Table of Contents

Introduction

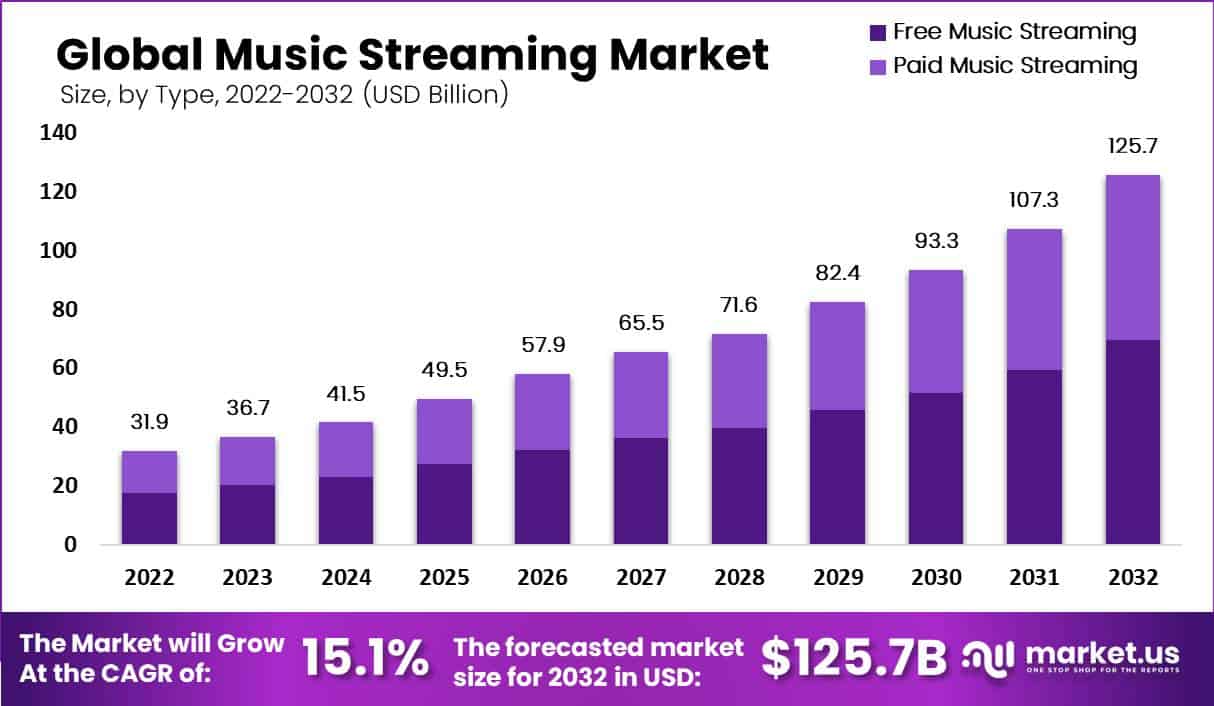

The Global Music Streaming Market is experiencing significant growth and changes, driven by evolving consumer dynamics. This market was valued at USD 36.7 Billion in 2023 and is projected to grow to approximately USD 125.70 Billion by 2032, with a CAGR of 15.10% during the forecast period from 2023 to 2032. The expansion is due to the increasing adoption of digital platforms and smart devices, as well as strategic innovations by key market players.

Several factors are driving the growth of this market. Advancements in mobile technology and internet accessibility have increased the reach of music streaming services, making them more accessible to a broader audience. The integration of artificial intelligence and machine learning into these platforms has significantly improved user experience by offering personalized playlists and recommendations, boosting user engagement and retention rates.

The market’s dynamic nature is highlighted by the surge in live streaming and on-demand services. Live streaming has seen remarkable growth, becoming a potent promotional tool for artists, enabling them to showcase their talents, cultivate dedicated fan bases, and reach new audiences effectively. On-demand streaming continues to dominate, providing users with personalized and convenient music experiences, generating the largest share of sales.

The music streaming industry has seen significant investment and acquisition activity, reflecting the sector’s rapid evolution and the strategic maneuvers of leading companies to strengthen their positions and diversify their services. In the first half of 2023, music-related mergers, acquisitions (M&A), and catalog investment activity exceeded $7 billion, nearly matching the total investment activity for the entire year of 2020. This considerable sum underscores the aggressive pace of investment in the sector.

Sony, a major player in the music industry, has been particularly active, spending $1.4 billion on music acquisitions in just six months. The company’s investments include the acquisition of AWAL, which adds nearly half a million recordings and almost 1,000 artists to Sony’s portfolio, significantly scaling its artist services division. This move, along with Sony’s investment in the beat marketplace BeatStars, demonstrates the company’s commitment to expanding its global music roster and supporting the independent music community. Sony’s aggressive A&R investment has grown its roster size by 40% in the past three years, highlighting its dedication to building a diverse and robust catalog.

These developments occur against a backdrop of broader trends in the media and entertainment sector, where companies are increasingly using M&A to extend their capabilities and build next-generation platforms. The focus is shifting towards interactivity, with significant interest in video games and virtual reality as mediums for music and entertainment. The consolidation within the streaming sector is expected to continue, driven by the end of strikes affecting the US entertainment industry and a clearer view of production costs and processes. Improved data analytics and insights into consumer preferences are expected to further drive consolidation and strategic partnerships in the coming years.

Key Takeaways

- The global music streaming market is projected to reach a substantial value of USD 125.70 billion by 2032.

- This represents a significant growth, with a remarkable CAGR of 15.10% from 2023 to 2032.

- In 2023, the market was valued at USD 36.7 billion, indicating substantial growth potential over the forecast period.

- Free music streaming dominates the market, capturing a larger share due to its widespread accessibility, ad-supported revenue models, and ease of streaming on mobile devices.

- On-demand streaming, which offers personalized and convenient music experiences, generated the largest share of sales.

- The individual end-user segment covers the largest revenue share, accounting for 59.8% of the market.

- North America held a dominant market position in 2022, with more than 31% share, driven by high internet penetration and strong digital music consumption culture.

- Spotify AB, Apple Inc., Amazon.com Inc., Google LLC, Deezer SA, Pandora Media Inc., Tencent Music Entertainment Group, Tidal, SoundCloud Global Limited & Co. KG, and iHeartMedia Inc. are among the top key players shaping the market.

Music Streaming Statistics

- Americans watch or listen to digital media for about 21 hours every week, which is roughly 3 hours daily.

- 99% of U.S. households have at least one streaming service subscription.

- Netflix is the top video streaming service with 260.28 million global subscribers.

- American households spend an average of $46 monthly on streaming services.

- 45% of users have ended a streaming service subscription in the past year, mainly due to costs.

- On average, Americans subscribe to 2.9 streaming services each month.

- Half of the users prefer services without ads.

- The U.S. has 90 million paid music streaming subscribers.

- Music streaming makes up 89% of the music industry’s total revenue, amounting to $17.5 billion yearly.

- People typically spend 20 hours a week streaming music.

- Over 3 billion people globally play video games, with U.S. gamers spending more than $55 billion in 2022.

- Twitch has 140 million monthly users and sees 1.86 billion hours of video game streaming monthly.

- 27% of gamers stream video games for 1 to 5 hours weekly.

- The PlayStation 2 is the top-selling video game console with over 155 million units sold.

- Streaming contributes to 84% of the music industry’s revenue, demonstrating its critical role.

- The music streaming sector grew by more than 10% over the past year.

- Global music streaming revenue stands at $17.5 billion.

- Paid subscriptions account for 23% of all music streaming activities.

- 78% of people prefer listening to music via streaming platforms.

- The global subscriber base for music streaming has reached over 600 million.

- In the U.S., 84% of the music industry’s revenue comes from streaming.

- Revenue from music streaming is expected to surpass $30 billion by 2025.

- Around 4 in 5 people worldwide use music streaming services.

- The number of music streaming subscribers jumped nearly 10 times since 2015 to 616.2 million by Q2 2022.

- Over 4 trillion songs were streamed in the U.S. in 2023.

- More than 80 million Americans prefer premium, ad-free music streaming.

- Over half of those aged 16 to 34 use audio subscription services.

- Nearly all Gen Z Americans regularly use streaming platforms for music.

- In Sweden, over half the population subscribes to premium music streaming services.

- Ad-free listening is the main reason people subscribe to streaming platforms.

- Listeners dedicate over 20 hours a week to streaming music.

- Users often search for specific songs and artists on streaming services.

- Every day, more than 100,000 new songs are added to streaming platforms.

- Spotify, with over 30% global market share, is followed by Apple Music, Tencent Music, and Amazon.

- The standard price for a monthly music streaming subscription is $10.

- Spotify’s premium subscriber count is over 226 million.

- Global music subscribers surged by 26.4% to 523.9 million during the Covid pandemic.

- In the first half of 2021, the U.S. saw a 13% increase in paid music streaming subscribers to 82.1 million.

- Americans stream music for 75 minutes daily on average.

- For every paid music streaming subscription globally, there are about 3.6 users, indicating shared account usage.

- R&B/hip-hop is the most streamed genre in the U.S., making up 29.9% of all streams.

- Spotify remains the leader with 180 million subscribers and 31% market share.

- The top reason for subscribing to music streaming services is to avoid ads.

- Gamers are 14% more likely to subscribe to music streaming services compared to the average listener.

Use Cases

Exploring the current landscape of music streaming, we uncover several compelling use cases, highlighting the behavior and preferences of millions of users globally. With over 2.8 billion active users across platforms like YouTube, Spotify, Apple Music, Tencent Music, and Amazon Music, the scale of engagement is vast. Here’s a closer look at how these users interact with music streaming services, shaped by insightful statistics:

- Diverse User Base: Gen Z and Millennials are the most avid streamers, with 73% of each demographic engaging weekly in the U.S. This demonstrates the appeal of music streaming across younger generations.

- Cross-Platform Listening: A significant portion of users, 64%, listen to music across multiple devices, indicating the importance of seamless integration and accessibility for music services.

- Sharing and Multi-Access: With an average of 3.6 users for every paid subscription globally, the trend of account sharing and cross-platform streaming is evident. For instance, 40% of Apple Music subscribers share their accounts, highlighting a communal approach to digital music access.

- Genre Preferences: R&B/hip-hop emerges as the top streaming genre in the U.S., capturing 29.9% of all streams. This preference underscores the cultural and musical trends driving the streaming industry.

- Market Leadership: Spotify maintains a dominant position with a 31% market share and 180 million subscribers, illustrating the platform’s vast reach and influence within the music streaming ecosystem.

- Engagement and Discovery: Streaming services play a crucial role in music discovery, particularly for genres like Americana and Afro-Pop/Afro-Beats, showcasing their impact on expanding musical tastes and experiences.

- Listening Habits: People worldwide spent an average of 18.4 hours each week listening to music in 2021, with streaming platforms accounting for 32% of this engagement. This statistic reflects the significant role of streaming in daily music consumption.

- Ad-Free Experience: The primary motivation for subscribing to paid services is the desire for uninterrupted music, free from ads. This consumer preference emphasizes the value of premium, ad-free listening experiences in the streaming market.

- Gamer Interaction: Gamers are 14% more likely to pay for music streaming services than average music listeners, indicating a unique crossover between gaming and music consumption habits.

Recent Developments

- Spotify’s Major Interface Overhaul: Spotify introduced a dynamic new mobile interface designed to foster deeper discovery and connections between artists and fans. This update emphasizes visual elements and interactive features, enabling users to actively engage with audio content. New discovery feeds for music, podcasts, shows, and audiobooks, alongside features like DJ and Smart Shuffle, aim to personalize the user experience further.

- Spotify and FC Barcelona Partnership: Spotify has entered into a unique collaboration with FC Barcelona, merging music with football. This partnership represents Spotify’s effort to connect with communities by integrating across diverse interests.

- Apple Music’s User Interface Enhancements: Apple Music announced updates to its app interface, including full-screen animated artwork for albums, depth effects for the minimized music player, and improvements in lyric visibility. These quality-of-life tweaks are part of the broader iOS 17 updates aimed at enhancing the listening experience.

- Artificial Intelligence and New Technologies: The music streaming industry is seeing significant investment in AI and new technologies. From personalized music curation, like Spotify’s DJ feature, to initiatives aiming to harness AI for creative and operational enhancements, technology is playing a central role in driving innovation and growth within the sector.

- Focus on Audiobooks and Diverse Content: Spotify has also ventured into audiobooks, launching a standalone subscription service to challenge Audible’s market dominance. This move indicates Spotify’s ambition to diversify its content offerings and cater to a broader range of audio entertainment preferences.

- Immersive and Spatial Audio Experiences: Advances in audio technology are enabling platforms to offer immersive and spatial audio experiences. These developments cater to the growing demand for high-quality sound and novel listening experiences, allowing users to enjoy music and other audio content in more engaging and dynamic ways.

- Generative AI and Music Creation: The integration of generative AI into the music creation process is a topic of keen interest and debate within the industry. Conferences and discussions are increasingly focusing on how AI can complement human creativity, offering new tools for artists and impacting the broader music ecosystem.

Conclusion

The music streaming market is characterized by rapid growth, driven by technological advancements, evolving consumer preferences, and strategic initiatives by industry players. Despite the challenges posed by copyright and licensing issues, the market’s trajectory remains upward, buoyed by the increasing adoption of streaming services, particularly in emerging economies, and the continuous innovation within the sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)