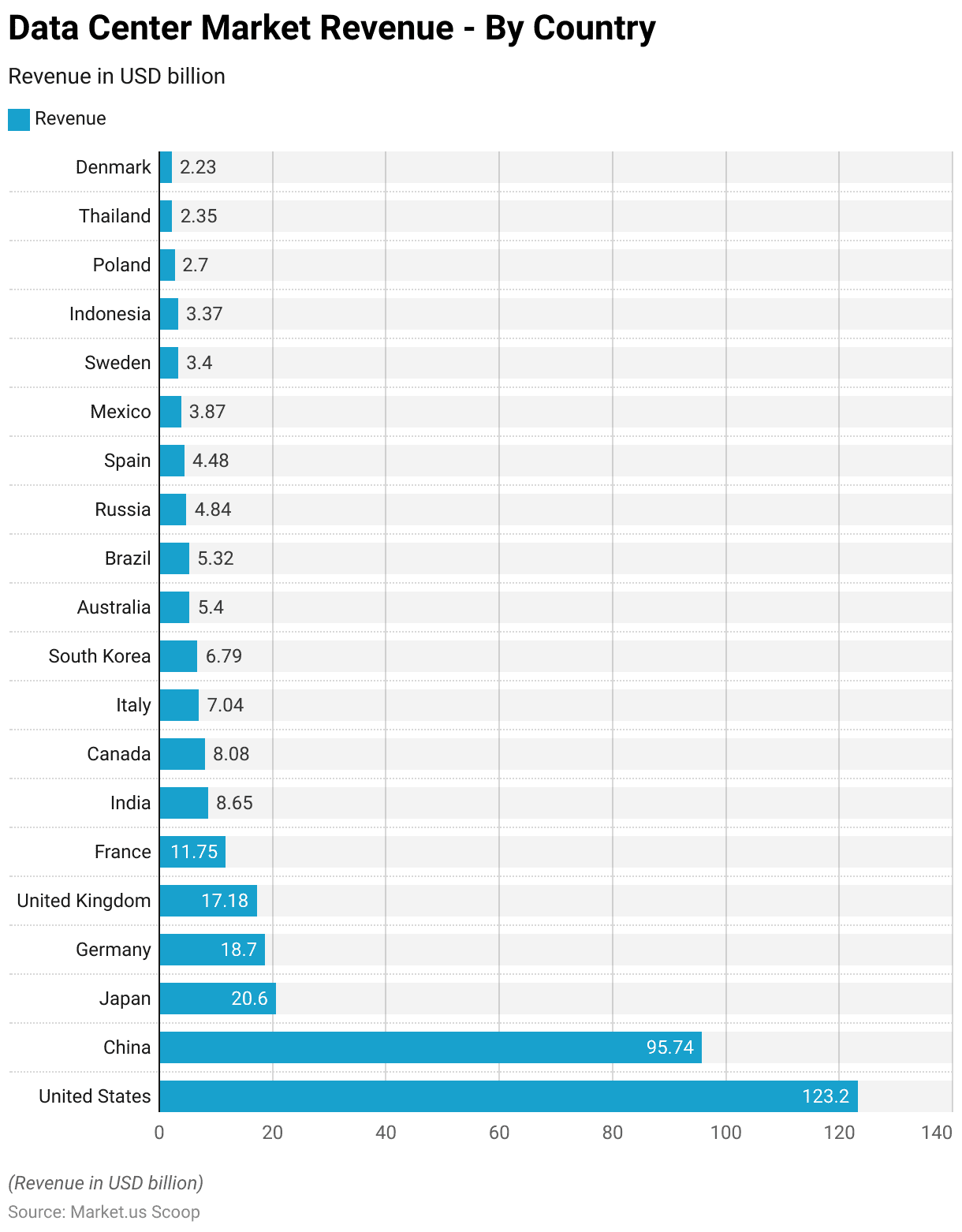

- In 2024, the global data center market is projected to be led by the United States, with an estimated revenue of USD 123.2 billion, reflecting its position as a dominant player in the digital infrastructure landscape.

- China follows closely with a significant market size of USD 95.74 billion, driven by its rapid technological advancements and digital transformation initiatives.

- Japan ranks third, contributing USD 20.6 billion, while Germany and the United Kingdom are expected to generate USD 18.7 billion and USD 17.18 billion, respectively. France also holds a notable share, with revenue of USD 11.75 billion.

- Emerging markets such as India and Canada are projected to generate USD 8.65 billion and USD 8.08 billion, respectively, showcasing their growing investments in data center infrastructure.

- Italy and South Korea followed with revenues of USD 7.04 billion and USD 6.79 billion, respectively.

- Australia, Brazil, and Russia also exhibit robust growth, with market revenues of USD 5.4 billion, USD 5.32 billion, and USD 4.84 billion, respectively.

- Other notable contributors include Spain (USD 4.48 billion), Mexico (USD 3.87 billion), Sweden (USD 3.4 billion), and Indonesia (USD 3.37 billion).

- Poland, Thailand, and Denmark round out the list with revenues of USD 2.7 billion, USD 2.35 billion, and USD 2.23 billion, respectively.

- This distribution highlights the global expansion of the data center market, with strong contributions from both established and emerging economies.

(Source: Statista)

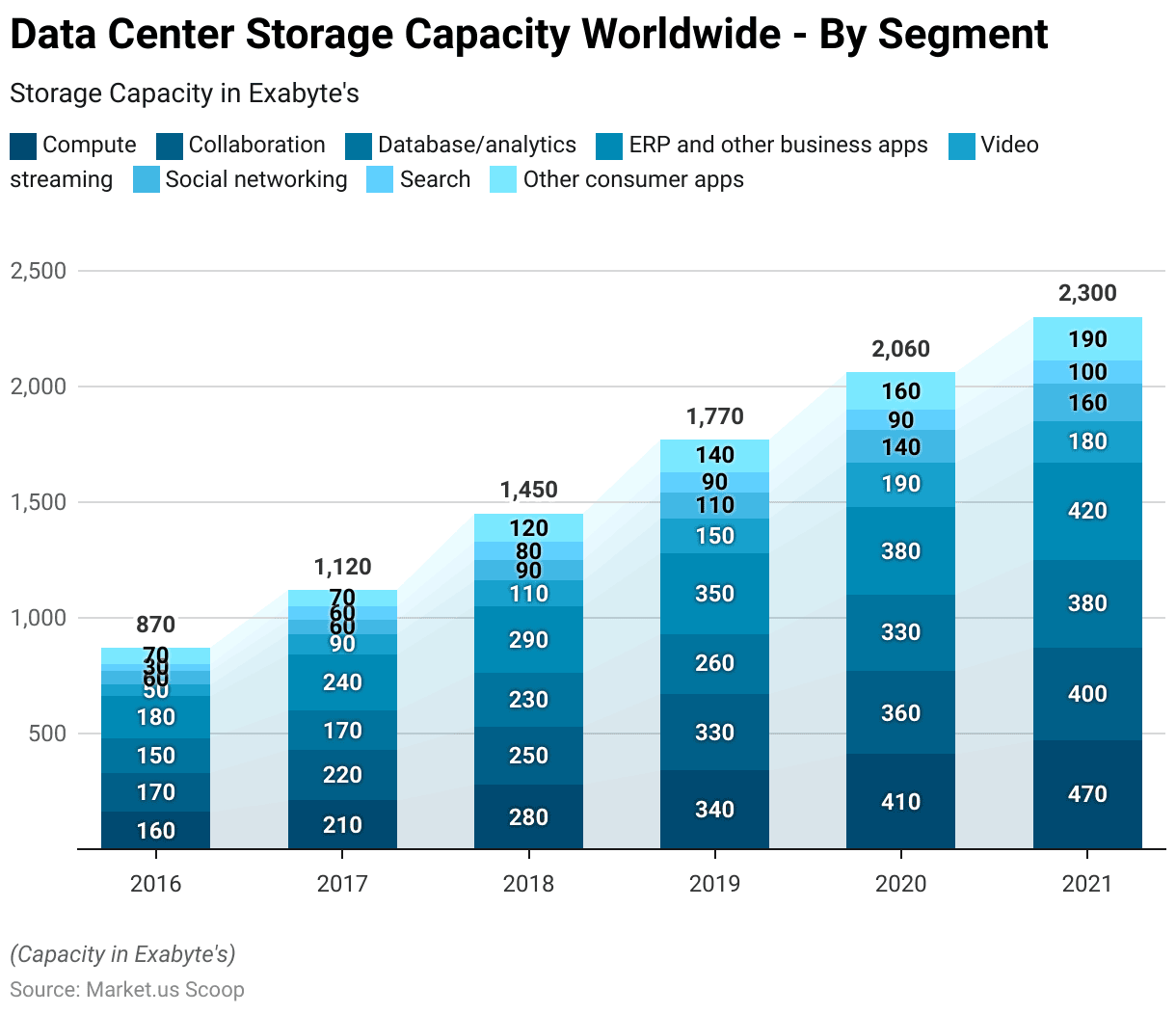

Data Center Storage Capacity Worldwide

- Between 2016 and 2021, global data center storage capacity experienced significant growth across various segments, reflecting the increasing reliance on digital infrastructure.

- The compute segment led the expansion, growing from 160 exabytes in 2016 to 470 exabytes in 2021.

- Similarly, collaboration tools saw consistent growth, with storage capacity increasing from 170 exabytes in 2016 to 400 exabytes by 2021, driven by the rise in remote work and digital communication.

- The database and analytics segment expanded from 150 exabytes in 2016 to 380 exabytes in 2021, highlighting the surge in data-driven decision-making.

- ERP and other business applications also demonstrated strong growth, rising from 180 exabytes in 2016 to 420 exabytes in 2021.

- Video streaming experienced rapid expansion early in the period, growing from 50 exabytes in 2016 to 190 exabytes in 2020 before declining slightly to 180 exabytes in 2021.

- Social networking saw steady growth from 60 exabytes in 2016 to 160 exabytes in 2021, reflecting increased user engagement and content sharing.

- The search segment doubled its capacity from 30 exabytes in 2016 to 100 exabytes in 2021, while other consumer applications grew from 70 exabytes in 2016 to 190 exabytes in 2021.

- This growth across all segments underscores the rapid expansion of digital services and the growing demand for data storage globally.

(Source: Statista)

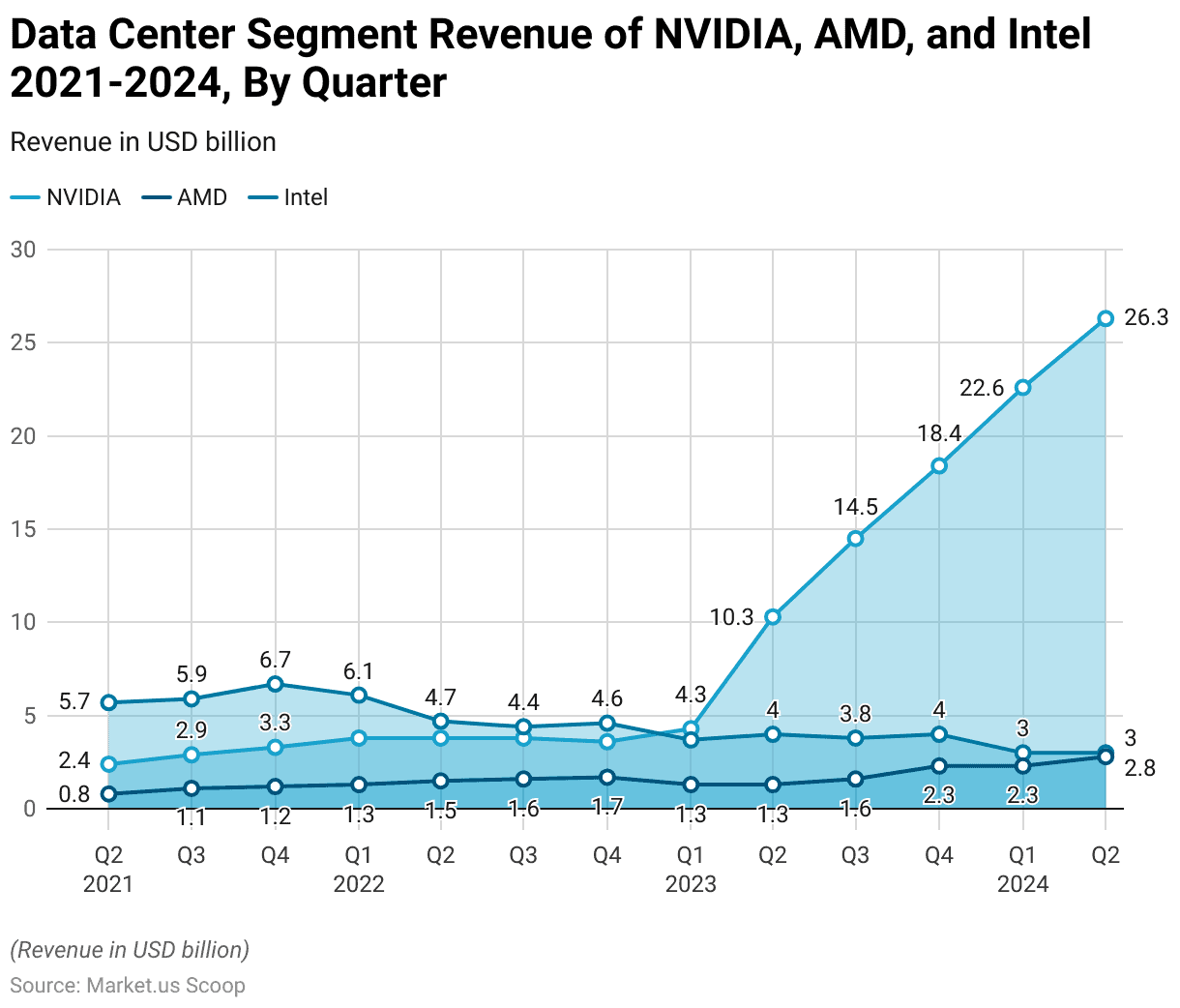

Revenue Obtained from Data Centers by Major Companies

- From Q2 2021 to Q2 2024, the data center segment revenues of Nvidia, AMD, and Intel have displayed varying growth trajectories.

- Nvidia experienced the most significant growth, with its revenue rising from USD 2.4 billion in Q2 2021 to a remarkable USD 26.3 billion in Q2 2024.

- This rapid increase highlights Nvidia’s dominant position in the data center market, driven by its advancements in GPU technology and AI workloads.

- AMD also exhibited steady growth, starting at USD 0.8 billion in Q2 2021 and reaching USD 2.8 billion by Q2 2024, reflecting its competitive offerings in the data center CPU and GPU markets.

- In contrast, Intel’s data center revenue remained relatively flat, fluctuating between USD 3 billion and USD 6.7 billion throughout the period.

- While Intel started strong with USD 5.7 billion in Q2 2021, its revenue declined over time, stabilizing at USD 3 billion by Q2 2024, amid increasing competition and market shifts toward GPUs and accelerators.

(Source: Statista)

Micro Mobile Data Center Market Overview

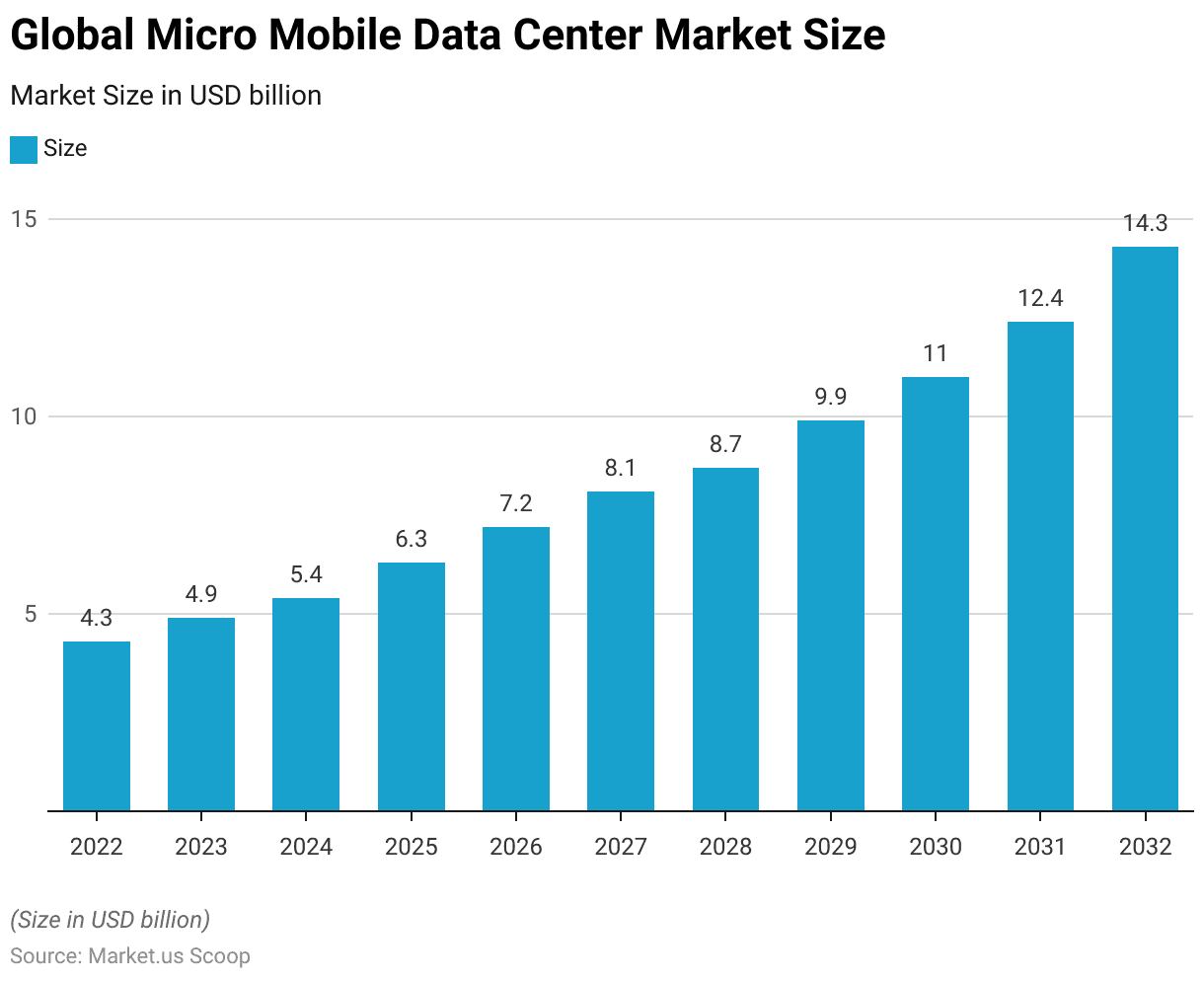

Global Micro Mobile Data Center Market Size Statistics

- The global micro mobile data center market is projected to experience steady growth over the forecast period, with its market size expected to increase from USD 4.3 billion in 2022 to USD 14.3 billion by 2032.

- This represents a significant expansion, driven by a compound annual growth rate (CAGR) of 13.1%, that underpins the rising demand for compact and efficient data processing solutions.

- In 2023, the market size is anticipated to reach USD 4.9 billion, followed by a consistent upward trajectory, reaching USD 5.4 billion in 2024 and USD 6.3 billion in 2025.

- Further acceleration is expected, with the market size projected to grow to USD 7.2 billion in 2026 and USD 8.1 billion in 2027.

- By 2028, the market is estimated to reach USD 8.7 billion, continuing to USD 9.9 billion in 2029 and USD 11.0 billion in 2030.

- The momentum is likely to persist into the subsequent years, with the market size forecasted to climb to USD 12.4 billion in 2031 before culminating at USD 14.3 billion in 2032.

- This growth underscores the increasing reliance on portable, scalable, and efficient data center solutions across various industries.

(Source: market.us)

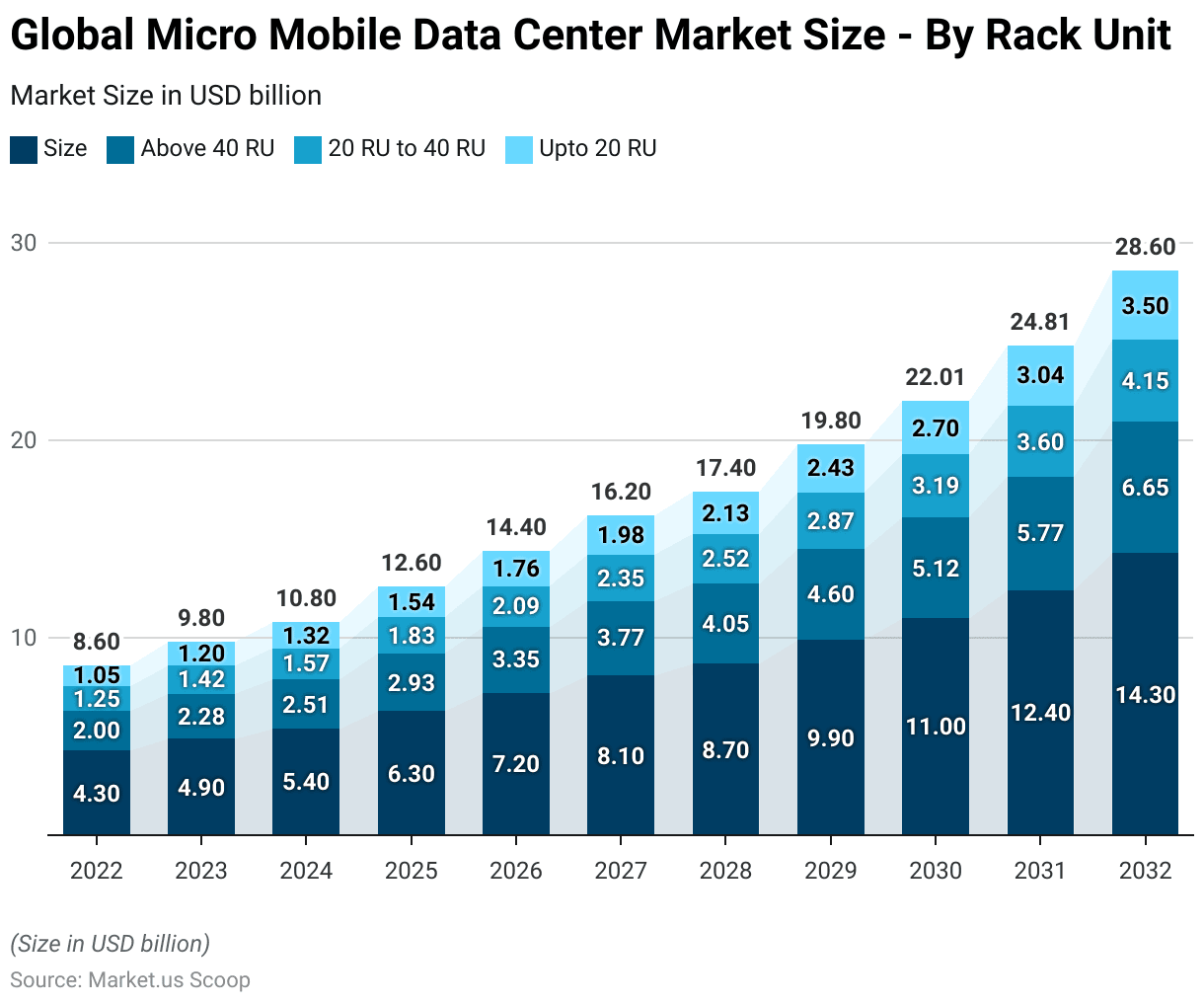

Global Micro Mobile Data Center Market Size – By Rack Unit Statistics

- The global micro mobile data center market has exhibited steady growth from 2022 to 2032.

- In 2022, the market size was valued at USD 4.3 billion, with the segment for above 40 RU units accounting for USD 2.00 billion, followed by 20 RU to 40 RU units at USD 1.25 billion, and up to 20 RU units at USD 1.05 billion.

- The market size increased to USD 4.9 billion in 2023, with corresponding growth in each rack unit category: above 40 RU reached USD 2.28 billion, 20 RU to 40 RU reached USD 1.42 billion, and up to 20 RU units rose to USD 1.20 billion.

- By 2024, the total market size is projected to reach USD 5.4 billion, with above 40 RU units growing to USD 2.51 billion, 20 RU to 40 RU at USD 1.57 billion, and up to 20 RU units at USD 1.32 billion.

- The market is expected to continue expanding, reaching USD 6.3 billion by 2025, USD 7.2 billion by 2026, and USD 8.1 billion by 2027.

- Growth continues into the next decade, with the total market size projected to hit USD 8.7 billion in 2028, USD 9.9 billion in 2029, and USD 11.0 billion by 2030.

- By 2031, the market size is forecasted to reach USD 12.4 billion, with the above 40 RU segment growing to USD 5.77 billion, and by 2032, the market is projected to reach USD 14.3 billion, with above 40 RU units accounting for USD 6.65 billion, 20 RU to 40 RU units at USD 4.15 billion, and up to 20 RU units at USD 3.50 billion.

- This data highlights the steady upward trajectory in the micro mobile data center market, driven by increasing demand for scalable and flexible data infrastructure solutions.

(Source: market.us)

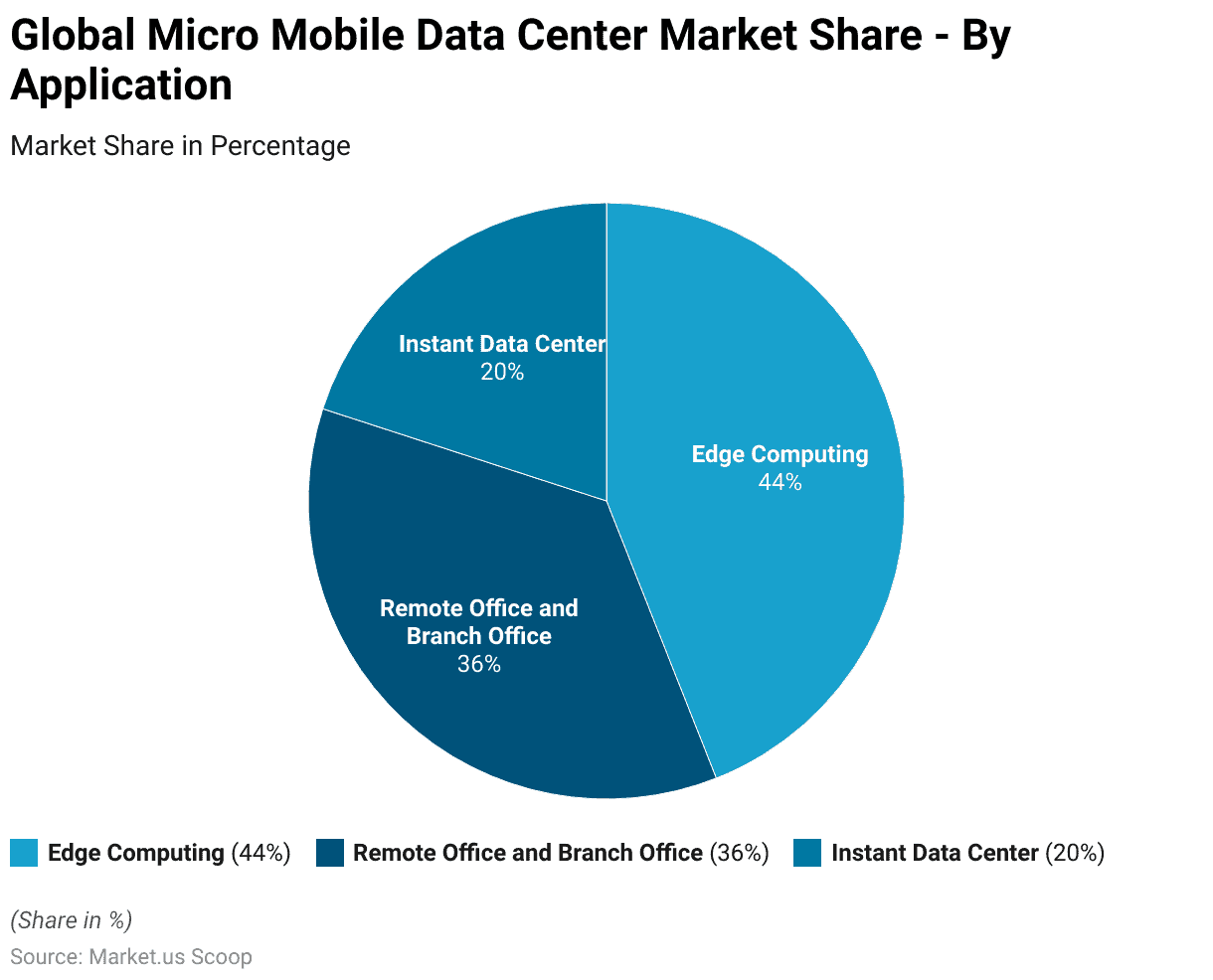

Micro Mobile Data Center Market Share – By Application Statistics

- In 2022, the global micro mobile data center market was dominated by the edge computing application segment, which accounted for the largest share at 44%.

- This dominance underscores the increasing reliance on decentralized data processing to support latency-sensitive applications and real-time analytics.

- The remote office and branch office (ROBO) segment followed closely, holding a 36% market share, driven by the need for scalable and efficient data storage and processing solutions in distributed enterprise environments.

- The instant data center segment accounted for the remaining 20%, reflecting its growing adoption for temporary or emergency data processing requirements.

- This distribution highlights the diverse application areas of micro mobile data centers, with edge computing leading the way in meeting the demands of modern digital infrastructure.

(Source: market.us)

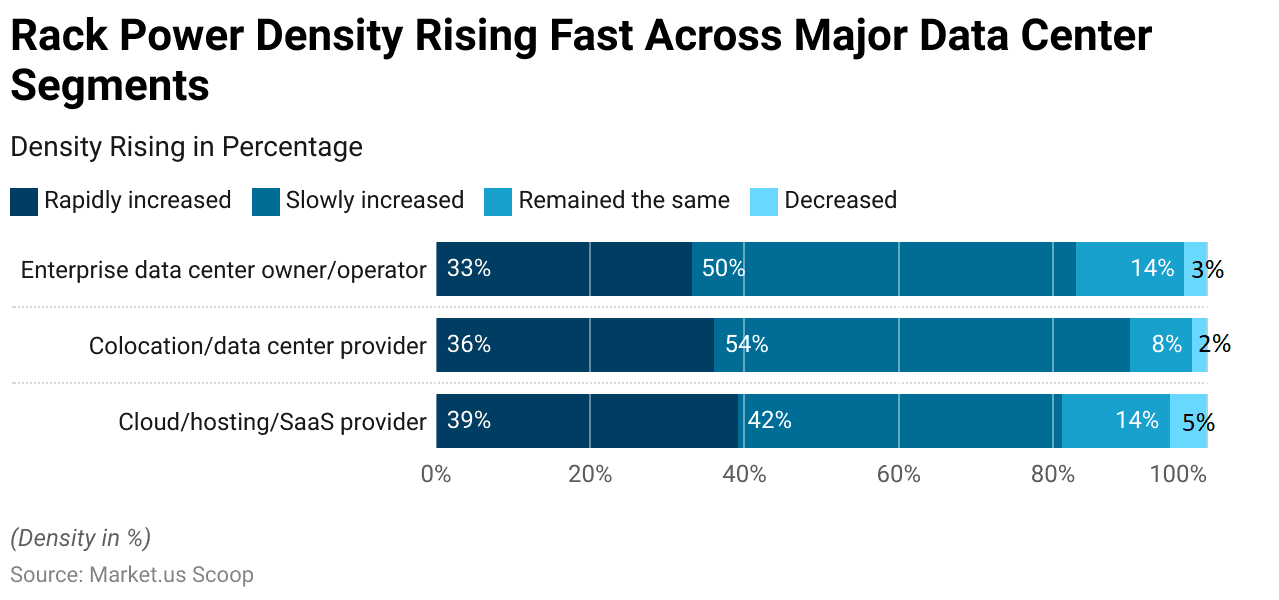

Rack Power Density Rising Fast Across Major Data Center Segments

- Over the past three years, rack power density has shown a notable upward trend across major data center segments, reflecting increasing energy demands and efficiency requirements.

- Among cloud/hosting/SaaS providers, 39% reported a rapid increase in rack power density, while 42% observed a slow increase.

- Only 14% indicated no change, and 5% reported a decrease.

- Similarly, colocation/data center providers saw 36% reporting rapid increases and 54% noting slow increases, with 8% indicating no change and 2% experiencing a decrease.

- Enterprise data center owners and operators reported 33% seeing rapid increases, 50% observing slow increases, 14% reporting no change, and 3% experiencing a decrease.

(Source: Uptime Institute)

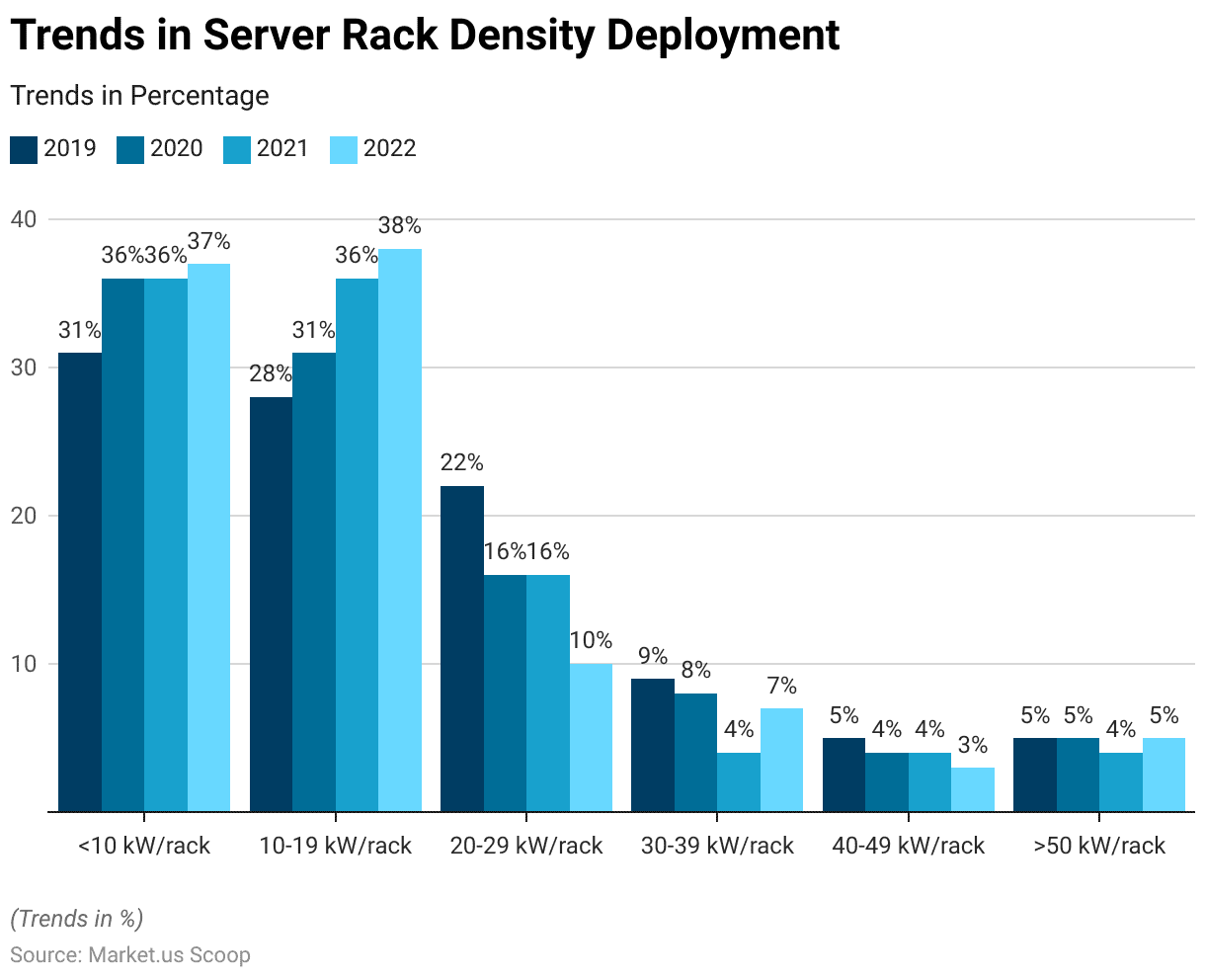

Trends in Server Rack Density Deployment

- Over the period from 2019 to 2022, server rack densities have shifted significantly, reflecting evolving trends in data center power usage.

- The share of respondents deploying racks with densities under 10 kW/rack increased from 31% in 2019 to 37% in 2022, indicating a sustained preference for low-power-density racks.

- Similarly, racks with densities between 10-19 kW/rack experienced consistent growth, rising from 28% in 2019 to 38% in 2022, becoming the most commonly deployed range.

- Conversely, the adoption of 20-29 kW/rack densities declined sharply from 22% in 2019 to just 10% in 2022.

- For densities between 30-39 kW/rack, the adoption fluctuated, with a low of 4% in 2021, increasing slightly to 7% in 2022.

- Deployment of racks with densities of 40-49 kW/rack decreased from 5% in 2019 to 3% in 2022.

- Meanwhile, densities exceeding 50 kW/rack remained relatively stable, at 5% in 2019 and 2022, with a slight dip to 4% in intervening years.

(Source: Uptime Institute)

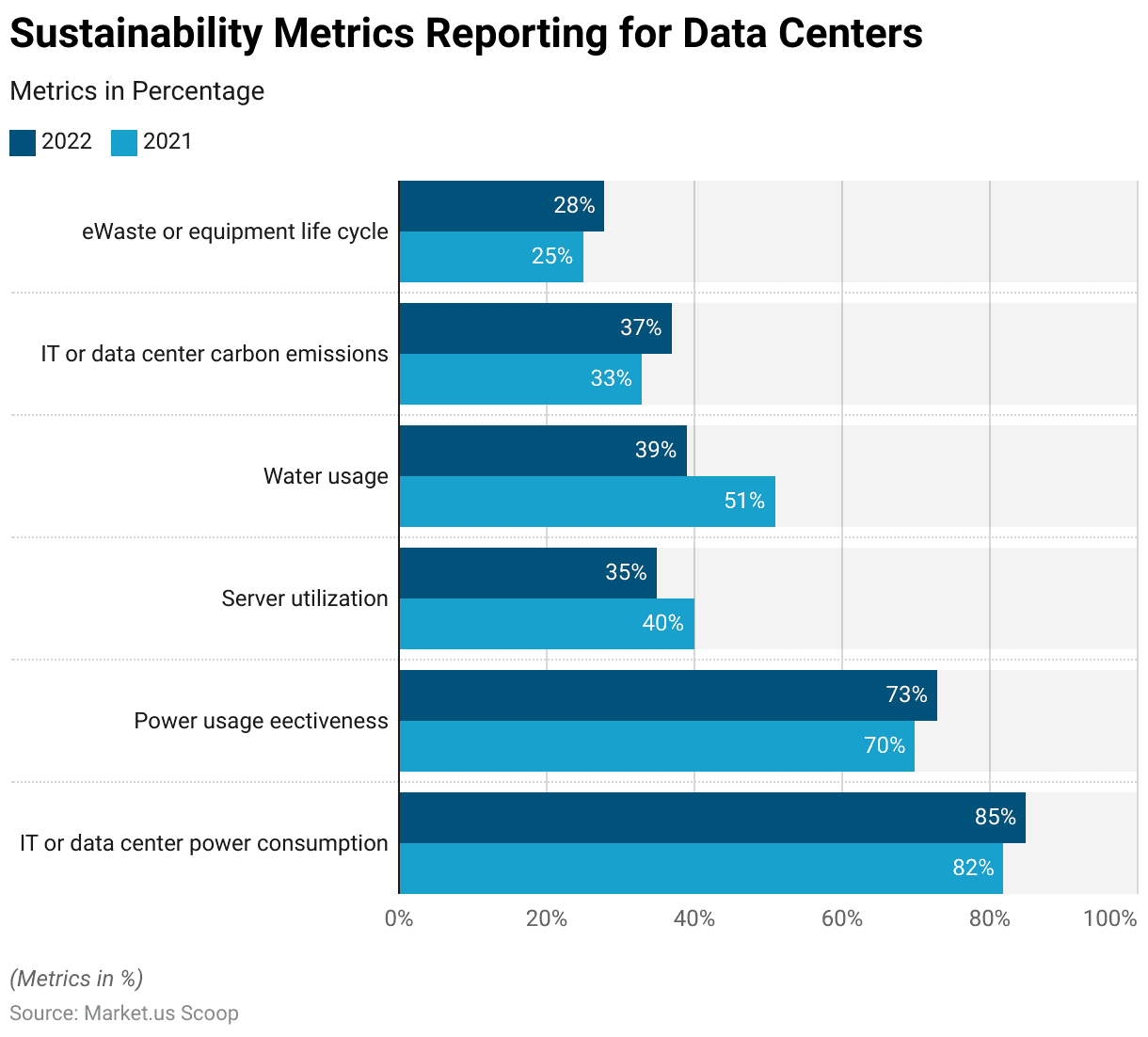

Sustainability Factors

- In 2022, the most commonly compiled and reported IT or data center metric for corporate sustainability purposes was power consumption, reported by 85% of respondents, an increase from 82% in 2021.

- Power Usage Effectiveness (PUE) followed closely, with 73% of respondents tracking it in 2022, up from 70% the previous year.

- However, server utilization metrics saw a decline, tracked by only 35% of respondents in 2022 compared to 40% in 2021.

- Water usage, another key sustainability metric, was reported by 39% in 2022, down significantly from 51% in 2021.

- IT or data center carbon emissions reporting increased, with 37% of respondents in 2022 compared to 33% in 2021.

- Lastly, eWaste or equipment life cycle metrics saw an incremental rise, being tracked by 28% in 2022, up from 25% in 2021.

(Source: Uptime Institute)

Key Investments in Different Regions

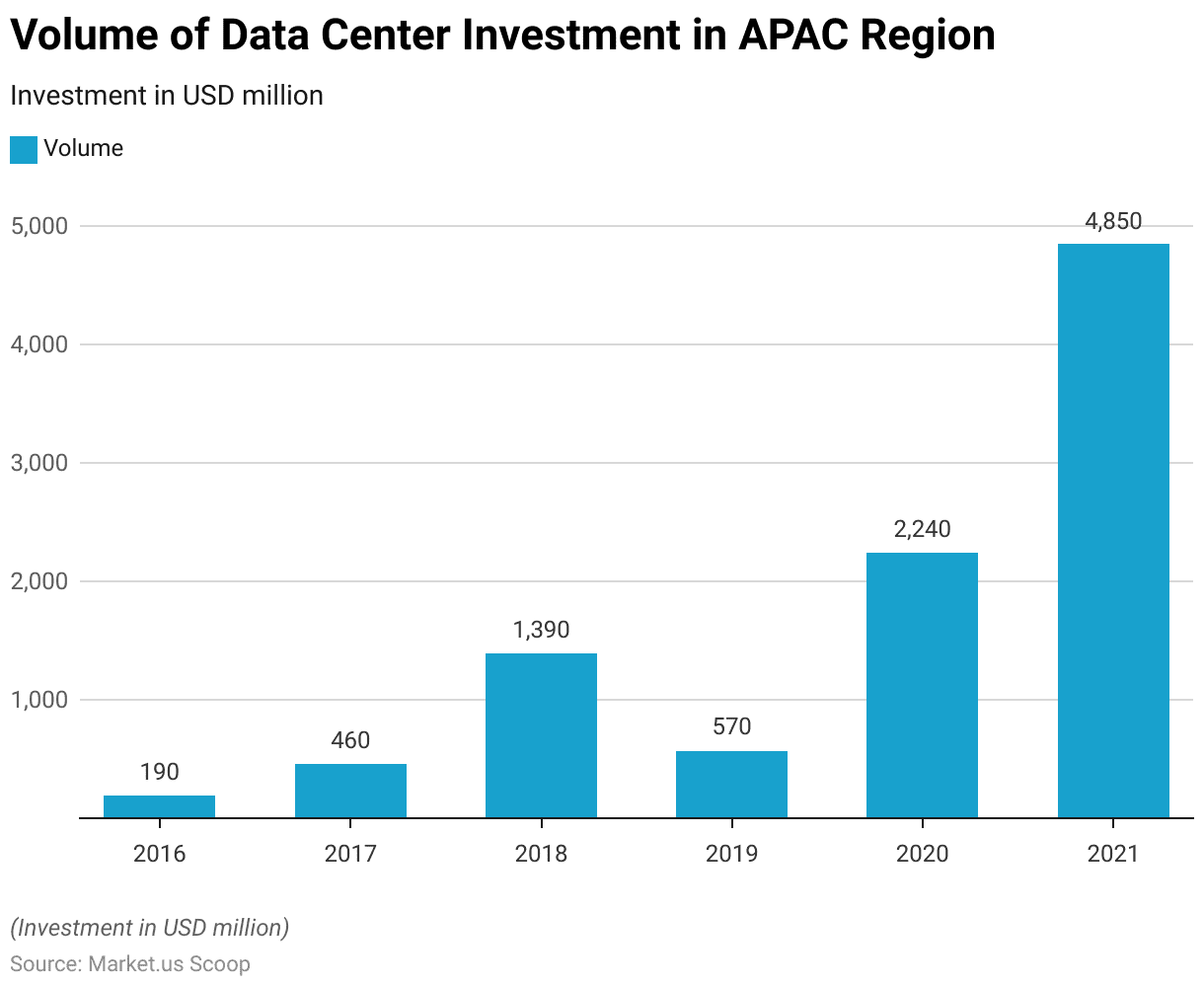

Asia-Pacific

- The volume of data center investment in the Asia Pacific region experienced significant growth from 2016 to 2021, reflecting the region’s increasing demand for digital infrastructure.

- In 2016, investment volume stood at USD 190 million, which more than doubled to USD 460 million in 2017.

- The growth accelerated in 2018, with investment surging to USD 1.39 billion.

- Although there was a temporary dip in 2019, with investment falling to USD 570 million, the upward trend resumed in 2020, reaching USD 2.24 billion.

- By 2021, the volume of investment had more than doubled again to USD 4.85 billion, highlighting the rapid expansion of data center infrastructure driven by the growing adoption of cloud computing, digital transformation, and increased demand for data processing capabilities in the region.

(Source: Statista)

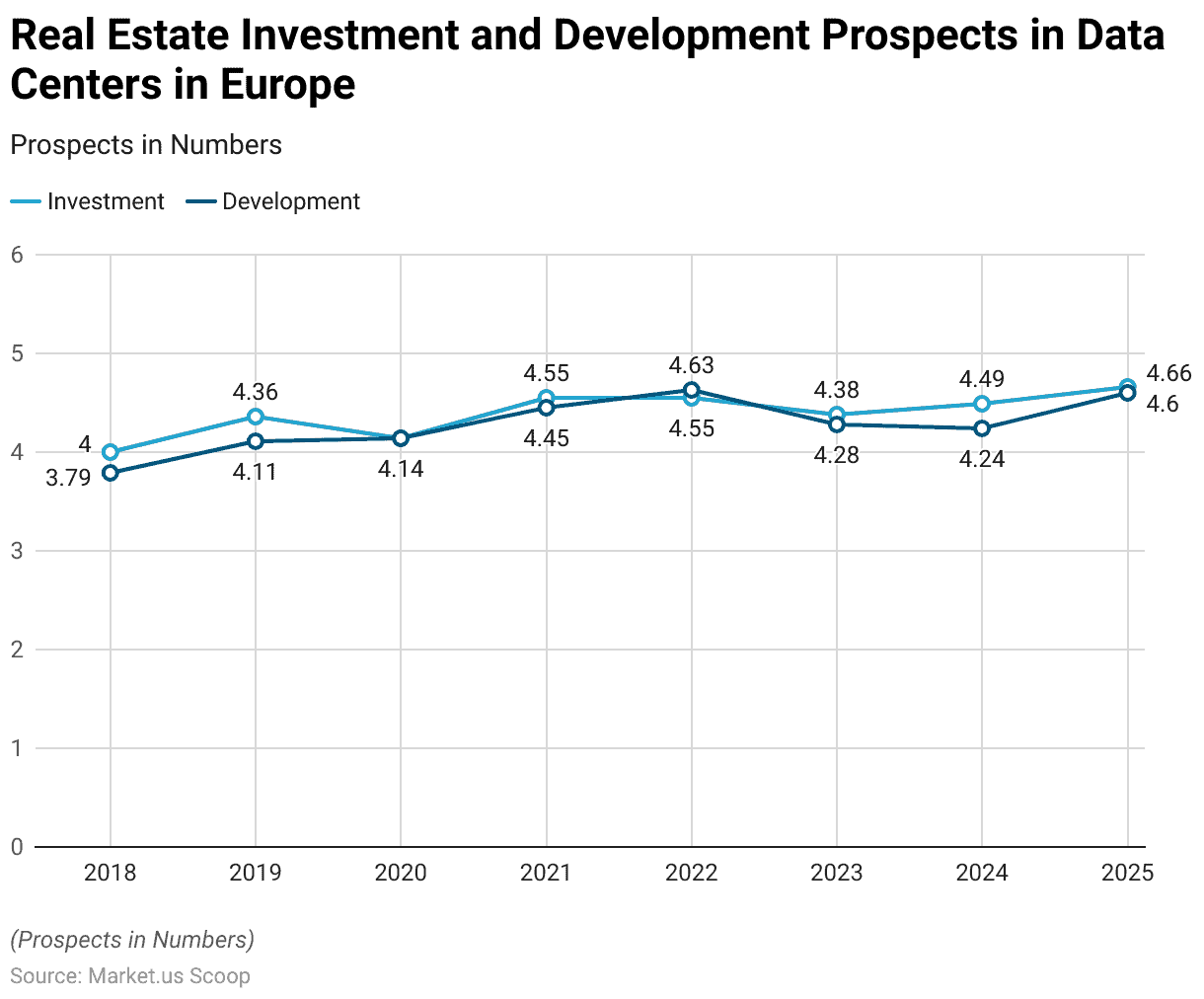

Europe

- From 2018 to 2025, real estate investment and development prospects in data centers across Europe have shown steady growth and resilience, reflecting the sector’s increasing importance.

- In 2018, investment prospects were rated at 4.0, while development prospects were slightly lower at 3.79.

- Both metrics saw consistent improvement over the years, with investment reaching 4.36 in 2019 and development rising to 4.11.

- By 2020, investment stood at 4.14, matching development prospects at 4.14, highlighting balanced growth despite global economic uncertainties.

- In 2021 and 2022, both metrics reached their peak values within the period, with investment prospects climbing to 4.55 and development hitting 4.63 in 2022, driven by heightened demand for data center infrastructure across the region.

- However, a slight dip was observed in 2023, with investment and development prospects recorded at 4.38 and 4.28, respectively.

- The trend reversed in 2024, with investment prospects rising to 4.49 and development stabilizing at 4.24.

- By 2025, investment prospects are projected to hit 4.66, while development returns to a strong 4.6, indicating renewed confidence in the sector.

- This consistent upward trajectory underscores the critical role of data centers in supporting Europe’s digital economy.

(Source: Statista)

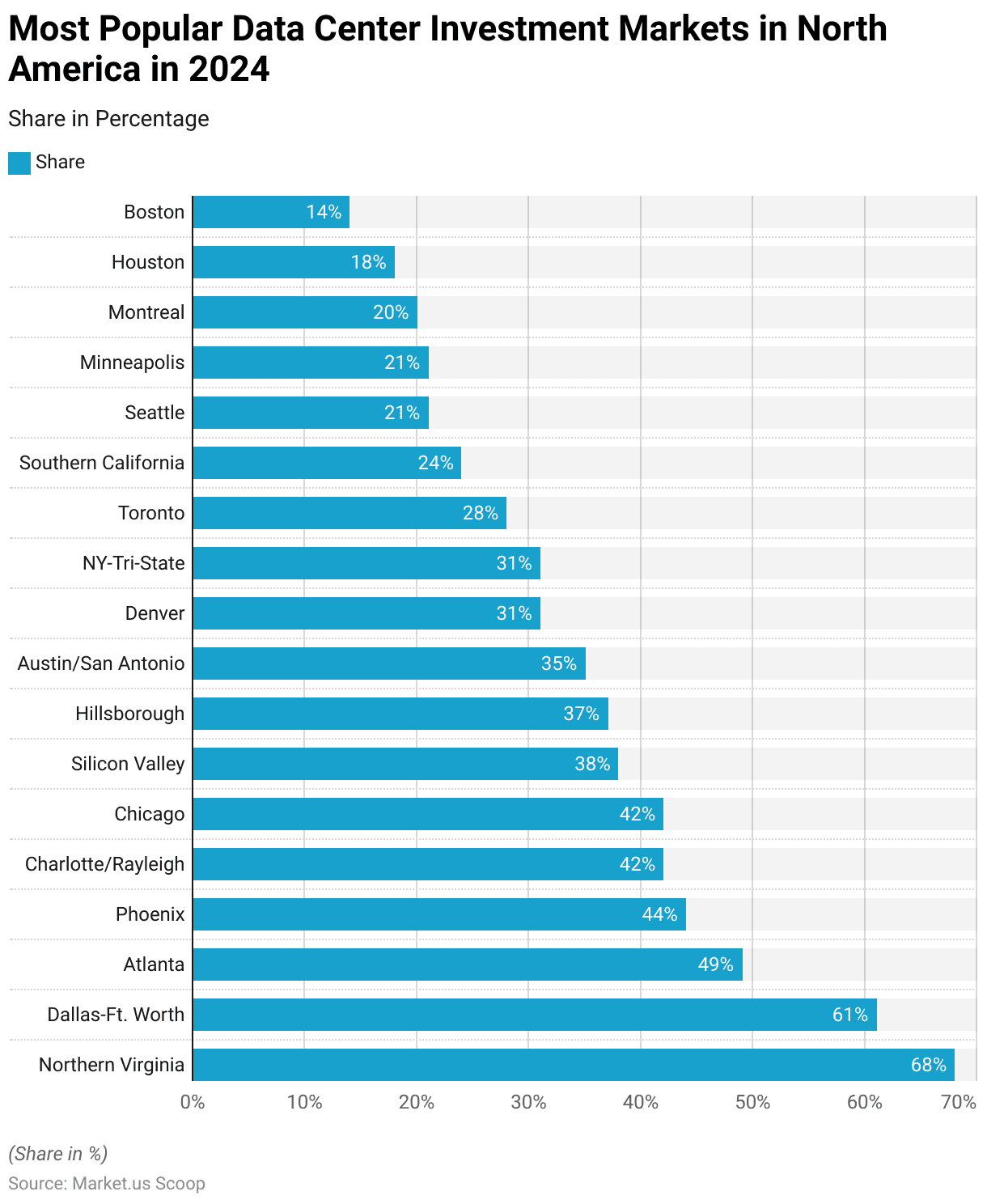

North America

- In 2024, Northern Virginia is projected to be the most attractive market for data center investment in North America, with 68% of respondents expressing interest.

- Dallas-Ft. Worth follows closely, with 61% of investors showing interest.

- Atlanta ranks third at 49%, while Phoenix garners attention from 44% of respondents.

- Both Charlotte/Raleigh and Chicago appeal to 42% of investors, underscoring their strong market potential.

- Silicon Valley remains a significant hub, with 38% of respondents expressing interest, followed by Hillsborough at 37% and Austin/San Antonio at 35%.

- Denver and the NY-Tri-State area attract 31% each, highlighting their growing appeal.

- Toronto leads among Canadian markets with 28%, while Southern California captures 24% of investor interest.

- Seattle and Minneapolis follow with 21% each, and Montreal draws 20% of respondents.

- Houston and Boston round out the list, with 18% and 14% of investors expressing interest, respectively.

- This distribution reflects a strong concentration of investment interest in both established and emerging data center markets across North America.

(Source: Statista)

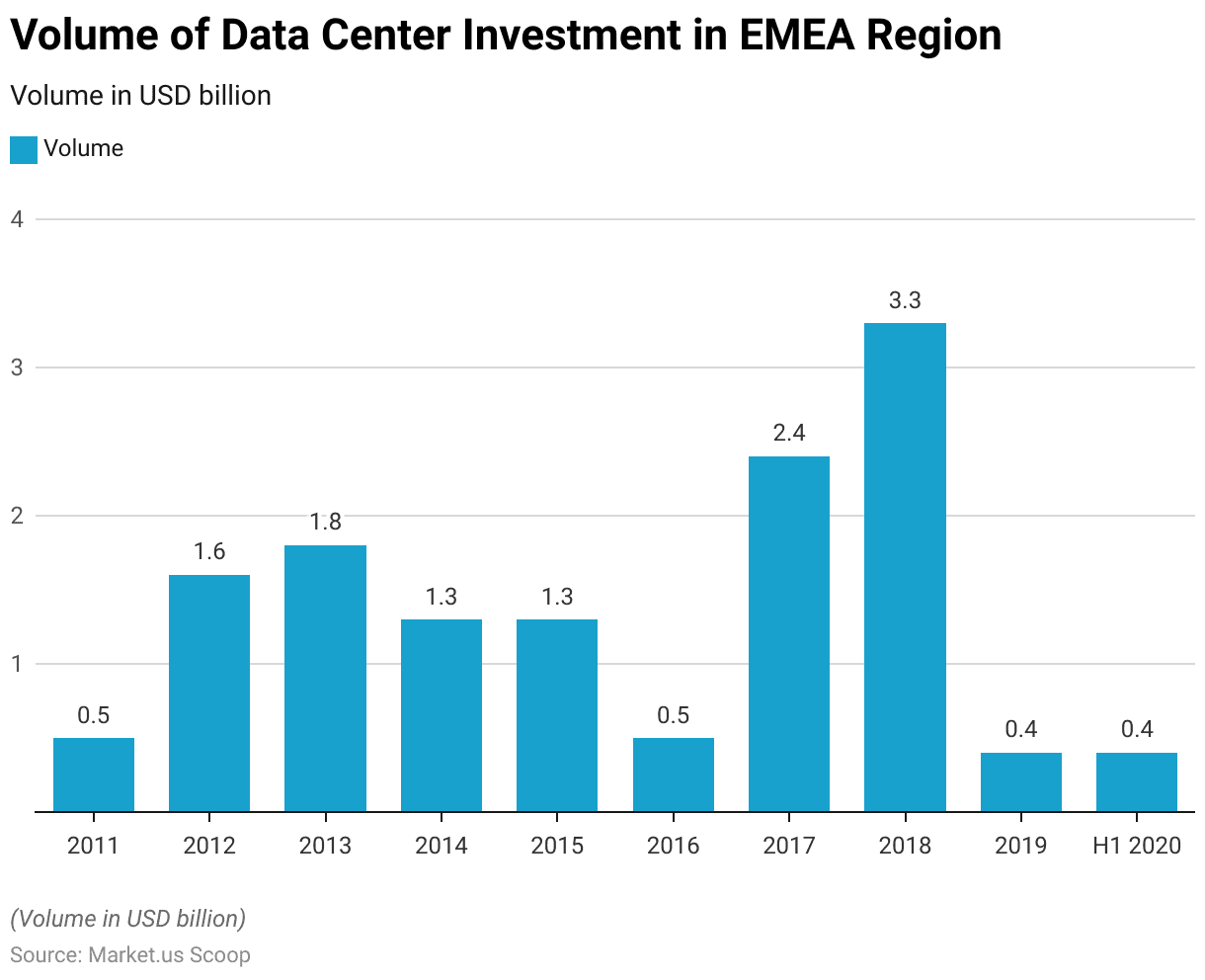

Europe, Middle East and Africa (EMEA)

- Between 2011 and the first half of 2020, the volume of data center investment in the EMEA region displayed significant fluctuations.

- In 2011, investment stood at USD 0.5 billion, followed by a sharp increase to USD 1.6 billion in 2012 and USD 1.8 billion in 2013.

- However, 2014 and 2015 saw a decline, with investment volumes stabilizing at USD 1.3 billion each year.

- Another dip occurred in 2016 when investment fell back to USD 0.5 billion.

- The market rebounded strongly in 2017, with investments reaching USD 2.4 billion, and peaked in 2018 at USD 3.3 billion, the highest during the observed period.

- However, a significant downturn followed in 2019, with investment plummeting to USD 0.4 billion, a level maintained in the first half of 2020.

- This volatility highlights the cyclical nature of data center investments in the EMEA region, influenced by market dynamics, technological advancements, and economic conditions.

(Source: Statista)

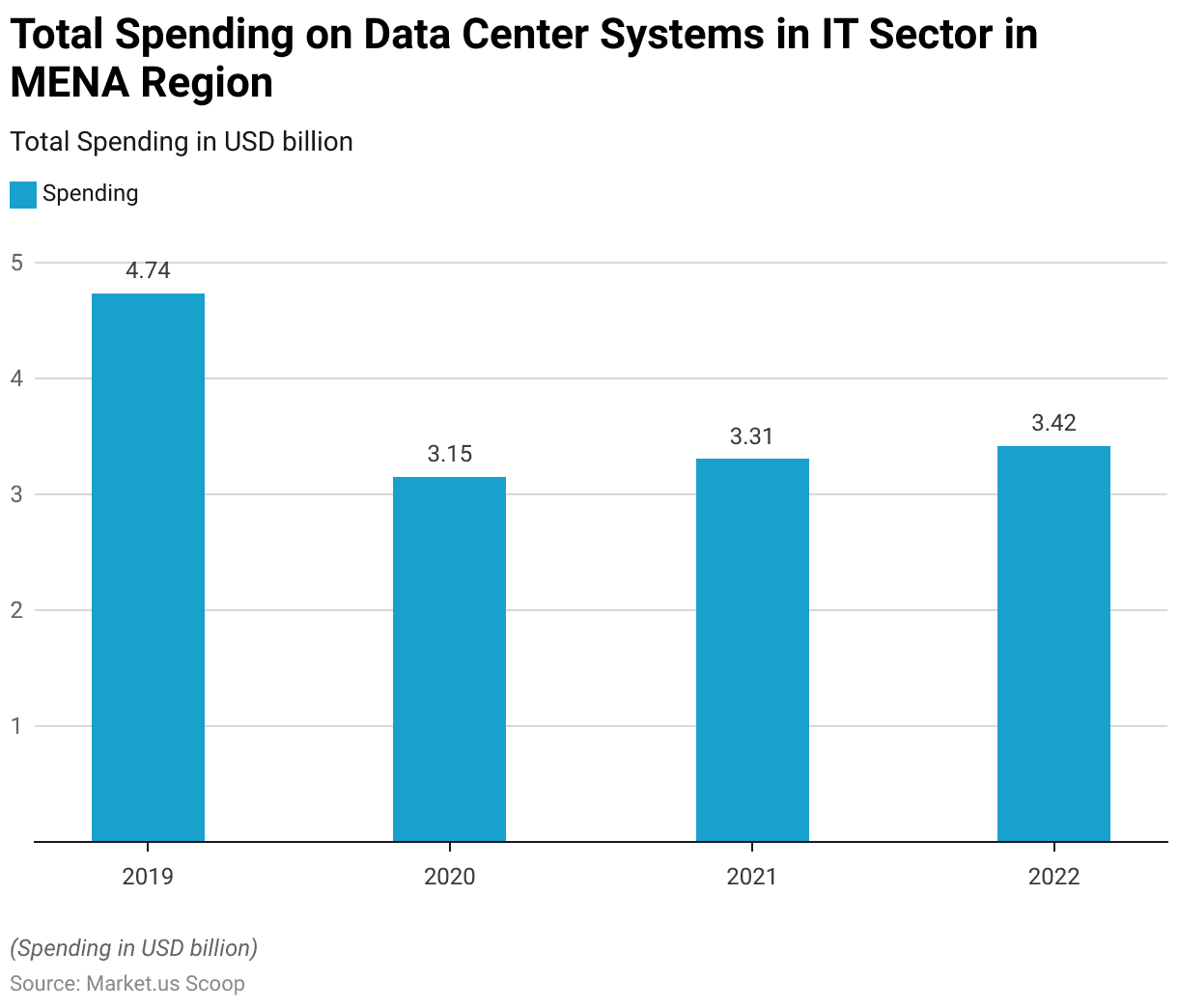

Middle East and North Africa

- Between 2019 and 2022, total spending on data center systems in the IT sector across the Middle East and North Africa (MENA) region experienced fluctuations.

- In 2019, spending peaked at USD 4.74 billion, reflecting strong investments in data center infrastructure.

- However, this figure declined significantly in 2020 to USD 3.15 billion, likely due to economic disruptions and shifting priorities caused by the global pandemic.

- The market showed signs of recovery in 2021, with spending increasing slightly to USD 3.31 billion.

- This upward trend continued into 2022, with total spending reaching USD 3.42 billion, signaling a gradual rebound in data center investments as businesses adjusted to new digital demands and economic conditions in the region.

(Source: Statista)

Power Usage Effectiveness (PUE)

- The average annual Power Usage Effectiveness (PUE) of data centers worldwide has shown a significant improvement over the years, reflecting increased energy efficiency in the sector.

- In 2007, the global average PUE was 2.5, indicating considerable energy loss.

- By 2011, this figure had improved to 1.98, marking a substantial reduction in energy inefficiency.

- Continued advancements in energy management saw the PUE drop further to 1.65 in 2013 and 1.58 in 2018.

- However, a slight rise was recorded in 2019, with the PUE increasing to 1.67 before dropping again to 1.59 in 2020.

- The trend towards more efficient energy usage continued with minor fluctuations, as the average PUE was 1.57 in 2021 and 1.55 in 2022.

- In 2023, the PUE rose slightly to 1.58 but is projected to decline again to 1.56 by 2024.

- These figures underscore the data center industry’s ongoing efforts to optimize energy consumption and enhance operational efficiency.

(Source: Statista)

Key Challenges and Concerns

Challenges in Investment

- In 2024, investors worldwide identified several key challenges impacting their data center sector investment strategies.

- The most significant concern, cited by 59% of respondents, was the availability and cost of debt, reflecting the financial pressures associated with securing capital.

- High valuations and intense competition were highlighted by 45% of investors, indicating a highly competitive market environment.

- Additionally, 41% pointed to the availability of products and lack of liquidity as major hurdles, underscoring challenges in acquiring or divesting assets.

- Regulations and power availability were concerns for 24% of investors, emphasizing the impact of compliance requirements and energy constraints on investment decisions.

- A lack of qualified management partners was noted by 15% of respondents, reflecting the difficulties in finding experienced operational partners.

- Meanwhile, 8% of investors cited other or unspecified challenges.

- Finally, only 3% of respondents highlighted the ability to invest in line with Environmental, Social, and Governance (ESG) targets as a significant challenge, indicating that ESG considerations, while important, are currently a lesser priority compared to financial and operational hurdles.

(Source: Statista)

Leading Concerns of Data Center Digital Infrastructure Managers Worldwide

- In 2023, digital infrastructure managers worldwide expressed varying levels of concern regarding key challenges in the data center sector.

- The most pressing issue was improving energy performance for facilities equipment, with 53% of respondents indicating they were very concerned and another 35% somewhat concerned.

- Addressing a lack of qualified staff also emerged as a significant challenge, with 30% of respondents being very concerned and 41% somewhat concerned.

- Similarly, improving energy performance for IT systems was a notable concern, with 30% very concerned and 35% somewhat concerned.

- Forecasting future data center capacity requirements posed another challenge, with 27% of respondents very concerned and 39% somewhat concerned about accurately predicting demand.

- Finally, procuring equipment to meet higher capacity demands was a concern for 26% of respondents, who were very concerned, while 42% were somewhat concerned.

- These findings highlight a broad spectrum of operational and strategic challenges faced by data center managers, particularly in energy efficiency, staffing, and resource planning.

(Source: Statista)

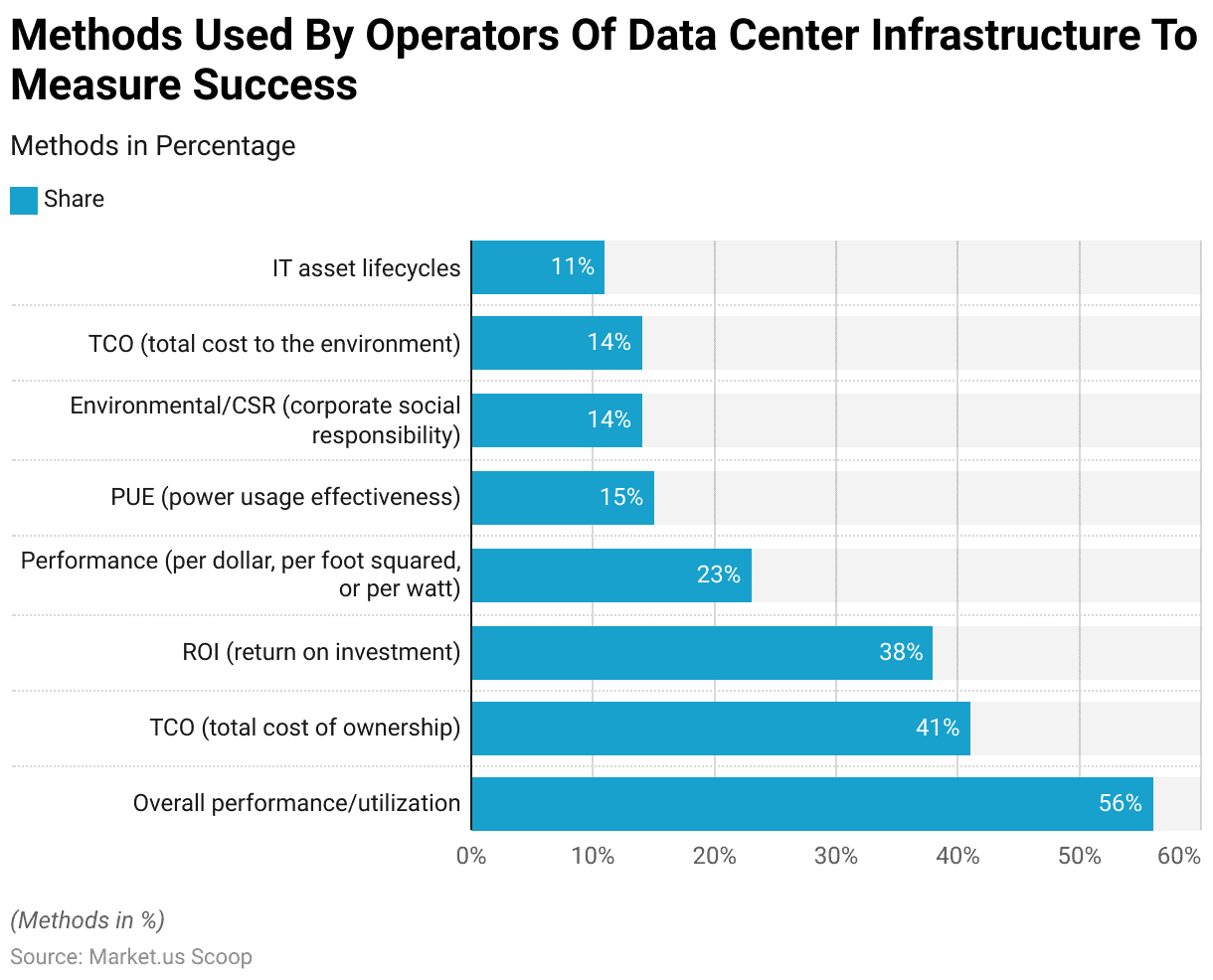

Methods Used by Operators of Data Center Infrastructure to Measure Success

- In 2019, data center operators worldwide employed various methods to measure the success of their infrastructure operations.

- The most commonly used metric was overall performance and utilization, cited by 56% of respondents as a key indicator.

- Total cost of ownership (TCO) followed closely, with 41% of operators utilizing this measure to assess the financial efficiency of their operations.

- Return on investment (ROI) was another widely adopted metric, with 38% of respondents relying on it to evaluate the profitability of their infrastructure investments.

- Additional metrics included performance efficiency, such as per dollar, per square foot, or watt, used by 23% of respondents.

- Power usage effectiveness (PUE), a specific energy efficiency metric, was utilized by 15%.

- Environmental and corporate social responsibility (CSR) considerations, along with the total cost to the environment, were each reported by 14% of operators, reflecting a growing emphasis on sustainability.

- Finally, IT asset lifecycle management was a measure of success for 11% of respondents, highlighting the importance of managing the full lifespan of data center assets.

- These metrics illustrate a diverse approach to evaluating data center performance, balancing financial, operational, and environmental considerations.

(Source: Statista)

Innovations and Developments in Micro Mobile Data Centers Statistics

- Micro mobile data centers (MMDCs) have experienced significant advancements driven by the escalating demand for edge computing and real-time data processing.

- Companies such as Schneider Electric and Dell EMC have introduced modular, scalable solutions that facilitate rapid deployment in diverse environments.

- Huawei Technologies has focused on energy-efficient designs, integrating advanced cooling systems to enhance performance while reducing power consumption.

- Hewlett Packard Enterprise has developed compact, high-density units tailored for remote and harsh locations, ensuring robust data processing capabilities.

- Eaton Corporation has emphasized the integration of power management solutions within MMDCs, enhancing reliability and operational efficiency.

- These innovations collectively address the growing need for localized data processing, offering flexible and efficient solutions across various industries.

(Sources: Schneider Electric Blog, Data Center International, Vertiv)

Regulations for Micro Mobile Data Centers

- Regulations for micro mobile data centers are heavily influenced by a range of compliance requirements that vary by country, designed to address multiple operational aspects, including environmental impact, data security, and energy efficiency.

- For instance, in the European Union, data centers are required to comply with rigorous energy management regulations such as the EU Renewable Energy Directive, which supports the union’s emission reduction targets by promoting energy from renewable sources.

- Additionally, data centers globally, including micro mobile facilities, must adhere to the Payment Card Industry Data Security Standard (PCI-DSS) if they process or handle credit card information, ensuring that financial data is secure from breaches.

- Further, specific regulations concerning energy consumption, greenhouse gas emissions, and electronic waste are crucial for operators to consider.

- For example, the use of energy in data centers is regulated to encourage the use of renewable sources and improve energy efficiency. At the same time, emissions regulations require reporting and reducing greenhouse gases produced by data center operations.

- In the United States, standards like SSAE 18 and HIPAA are essential for data centers handling financial reporting and health-related information, ensuring that they have stringent controls and security measures in place.

- In summary, compliance in micro mobile data centers is not only about adhering to global standards like PCI-DSS but also involves meeting localized regulatory demands that govern environmental practices, data protection, and operational continuity, which can vary significantly depending on the country of operation.

(Source: Data Canopy, Upsite Technologies, Enhesa)

Recent Developments

Acquisitions and Mergers:

- Brookfield’s Acquisition of Data4: In April 2023, Brookfield acquired European data center operator Data4 for approximately $3.8 billion. This strategic move aimed to expand Brookfield’s presence in the European data center market.

- Brookfield and Ontario Teachers’ Pension Plan’s Acquisition of Compass Datacenters: In June 2023, Brookfield Infrastructure and the Ontario Teachers’ Pension Plan acquired Compass Datacenters for a reported $5.5 billion. This acquisition was part of a strategy to enhance their data center portfolios.

Product Launches:

- EdgeMicro’s Deployment of Micro Data Centers: In August 2020, EdgeMicro launched five micro data centers across the United States to offer enhanced edge solutions in underserved markets, creating stronger connectivity options.

Funding:

- d-Matrix’s Funding for AI Chip Development: As of November 2024, d-Matrix, a startup backed by Microsoft, has raised over $160 million to develop its first AI chip designed for applications such as chatbots and video generators. Early customers are testing sample chips, with full shipments expected next year.

Conclusion

Micro Mobile Data Center Statistics: The micro mobile data center market is set for substantial growth, driven by rising demand for edge computing, IoT, and 5G deployments.

These compact, modular data centers offer cost-effective, scalable, and efficient solutions for real-time data processing in industries like telecommunications, healthcare, and manufacturing. Key applications include disaster recovery, remote operations, and military use.

While challenges such as power efficiency and deployment costs remain, advancements in energy-efficient technologies and growing adoption in North America and Asia-Pacific will fuel market expansion. Overall, micro mobile data centers are poised to play a crucial role in the future of digital infrastructure.

FAQs

A micro mobile data center is a compact, self-contained data center designed for quick deployment and localized data processing. It typically includes power, cooling, and networking infrastructure in a single modular unit.

Micro mobile data centers typically come in various rack sizes, ranging from less than 20 rack units (RU) to over 40 RU, depending on the storage and processing requirements.

These units are equipped with built-in power management and cooling systems designed for energy efficiency and to ensure optimal performance in various environments.

By processing data locally, micro mobile data centers reduce latency, enabling real-time analysis and decision-making for IoT devices, 5G networks, and other edge applications.

The market is expected to grow significantly, driven by increasing demand for edge computing, IoT, and real-time data processing across industries, with strong adoption in North America and Asia-Pacific.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)