Table of Contents

Introduction

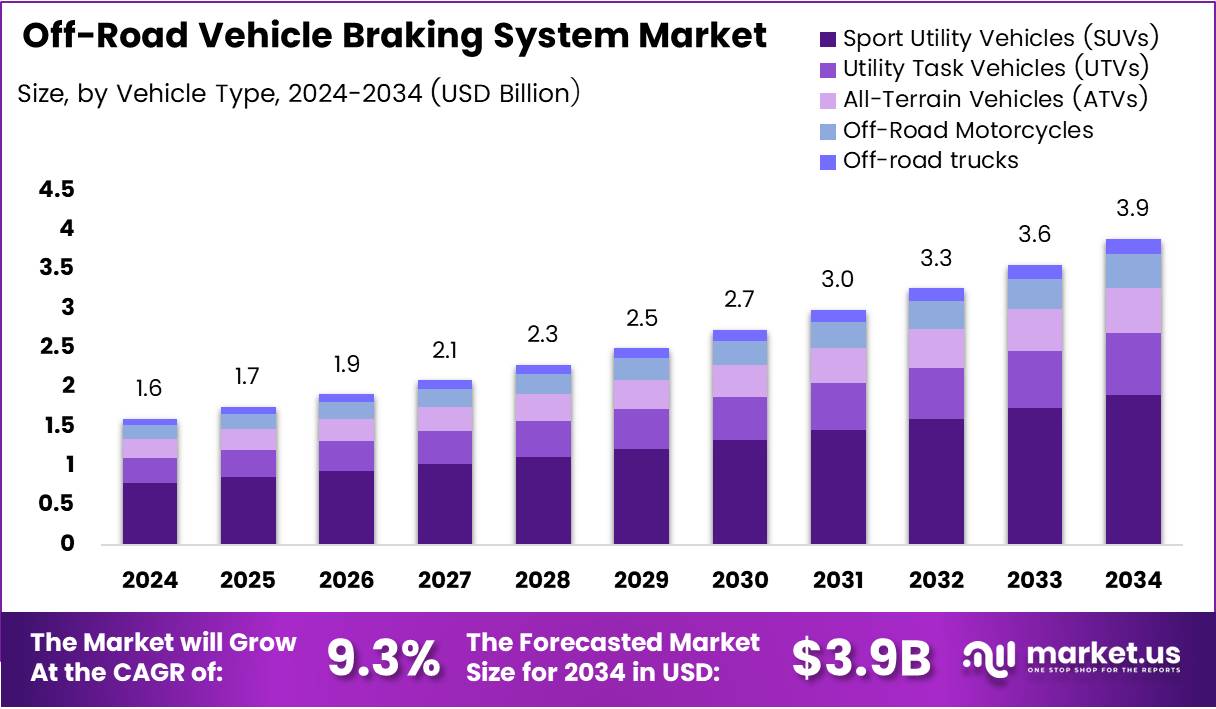

The Global Off-Road Vehicle Braking System Market is poised for substantial growth, with projections estimating a rise from USD 1.6 billion in 2024 to USD 3.9 billion by 2034, reflecting a robust CAGR of 9.3% over the forecast period. This growth is primarily driven by the increasing demand for high-performance braking technologies across various sectors including agriculture, construction, defense, and recreational applications. As off-road vehicles become more powerful and versatile, there is a rising need for advanced braking solutions to ensure safety, performance, and durability in challenging terrains.

Key Takeaways

- The Global Off-Road Vehicle Braking System Market is expected to reach USD 3.9 billion by 2034, growing at a CAGR of 9.3%.

- Sport Utility Vehicles (SUVs) dominate the vehicle type segment, holding a 31.8% share in 2024.

- Hydraulic Brakes are the leading brake type, valued for their superior control and efficiency.

- The agricultural off-roading application segment holds the largest share, driven by mechanized farming and UTV adoption.

- North America leads the market with a 36.1% share, owing to strong consumer spending and safety regulations.

Key Market Segments

- By Vehicle Type:

- Sport Utility Vehicles (SUVs): Leading with 31.8% share due to their versatile performance across diverse terrains.

- Utility Task Vehicles (UTVs) and All-Terrain Vehicles (ATVs): Gaining popularity among agricultural and recreational users.

- Off-Road Motorcycles and Trucks: Serving niche markets like motorsports and heavy-duty applications.

- By Brake Type:

- Hydraulic Brakes: Dominating the market, preferred for their stopping power and control.

- Pneumatic Brakes: Common in larger off-road trucks.

- Disc Brakes: Increasing adoption due to heat resistance.

- Electromechanical Brakes: Emerging for electric off-road vehicles.

- By Application:

- Agricultural Off-Roading: The dominant sector, spurred by mechanized farming.

- Commercial Off-Roading: Growing with the rise in construction and logistics.

- Recreational Off-Roading: Gaining momentum with the surge in adventure tourism.

Drivers

- Technological Advancements: The integration of advanced braking technologies like Anti-lock Braking Systems (ABS), Electronic Brake-force Distribution (EBD), and regenerative braking is enhancing vehicle performance, particularly in demanding environments.

- Recreational Vehicle Growth: Increasing recreational off-roading activities in rural areas demand higher braking performance, pushing manufacturers to innovate in braking technologies.

- Industrial Expansion: The growing use of off-road vehicles in sectors like mining, construction, and agriculture necessitates the adoption of reliable and durable braking systems to ensure safety and operational efficiency.

- Regulatory Pressures: Stricter safety regulations, especially in North America and Europe, require the incorporation of advanced braking systems to meet industry standards.

Use Cases

- Agriculture: Off-road vehicles like UTVs and all-terrain vehicles (ATVs) are used extensively for farming tasks, where reliable braking systems ensure safety in rugged and often unpredictable conditions.

- Construction and Mining: Heavy-duty off-road trucks and machinery require braking systems that can withstand extreme workloads, while also ensuring precise control on rough terrain.

- Military and Defense: High-performance braking systems are critical for military vehicles operating in harsh, unpredictable environments, where reliability and safety are paramount.

- Recreational Off-Roading: ATV and motorcycle enthusiasts require advanced braking solutions for safety during leisure activities in challenging outdoor environments.

Major Challenges

- High Maintenance Costs: Off-road braking systems are costly to maintain due to their susceptibility to wear in extreme conditions, leading to higher operational costs for businesses with large vehicle fleets.

- Limited Availability of Spare Parts: In remote regions, the unavailability of replacement parts poses significant challenges, causing delays and increasing downtime for operators.

- Space and Weight Limitations: Compact off-road vehicles face difficulties integrating advanced braking technologies without affecting performance or adding excessive weight.

- Customization Challenges: Designing braking systems that are equally effective across varied terrains such as sand, mud, and snow remains complex and costly.

Business Opportunities

- Regenerative Braking Systems: With the rise of electric and hybrid off-road vehicles, regenerative braking systems present an opportunity to improve energy efficiency and performance.

- Autonomous Off-Road Mobility: The growing demand for autonomous off-road vehicles presents an opportunity for developing intelligent braking systems, capable of adapting to terrain and vehicle status in real-time.

- Strategic Partnerships: Collaborations between OEMs and brake technology companies can lead to the development of next-generation braking systems tailored for specific vehicle types or applications.

- Eco-friendly Materials: There is an increasing focus on sustainable manufacturing, with a growing demand for eco-friendly materials like non-asbestos brake pads and low-emission lubricants.

Regional Analysis

- North America: Leading the market with a 36.1% share, North America benefits from a robust off-road vehicle market, driven by high consumer demand and stringent safety regulations.

- Europe: Europe’s focus on environmental sustainability and safety drives demand for high-performance braking systems. Countries like Germany and the UK are key contributors to the market.

- Asia Pacific: Rapid industrialization in China and India fuels the adoption of off-road vehicles, boosting the demand for advanced braking systems in construction and agricultural applications.

- Middle East and Africa: Increasing infrastructure projects and mining activities are driving demand in this region, although the market is still in its developmental phase.

Recent Developments

- January 2025: Powersports announced a revenue of €30 million, bolstering its portfolio in the motorcycle components sector. This acquisition strengthens their off-road product offerings.

- July 2024: ZF Friedrichshafen AG secured a €425 million loan from the European Investment Bank to advance its investment in next-generation braking and steering technologies.

Conclusion

The Off-Road Vehicle Braking System Market is experiencing strong growth, driven by technological advancements, increasing demand for safety features, and the expansion of off-road vehicle applications across agriculture, construction, and recreation. The market is ripe with opportunities for innovation, especially with the rise of electric vehicles and autonomous mobility. Companies that capitalize on these trends, while addressing challenges such as high maintenance costs and parts availability, will be well-positioned to thrive in this evolving market landscape.