Table of Contents

Introduction

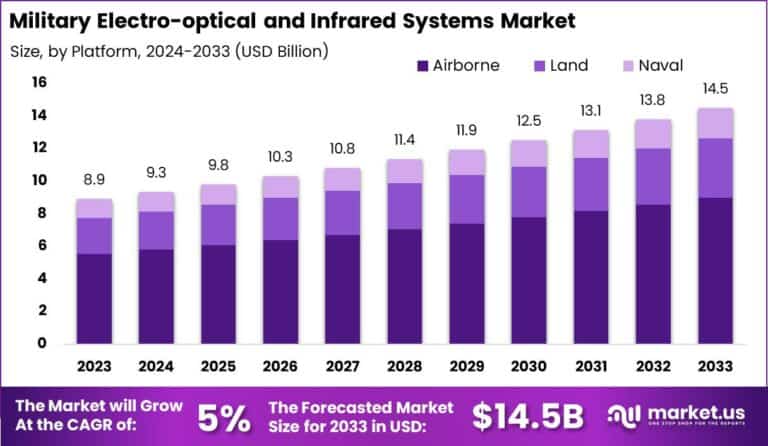

The global military electro-optical and infrared (EO/IR) systems market is set to grow from USD 8.9 billion in 2023 to USD 14.5 billion by 2033, reflecting a CAGR of 5%. EO/IR systems play a crucial role in military operations, offering enhanced surveillance, targeting, and night vision capabilities. North America holds a dominant market share, capturing over 37% in 2023, with USD 3.3 billion in revenue. The growing demand for advanced defense technologies in surveillance, reconnaissance, and combat operations is driving this market’s expansion, particularly in missile defense, border security, and aerial surveillance.

How Growth is Impacting the Economy

The growth of the military EO/IR systems market is contributing to the global defense economy by enhancing military capabilities and fostering technological advancements. As countries continue to invest in advanced defense systems, the demand for EO/IR technologies increases, leading to job creation in defense technology sectors. The market’s expansion also promotes innovation in infrared imaging, sensor technology, and optical systems.

As military forces adopt more precise and efficient EO/IR systems, governments are making significant investments in research and development (R&D) to enhance security infrastructure. The demand for these systems is also benefiting defense contractors and electronic component manufacturers. This growth drives economic output, particularly in defense and security industries, while contributing to the advancement of military operations. Moreover, as nations modernize their military arsenals, the EO/IR systems market plays a crucial role in promoting national security and global defense cooperation.

➤ To Elevate Your Business – Request Sample Here @ https://market.us/report/military-electro-optical-and-infrared-systems-market/free-sample/

Impact on Global Businesses

The rise in demand for military EO/IR systems is reshaping the global defense industry, impacting defense contractors, manufacturers, and technology providers. However, businesses are facing rising costs associated with R&D, manufacturing, and supply chain management. The shift toward more complex technologies, such as advanced infrared sensors and optical components, is increasing the need for specialized expertise and precision in component manufacturing.

Supply chain shifts are also evident, as the demand for these high-tech systems requires a steady flow of advanced materials and high-performance components. These developments are causing challenges related to cost management and production scaling. Additionally, sector-specific impacts are seen in industries like aerospace, defense manufacturing, and cybersecurity, where companies are focusing on the integration of EO/IR systems in drones, satellite technologies, and border security solutions to meet national security needs and evolving military requirements.

Strategies for Businesses

To capitalize on the growth of the military EO/IR systems market, businesses should:

- Invest in R&D to develop advanced infrared technologies that improve targeting systems and sensor accuracy

- Collaborate with defense contractors and government agencies to integrate EO/IR systems in modern defense applications

- Adopt a global approach to supply chain management, ensuring a steady flow of advanced materials and components

- Expand product offerings to cater to emerging markets in border security, satellite surveillance, and drone technologies

- Embrace innovation in night vision, thermal imaging, and remote sensing to improve the performance of military operations

By following these strategies, businesses can position themselves to meet the increasing demand for high-performance EO/IR systems and maintain a competitive edge in a rapidly evolving market.

Key Takeaways

- The military EO/IR systems market is projected to grow from USD 8.9 billion in 2023 to USD 14.5 billion by 2033, with a CAGR of 5%.

- North America captured more than 37% of the market share in 2023, generating USD 3.3 billion in revenue.

- EO/IR technologies enhance military capabilities, surveillance, targeting, and reconnaissance operations.

- Rising costs of advanced technologies and supply chain shifts impact defense contractors and component manufacturers.

- The future of the market looks positive, driven by the growing demand for advanced defense systems in aerial surveillance, border security, and missile defense.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=134399

Analyst Viewpoint

The military EO/IR systems market is expanding steadily, driven by increasing defense budgets and the growing need for advanced surveillance and targeting systems. North America remains the largest market, though Asia-Pacific and Europe are expected to show robust growth as countries modernize their military infrastructure.

The market will continue to evolve with the adoption of cutting-edge infrared sensors, optical technologies, and real-time data processing systems. The growing focus on cybersecurity, border security, and counter-terrorism will fuel further demand for military EO/IR solutions, ensuring long-term growth and technological innovation in the sector.

Regional Analysis

North America dominates the military EO/IR systems market, capturing 37% of the global share and generating USD 3.3 billion in revenue in 2023. The U.S. military remains the largest customer for these systems, driven by continuous investments in modernizing defense technologies.

Europe and Asia-Pacific are seeing significant growth in EO/IR system integration, particularly within border security and military defense initiatives. Further, Asia-Pacific is expected to experience rapid growth, especially in countries like China, India, and Japan, which are expanding their military capabilities and investing in advanced defense technologies.

Business Opportunities

The expanding military EO/IR systems market offers several key business opportunities:

- Defense contractors can develop advanced EO/IR sensors for integration into aerospace, missile defense, and satellite technologies.

- Technology firms can collaborate with defense companies to develop high-performance imaging systems for smart surveillance and targeting.

- Startups and SMEs can enter the market by providing specialized components such as infrared lenses and optical filters for infrared systems.

- Manufacturers can produce ruggedized systems for extreme operational conditions, ensuring that EO/IR systems can function effectively in harsh environments.

- Cybersecurity providers can offer protection solutions for EO/IR systems to safeguard sensitive military data from cyber threats.

These opportunities provide substantial potential for businesses looking to expand their product portfolios and invest in emerging defense technologies.

Key Segmentation

The military EO/IR systems market is segmented as follows:

By Application

- Surveillance (border security, maritime patrol, airborne surveillance)

- Targeting and Fire Control (precision targeting, defense weapons)

- Reconnaissance (intelligence gathering, satellite systems)

By Technology - Infrared Sensors (thermal imaging, night vision)

- Optical Sensors (laser targeting, image processing)

- Radar Integration (combining radar with EO/IR systems)

By Region - North America (dominates with advanced military applications)

- Europe (growth in missile defense, satellite surveillance)

- Asia-Pacific (fastest growth in defense modernization)

These segments highlight the various military applications of EO/IR systems, ranging from surveillance and reconnaissance to targeting and fire control, ensuring a diverse market outlook.

Key Player Analysis

Key players in the military EO/IR systems market are investing in developing next-generation infrared sensors and optical technologies that integrate seamlessly with advanced military systems. Moreover, these companies focus on innovative design, precision manufacturing, and cost-effective solutions for airborne, land-based, and naval operations.

Strategic partnerships with military forces and defense contractors help strengthen their position in the market. Further, the players are also improving the integration of EO/IR systems with AI-based image processing and real-time data analytics to enhance operational effectiveness and decision-making in military scenarios.

- BAE Systems Plc Company Profile

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Thales S.A. Company Profile

- Other Key Players

Recent Developments

- 2023: Introduction of AI-powered infrared sensors for real-time target detection in combat operations

- 2023: Development of lightweight EO/IR systems for unmanned aerial vehicles (UAVs)

- 2022: Enhanced thermal imaging systems for border security and counter-terrorism operations

- 2022: Partnership with military contractors for integrated EO/IR systems in missile defense systems

- 2021: Launch of advanced EO/IR technology for satellite surveillance in defense monitoring

Conclusion

The military EO/IR systems market is on track to grow significantly, with a projected CAGR of 5%, driven by increasing demand for advanced surveillance, targeting, and reconnaissance capabilities. Moreover, as the market expands, there are vast opportunities for businesses to invest in cutting-edge defense technologies and strengthen global security initiatives.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)