Table of Contents

Market Overview

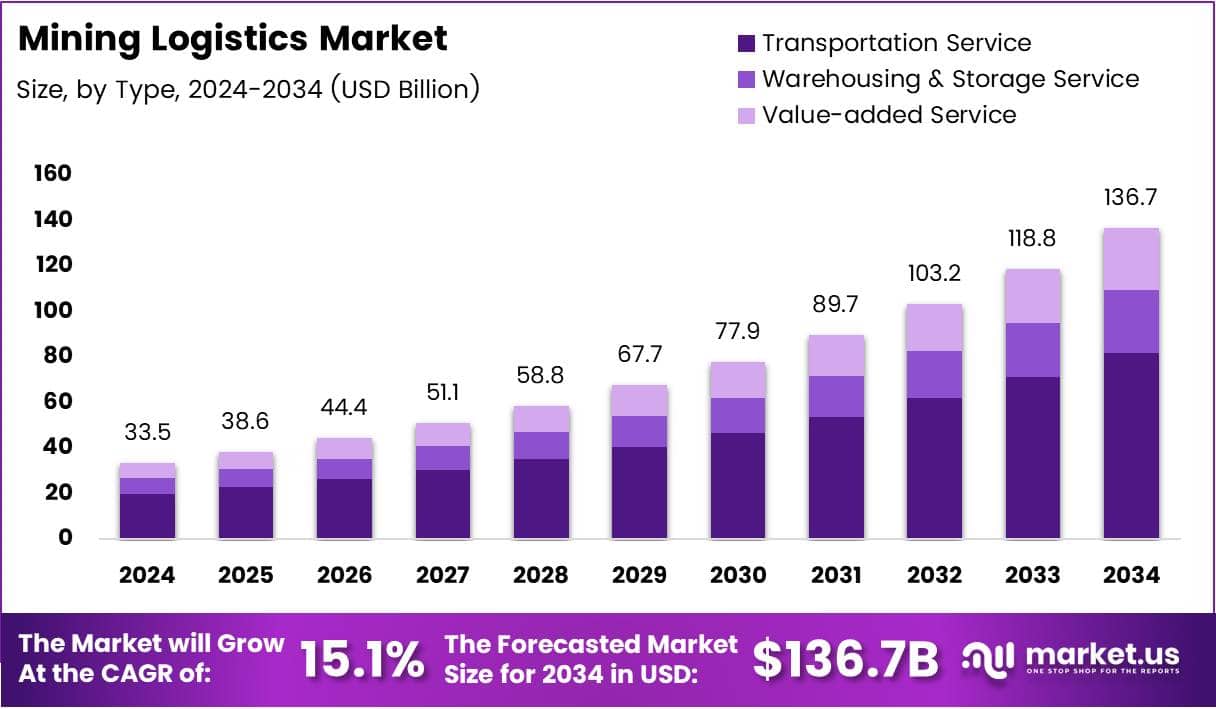

The Global Mining Logistics Market size is expected to be worth around USD 136.7 Billion by 2034, from USD 33.5 Billion in 2024, growing at a CAGR of 15.1%. The Mining Logistics Market is experiencing strong growth due to rising global demand for minerals and increased infrastructure development.

Strategic moves like Himadri Speciality Chemical’s ₹4.23 crore acquisition of a 60% stake in logistics firms, and Northern Star’s $3.25 billion takeover of De Grey Mining, highlight the sector’s focus on strengthening supply chains. With more companies joining industry bodies like the Silver Institute, collaboration and innovation are driving efficiency and sustainability. The market is evolving fast, with digitalization and end-to-end logistics solutions becoming key to competitive advantage.

Key Takeaways

- Market is expected to reach USD 136.7 Billion by 2034, growing at a CAGR of 15.1% from 2025 to 2034.

- In 2024, Transportation Service dominated the market with a 62.1% share in the By Type segment.

- Coal led the By Application segment in 2024, holding a significant market share.

- Asia Pacific accounted for the largest market share at 37.5%, valued at USD 12.7 Billion in 2024.

- Growth in Asia Pacific is driven by rapid industrialization an

Market Growth Drivers

The key driver of the mining logistics market is the rising global demand for minerals, especially coal and iron ore. Countries such as Indonesia are experiencing booming mining sectors, largely due to increased export demand and rising commodity prices. This, in turn, fuels the need for advanced logistics solutions to handle growing production volumes.

Additionally, logistics in mining can account for up to 40% of production costs. To reduce these expenses, mining companies are rapidly embracing technologies like automation, artificial intelligence, real-time monitoring, and data analytics to optimize supply chains. These technologies improve transportation reliability, minimize waste, and enhance inventory management.

Governments worldwide are also boosting infrastructure through strategic investments aimed at easing the transport of raw materials. Simultaneously, the shift toward sustainability is prompting mining firms to adopt cleaner transportation options, including electric trucks and biofuel alternatives.

Market Type Analysis

Coal is the leading application in mining logistics due to its widespread use in power generation. In 2024, it held the largest market share because moving coal requires a massive and well-organized logistics setup. With global energy needs still heavily relying on coal, the segment remains a top contributor to logistics demand in the mining industry.

Iron Ore is next in line, supported by its key role in steel production. The logistics needs for iron ore are large-scale and complex, involving heavy-duty transportation networks. As the global construction and infrastructure sectors grow, the demand for efficient iron ore logistics continues to increase.

Metals and Gold also play major roles in mining logistics. Metals like copper and aluminum are widely used in manufacturing and require strong logistics systems to meet industrial demand. Gold, being a high-value material, needs highly secure and precise logistics to protect against loss or theft during transit and storage.

Other Minerals make up the final category. These include materials like lithium, rare earth elements, and other industrial minerals. While the volume may be smaller compared to coal or iron ore, their importance in industries such as electronics and renewable energy means that reliable logistics for these materials is still essential.

Regional Analysis

Asia Pacific

Asia Pacific leads the global mining logistics market with a strong 37.5% share, valued at USD 12.7 billion. This growth is mainly due to the rapid pace of industrialization and expanding mining activities in countries like China and India. The need for modern infrastructure and efficient mining operations is pushing demand for reliable logistics services across the region.

North America

North America plays a key role in the mining logistics sector, thanks to its strong and advanced logistics infrastructure. The use of modern technologies and a mature mining industry support stable market performance. Government policies promoting sustainability and responsible mining practices also help in driving further growth in the region.

Europe

In Europe, the mining logistics market is steadily growing as companies invest in smarter and greener logistics solutions. The focus is on using automation and digital tools to improve efficiency. European countries are also investing in sustainable practices and eco-friendly transport options, which are expected to boost the market further.

Middle East and Africa

The Middle East and Africa region is seeing slow but steady growth in mining logistics, supported by rich natural resources, especially in Africa. Rising demand for minerals is pushing development, although weak infrastructure and logistical hurdles in some areas are challenges. However, ongoing investment in infrastructure is gradually improving the situation.

Latin America

Latin America has strong potential in the mining logistics market due to its large reserves of minerals like copper and lithium. Foreign investment and regional infrastructure improvements are helping the market expand. Still, political and economic instability in some countries could slow progress, making the market’s future both promising and uncertain.

Emerging Trends

- Real-time data analytics is enhancing decision-making and operational efficiency by tracking shipments and predicting maintenance needs.

- Electric vehicles and autonomous technologies, such as drones and self-driving trucks, are reducing emissions and improving safety.

- Blockchain is gaining traction for its ability to increase supply chain transparency and reduce fraud

Market Restraints

Despite its strong outlook, the mining logistics market faces challenges. High initial investment requirements for modern logistics technologies can deter smaller players. Regulatory compliance across different regions adds complexity and cost. Additionally, there’s a shortage of skilled labor capable of managing and operating advanced logistics systems.

Growth Opportunities

Emerging markets across Africa, Latin America, and Southeast Asia offer fertile ground for market expansion due to increasing mining activities and infrastructural development. The integration of AI and machine learning holds promise for further optimizing logistics operations, while strategic partnerships with third-party logistics providers are expected to enhance scalability and efficiency for mining firms.

Competitive Landscape

- Vale stands out globally for its robust mining logistics network, especially in South America and Asia.

- Bis Industries offers integrated logistics services, excelling in Australian mining terrains.

- ATG Australian Transit Group provides comprehensive services, including warehousing and bulk goods transport.

- Blue Water Shipping is known for handling international freight, especially for large mining equipment and complex cross-border shipments.

Recent Developments

In April 2025, Himadri Speciality Chemical Ltd announced the acquisition of a 60% stake in Trancemarine and Confreight Logistics Private Limited. The deal, valued at ₹4.23 crore in cash, marks a strategic move by Himadri to strengthen its logistics capabilities and expand its footprint in the supply chain sector.

By May 2025, Northern Star Resources completed its $3.25 billion acquisition of De Grey Mining. As part of the transaction, eligible De Grey shareholders received 0.119 new Northern Star shares for every De Grey share held, further solidifying Northern Star’s position in the gold mining industry.

Earlier in March 2025, Agnico Eagle Mines Ltd finalized the $204 million acquisition of O3 Mining. This acquisition aims to boost Agnico Eagle’s exploration potential and resource base, demonstrating the company’s commitment to expanding its presence in key mining regions across North America.

In July 2024, Ava Global Logistics and San Cristobal Mining joined the Silver Institute as new members. They followed five earlier additions that year: The Australian Bullion Company, Bunker Hill Mining Corp., Glencore, Silver Bullion Pte Ltd, and Sunshine Minting, all of whom contributed to broadening the Institute’s global network.

Conclusion

The mining logistics market is on a strong upward trajectory, driven by rising global mineral demand, technological advancements, infrastructure development, and sustainability efforts. While challenges exist, the sector is ripe with opportunity, especially for companies that embrace innovation and eco-friendly practices. As mining continues to expand into new geographies, the demand for efficient, reliable, and sustainable logistics solutions will remain crucial to the industry’s success.