Table of Contents

Introduction

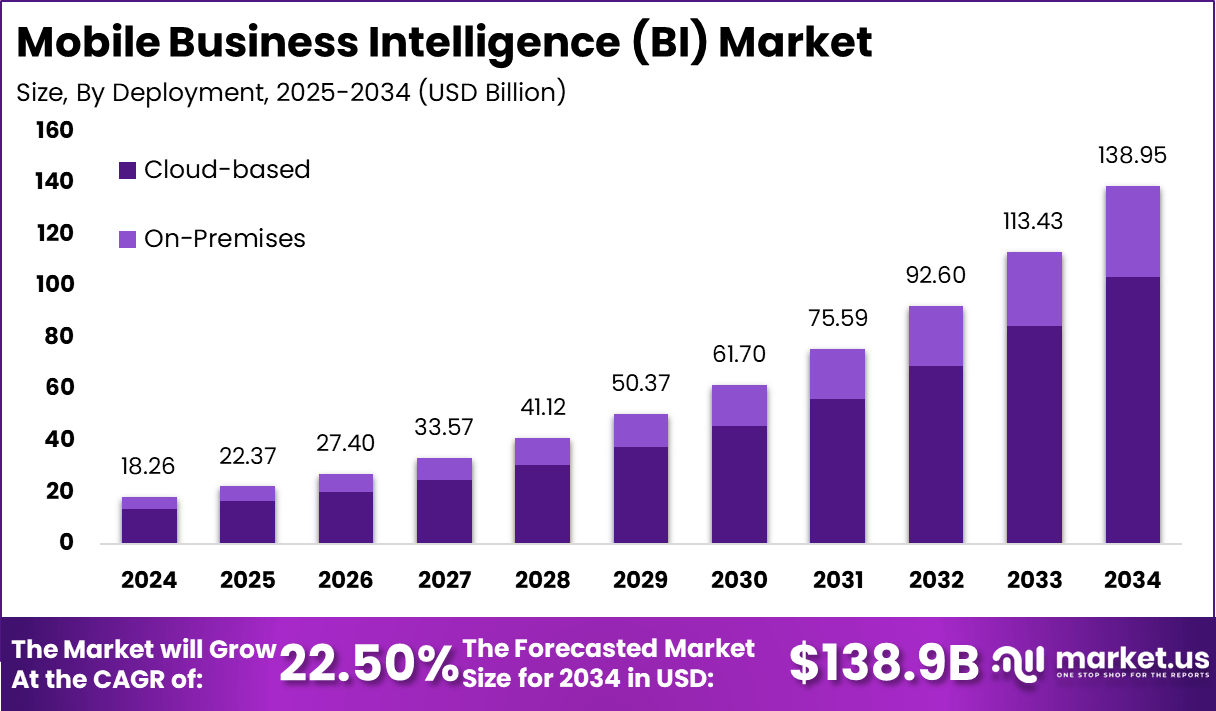

The global Mobile Business Intelligence (BI) market was valued at USD 18.26 billion in 2024 and is projected to reach approximately USD 138.9 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 22.5%.

In 2024, North America accounted for about 39.3% of the market share at USD 7.17 billion, with the United States contributing USD 6.29 billion and expected to grow to USD 39.93 billion by 2034 at a CAGR of 20.3%. The growth is being driven by increasing enterprise mobility, greater smartphone and tablet usage in the workplace, cloud-based analytics proliferation, and rising demand for real-time insights on the go.

How Growth is Impacting the Economy

The substantial growth of Mobile BI is fostering economic productivity by enabling faster decision-making and reducing latency in operational responses across industries. As organizations adopt mobile analytics, labour productivity is expected to improve, same-day actions can be taken, and wastage from delayed insights is projected to decline.

The expansion of cloud infrastructure, mobile device ecosystems and related services is anticipated to spur investment in IT hardware, software and services, creating jobs and stimulating related supply-chains. Furthermore, as smaller firms adopt mobile BI tools, competitive dynamics shift and markets are expected to become more efficient, supporting overall economic resilience. The ripple effect of digital-analytics adoption is expected to extend into service sectors, under-served geographies and SMB segments, broadening the economic base and encouraging digital inclusion.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/mobile-business-intelligence-bi-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The adoption of mobile BI solutions is shaping business cost structures: companies must invest in mobile-first dashboards, secure networks, and training, increasing upfront capital expenditure. Supply chains are shifting toward more agile and data-driven models—firms are leveraging mobile analytics to monitor logistics, inventory and distribution in near real-time, which means suppliers and carriers must upgrade tracking systems, elevating costs but yielding faster turnaround.

Sector-Specific Impacts

In retail and e-commerce, mobile BI is enabling store managers and field staff to access dashboards on tablets or smartphones, enabling quicker stock replenishment and personalized offers. In manufacturing and operations, mobile analytics support predictive maintenance and on-the-go quality checks, reducing downtime. In banking, financial services and insurance (BFSI), mobile BI empowers front-line staff with customer insights at branch or remote locations. Service sectors such as healthcare are using mobile BI to monitor patient flows and clinician performance in real time, driving efficiency and cost controls.

Strategies for Businesses

Businesses should pursue these strategic actions to harness mobile BI growth:

- Deploy mobile-optimized dashboards and analytics apps that are intuitive and accessible to non-technical users.

- Invest in cloud and mobile infrastructure while ensuring robust security and governance frameworks.

- Partner with analytics vendors to embed mobile BI into existing enterprise workflows and mobile apps.

- Train and upskill employees in mobile-first data interpretation and decision-making culture.

- Prioritise data quality, mobile user-experience and real-time reporting to fully leverage the mobility benefit.

- Monitor and manage total cost-of-ownership—objectively assess return on mobile BI investments through metrics such as decision-latency reduction and productivity gains.

Key Takeaways

- The mobile BI market is set to expand rapidly, reaching USD 138.9 billion by 2034 with a CAGR of ~22.5%.

- North America dominates current share (~39.3% in 2024) while significant growth opportunity lies in other regions.

- Adoption of mobile BI is boosting enterprise agility, productivity and digital transformation.

- Businesses face cost and supply-chain shifts but can gain competitive advantage by integrating mobile analytics.

- Strategic investment in mobile BI, training and governance is critical for organisations to capitalise on this trend.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161683

Analyst Viewpoint

Currently the mobile BI market is in a strong growth phase, driven by mobile-device ubiquity, enterprise demand for real-time insights and cloud analytics-enablement. The outlook remains highly positive as mobile workforces expand, BYOD (bring-your-own-device) policies strengthen and 5G networks mature, enabling smoother mobile data flows.

Over the next decade, mobile BI is projected to become a mainstream tool across sectors and geographies, with deeper integration of AI, augmented analytics and embedded mobile dashboards enhancing value. Organisations that strategically adopt mobile BI early are anticipated to gain differential advantage, while the overall ecosystem is expected to mature and stabilise with stronger governance and cost-efficiencies.

Use Cases and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Sales team using mobile dashboards to track KPIs in real time | Rising smartphone/tablet penetration, mobile workforce expansion |

| Field service technicians accessing live analytics on mobile devices for predictive maintenance | Demand for operational agility and real-time insights, edge computing growth |

| Retail store managers using mobile BI for stock replenishment and customer segmentation | Growth of mobile commerce, customer expectations for faster fulfilment |

| Executives and managers accessing mobile BI apps for decision-making on the go | Cloud-based BI adoption, BYOD and remote-work trends |

| SMEs deploying mobile BI solutions to gain analytics capability without large infrastructure | SaaS-based mobile BI, lowering entry-costs, democratization of data |

Regional Analysis

North America commanded approximately 39.3% of the mobile BI market in 2024, underpinned by mature enterprise mobility frameworks, high smartphone penetration and advanced IT infrastructure. The United States drove this regional dominance with USD 6.29 billion in revenue in 2024, with projected growth to USD 39.93 billion by 2034 at a CAGR of 20.3%.

Meanwhile, other regions such as Asia Pacific and Europe represent significant growth opportunities, with digital transformation initiatives, mobile-first strategies and 5G roll-outs expected to accelerate adoption. Emerging markets in Latin America, Middle East and Africa are also expected to grow, albeit from a smaller base, as mobile connectivity and cloud services expand.

➤ More data, more decisions! see what’s next –

- Smartphone Envelope Tracker IC Market

- Voicebot Market

- Data Center Immersion Cooling Market

- Database Management Analytics Market

Business Opportunities

The burgeoning mobile BI market offers numerous opportunities for businesses. Analytics software providers can deliver mobile-first BI platforms tailored to remote and field-based users. Service firms can offer consulting, integration and managed mobile BI solutions, especially for SMEs. Enterprise users can embed mobile analytics into operational workflows, enabling faster decisions and productivity improvements.

There are opportunities to develop vertical-specific mobile BI apps—for example in healthcare, manufacturing or retail—that leverage mobile devices uniquely. Geographic expansion presents business potential, with untapped adoption in developing regions where mobile connectivity is growing rapidly.

Key Segmentation

Segmentation of the mobile BI market is critical for targeting and strategy. Key segmentation includes solution type (software platforms, data-visualization tools, dashboard/reporting apps; services such as professional and managed services), deployment mode (cloud-based, on-premises), organization size (large enterprises, small and medium enterprises), business functions (sales, marketing, finance, operations/supply-chain, HR), and end-user industries (BFSI, IT & telecommunications, healthcare & life sciences, retail & e-commerce, manufacturing, government & public sector). Each segment provides distinct growth rates and strategic focus, so businesses must align their offering and go-to-market plans based on the segment dynamics.

Key Player Analysis

Leading firms in the mobile BI market are rapidly enhancing mobile and cloud capabilities, integrating augmented analytics, AI and natural language querying into their mobile dashboards. They are expanding global presence, forging partnerships for mobile-app embedding, optimizing pricing for mobile deployments and focusing on user experience for field and mobile workers.

Competitive pressures are driving investment in mobile security, offline capability, data governance and cross-platform interoperability. Firms that can deliver intuitive mobile experiences, fast time-to-value and strong enterprise integrations are positioned to scale. Additionally, differentiation through vertical-specific mobile BI apps and services is becoming a crucial strategic lever.

- Microsoft (Power BI)

- Salesforce (Tableau)

- Qlik (Qlik Sense)

- Strategy (formerly MicroStrategy)

- SAP (SAP Analytics Cloud)

- IBM (Cognos Analytics)

- Domo Inc.

- Sisense Inc.

- Oracle Corporation (Oracle Analytics Cloud)

- TIBCO Software (Spotfire)

- Yellowfin BI (now part of Idera)

- ThoughtSpot Inc.

- Google LLC (Looker)

- Phocas Software

- Zoho Corporation

- Board International

- Dundas Data Visualization

- TARGIT A/S

- e-Zest Solutions Ltd.

- Information Builders Inc.

- Others

Recent Developments

- Mobile-BI adoption trends are accelerating as real-time data access becomes an expectation across business operations.

- Mobile BI platforms are increasingly incorporating augmented analytics and AI capabilities, enabling conversation-style querying and predictive insights.

- Mobile-first and cloud-based BI deployments are gaining priority, with organisations shifting away from desktop-only analytics.

- Bring-Your-Own-Device (BYOD) policies and remote-work dynamics are driving mobile BI usage among distributed teams.

- Emerging markets and the Asia-Pacific region are being identified as high-growth zones for mobile BI adoption, driven by mobile connectivity and digital transformation.

Conclusion

The global mobile BI market is poised for significant growth, underpinned by mobile-device ubiquity, cloud analytics and enterprise mobility trends. Businesses that embrace mobile-first analytics with strategic investments in platforms, governance and mobile UX stand to gain competitive advantage and long-term productivity benefits.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)