Table of Contents

Mobile POS Systems Market Size

The global Mobile POS Systems Market was valued at USD 3.6 billion in 2024 and is projected to reach nearly USD 144.9 billion by 2034, registering an exceptional CAGR of 44.7% from 2025 to 2034. Growth in this sector is being fueled by the increasing adoption of cashless transactions, the rapid expansion of e-commerce, and the demand for flexible payment solutions that enhance customer convenience in retail, hospitality, and logistics.

The mobile POS systems market is growing rapidly as businesses shift toward more flexible and efficient payment solutions. Strong adoption of digital payment methods is a key driving factor. With over 68% of small and medium enterprises globally using mobile POS in 2025, these systems help businesses accept payments anywhere and anytime, enhancing customer experience and operational efficiency. The rise in smartphone penetration makes mobile POS accessible and affordable, especially in emerging markets where they serve as scalable alternatives to traditional fixed POS terminals.

Demand for mobile POS systems is fueled by increasing consumer preference for cashless transactions, including contactless cards and mobile wallets. More than 79% of businesses now use some form of POS system, with 82% of retailers prioritizing upgrades to speed up transactions and improve accuracy. The flexibility and portability of mobile POS devices allow retail, hospitality, healthcare, and service providers to conduct payments on the go, reducing wait times and providing seamless billing experiences even in dynamic environments like pop-up shops or outdoor markets.

Technological advancements are central to mobile POS adoption. Integration of cloud computing has led to over 64% of retailers implementing cloud-based POS systems, which offer real-time data access and remote management, reducing upfront costs significantly. Contactless payments powered by NFC technology accounted for over 22 billion transactions in 2022, and that number is expected to more than double by 2028, reflecting the convenience customers expect today. Additionally, AI and machine learning are improving mobile POS by enabling predictive analytics for personalized customer service and better inventory management.

Key Insight Summary

- By Component: Hardware held the leading position with 70.5% share, supported by high demand for POS terminals, scanners, and supporting devices.

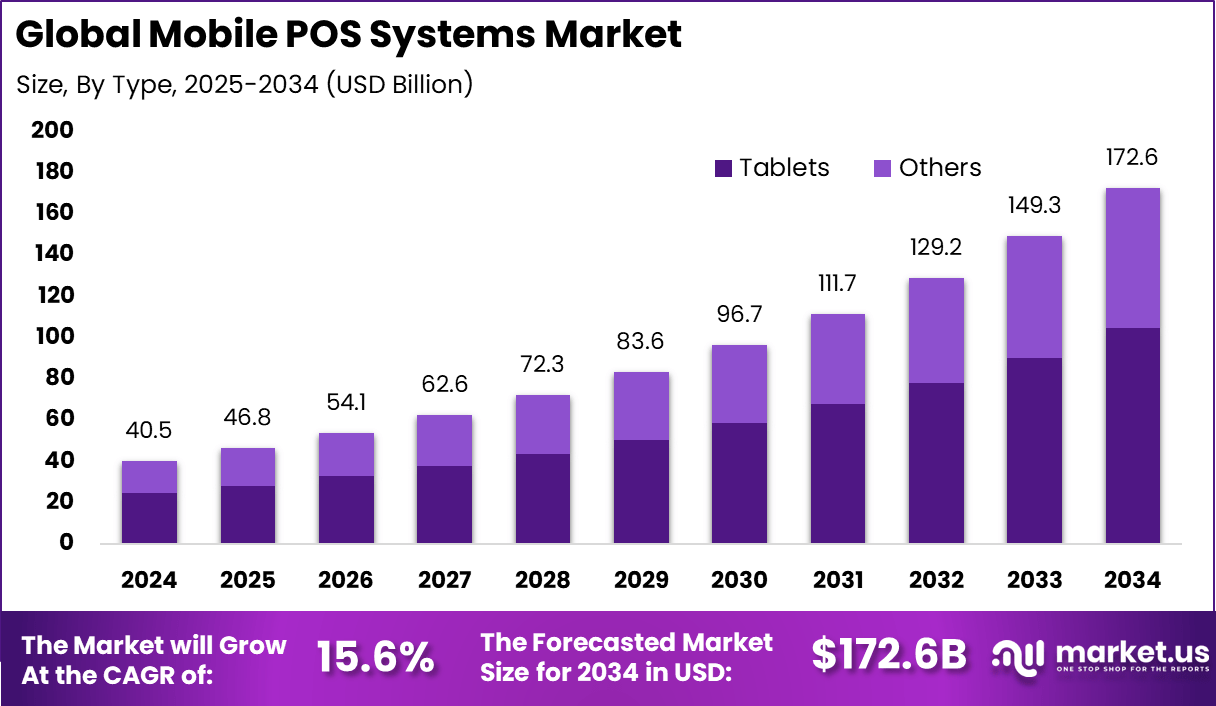

- By Type: Tablets dominated with a 60.6% share, driven by their portability, cost-effectiveness, and ease of integration in diverse retail and service environments.

- By Application: The Healthcare sector captured 28.5% share, reflecting the growing adoption of mobile POS solutions for billing, patient check-in, and service efficiency.

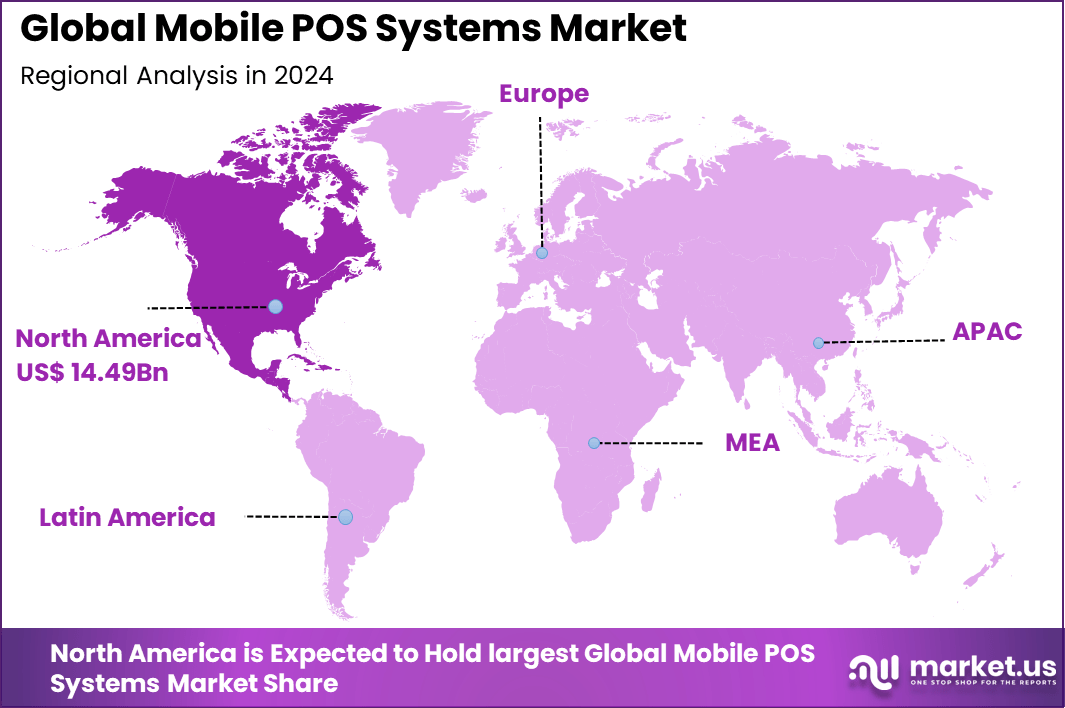

- Regional Insights: North America led the global market with 35.8% share in 2024.

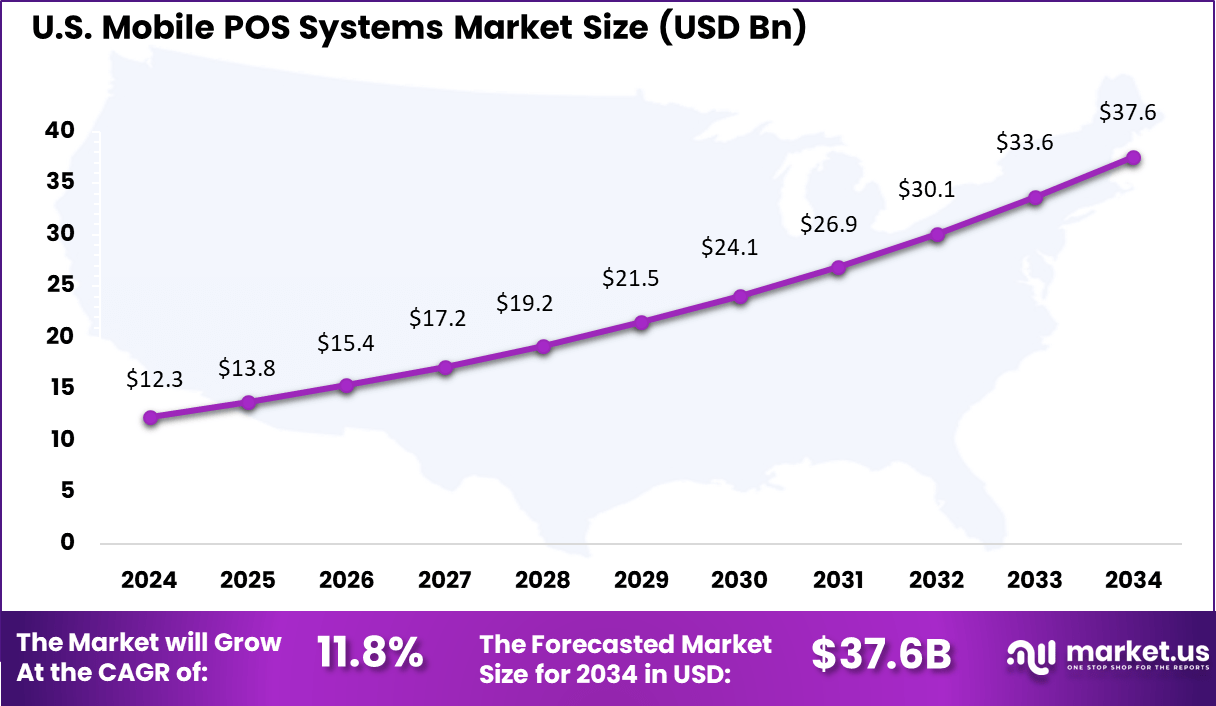

- U.S. Market: Valued at USD 12.32 Billion in 2024, the U.S. market is projected to grow at a strong CAGR of 11.80%, supported by widespread digital payment adoption and strong retail penetration.

Role of Generative AI

Generative AI is playing an increasing role in mobile POS systems by enabling personalization and smarter decision-making. It helps analyze customers’ past purchases and behaviors to create customized product recommendations and targeted promotions. Businesses using generative AI in their POS systems gain the ability to forecast demand more accurately, optimize inventory, and improve customer retention.

AI-powered solutions also automate routine tasks such as fraud detection and staff performance tracking, making operations more efficient. Research shows that many mobile POS providers have started integrating generative AI features to enhance sales and customer engagement in real-time environments.

Regional Analysis

In 2024, North America held a dominant market share of more than 38.7%, generating around USD 1.3 billion in revenue. The region’s leadership is supported by advanced digital payment infrastructure, early adoption of mobile-first solutions, and strong investments in next-generation POS technologies. This dominance highlights North America’s central role in driving innovation and setting benchmarks for mobile payment solutions globally.

The United States is leading the adoption of mobile POS systems, with the segment expected to reach about USD 12.32 billion by 2025, growing at a CAGR of 11.80%. This growth is supported by strong investments from retailers, service providers, and healthcare networks in advanced mobile POS technologies.

The focus is on enhancing payment experiences and meeting the evolving expectations of consumers who increasingly prefer fast, secure, and contactless transactions. The integration of mobile POS solutions is also enabling businesses to streamline operations, improve flexibility, and strengthen customer engagement, positioning the U.S. as a central driver in the global mobile POS market.

Emerging Trends

In 2025, mobile POS systems are trending toward greater adoption of cloud-based platforms and omnichannel integrations. Over 72% of retailers now use cloud-enabled POS allowing real-time syncing between in-store, online, and mobile sales channels, creating seamless shopping experiences. Contactless payments, digital wallets, and voice-activated commands are rapidly becoming standard features.

Additionally, the use of augmented reality and IoT for inventory management is enhancing retail efficiency. Sustainability initiatives are also influencing mobile POS development, with many systems now supporting digital receipts and eco-friendly practices to reduce waste.

Growth Factors

Several factors are driving the strong growth of mobile POS systems. The increasing preference for cashless and digital payments is a primary motivator, pushing businesses to upgrade their payment infrastructure. The widespread penetration of smartphones, easier internet access, and more affordable mobile devices have expanded mobile POS adoption, especially among small and medium enterprises.

Business owners appreciate the low upfront costs, flexibility to operate anywhere, and improved transaction speed that mobile POS solutions offer. Statistics indicate around 79% of businesses use POS systems, and 64% of retailers have moved to cloud-based mobile POS, both contributing to rapid market growth.

Driver Analysis

Growing Demand for Cashless Payments

Mobile POS systems are gaining popularity as more consumers prefer cashless transactions for their convenience and safety. Customers now expect to pay using credit cards, mobile wallets, or contactless methods wherever they shop. This shift pushes businesses – especially small retailers, food trucks, and pop-up shops – to adopt mobile POS solutions that allow seamless payment acceptance anywhere. For instance, retailers avoid long checkout queues, speeding up purchases and improving the shopping experience.

This driver is boosted by the widespread use of smartphones and tablets, which serve as easy-to-use terminals for these systems. In emerging markets where traditional payment infrastructure is less developed, mobile POS offers an accessible way for vendors to serve customers digitally, promoting financial inclusion. The result is smoother sales processes and more satisfied customers, encouraging broader adoption of mobile POS technology.

Restraint Analysis

Security and Privacy Concerns

A significant restraint to mobile POS adoption is the concern over data security and privacy. Since these systems handle sensitive payment information through portable devices and cloud-based platforms, they are vulnerable to potential data breaches, fraud, and unauthorized access. Retailers must invest in secure software, regular updates, and staff training on safety protocols to avoid costly risks.

For smaller businesses, limited IT resources can make it difficult to maintain sufficient cybersecurity measures, making them hesitant to fully adopt mobile POS. The fear of reputational damage from security lapses often slows down implementation even when the technology offers operational benefits. For instance, compliance with payment industry standards and data regulations adds complexity and cost.

Opportunity Analysis

Advancements in Cloud and Real-Time Analytics

Technological improvements present a major opportunity for mobile POS systems. Cloud-based platforms allow businesses to access real-time sales data and inventory updates from anywhere, facilitating better decision making. In addition, features like contactless payments and integration with customer relationship systems help companies boost operational efficiency.

These technological gains give vendors a way to differentiate their offerings by providing customizable solutions that suit specific business needs. For example, analytics provided by mobile POS can guide promotional activities and inventory management, helping small and medium enterprises optimize their operations. This opportunity is particularly promising in retail and hospitality sectors where customer experience and speed are priorities.

Challenge Analysis

Integration with Legacy Systems

One of the common challenges businesses face with mobile POS adoption is integrating new systems with existing hardware and software infrastructures. Older, legacy systems may not support real-time synchronization or lack compatibility with modern mobile POS APIs. This can create operational inefficiencies and data inconsistencies, frustrating staff and customers alike.

Additionally, ensuring secure data exchange during integration while complying with industry regulations is complex. Businesses must carefully audit their current systems and may need to invest in middleware or upgrades to facilitate smooth integration. Training staff on the new processes is also essential to avoid errors. The challenge is balancing innovation adoption while maintaining consistent, reliable operations.

Key Market Segments

By Component

- Hardware

- Software

By Type

- Tablets

- Others

By Application

- Restaurant

- Hospitality

- Healthcare

- Retail

- Warehouse

- Entertainment

- Others

Top Key Players in the Market

- Fiserv, Inc.

- Hewlett Packard Enterprise Development LP

- Ingenico

- NEC Corporation

- Oracle

- Panasonic Holdings Corporation

- PAX Technology

- Posiflex Technology, Inc.

- QVS Software

- SAMSUNG

- SPECTRA Technologies

- TOSHIBA CORPORATION

- VeriFone, Inc.

- Zebra Technologies Corp.

- Others

Read More – https://market.us/report/global-mobile-pos-systems-market/

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)