Table of Contents

Introduction

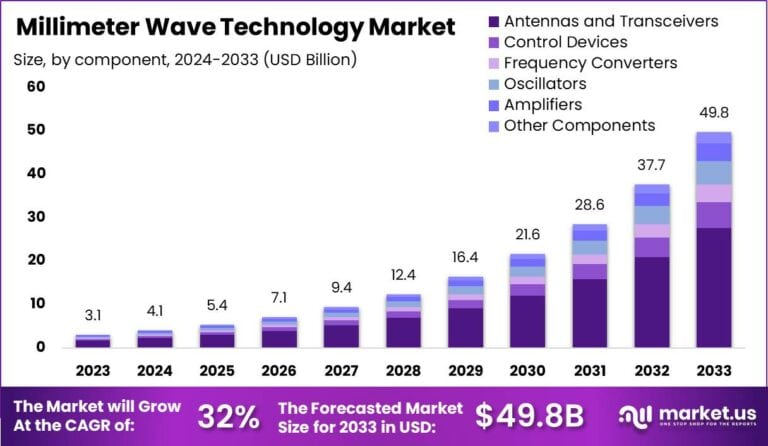

The Global Millimeter Wave Technology Market is experiencing rapid expansion, driven by the growing demand for high-speed wireless communication, automotive radar systems, and advanced security applications. In 2023, the market reached USD 3.1 billion and is projected to surge to USD 49.8 billion by 2033, growing at an impressive CAGR of 32.00%.

North America led the market with a 38.9% share, generating USD 1.2 billion in revenue. The proliferation of 5G networks, IoT integration, and increased defense spending are key factors accelerating global adoption of millimeter wave (mmWave) technology.

How Growth is Impacting the Economy

The robust growth of the millimeter wave technology market is fostering innovation across multiple sectors, positively impacting the global economy. Expanding 5G networks stimulate infrastructure investments, creating jobs in telecom construction, software development, and semiconductor manufacturing.

The surge in autonomous vehicles and smart transportation solutions drives new business opportunities in the automotive sector. National defense and security budgets benefit from advanced radar and surveillance technologies. Startups thrive as demand for new applications rises, fostering entrepreneurship and expanding the tech startup ecosystem. Governments also capitalize on improved communication infrastructure to drive smart city development, positioning digital economies for long-term competitiveness.

➤ To Elevate Your Business – Request Sample Here @ https://market.us/report/millimeter-wave-technology-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Global businesses face escalating costs related to advanced semiconductor components, testing equipment, and regulatory certifications. To address these challenges, companies are diversifying supply chains and partnering with specialized chip manufacturers, often concentrating production in Asia-Pacific regions with established semiconductor hubs.

Sector-Specific Impacts

Telecommunications lead adoption with 5G base stations and mobile backhaul systems. Automotive industries integrate mmWave sensors for autonomous driving and collision avoidance. Defense sectors rely on advanced radar and surveillance solutions, while healthcare applies mmWave in high-resolution imaging systems. Retail and airports adopt mmWave scanners for advanced security screening.

Strategies for Businesses

Businesses should invest in R&D to optimize antenna designs, miniaturize components, and enhance data processing capabilities. Forming alliances with telecom providers accelerates 5G deployments. Leveraging AI for spectrum management and interference mitigation enhances network efficiency. Strategic supply chain partnerships ensure component availability, while compliance with evolving global frequency regulations secures market access. Developing industry-specific solutions will broaden application scopes and revenue streams.

Key Takeaways

- Global market to grow at 32.00% CAGR by 2033.

- North America leads with 38.9% share, generating USD 1.2 billion.

- 5G deployment, automotive radar, and security fuel demand.

- High R&D and manufacturing costs drive strategic alliances.

- AI and miniaturization enhance technology performance.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=134534

Analyst Viewpoint

The millimeter wave technology market is rapidly evolving, transitioning from early-stage deployments to mainstream adoption across multiple industries. Present growth is fueled by global 5G rollouts, defense modernization, and autonomous vehicle development. Looking ahead, innovations in spectrum sharing, AI-powered beamforming, and ultra-high-frequency communication will unlock new market segments. The sector’s long-term outlook remains highly positive, underpinned by technological advancements and rising global digital infrastructure demands.

Regional Analysis

North America dominates with a 38.9% share, generating USD 1.2 billion in 2023, driven by aggressive 5G rollouts, defense investments, and leading semiconductor manufacturers. Europe follows with strong demand for automotive radar and industrial automation. Asia-Pacific experiences rapid growth due to expanding 5G networks, smart city projects, and advanced manufacturing capabilities. Latin America and the Middle East & Africa are emerging regions benefiting from telecom infrastructure upgrades and growing defense expenditures.

Business Opportunities

Opportunities abound in developing next-generation 5G infrastructure, autonomous vehicle sensors, and advanced imaging systems. Startups can target niche sectors like healthcare diagnostics and airport security. Cloud providers and AI companies can expand into mmWave-powered edge computing and spectrum management. Defense contracts offer long-term revenue stability. Emerging markets present opportunities for telecom partnerships as governments accelerate broadband infrastructure to meet digital economy goals.

Key Segmentation

The millimeter wave technology market is segmented into:

Product Type

- Telecommunication Equipment

- Imaging & Scanning Systems

- Radar & Satellite Communication Systems

Frequency Band

- 30 GHz to 57 GHz

- 57 GHz to 86 GHz

- 86 GHz to 300 GHz

License Type

- Fully Licensed

- Light Licensed

- Unlicensed

End-Use Industry

- Telecommunications

- Automotive & Transportation

- Healthcare

- Military & Defense

- Industrial

- Security

- Others

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Key Player Analysis

Leading companies focus on advancing antenna technology, increasing data transmission rates, and minimizing latency. R&D investment drives innovation in semiconductor materials and integration with AI-powered signal processing. Partnerships with telecom carriers and defense contractors enable large-scale deployment. Vertical integration strategies strengthen control over chip design and manufacturing, ensuring supply chain stability. Regulatory compliance and global spectrum coordination remain critical for international expansion.

- Keysight Technologies, Inc.

- NEC Corporation

- Ceragon Networks Ltd.

- E-Band Communications, LLC

- Aviat Networks, Inc.

- Farran Technology

- L3Harris Technologies, Inc.

- QuinStar Technology Inc.

- Millimeter Wave Products Inc.

- Eravant

- Other Key Players

Recent Developments

- In 2023, new AI-powered beamforming technologies were introduced to optimize 5G mmWave network performance.

- Strategic partnerships with automotive OEMs expanded mmWave radar adoption in autonomous vehicles.

- Defense sectors deployed advanced mmWave surveillance and radar systems for border security.

- Innovations in semiconductor manufacturing improved chip miniaturization and heat dissipation.

- Government-funded research initiatives advanced mmWave healthcare imaging and diagnostic applications.

Conclusion

The Global Millimeter Wave Technology Market is set for exceptional growth, driven by 5G, autonomous vehicles, defense, and healthcare innovations. As technologies mature and adoption broadens, mmWave solutions will play a crucial role in shaping the future of global digital infrastructure, ensuring long-term growth and resilience.