Table of Contents

Introduction

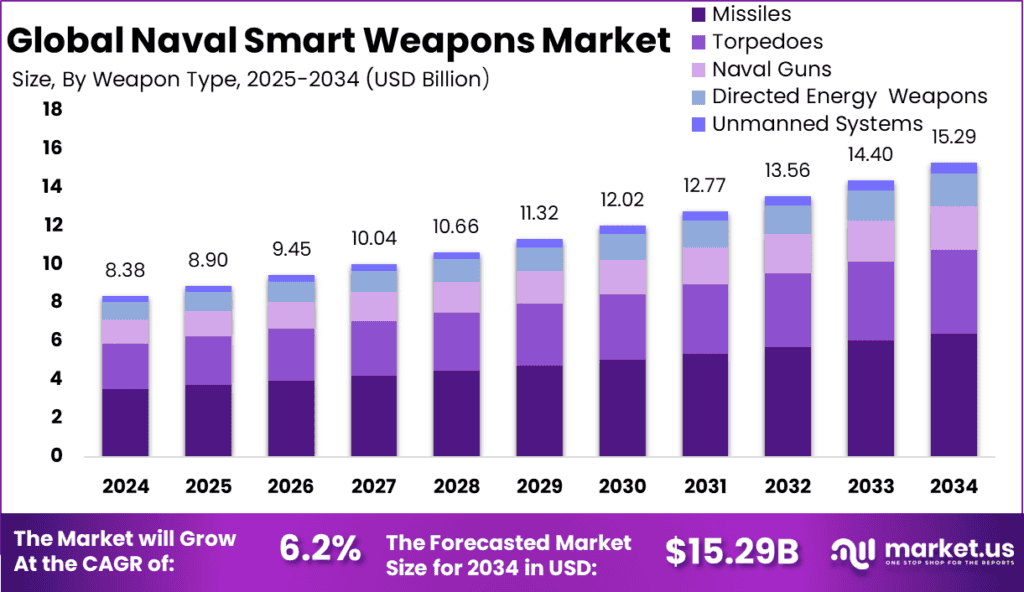

The global Naval Smart Weapons market is projected to reach approximately US$ 15.29 billion by 2034, up from US$ 8.38 billion in 2024, growing at a CAGR of 6.2% during 2025–2034. North America leads the market with a commanding 41% share, generating US$ 3.4 billion in revenue in 2024. Rising geopolitical tensions, advancements in defense technologies, and increased naval modernization programs are key drivers of market growth. Growing investments in smart missile systems, autonomous weapons, and precision-guided munitions contribute to the expanding demand globally.

How Growth is Impacting the Economy

The growth of the Naval Smart Weapons market plays a significant role in strengthening national defense capabilities, which indirectly supports economic stability. Increased defense spending stimulates manufacturing, research, and development sectors, creating high-skilled jobs and fostering innovation. The rise in production and export of smart weapons boosts defense trade balances, especially in leading manufacturing countries. Additionally, technological advancements in this sector often spill over into civilian industries, promoting wider economic benefits. Furthermore, enhanced naval security contributes to safer maritime trade routes, facilitating global commerce and reducing economic risks associated with piracy and conflicts.

➤ Get valuable market insights here @ https://market.us/report/naval-smart-weapons-market/free-sample/

Impact on Global Businesses

Global defense contractors and allied industries face rising costs due to investments in cutting-edge technology and compliance with strict regulatory standards. Supply chains are adapting to source advanced materials and components required for smart weapon systems, sometimes causing logistical challenges. Sector-specific impacts are prominent in aerospace, electronics, and manufacturing, where precision and reliability are paramount. Businesses must innovate rapidly to meet evolving defense requirements and maintain competitive advantages. Partnerships between technology firms and defense agencies are increasingly important for integrating artificial intelligence, guidance systems, and autonomous capabilities into naval weapons.

Strategies for Businesses

Businesses should prioritize research and development to innovate smart guidance, propulsion, and autonomous targeting technologies. Building strategic alliances with defense organizations and technology providers can accelerate product development and deployment. Focusing on modular and scalable weapon systems allows customization for various naval platforms. Ensuring compliance with international arms regulations and export controls is critical. Investing in cybersecurity measures protects sensitive defense data. Additionally, businesses should explore diversification into related defense segments to mitigate risks and capitalize on broader market opportunities.

Key Takeaways

- Naval Smart Weapons market to reach US$ 15.29 billion by 2034

- North America leads with 41% market share in 2024

- CAGR of 6.2% driven by technological advancements and naval modernization

- Growth supports defense sector employment and innovation

- Companies must invest in R&D, partnerships, and regulatory compliance

➤ Buy Full PDF report here @ https://market.us/purchase-report/?report_id=149776

Analyst Viewpoint

The Naval Smart Weapons market currently experiences steady growth fueled by geopolitical tensions and technological progress. Future prospects remain positive as navies worldwide invest in modernizing fleets with smart, autonomous weaponry. AI integration and precision targeting will drive innovation and market expansion. North America’s dominance is supported by substantial defense budgets and advanced R&D capabilities. Emerging economies’ increasing naval investments represent growth opportunities. Overall, the market is expected to sustain momentum, driven by strategic defense priorities and evolving warfare technologies.

Regional Analysis

North America dominated the market in 2024 with a 41% share, driven by extensive naval modernization and R&D investments. Europe shows moderate growth supported by collaborative defense initiatives and technology upgrades. Asia Pacific is an emerging market with increasing naval capabilities and procurement programs. Latin America and the Middle East & Africa exhibit slower adoption but growing interest due to regional security concerns. Regional differences reflect defense budgets, geopolitical dynamics, and industrial capabilities, shaping market strategies accordingly.

➤ Discover More Trending Research

- Mems High Density Probe Cards Market

- Low Voltage Current Converter Market

- North America Open RAN Market

- North America Drone Market

Business Opportunities

Opportunities include developing AI-enabled targeting systems, autonomous weapon platforms, and enhanced propulsion technologies. Growth in unmanned naval vehicles and precision-guided munitions offers niche markets. Export potential to allied countries with increasing naval budgets is significant. Collaborations between tech startups and defense contractors foster innovation. Additionally, cybersecurity solutions for weapon systems represent a critical emerging segment, addressing vulnerabilities in connected smart weapons.

Key Segmentation

The market is segmented as follows:

Weapon Type

- Smart Torpedoes

- Guided Missiles

- Autonomous Naval Drones

Technology

- AI & Machine Learning

- GPS/INS Navigation

- Infrared & Radar Guidance

Application

- Surface Warfare

- Submarine Warfare

- Coastal Defense

These segments address diverse operational and technological needs within naval defense.

Key Player Analysis

Leading companies focus on innovation in guidance systems, propulsion, and AI integration to enhance weapon accuracy and autonomy. They invest heavily in R&D and collaborate with governments to meet stringent defense standards. Expanding global footprints through strategic partnerships and export agreements strengthens their market position. Emphasis on modular designs and interoperability with naval platforms improves flexibility. Continuous enhancement of cybersecurity and electronic warfare capabilities differentiates top players in this competitive landscape.

Recent Developments

- Introduction of AI-powered autonomous naval drones in 2024

- Deployment of next-generation smart torpedoes with enhanced guidance systems in 2023

- Strategic alliances formed to develop hypersonic naval missiles in 2024

- Expansion of export contracts with allied nations in Asia Pacific during 2023

- Integration of advanced radar and infrared technologies in guided missiles launched in 2024

Conclusion

The Naval Smart Weapons market is poised for steady growth driven by technological advancements and global defense modernization. Companies investing in innovation and partnerships will capitalize on expanding opportunities in this critical defense sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)