Table of Contents

Introduction

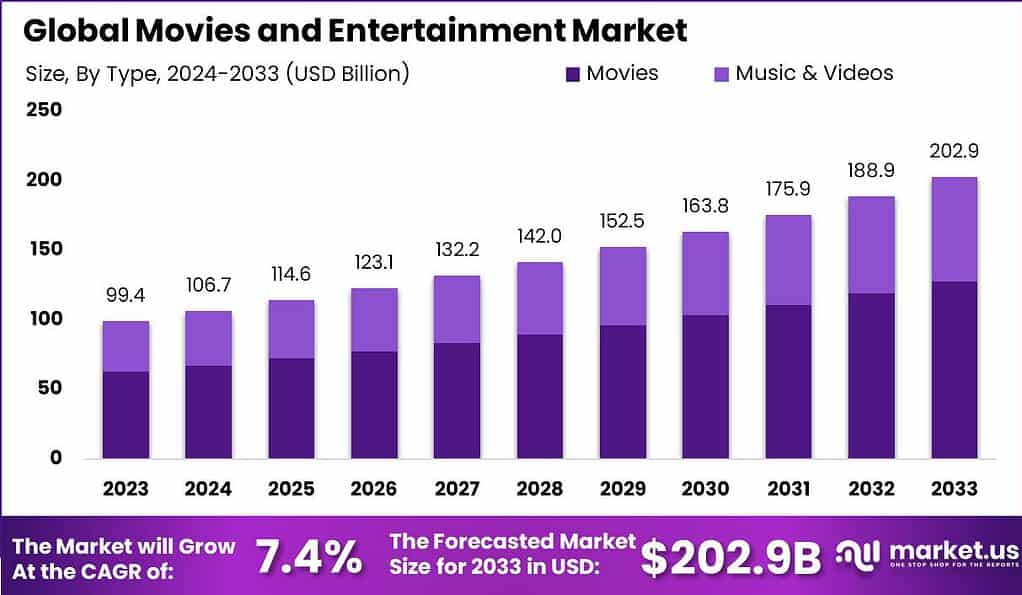

According to Market.us, The global movies and entertainment market is projected to attain a value of approximately USD 202.9 billion by 2033, up from USD 99.4 billion in 2023, reflecting a compound annual growth rate (CAGR) of 7.4% over the forecast period from 2024 to 2033.

The movies and entertainment industry encompasses a vast array of activities and services designed to entertain audiences across the globe. This sector includes the production, distribution, and exhibition of films and television shows, along with music concerts, theater productions, and other forms of live performances. Key players in this industry range from film studios and production companies to streaming services and theater chains.

The landscape of this industry has been significantly transformed with the advent of digital technology, leading to new platforms for content delivery, such as streaming services that have altered how consumers access and consume entertainment. This shift has also influenced how content is monetized and the strategies for audience engagement.

The global market for movies and entertainment has seen significant growth, driven by increasing consumer demand for diverse and high-quality content. This market is influenced by several factors including technological advancements, changing viewer habits, and economic conditions. The rise of streaming services like Netflix, Amazon Prime, and Disney+ has revolutionized the industry, offering new revenue streams and distribution models.

Additionally, international markets, especially in Asia, have become increasingly important for the revenue of films and entertainment content, broadening the scope and reach of the industry. Despite challenges such as piracy and economic fluctuations, the movies and entertainment market continues to expand, reflecting its adaptability and enduring appeal.

The demand within the movies and entertainment market is shaped by consumer preferences and technological trends. Consumers increasingly seek convenience, variety, and quality in their entertainment choices, driving demand for streaming services that offer extensive libraries of content accessible on multiple devices.

Additionally, there is a growing appetite for diverse and culturally rich content, which has prompted studios and content creators to develop a broader range of genres and stories that reflect global perspectives. High-definition visuals and immersive audio technologies also enhance the viewing experience, further increasing consumer demand for premium content.

Opportunities within the movies and entertainment market are abundant, especially in areas that leverage technological innovations and changing consumer behaviors. The expansion of virtual reality (VR) and augmented reality (AR) offers new ways for creators to deliver immersive experiences, opening up fresh avenues for revenue.

Additionally, the globalization of content allows producers to reach international audiences more effectively, tapping into emerging markets with rising middle-class populations. Content personalization and data analytics present another significant opportunity, enabling marketers to tailor experiences and advertisements to individual preferences, thus improving engagement and customer loyalty.

Key Takeaways

- The global movies and entertainment market is projected to reach a value of approximately USD 202.9 billion by 2033, ascending from USD 99.4 billion in 2023. This growth trajectory implies a compound annual growth rate (CAGR) of 7.4% over the forecast period from 2024 to 2033.

- In 2023, the Movies segment held a dominant position within the industry, capturing over 63.1% of the total market share in the movies and entertainment sector. This segment’s substantial share underscores its pivotal role in driving revenue and shaping market dynamics.

- Furthermore, the OTT Platforms segment also exhibited a significant presence, accounting for more than 69.5% of the industry in 2023. The robust performance of this segment highlights the shifting consumer preferences towards digital and streaming services, which have been reshaping the entertainment landscape.

- Regionally, North America continued to lead the global market, securing more than 34.7% of the market share. The revenues from this region were estimated at around USD 34.4 billion in 2023, indicating a strong market presence and consumer engagement within the North American entertainment sector. This regional dominance is supported by a well-established infrastructure for both film production and distribution, coupled with high consumer spending on entertainment.

Movies and Entertainment Statistics

The film industry remains a significant contributor to the global economy. Prior to the pandemic, Hollywood generated approximately $504 billion towards the U.S. GDP, showcasing its pivotal role in the media and entertainment sectors.

Box Office Revenues

- In 2022, domestic box office revenues in the U.S. achieved approximately $7.38 billion.

- Conversely, the North American film industry’s total box office revenue was slightly lower at $5.99 billion for the same period.

Industry Growth Forecasts

- Analysts from PwC predict that the annual growth rate of the industry will stabilize at 2.8% by 2027. This forecast suggests a recalibration within the media and entertainment industry, reflecting adaptations to new consumption patterns and market realities.

Market Capitalization and Financial Ratios

- Currently, the average market capitalization of companies within the movies and entertainment sector stands at around INR 995 crores.

- These entities exhibit a price-to-earnings (P/E) ratio of 55.60 and a return on equity of 36.19%.

- The sector has encountered challenges, notably a net profit growth decline of -163.28% year-over-year, highlighting substantial volatility in profitability.

Advertising Revenue Insights

- By 2025, advertising is projected to overtake consumer spending as the dominant category within Entertainment and Media (E&M), propelled by a robust growth of 8.1% in internet advertising during 2022.

- Advertising revenue is anticipated to escalate from US$763.7 billion to US$952.6 billion globally over the period from 2022 to 2027, setting the stage for advertising to become the first E&M category to achieve US$1 trillion in annual revenue.

Consumer Spending Trends

- Despite an increase in time spent accessing entertainment and media content, consumer spending per capita in the digital entertainment and media industries is expected to decrease from 0.53% of average personal income in 2023 to 0.45% by 2027.

Leading Global Film Industries:

- Hollywood: $11.1 billion

- Cinema of China: $9.15 billion

- Cinema of Japan (Nihon Eiga): $2.39 billion

- Bollywood: $2.26 billion

- United Kingdom: $1.7 billion

- South Korean Cinema: $1.6 billion

- France: $1.5 billion

- Germany: $1.1 billion

- Russia: $1 billion

- Australia: $0.95 billion

Emerging Trends

- AI and User-Generated Content: The integration of artificial intelligence in entertainment continues to grow, influencing how content is created and consumed. User-generated content is also gaining prominence, competing with traditional media for viewers’ attention. Together, these trends are reshaping content production and consumption dynamics.

- Streaming Service Evolution: Streaming platforms are increasingly emphasizing personalized, data-driven marketing strategies to enhance viewer engagement. This shift away from traditional blanket advertising allows for more targeted and effective use of advertising budgets.

- Resurgence of Live Entertainment: Live entertainment, including sports and concerts, is witnessing a significant rebound, with revenues expected to surpass pre-pandemic levels. This trend is driven by the high demand for in-person experiences after extended periods of social distancing.

- Advancements in Gaming: The gaming industry remains a juggernaut, expanding its influence on the entertainment sector. Beyond just being a form of entertainment, gaming is becoming a key player in advertising and consumer engagement. Revenue from gaming is projected to continue its robust growth, significantly impacting entertainment and media experiences.

- Bundling of Streaming Services: As the market for streaming platforms becomes more saturated, there is a shift back towards bundled offerings. These bundles, which combine several services, are becoming more attractive as they potentially offer better value propositions to consumers, helping to reduce churn and acquisition costs for providers.

Top Use Cases

- Creative Ad Generation: AI tools are being increasingly used to streamline the ad creation process, enhancing ad performance and enabling personalization at scale. This application not only reduces labor but also improves the effectiveness of marketing campaigns.

- Enhanced Post-Production: AI is revolutionizing post-production by offering services like deepfake dubbing and advanced editing. These technologies allow for greater scalability in localizing content and enhancing viewer engagement by matching dubbing with on-screen actors’ lip movements and facial expressions.

- Real-Time Video Analysis: AI-driven tools are transforming how sports and live events are covered by automating the creation and distribution of highlight clips. This technology supports faster content turnaround and can tailor highlights to specific audiences, which enhances user engagement.

- Dynamic Content Recommendations: Streaming platforms are increasingly employing AI to offer dynamic content recommendations. By analyzing viewing habits and preferences, these platforms can present highly personalized content suggestions, improving user satisfaction and retention rates.

- AI in Audio Enhancement: In the realm of home entertainment, AI is set to revolutionize audio experiences by automatically adjusting volume and audio settings based on the viewer’s environment and preferences, thus enhancing the overall user experience without manual adjustments.

Major Challenges

- Intensified Competition: As streaming services continue to proliferate, the competition for viewer attention has become fierce. Media companies face the challenge of distinguishing their offerings in a saturated market where consumers are increasingly selective about their subscriptions.

- Economic Pressures on Production Costs: With economic downturns, the cost of production and the return on investment from big-budget productions are under scrutiny. This has led to a cautious approach toward spending on new, original content.

- Shortening Theatrical Windows: The shift towards direct-to-streaming releases or shortened theatrical windows challenges traditional cinema revenues, compelling distributors and cinema owners to innovate their business models.

- Technological Disruptions: The rapid evolution of technology, particularly around streaming and direct-to-consumer platforms, is disrupting traditional media and entertainment business models, pushing companies to adapt swiftly to remain relevant.

- Regulatory and Geopolitical Issues: Changes in regulatory frameworks and ongoing geopolitical tensions, especially in significant markets like China and Russia, continue to impact market dynamics and content distribution strategies.

Top Opportunities

- Expansion into New Markets: Companies are looking to tap into emerging markets, like Saudi Arabia, which has shown significant growth potential in cinema revenues post-pandemic.

- Innovative Content Formats: There is a growing opportunity in exploring new content formats and technologies like immersive VR experiences, which can attract a tech-savvy audience looking for novel entertainment experiences.

- Gaming and Interactive Media: The blending of gaming with traditional media offers vast opportunities for growth. The gaming sector’s influence is expanding into narrative storytelling and character development, providing a new realm for content creation.

- Live and Event-driven Content: The demand for live content, especially in sports and live events, continues to be a strong driver for audience engagement and subscription growth.

- Content Personalization and User Engagement: Leveraging data analytics to personalize content and enhance user engagement can help companies increase viewer satisfaction and reduce churn rates.

Conclusion

The movies and entertainment industry remains a dynamic and evolving sector, integral to both cultural landscape and economic vitality worldwide. As technology continues to advance and consumer preferences shift towards more digital and personalized content, the industry is adapting with innovative distribution methods and content types.

Despite facing challenges like piracy and varying global economic conditions, the movies and entertainment market is poised for continued growth, driven by robust demand and the expansion of global digital platforms. This resilience and adaptability underline the industry’s potential to thrive and expand, offering vast opportunities for stakeholders across the globe.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)