Table of Contents

Introduction

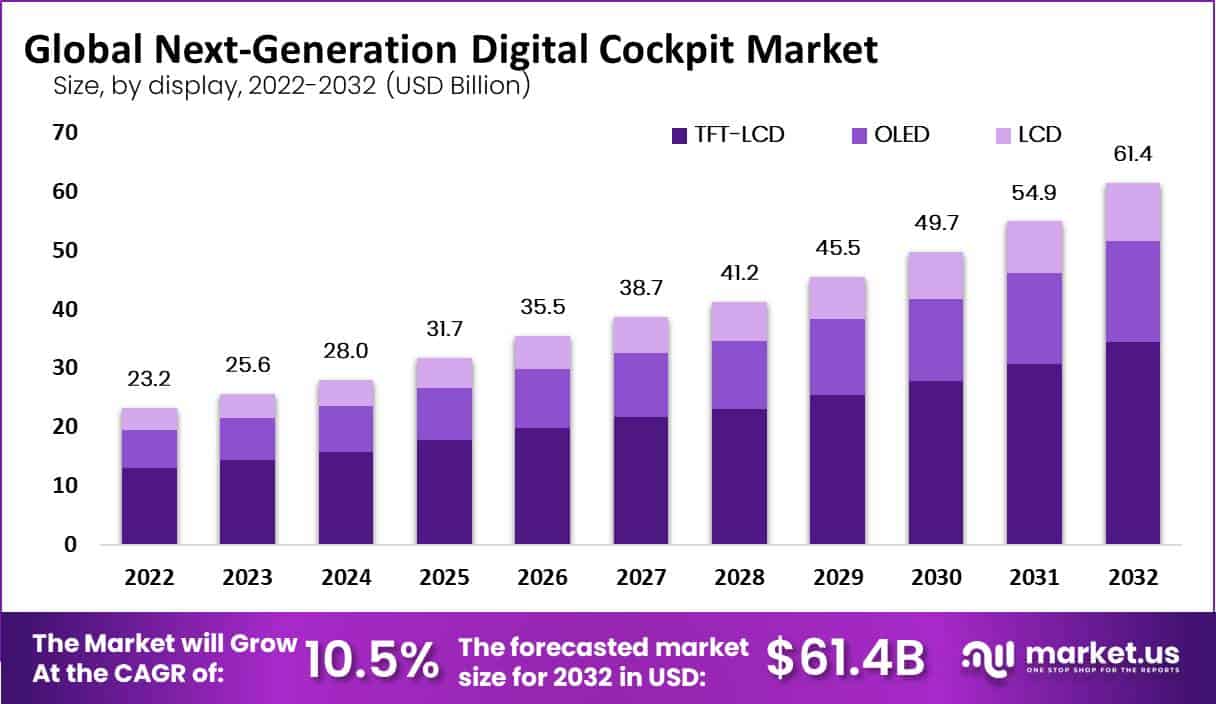

The Global Next-Generation Digital Cockpit market is projected to grow from USD 25.6 billion in 2023 to approximately USD 61.4 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.5% over the forecast period.

The Next-Generation Digital Cockpit market represents a pivotal evolution in automotive technology, integrating advanced display systems, AI-driven interfaces, and enhanced connectivity to transform the in-car experience. With consumers increasingly valuing immersive and intuitive digital interactions within their vehicles, this market has become a focal point for innovation in the automotive industry.

As automakers prioritize seamless integration of infotainment, navigation, and driver-assistance systems, the digital cockpit serves as a strategic enabler for differentiating vehicle models in a highly competitive landscape. This shift is particularly pronounced as manufacturers pivot toward electric and autonomous vehicles, where the digital cockpit not only enhances user experience but also plays a critical role in optimizing vehicle control and safety.

The Next-Generation Digital Cockpit market encompasses advanced in-vehicle systems that merge displays, voice-activated interfaces, and touch controls to create an integrated, digitalized driving environment.

These cockpits typically include high-resolution instrument clusters, infotainment systems, and heads-up displays (HUDs) that enable a more intuitive interaction between the driver, passengers, and the vehicle’s systems. The market is characterized by a shift from traditional analog gauges to digital dashboards, which can integrate navigation, entertainment, and vehicle diagnostics, offering a more personalized and interactive driving experience.

The growth of the Next-Generation Digital Cockpit market is primarily driven by technological advancements in automotive electronics and the increasing demand for enhanced in-car experiences. Key growth factors include the rise of connected vehicles, the proliferation of 5G networks, and the integration of advanced driver assistance systems (ADAS).

Automakers are increasingly investing in digital cockpits to differentiate their products, leveraging them as a competitive edge in the market. Moreover, regulatory requirements for safety, such as driver monitoring systems, further accelerate the adoption of advanced digital interfaces. As consumers seek greater convenience and entertainment options within their vehicles, digital cockpits are evolving to meet these expectations, thereby driving market expansion.

The demand for next-generation digital cockpits is largely influenced by changing consumer preferences toward smart, connected vehicles that offer a seamless blend of functionality and entertainment. This demand is particularly strong in premium and mid-segment passenger vehicles, where buyers are willing to invest in enhanced user interfaces and advanced display technologies.

As vehicle ownership models evolve, with more emphasis on shared mobility and fleet management, the demand for digital cockpits also extends to commercial and electric vehicles. This growing appetite for digital experiences on the go is encouraging automakers and technology providers to collaborate more closely, ensuring that digital cockpits are designed with user-centric features and interoperability in mind.

The market for next-generation digital cockpits holds significant potential, especially with the rise of electric vehicles (EVs) and autonomous driving technologies. As these trends gain momentum, the role of digital cockpits expands from being a mere interface to a central command center for vehicle control and passenger interaction. The shift towards EVs offers a unique opportunity for digital cockpit manufacturers to design interfaces that manage battery information, range monitoring, and charging status in a user-friendly manner.

Key Takeaways

- The global Next-Generation Digital Cockpit market is expected to grow from USD 25.6 billion in 2023 to USD 61.4 billion by 2032, with a compound annual growth rate (CAGR) of 10.5%. This growth is driven by rising consumer demand for enhanced in-car experiences and advancements in connectivity technologies.

- The Driver Monitoring System led the equipment type segment in 2022, accounting for 49% of the market share. This growth is supported by stricter safety regulations and the increasing adoption of autonomous driving technologies.

- TFT-LCD displays dominated the display segment, capturing a 56% market share in 2022, owing to their cost-effectiveness and adaptability across various vehicle models.

- Passenger cars held a dominant position in the vehicle type segment, with a 75% market share in 2022, reflecting strong consumer demand for advanced digital interfaces and infotainment systems.

- The Asia-Pacific region led the digital cockpit market, holding a 45% market share in 2022. This leadership is attributed to a robust automotive industry and growing demand for advanced vehicle technologies in countries such as China and India.

Next-Generation Digital Cockpit Statistics

- In 2023, over 60% of new vehicles globally had digital cockpit technology.

- Global connected car sales grew by 28% year-on-year in Q3 2023.

- Nearly 20% of cars sold in 2023 were electric, a 35% increase from the previous year.

- Implementing a next-generation digital cockpit system costs between USD 1,000 and USD 3,000.

- By 2025, more than 50 million vehicles will feature advanced driver assistance systems (ADAS).

- Integrating driver monitoring systems costs between USD 500 and USD 1,500 per vehicle.

- By 2030, machine learning advancements will enhance driver assistance features in 50% of new cars.

- In 2023, over 80% of luxury vehicles had fully digital instrument clusters.

- Around 30% of new vehicles in 2023 featured head-up displays (HUDs).

- The average size of center console displays in mid-range vehicles grew to 10.5 inches in 2023.

- More than 40% of new vehicles in 2023 had voice control features.

- OLED display use in digital cockpits increased by 25% from 2022 to 2023.

- Approximately 35% of digital cockpits included gesture control in 2023.

- The market for automotive AI-powered voice assistants was worth USD 2.5 billion in 2023.

- 5G integration in digital cockpits grew by 40% in 2023.

- Augmented reality (AR) in HUDs increased by 50% from 2022 to 2023.

- About 25% of new vehicles in 2023 had driver monitoring systems.

- Processing power of automotive-grade chipsets grew by 30% in 2023.

- Android Automotive OS adoption in digital cockpits rose by 35% in 2023.

- Around 20% of digital cockpits in 2023 used AI-based personalization.

- Haptic feedback in digital cockpit controls increased by 15% from 2022 to 2023.

- Over 50% of luxury cars offered digital side-view mirrors in 2023.

- Curved displays in digital cockpits saw a 20% increase in adoption in 2023.

- About 15% of new vehicles in 2023 had holographic display technology.

- Voice control systems improved accuracy by 10% due to better natural language processing in 2023.

- Biometric authentication was included in over 30% of digital cockpits in 2023.

- Over-the-air (OTA) software updates for digital cockpits grew by 45% in 2023.

- Approximately 25% of digital cockpits in 2023 had gesture-based payment systems.

- The use of anti-glare and anti-fingerprint coatings on displays increased by 30%.

- Cloud connectivity was included in over 40% of digital cockpits in 2023.

- The market for automotive-grade touch sensors reached USD 1.5 billion in 2023.

- Multi-modal interaction in digital cockpits grew by 25% in 2023.

- Eye-tracking technology was featured in around 20% of digital cockpits in 2023.

- AI-driven predictive maintenance alerts increased by 35% from 2022 to 2023.

- Over 50% of luxury vehicles in 2023 offered smart home integration.

- Split-screen functionality in center console displays grew by 30% in 2023.

- Around 15% of digital cockpits included in-vehicle payment systems in 2023.

- The use of AI-powered virtual assistants in digital cockpits increased by 40% in 2023.

- About 25% of digital cockpits monitored driver health in 2023.

- Multi-layer 3D displays in digital cockpits grew by 15% in 2023.

- Around 10% of digital cockpits in 2023 had olfactory feedback systems.

- AI-powered content recommendations in infotainment systems grew by 30% in 2023.

- More than 35% of digital cockpits in 2023 connected with wearable devices.

- Configurable ambient lighting systems grew by 25% in 2023.

- Around 20% of digital cockpits in 2023 had AR navigation overlays.

- AI-based voice emotion recognition increased by 20% in 2023.

- Over 30% of digital cockpits integrated 360-degree external camera views in 2023.

Emerging Trends

- AI-Driven Personalization: Artificial intelligence (AI) is increasingly central to digital cockpit design, enabling deeper personalization of in-car experiences. Through AI, systems can learn driver habits, adjust settings automatically, and provide tailored recommendations, creating a more intuitive interaction with the vehicle. Automakers are integrating AI-based voice assistants and large language models to enhance the user interface, allowing drivers to control functions through natural language.

- Integration of Augmented Reality (AR) Displays: AR is transforming how information is presented in digital cockpits. Next-generation head-up displays (HUDs) now integrate augmented reality, overlaying navigation directions, speed, and safety alerts directly onto the windshield. This enhances situational awareness and offers a safer, distraction-free driving experience. Companies like Aptiv and Continental are pushing the boundaries of these technologies.

- Modular and Upgradable Architectures: The transition to software-defined vehicles is driving the adoption of modular digital cockpit platforms. These architectures enable over-the-air (OTA) updates, allowing new features to be deployed throughout a vehicle’s life cycle. This approach not only supports faster innovation but also offers automakers the flexibility to customize software solutions for different models and regions, as seen with Visteon’s SmartCore platform.

- Enhanced In-Vehicle Connectivity: Connectivity remains a cornerstone of next-generation digital cockpits, offering seamless integration with cloud services and external devices. With advancements in 5G and vehicle-to-everything (V2X) communications, vehicles can provide high-speed internet access, stream content, and support real-time navigation updates. This connectivity is pivotal in creating a “workplace on wheels” environment, catering to the growing demand for in-car productivity and entertainment.

- Focus on Safety and Driver Monitoring: Advanced driver monitoring systems (DMS) are becoming standard in new digital cockpit designs. Using cameras and AI algorithms, these systems can track driver attention and detect drowsiness or distraction, providing real-time alerts. This enhances safety, especially in semi-autonomous driving scenarios. Integrating such features is becoming a differentiator for automakers, helping to meet regulatory requirements and improve the overall user experience

Top Use Cases

- Enhanced Infotainment Systems with Seamless Connectivity: Modern digital cockpits integrate advanced infotainment systems that deliver smartphone-like experiences within vehicles. This includes features such as cloud-based navigation, voice recognition, and app mirroring, allowing users to access their favorite apps and media directly on the car’s display. With platforms like Android Automotive, carmakers can provide more frequent over-the-air (OTA) updates, keeping software fresh and responsive to user needs.

- Driver and Occupant Monitoring: Safety is a key focus in next-gen cockpits, with integration of advanced driver and occupant monitoring systems. Using interior cameras and AI, these systems can track driver attentiveness, issue alerts in case of drowsiness, and even adjust settings based on passenger profiles. This feature is especially important as vehicles approach higher levels of autonomy, ensuring that drivers remain alert when necessary.

- Integrated Advanced Driver-Assistance Systems (ADAS): Next-generation digital cockpits enable seamless integration of ADAS, offering real-time displays of critical information such as lane-keeping assist, blind-spot monitoring, and adaptive cruise control data. This integration allows for a centralized display of driving conditions, improving situational awareness and safety. As ADAS adoption grows, the digital cockpit becomes a hub for delivering visual and audio feedback to drivers, enhancing their decision-making on the road.

- Customizable User Interfaces and Multi-Screen Setups: The shift from traditional dashboards to fully digital, multi-display setups enables a more personalized driving experience. Automakers can implement flexible screen configurations that display different information to the driver and passengers, such as navigation on the main screen while entertainment options are shown on secondary displays. This customization caters to varying user needs and enhances in-cabin experiences, especially in premium vehicles.

- Support for Electric Vehicle (EV) Integration: Digital cockpits play a crucial role in EVs by providing detailed battery management, charging status, and energy consumption insights directly on the user interface. As the global market for EVs grows—expected to reach over 25% of vehicle sales by 2030—the ability of digital cockpits to integrate with vehicle electrification becomes a differentiating factor. This allows drivers to optimize charging strategies and access route planning for charging stations

Major Challenges

- Integration Complexity: The digital cockpit requires seamless integration of diverse hardware and software components, such as advanced driver-assistance systems (ADAS), infotainment, and communication modules. The shift towards a software-defined vehicle (SDV) model necessitates new architectures that can handle these complexities, making middleware crucial for managing interactions across systems. Achieving this integration without compromising on performance remains a critical hurdle for automakers and suppliers.

- High Development Costs: Developing next-generation digital cockpit systems involves substantial investment, particularly in the areas of high-performance chipsets and artificial intelligence (AI). For instance, top-tier chips from companies like Qualcomm and NVIDIA are integral for supporting the computing power needed, but they come with a high price tag. This makes it challenging for automakers to balance the costs while offering competitive pricing in different vehicle segments.

- Cybersecurity and Data Privacy: As digital cockpits become more connected through cloud services and AI capabilities, they present a growing target for cybersecurity threats. Protecting sensitive user data, such as personal settings and navigation histories, is paramount. The industry must adhere to stringent regulatory standards, which can vary by region, making it complex for manufacturers to ensure compliance across global markets.

- User Experience Consistency: Consumers now expect a smooth, smartphone-like experience in their vehicles. This includes intuitive user interfaces, fast response times, and reliable voice controls. Achieving such a user experience is particularly challenging in automotive environments due to variability in hardware performance across different vehicle models. Automakers must ensure that digital cockpit systems deliver a consistent user experience without significant lag or errors.

- Scalability of Platforms: Developing digital cockpits that can scale across various car models is crucial for cost-effectiveness, especially for automakers aiming to offer both luxury and entry-level vehicles. This requires adaptable architectures that can support different functionalities without extensive redesign. Centralized computing platforms and scalable software architectures are critical here, but adapting these across a diverse product lineup can be technically demanding and costly

Top Opportunities

- Rising Adoption of Electric Vehicles (EVs): The global shift towards electric vehicles creates substantial opportunities for advanced digital cockpits. EVs rely heavily on software-defined architectures to manage battery performance, integrate with infotainment systems, and provide real-time data on vehicle status. The market for digital cockpits is expected to grow at a compound annual growth rate (CAGR) of around 11.8% from 2024 to 2032, with EV integration playing a crucial role in this expansion.

- Increased Demand for Advanced Driver Assistance Systems (ADAS): With safety and automation becoming more critical in the automotive industry, the integration of ADAS in digital cockpits is a major growth driver. Technologies such as camera-based driver monitoring systems are gaining traction, helping automakers enhance safety by providing real-time driver behavior analysis. This segment is expected to see significant growth as consumers prioritize safety features.

- Expansion of 5G Connectivity: The roll-out of 5G networks is a game-changer for the digital cockpit market, enabling faster and more reliable connectivity in vehicles. This enhanced communication infrastructure supports real-time cloud services, augmented reality (AR) displays, and seamless integration of streaming and navigation services. In regions like Asia-Pacific, where demand for connected and smart vehicles is high, 5G integration is expected to drive significant growth in the digital cockpit sector.

- Customization and AI-Driven Personalization: Automakers are increasingly incorporating artificial intelligence (AI) in digital cockpits to deliver tailored user experiences. AI systems can adjust in-vehicle settings like climate control, seat positioning, and infotainment preferences based on user behavior and preferences. This trend is particularly strong in premium vehicle segments, where automakers aim to differentiate their offerings through superior in-cabin experiences.

- Growth in Emerging Markets: Regions like Asia-Pacific, including China and India, present considerable growth potential due to rising consumer demand for advanced in-car technology. As mid-range and economy vehicles start integrating digital cockpits, these markets are expected to contribute significantly to the industry’s growth. By 2028, the market size for automotive digital cockpits is projected to reach around USD 49.19 billion, with a notable portion of this growth coming from these emerging market

Key Player Analysis

- Continental AG: Continental is a leading player in the digital cockpit market, leveraging its expertise in advanced driver assistance systems (ADAS) and integrated software platforms. The company is known for its high-performance digital instrument clusters and heads-up displays (HUD). Continental’s strategic focus on software-defined vehicles allows it to offer scalable solutions, supporting growth in autonomous and connected vehicle technologies.

- Denso Corporation: A major supplier in the automotive sector, Denso is focusing on AI-driven digital cockpit solutions and integrated in-car systems. Denso’s expertise lies in combining infotainment with safety features like driver monitoring systems. This has positioned the company well in regions like Asia-Pacific, which is seeing rapid adoption of connected cars. Denso’s continued investment in R&D aims to enhance user safety and comfort through advanced displays and interfaces.

- Faurecia SE: Faurecia specializes in developing human-machine interface (HMI) solutions for digital cockpits, such as advanced head units and immersive displays. The company’s strategy emphasizes user experience and personalization, integrating features like voice recognition and biometric security.

- Garmin Ltd.: Known for its navigation and infotainment systems, Garmin brings a strong background in GPS technology to the digital cockpit market. The company is a preferred supplier for various automakers, particularly in North America, where demand for connected vehicle technologies is high. Garmin’s focus on intuitive user interfaces and seamless integration of smartphone connectivity makes it a competitive player in the evolving digital cockpit landscape.

- HARMAN International: A subsidiary of Samsung, HARMAN is a key player in audio and infotainment systems for digital cockpits. Its “HARMAN Ready Upgrade” platform allows automakers to introduce new features through over-the-air (OTA) updates, enabling continuous enhancement of the in-car experience. HARMAN’s partnerships with premium car brands, such as its collaboration with Ferrari, underscore its focus on high-end automotive markets. The company’s offerings are integral to a market expected to grow significantly as vehicle connectivity becomes more sophisticated

Recent Developments

- In 2023, in Las Vegas, ECARX and smart introduced their new high-performance digital cockpit platform at CES 2023. This innovative platform, developed collaboratively, leverages advanced AMD technology to elevate the in-car digital experience.

- In 2023, BlackBerry Limited and PATEO, a leading provider of Internet of Vehicles (IoV) technology from China, announced that Dongfeng Motor selected their BlackBerry IVY™-powered digital cockpit for the next-generation electric VOYAH H97 model. This decision followed a successful proof of concept (POC) test.

- In 2023, Analog Devices, Inc. and Hon Hai Technology Group, better known as Foxconn (TWSE: 2317), signed a Memorandum of Understanding (MoU). This partnership focuses on developing advanced digital car cockpits and a high-performance battery management system (BMS). The agreement was formalized by ADI’s CEO, Vincent Roche, and Foxconn’s CEO, Young Liu.

- In 2023, ECARX Holdings, Inc. hosted its first investor day, showcasing a range of new technologies aimed at enhancing the driving experience. Key announcements included Super Brain, an integrated central computing system, and Makalu, a state-of-the-art cockpit platform with real-time 3D rendering and enhanced safety features. ECARX also highlighted its partnership with Epic Games to develop 3D immersive in-vehicle digital cockpits and infotainment systems.

- In January 4, 2023, Visteon and Qualcomm Technologies, Inc. announced plans to expand their technology collaboration with the development of a high-performance cockpit domain controller. This initiative aims to empower global automakers in creating next-generation cockpit systems.

Conclusion

The next-generation digital cockpit market is poised for substantial growth as it aligns with the evolving needs of the automotive industry. Technological advancements such as augmented reality (AR), voice recognition, and 5G connectivity are transforming the digital cockpit into a central hub for vehicle information and entertainment . As automakers continue to shift towards electric and autonomous vehicles, digital cockpit solutions become essential for managing complex software architectures and delivering a seamless user experience.

The integration of cloud-based services and over-the-air updates ensures that vehicles stay current with the latest functionalities, appealing to tech-savvy consumers. Moreover, emerging markets, particularly in Asia-Pacific, present significant opportunities for growth due to their expanding middle class and increasing preference for connected vehicles

The future of the digital cockpit is closely tied to collaborations between automotive manufacturers and technology companies. This will be crucial for developing innovative, scalable solutions that meet rising consumer expectations for connectivity and safety. As the market evolves, the next-generation digital cockpit is set to become a defining feature of modern vehicles, providing both a competitive edge for manufacturers and an enriched driving experience for consumers

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)