Table of Contents

Introduction

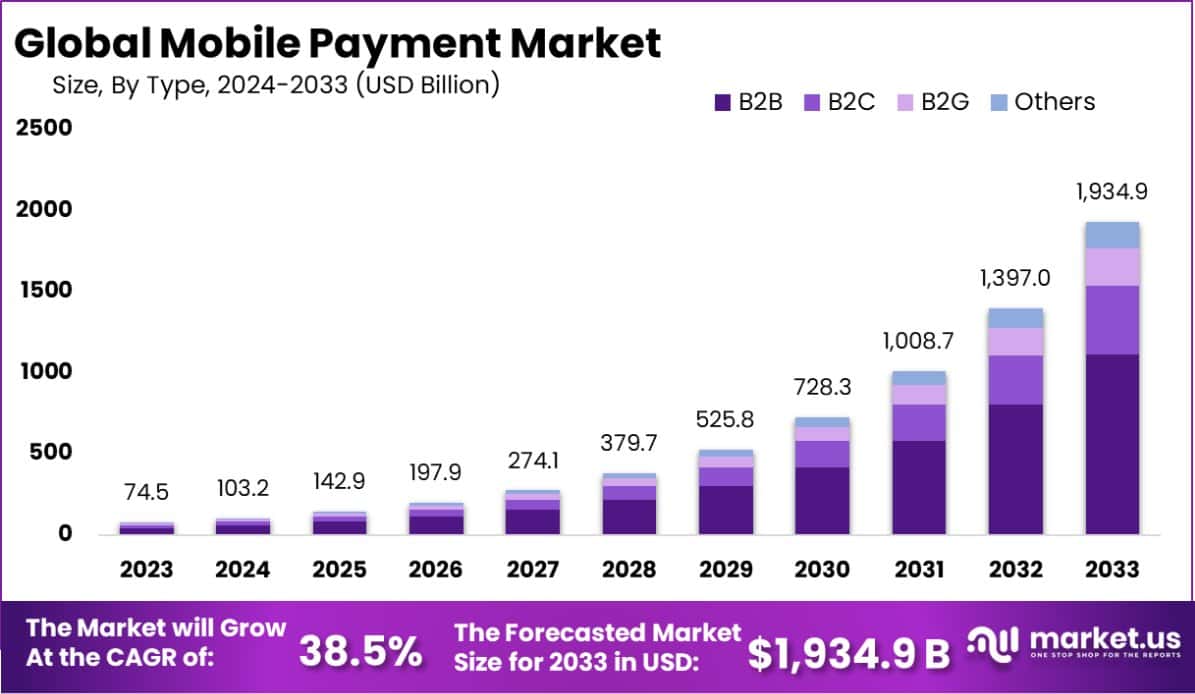

The Global Mobile Payment Market is projected to witness substantial growth, with its market size anticipated to reach USD 1,934.9 billion by 2033, up from USD 74.5 billion in 2023. This represents a robust compound annual growth rate (CAGR) of 38.5% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region emerged as the dominant player in the market, capturing a significant 38.3% market share. The region recorded revenue of USD 28.53 billion, underscoring its leadership position in the global mobile payment sector.

Mobile payments refer to transactions where mobile devices, like smartphones or tablets, are used to transfer money or pay for goods and services, either in-person or online. This method leverages technologies such as Near Field Communication (NFC), QR codes, or mobile payment apps to facilitate payments without the physical exchange of cash or cards. The convenience, speed, and enhanced security features offered by mobile payment systems have contributed to their increasing popularity globally.

The mobile payment market has experienced rapid growth, driven by the widespread adoption of smartphones and the increased digitization of banking and retail services. This market encompasses various services and technologies that allow consumers to make transactions through mobile devices. As financial institutions, tech companies, and retailers continue to invest in mobile payment technology, the market is expanding to include a broader range of payment methods and services, attracting a diverse customer base looking for convenience and efficiency in their transactions.

The demand for mobile payment solutions is soaring due to the global shift towards digital and contactless payment methods, accelerated by the COVID-19 pandemic. Consumers value the ability to make quick and secure payments from anywhere at any time, which mobile payments provide. This demand is also bolstered by the growing number of merchants accepting mobile payments, which enhances consumer convenience and drives further adoption.

The mobile payment market is set to continue its growth trajectory, with projections showing significant expansion in both developed and emerging economies. Innovations in technology, such as the integration of biometric authentication and the advancement of blockchain for secure transactions, are expected to drive future growth. Additionally, the increasing comfort level with digital solutions among consumers of all ages supports a positive outlook for the sector’s expansion.

The market offers abundant opportunities, including the potential for businesses to tap into new customer segments by offering mobile-oriented payment solutions. For financial technology companies, there is a chance to innovate and deliver services that meet the evolving expectations of security and convenience. Furthermore, partnerships between tech companies and traditional banks can potentially open up new revenue streams and expand market reach, ensuring that the mobile payment ecosystem remains vibrant and competitive.

Key Takeaways

- The Global Mobile Payment Market is projected to reach a valuation of USD 1,934.9 Billion by 2033, growing from USD 74.5 Billion in 2023, at a robust CAGR of 38.5% during the forecast period from 2024 to 2033.

- In 2023, the B2B segment held a dominant position within the By Type category of the Mobile Payment Market, accounting for over 57.5% of the market share.

- In the By Technology segment, Mobile Web Payment emerged as a leading technology in 2023, capturing more than 24% of the market share.

- The By Location segment was dominated by Remote Payment in 2023, with over 61% of the market share, indicating the growing preference for remote transaction capabilities.

- In the end-user category, the BFSI (Banking, Financial Services, and Insurance) sector secured more than 25.2% of the market in 2023, reflecting strong demand for mobile payment solutions in this industry.

- Regionally, the Asia Pacific led the market, holding a significant 38.3% share and generating revenues of USD 28.53 Billion in 2023. This dominance underscores the region’s growing adoption of mobile payment technologies.

Mobile Payment Statistics

- The Global Digital Payment Market is projected to experience substantial growth, escalating from USD 105.3 Billion in 2023 to USD 514.9 Billion by 2033. This represents a robust Compound Annual Growth Rate (CAGR) of 17.2% over the forecast period from 2024 to 2033.

- In parallel, the Global Payment As A Service (PaaS) Market is anticipated to expand significantly, with projections indicating a growth from USD 12.5 Billion in 2023 to USD 75.5 Billion by 2033. The market is expected to grow at a CAGR of 19.7% during the same period. North America remains a key contributor, holding 37.5% of the market share, translating to revenues of USD 4.68 Billion.

- In China, dominant forces in the payment services sector are AliPay and WeChat Pay, which collectively command approximately 90% of the market. In 2021, mobile payment transaction volume reached $1.7 billion, marking a 27% annual increase. By 2023, mobile payments have become integral, accounting for 56% of all in-store retail transactions in China.

- The mobile payment landscape in the U.S. is also noteworthy, with the average transaction value reaching $249. In 2023, the transaction volume soared to $2.3 trillion, primarily fueled by small interchange fees charged per transaction. The rapid adoption during the pandemic has plateaued in recent years, yet the foundational growth is significant.

- Globally, Denmark leads in mobile payment adoption at 81.5%, closely followed by China and Sweden, each at 79.3%. By 2023, the number of mobile wallet users globally is expected to touch 1.31 billion. In the U.S., the anticipated mobile payment transaction value by 2024 is estimated at $632 billion.

- Mobile payments are becoming the preferred method of transaction with over 70% of South Korean consumers favoring this mode. Apple Pay dominates the U.S. mobile payment market, used by over 43% of iPhone owners. Furthermore, more than half (53%) of Americans now prefer digital wallets over traditional payment methods such as cash or physical cards.

- Despite the growth, there are security concerns, with 47% of cybersecurity professionals expressing reservations about the security of mobile payments. In North America, 66% of restaurants now accept mobile payments, a slightly higher rate than those accepting credit cards (63%) and significantly more than those accepting debit cards (38%).

- Overall, the mobile payment sector is on a trajectory of exponential growth, evidenced by the 3.37 billion users across the top 10 mobile payment apps, signaling a major shift in consumer payment preferences globally.

Top Mobile Payments Apps

The landscape of mobile payment apps in 2023 is dominated by a variety of platforms that offer convenience, enhanced security, and global reach. Here are some of the top mobile payment apps based on their features and popularity:

- Venmo: Known for its ease of use, Venmo offers instant transfer to bank accounts and is popular for its social features that allow users to share payments with friends along with messages and emojis. It supports transactions with all U.S. banks and offers the option of keeping money within the app or in a linked bank account.

- PayPal: A well-established player in the payment space, PayPal provides robust services suitable for both personal use and businesses. It offers high security and a quick turnaround on transactions, making it a versatile choice for a wide range of users.

- Apple Pay: Widely used among Apple device owners, Apple Pay supports in-store, online, and in-app purchases across multiple countries. It’s highly favored by younger demographics, particularly Gen Z users, for its convenience and security features.

- Google Pay: Initially launched as Google Wallet, Google Pay has expanded significantly and is now available in many countries worldwide. It offers a straightforward, secure way to manage payments across various platforms.

- Zelle: Integrated directly into many users’ banking apps, Zelle facilitates fast, direct bank-to-bank transfers without any fees. It’s highly regarded for its simplicity and speed in processing transactions.

- Starbucks App: Surprisingly, the Starbucks mobile app ranks highly among payment platforms due to its extensive use for coffee purchases, mobile orders, and loyalty rewards. It highlights how niche apps can dominate within their specific sectors.

- Xoom: Operated by PayPal, Xoom allows users to send money internationally, offering features like fast transfers to bank accounts and cash pick-up options in various countries.

- Wise (formerly TransferWise): Wise is renowned for its ability to handle international transfers efficiently, offering real-time exchange rates and low fees. It supports money transfers in over 80 countries, with many transactions being instant or completed within an hour.

Emerging Trends

- Adoption by Gen Z: Gen Z is rapidly adopting mobile peer-to-peer (P2P) transfers, signaling a shift in how future generations will manage money. This demographic’s preference for quick and easy digital transactions is driving widespread acceptance of mobile payment technologies.

- Contactless Payments: The popularity of Near Field Communication (NFC) and QR code-based transactions continues to rise, driven by the demand for fast, secure, and hygienic payment methods. This trend is reshaping both physical and digital shopping experiences.

- Biometric Authentication: With the increase in mobile transactions, security remains a top concern. Biometric methods such as fingerprint scanning and facial recognition are becoming more prevalent, offering a secure and user-friendly alternative to traditional passwords.

- Super Apps: The rise of super apps, which integrate multiple services like financial transactions, shopping, and social media into a single platform, is transforming the mobile payment ecosystem. These apps provide a seamless user experience and are becoming a central hub for everyday digital activities.

- Cryptocurrency Integration: Despite the volatility, cryptocurrencies are making inroads into the mobile payment space. The decentralized nature of these transactions offers benefits such as lower fees and enhanced transaction privacy, appealing to a growing segment of consumers and businesses.

Top Use Cases for Mobile Payments

- Point-of-Sale Transactions: Mobile payments are increasingly used at retail points of sale, where consumers enjoy the speed and convenience of paying with their mobile devices without the need for physical cards.

- In-App Purchases: Mobile apps, especially those in the gaming and entertainment sectors, are leveraging in-built payment systems to facilitate easy and instant purchases by consumers, driving significant revenue growth.

- Peer-to-Peer Transfers: Apps like PayPal and Venmo allow for instant money transfers between individuals, simplifying the way people split bills or exchange money socially. This use case has gained popularity due to its convenience and the ability to conduct transactions anytime, anywhere.

- Buy Now, Pay Later Services: This model has become increasingly popular, especially for making larger purchases more manageable by spreading the cost over time. It appeals particularly to consumers looking for flexibility in managing their finances amid rising living costs.

- Cross-Border Payments: Mobile payment technologies facilitate smoother and more cost-effective international transactions. They are particularly beneficial for businesses and consumers engaged in global trade or who have international dealings.

Major Challenges

- Regulatory Complexity: The mobile payment sector is heavily regulated, with diverse regulations across different regions affecting everything from anti-money laundering (AML) practices to data protection laws. Keeping up with these regulations is crucial for compliance but can be challenging as they evolve rapidly.

- Security Concerns: As mobile payments involve sensitive personal information and financial details, there is a high risk of cyber threats, such as fraud and data breaches. Ensuring robust security measures and constant vigilance is a persistent challenge for the industry.

- Technological Integration: Integrating new technologies with existing payment infrastructures without disrupting service can be difficult. Innovations such as instant payments and digital wallets require significant backend changes and pose integration challenges.

- Market Fragmentation: The global nature of the mobile payments market involves dealing with a fragmented market landscape, where different countries and regions have varying preferences and dominant technologies, such as the diverse uptake in digital wallets across countries.

- Consumer Trust: Building and maintaining consumer trust is a critical challenge. This includes concerns over privacy, the security of transactions, and the reliability of new payment technologies. Consumers’ hesitancy to adopt new forms of payment can hinder market expansion.

Top Opportunities

- E-commerce Growth: The booming e-commerce sector, driven by an increase in mobile shopping, presents significant opportunities for mobile payments. As more consumers shop on their mobile devices, there is a greater need for seamless and secure payment methods.

- Financial Inclusion: Mobile payments can play a crucial role in financial inclusion, providing access to financial services for unbanked and underbanked populations. This is particularly pertinent in developing regions where traditional banking infrastructure is limited.

- Technological Advancements: Innovations such as blockchain, AI, and machine learning offer opportunities to enhance the security and efficiency of mobile payments. These technologies can help in fraud detection and offer a more personalized user experience.

- Sustainability Initiatives: There is a growing interest in sustainable business practices within the payments industry. Developing carbon-neutral transaction processes and eco-friendly payment solutions can serve as a significant market differentiator

- Expansion into New Markets: As the digital economy expands, there is potential for mobile payments to grow into new geographic and sectoral markets. Tailoring mobile payment solutions to fit local needs and preferences can unlock new customer segments.

Technological Innovations in Mobile Payments

- Digital Wallets and NFC Technology: The adoption of Near Field Communication (NFC) technology and digital wallets such as Apple Pay and Google Wallet has streamlined transactions, allowing users to pay with a simple tap of their mobile device, eliminating the need to physically handle cards or cash.

- Biometric Authentication: Enhancing security, mobile payment apps now often include biometric features such as fingerprint scanning and facial recognition, ensuring that transactions are not only convenient but also secure.

- Peer-to-Peer (P2P) Payments: Apps like Venmo and Cash App have revolutionized how people send and receive money, offering instantaneous peer-to-peer transactions without the need for bank visits or even online banking.

- Augmented Reality (AR) for Payments: Integrating AR with mobile payments is on the rise, providing users with immersive and interactive shopping experiences, which help in visualizing products before purchase.

- Blockchain Technology: Utilizing blockchain for payments ensures transparency and security, reducing the need for intermediaries and lowering transaction costs, which is particularly significant in cross-border transactions.

Business Benefits of Mobile Payment Innovations

- Increased Transaction Speed and Convenience: Mobile payments significantly reduce the time spent on transactions, offering a seamless checkout experience that enhances customer satisfaction and turnover rate.

- Enhanced Security: With advanced encryption, tokenization, and biometric verification, mobile payments offer superior security features that reduce the risk of fraud and unauthorized transactions.

- Cost Reduction: By eliminating the need for physical payment hardware and reducing transaction fees associated with traditional banking, businesses can lower their operational costs.

- Broader Customer Reach: Mobile payment platforms, especially those that facilitate cross-border transactions, help businesses expand their reach to international markets without the complexity of traditional banking arrangements.

- Improved Customer Insights and Loyalty Programs: Digital wallets and payment apps often provide businesses with valuable consumer data, which can be used to tailor marketing strategies and improve customer loyalty programs.

Conclusion

The mobile payment market is positioned at the intersection of technological innovation and consumer demand, setting a course for sustained growth in the foreseeable future. As technologies evolve and consumer behaviors shift towards more digital and contactless interactions, the adoption of mobile payments is expected to escalate.

This trend presents significant opportunities for businesses across sectors to innovate, collaborate, and enhance the convenience and security of transactions. Embracing these changes and investing in mobile payment technologies will be crucial for companies aiming to stay competitive and responsive to consumer needs in a digital economy.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)