Table of Contents

Introduction

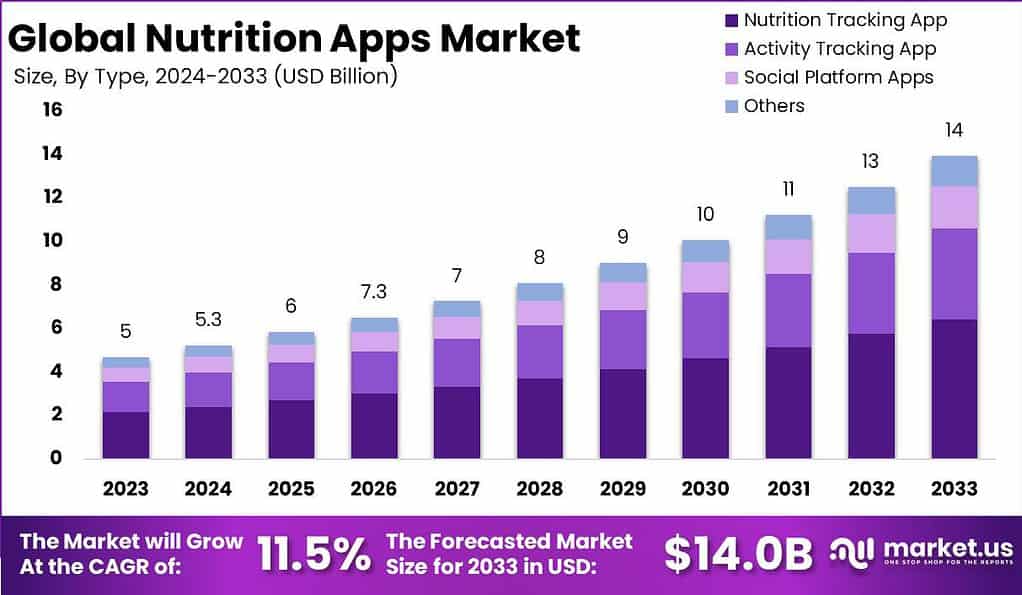

According to Market.us, The Nutrition Apps Market is poised for substantial growth, projected to reach USD 14.0 billion by 2033, with a robust CAGR of 11.5% from 2024 to 2033. These apps serve as digital tools that assist users in managing their dietary habits through features like meal tracking, nutritional analysis, and personalized diet recommendations.

The Nutrition Apps Market is poised for substantial growth, driven by increasing health awareness and the widespread adoption of mobile technology. These apps offer users convenient ways to track their dietary habits, access nutritional information, and personalize their health goals, contributing to the market’s expansion. The rise in obesity rates globally and the growing interest in fitness and wellness are significant growth factors. Additionally, advancements in artificial intelligence and machine learning enhance the functionality and user experience of these apps, creating more opportunities for market expansion.

One of the key drivers of the nutrition apps market is the increasing prevalence of chronic diseases, such as obesity, diabetes, and cardiovascular conditions. People are becoming more aware of the impact of nutrition on overall health and are actively seeking ways to improve their diet. Nutrition apps offer features like food tracking, meal planning, calorie counting, and nutrient analysis, empowering individuals to monitor their nutritional intake and make healthier choices.

Additionally, the growing adoption of smartphones and mobile devices has significantly contributed to the market’s growth. With the availability of nutrition apps on various platforms, individuals can conveniently access information and tools anytime and anywhere. The ease of use and accessibility of nutrition apps make them attractive to a wide range of users, including health-conscious individuals, athletes, and individuals with specific dietary needs.

To learn more about this report – request a sample report PDF

However, challenges exist in the nutrition apps market. One challenge is the accuracy and reliability of nutrition data. App developers need to ensure that their databases are comprehensive, up-to-date, and scientifically validated to provide accurate nutritional information to users. Additionally, maintaining user engagement and adherence to app usage can be a challenge, as individuals may lose interest or find it difficult to sustain long-term usage of nutrition apps.

Despite these challenges, there are ample opportunities for growth. The increasing adoption of wearable devices that can sync with nutrition apps offers new avenues for integration and innovation. There is also a growing trend of partnerships between app developers and healthcare providers, which can enhance the credibility and effectiveness of these apps. Additionally, expanding into emerging markets with rising health awareness presents a significant opportunity for growth. Overall, the nutrition apps market is poised for continued expansion, driven by technological advancements and the increasing focus on health and wellness.

Key Takeaways

- The Nutrition Apps Market is projected to reach USD 14.0 Billion by 2033, up from USD 5.0 Billion in 2023. This represents a strong compound annual growth rate (CAGR) of 11.5% from 2024 to 2033.

- In 2023, the Nutrition Tracking App segment dominated the market, capturing over 46% of the share. This prominence is due to the growing demand for personalized dietary guidance and the ease of tracking food intake digitally.

- The iOS segment also performed exceptionally well in 2023, holding a dominant market position with over 55% of the share. The popularity of iOS devices is attributed to their seamless app integration within the Apple ecosystem and high penetration rates in key markets.

- North America led the nutrition apps market in 2023, capturing over 40% of the share, with revenues reaching around USD 2.0 billion. This leadership is driven by high smartphone penetration, increased health awareness, and substantial investments in digital health technologies in the region.

Nutrition Apps Statistics

- The Global Virtual Nutrition Coach App Market is projected to reach a market size of approximately USD 1,111.4 billion by 2033, up from USD 248.3 billion in 2023.

- The market is expected to grow at a CAGR of 16.17% during the forecast period from 2024 to 2033.

- User penetration in health apps will be 4.40% in 2024, with expectations to reach 5.36% by 2029.

- The Average Revenue Per User (ARPU) is forecasted to be approximately USD 15.29.

- In global comparison, India will generate the highest revenue in the health app market, with an estimated USD 1,581.2 million in 2024.

- For 2023, India is projected to generate the highest revenue at USD 1,236.00 million.

- The health app industry produced USD 3.43 billion in 2023, marking a 9.9% increase from the previous year.

- Noom led the market in 2023, generating USD 500 million in revenue, followed by WeightWatchers with substantial earnings from digital subscriptions.

- There were 311 million health app users in 2023.

- Health apps saw a total of 379 million downloads in 2023.

Top 5 Best Nutrition Apps

- MyFitnessPal MyFitnessPal is widely recognized for its extensive food database, which contains over 14 million foods. This app simplifies food logging by allowing users to scan barcodes or search for items. It provides a detailed breakdown of daily macronutrient intake, helping users stay on track with their nutrition goals. The app also supports creating a personalized food database, making it easier to log frequently consumed items.

- Fooducate Fooducate focuses on educating users about healthy eating rather than just counting calories. It analyzes the quality of calories consumed, highlighting added sugars, artificial sweeteners, trans fats, and other potentially harmful ingredients. Each food item is graded from A to D based on its nutritional value, helping users make healthier choices. The app also provides community support and nutritional tips, making it a comprehensive tool for those looking to improve their diet.

- Carb Manager Designed specifically for those following a keto diet, Carb Manager tracks net carbs, calories, ketones, and other relevant metrics. The app features a large database of foods and recipes, and it can connect with other fitness apps and devices like Fitbit and Apple Watch. Carb Manager helps users maintain their keto lifestyle by offering personalized meal plans, grocery lists, and the ability to log food via photo or voice command.

- Ate Food Journal Ate Food Journal promotes intuitive eating and mindfulness. Instead of tracking calories, this app focuses on helping users understand their hunger cues and find enjoyment in food without judgment. Users can log their intake using photos or written logs and share their data with friends or dietitians. The app tracks dietary intake, water consumption, exercise, and sleep patterns, offering a holistic approach to health and nutrition.

- Lifesum Lifesum offers a well-rounded approach to health and wellness by focusing on calorie tracking, exercise planning, and sleep schedules. It includes a user-friendly food diary, community-based support, and healthy recipes. The app is designed to help users develop balanced and sustainable food habits, whether their goal is weight loss or improving overall nutrition.

Emerging Trends

- Personalized Nutrition: Advancements in AI and machine learning are driving the trend towards personalized nutrition. Apps are increasingly offering tailored dietary recommendations based on individual health data, preferences, and goals, enhancing user engagement and outcomes.

- Focus on Mental Well-being: Nutrition apps are expanding their scope to include mental health and cognitive function. This trend reflects growing awareness of the link between diet and mental well-being. Apps now offer features that promote healthy eating habits to support mental health, stress reduction, and cognitive performance.

- Mental Health Focus: There is a growing emphasis on the connection between nutrition and mental health. Apps are beginning to include features that focus on the mental well-being of users, promoting diets that support cognitive function and reduce stress.

- Gamification: To increase user engagement, many nutrition apps are incorporating gamification elements. These features include challenges, rewards, and social sharing options that make tracking nutrition and maintaining healthy habits more interactive and motivating.

- Sustainability and Ethical Eating: With increasing consumer awareness about environmental issues, many apps now feature guidance on sustainable and ethical eating. This includes promoting plant-based diets and providing information on the environmental impact of different food choices.

Top Use Cases for Nutrition Apps

- Calorie Counting and Meal Tracking: One of the primary uses of nutrition apps is tracking daily calorie intake and logging meals. Apps like MyFitnessPal and Lose It! offer extensive food databases and barcode scanners to simplify the process.

- Weight Management: Many users turn to nutrition apps for weight loss or gain. These apps provide personalized meal plans, track physical activity, and offer progress reports to help users meet their weight goals. Examples include Noom and Lifesum.

- Dietary Recommendations and Meal Planning: Nutrition apps often offer meal planning services that cater to specific dietary needs and preferences, such as vegan, keto, or gluten-free diets. They help users plan balanced meals and ensure they meet their nutritional requirements.

- Fitness and Performance Tracking: Integrated with fitness tracking, nutrition apps help users optimize their diet for better athletic performance. These apps provide nutritional guidance tailored to workout routines and recovery needs, appealing to fitness enthusiasts and athletes.

- Chronic Disease Management: Nutrition apps play a crucial role in managing chronic diseases such as diabetes and cardiovascular conditions. They provide tools to monitor blood sugar levels, track nutrient intake, and offer educational resources to help users manage their health conditions more effectively.

Major Challenges

- Data Privacy and Security Concerns: The increasing use of nutrition apps involves the collection and processing of sensitive personal data, including health and dietary habits. Ensuring robust data privacy and security measures to protect user information from breaches and misuse remains a significant challenge. Users are increasingly aware of privacy issues, which can impact the adoption and trust in these apps.

- User Engagement and Retention: Keeping users engaged over the long term is challenging due to the need for sustained motivation to maintain healthy habits. Many users may initially download and use the app but eventually discontinue due to a lack of motivation, perceived complexity, or inadequate personalized support.

- Competition and Market Saturation: The nutrition apps market is highly competitive with numerous players offering similar functionalities, leading to market saturation. This makes it difficult for new entrants to differentiate their offerings and capture market share. Additionally, established apps constantly innovate, making it challenging for smaller or newer apps to keep up.

- Regulatory and Compliance Issues: Varying regulations across different regions concerning health and dietary advice pose challenges for app developers. Compliance with health regulations, obtaining necessary certifications, and ensuring the accuracy of nutritional information provided by the apps are critical but complex tasks.

- Technological Integration and Updates: Integrating the latest technology and ensuring that apps remain compatible with the continuous updates of mobile operating systems (iOS, Android) can be a significant challenge. Regular updates and maintenance are required to ensure smooth functionality, which can be resource-intensive.

Market Opportunities

- Personalization and AI Integration: Leveraging artificial intelligence (AI) to provide highly personalized dietary recommendations can significantly enhance user engagement and satisfaction. AI can analyze individual user data to offer tailored meal plans, track progress, and provide motivational insights, thereby increasing app effectiveness and retention rates.

- Expansion in Emerging Markets: There is substantial growth potential in emerging markets where smartphone penetration is rapidly increasing. Regions such as Asia-Pacific and Latin America present significant opportunities due to the growing awareness of health and wellness, and the increasing prevalence of chronic diseases requiring dietary management.

- Integration with Wearable Devices: Developing compatibility with wearable fitness devices (like smartwatches) can enhance the functionality of nutrition apps by providing comprehensive health tracking. This integration can offer users a holistic view of their health and wellness, combining dietary data with physical activity and vital statistics.

- Corporate Wellness Programs: There is an opportunity to partner with businesses to include nutrition apps as part of corporate wellness programs. Companies are increasingly investing in employee health initiatives, and providing access to nutrition apps can be a valuable addition to their wellness offerings.

- Focus on Specific Demographics: Targeting specific user groups, such as pregnant women, athletes, or individuals with specific dietary needs (e.g., diabetes management), can create niche markets. Providing specialized content and support tailored to these groups can differentiate apps and attract dedicated user bases.

Recent Developments

- Under Armour Inc. continued to enhance its MyFitnessPal app with new integrations and features. In early 2024, the company introduced a partnership with several food delivery services to provide users with healthier meal options directly from the app.

- MyFitnessPal Inc. introduced a significant update in early 2024, focusing on improving user interface and experience. The update includes new meal recommendations based on user preferences and dietary goals, enhancing the app’s personalization capabilities

- Azumio Inc. expanded its app’s capabilities in 2023 by incorporating new fitness tracking features that complement its nutrition tracking functionalities. This holistic approach aims to provide users with a comprehensive health management tool.

- Lifesum AB launched an innovative update in late 2023 that includes a feature for tracking micronutrients, addressing a common user request. This update has positioned Lifesum as a leading app in providing detailed nutritional analysis.

- In October 2023, Noom launched Noom Med, a clinical obesity management solution that offers access to healthcare professionals and medications. This new service was unveiled at HLTH 2023 in Las Vegas and aims to provide comprehensive support for users with significant weight management needs.

Conclusion

The nutrition apps market is poised for substantial growth, driven by increasing health consciousness and the proliferation of mobile technology. However, challenges such as data privacy, user engagement, market competition, regulatory compliance, and technological integration must be addressed to sustain this growth. Opportunities lie in the personalization of app experiences through AI, expansion into emerging markets, integration with wearable devices, corporate wellness partnerships, and targeting specific demographics. By navigating these challenges and capitalizing on these opportunities, nutrition app developers can enhance user experiences and contribute to better health outcomes on a global scale.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)