Table of Contents

Introduction

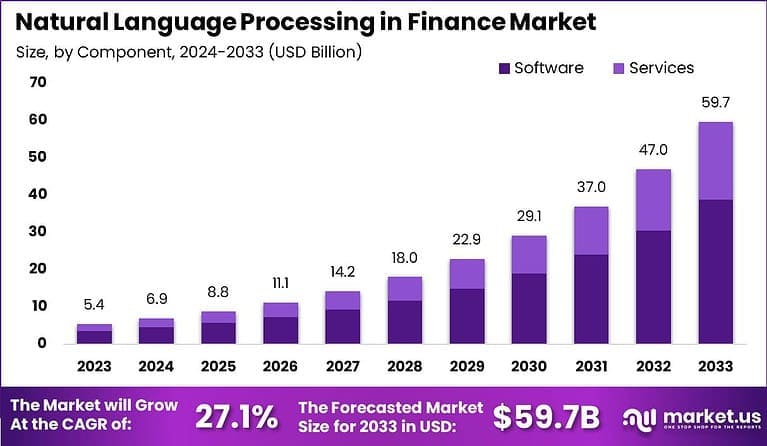

The global natural language processing (NLP) in finance market is experiencing tremendous growth, expected to reach USD 59.7 billion by 2033, up from USD 5.43 billion in 2023. This growth reflects a CAGR of 27.10% during the forecast period from 2024 to 2033.

NLP applications in finance are transforming how financial institutions process data, analyze customer sentiment, detect fraud, and improve decision-making. The market is driven by the increasing demand for automation, data-driven insights, and enhanced customer service in the financial industry. As NLP technology advances, financial services are becoming more efficient, accessible, and responsive.

How Growth is Impacting the Economy

The growth of NLP in finance is significantly impacting the global economy by enhancing the efficiency and productivity of financial institutions. With an increasing focus on automation and AI-driven insights, financial institutions can process vast amounts of unstructured data, including customer feedback, financial reports, and news articles, to make informed decisions. NLP applications help in streamlining back-office operations, improving customer service, and automating compliance tasks.

Moreover, as more businesses adopt NLP technologies, they are creating high-value jobs in AI, data science, and cybersecurity, driving employment in technology sectors. The rise of NLP in finance is also encouraging innovation in new financial products and services, further fostering economic growth. This technological advancement allows financial companies to cater to a global audience, particularly by expanding into emerging markets with cost-effective, automated solutions. The continuous adoption of NLP is contributing to economic efficiency, enhancing competitiveness in the financial services industry.

➤ Research uncovers business opportunities here @ https://market.us/report/natural-language-processing-in-finance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The widespread adoption of NLP in finance is raising operational costs, particularly in implementing advanced AI systems and training employees to utilize new technologies. Financial institutions are also investing in large-scale data infrastructure to handle the vast amounts of unstructured data that NLP systems process. As NLP solutions increasingly replace manual tasks in customer service and risk management, there is a shift in the supply chain towards automation and cloud-based platforms.

This has led to higher demand for cloud service providers and AI technology firms, while reducing the reliance on traditional IT infrastructure and personnel. Businesses are also adapting to this shift by outsourcing certain functions to technology vendors that specialize in NLP solutions, leading to changes in the global outsourcing landscape.

Sector-Specific Impacts

- Banking & Finance: NLP is revolutionizing fraud detection, compliance, and customer service by automating document processing, analyzing customer sentiment, and identifying suspicious activity.

- Investment: NLP helps analyze market sentiment, automate trading strategies, and optimize portfolio management by processing financial news, earnings reports, and market data.

- Insurance: Insurers use NLP to enhance claims processing and underwriting by extracting insights from customer communications and policy documents.

- Regulatory & Compliance: NLP assists in automating regulatory compliance, enabling financial institutions to monitor vast volumes of transactions and documents for compliance with global regulations.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=133091

Strategies for Businesses

To capitalize on the rapid growth of NLP in finance, businesses must focus on integrating NLP solutions into their existing IT systems, improving automation and data analysis capabilities. Investment in research and development will be critical to staying competitive, as the field of NLP continues to evolve. Financial institutions should focus on enhancing customer experiences through AI-powered chatbots, virtual assistants, and personalized financial advice.

Building partnerships with AI and NLP technology providers can help businesses access the latest innovations. Additionally, businesses should invest in employee training to ensure effective adoption of NLP technologies and maintain compliance with data privacy regulations. Expanding into emerging markets where financial institutions are adopting automation can offer new revenue opportunities.

Key Takeaways

- The NLP in the finance market is expected to reach USD 59.7 billion by 2033.

- CAGR of 27.10% reflects the rapid adoption of NLP across the finance sector.

- NLP is enhancing fraud detection, compliance, and customer service in banking and finance.

- Financial businesses must invest in AI and automation to improve efficiency and stay competitive.

- Market growth is driven by the demand for automation and enhanced data analysis capabilities in financial services.

Analyst Viewpoint

Currently, the NLP in finance market is experiencing a rapid expansion, driven by the growing need for automation and data-driven decision-making across financial services. In the present, the focus is on automating customer service and compliance operations through AI-driven NLP systems.

In the future, we can expect NLP technologies to advance further, integrating with emerging technologies such as blockchain and quantum computing, which will bring more sophisticated capabilities for fraud detection, risk management, and financial forecasting. The continued evolution of NLP will drive innovation in the financial sector, resulting in even more personalized and efficient services for consumers and businesses alike.

Regional Analysis

North America holds a dominant position in the NLP in finance market, capturing more than 36% of the market share, with USD 1.95 billion in revenue in 2023. The U.S. is a leader in adopting AI technologies, especially in financial services, due to advanced infrastructure and a strong technology ecosystem. Europe follows with increasing adoption of NLP in banking and insurance sectors, driven by regulatory demands and the need for improved customer engagement.

Asia-Pacific is expected to experience the highest growth, especially in China and India, where the finance sector is rapidly digitizing, creating substantial opportunities for NLP solutions. Latin America and Middle East & Africa are emerging markets with growing adoption of AI technologies in financial services, driven by increasing internet penetration and digital transformation.

Business Opportunities

The NLP in the finance market presents substantial business opportunities for AI and software developers, as well as financial institutions. Companies can explore providing AI-driven solutions for fraud detection, sentiment analysis, and document automation tailored to the finance sector. There is also significant potential in offering managed NLP services for small and medium-sized businesses looking to integrate AI technologies but lacking the infrastructure to do so independently.

As the demand for personalized financial services grows, businesses can capitalize on opportunities to provide NLP solutions for customer engagement and support. Such as AI chatbots, virtual assistants, and automated financial advisory services. Expanding into emerging markets offers additional opportunities as financial services digitize rapidly.

Key Segmentation

Application:

- Fraud Detection

- Compliance & Regulatory Monitoring

- Sentiment Analysis & Market Forecasting

- Customer Service Automation

Technology:

- Machine Learning

- Deep Learning

- Natural Language Understanding

- Speech Recognition

End-User:

- Banks & Credit Institutions

- Insurance Companies

- Investment Firms

- Regulatory Authorities

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Key Player Analysis

The NLP in the finance market is highly competitive. With numerous companies offering AI-driven solutions designed to streamline operations and enhance decision-making. Key players are focusing on improving machine learning models to better understand financial data, customer sentiment, and regulatory requirements.

Partnerships between financial institutions and technology providers are becoming increasingly important to develop and implement NLP solutions tailored to the specific needs of the finance sector. As demand for automation and AI integration increases, companies that can offer scalable and customizable NLP solutions will be well-positioned for success in the market.

Recent Developments

- A leading NLP provider launched an AI-powered solution to automate fraud detection and compliance monitoring in the banking sector.

- Financial institutions in North America are adopting NLP-based virtual assistants to enhance customer service and improve operational efficiency.

- An AI firm introduced an NLP-driven sentiment analysis tool to help investment firms make more informed market predictions.

- A prominent insurance provider deployed NLP technology to automate claims processing, improving customer experience and reducing operational costs.

- Several fintech startups have introduced NLP-based robo-advisors for personalized financial planning, expanding access to financial services.

Conclusion

The NLP in the finance market is set to grow significantly, reaching USD 59.7 billion by 2033. As AI technologies continue to transform the finance sector, businesses that invest in NLP solutions to improve fraud detection, compliance, and customer engagement will be well-positioned for long-term success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)