Table of Contents

Introduction

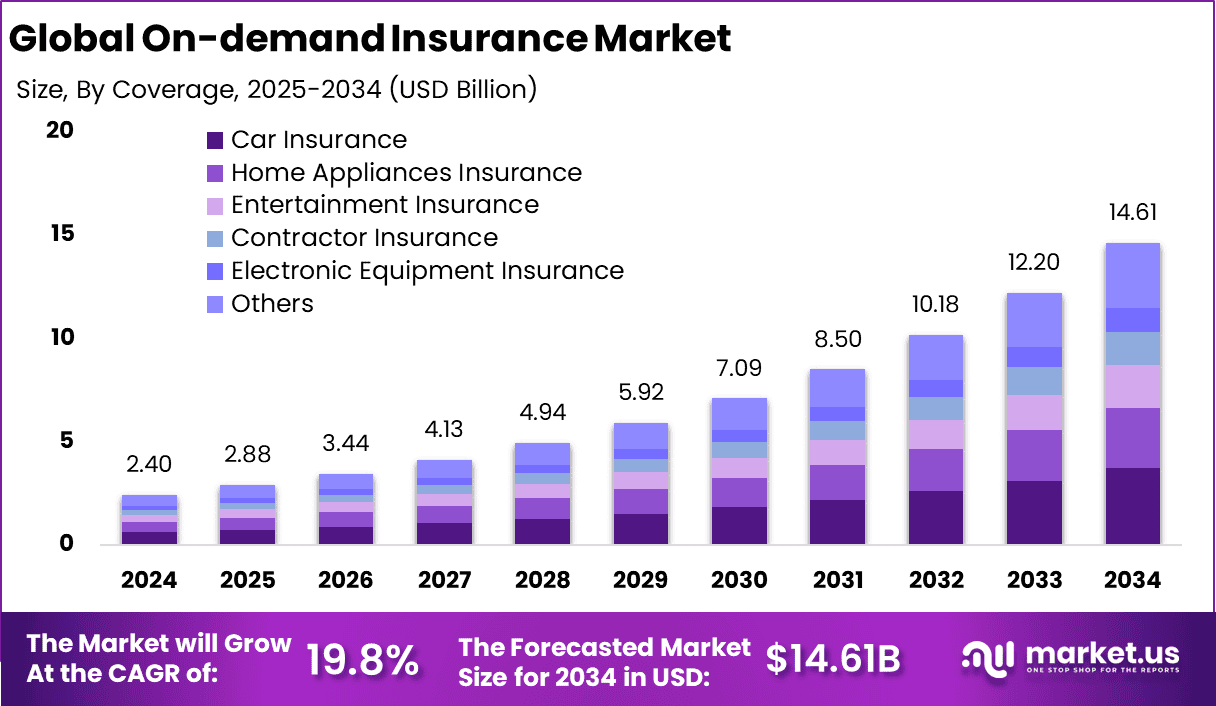

The global On-demand Insurance Market is projected to grow significantly, reaching an estimated value of USD 14.61 billion by 2034, from USD 2.40 billion in 2024. This growth represents a robust CAGR of 19.8% during the forecast period (2025-2034). North America is leading the market, capturing over 31.2% of the market share, with a revenue of USD 0.7 billion in 2024. The rapid rise of on-demand insurance solutions, driven by consumer demand for flexibility and convenience, positions this market as a key player in the evolving insurance landscape.

How Growth is Impacting the Economy

The substantial growth in the On-demand Insurance Market is directly influencing the global economy by contributing to technological innovation and creating new revenue streams within the insurance industry. The rising demand for personalized, on-demand policies, driven by digital transformation, is enhancing financial inclusion. Additionally, the shift from traditional insurance models to more adaptable, customer-centric services is empowering consumers and businesses alike.

With an increasing preference for immediate coverage, this market fosters increased competition, leading to improved service offerings and higher customer satisfaction. Economically, this growth is expected to create new job opportunities in the fintech and insurance sectors, boosting both regional and global economies.

➤ Unlock growth! Get your sample now! – https://market.us/report/on-demand-insurance-market/free-sample/

Impact on Global Businesses

Rising costs and shifts in supply chains are reshaping the business landscape. As businesses adapt to the On-demand Insurance market’s growth, they face challenges in managing rising insurance premiums, particularly in industries with high risk. On-demand policies allow companies to cover specific needs without long-term commitments, helping manage costs more effectively.

Sector-specific impacts include the rise of custom insurance solutions for industries like travel, logistics, and technology. For example, travel companies can now offer instant insurance to customers based on their trip needs, and logistics firms can secure short-term policies that align with shipment durations. Businesses are leveraging this flexibility to optimize insurance spend and enhance operational efficiency.

Strategies for Businesses

To capitalize on the growth of the On-demand Insurance Market, businesses must adapt by adopting digital-first strategies that offer flexibility and immediate coverage to their customers. Insurers should invest in technologies like AI and blockchain to offer tailored policies, ensure faster claims processing, and reduce operational costs. Additionally, partnerships between tech companies and insurers can drive innovation in product development and enhance customer engagement. Implementing data-driven insights can enable businesses to understand consumer preferences and develop solutions that meet specific needs, ultimately increasing market share.

Key Takeaways

- The On-demand Insurance Market is growing at a CAGR of 19.8%.

- North America holds a dominant market share of 31.2%.

- The market is driven by consumer demand for flexible, personalized coverage.

- The rise in technology adoption is accelerating market growth.

- Sector-specific impacts include innovations in travel, logistics, and technology insurance.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=155298

Analyst Viewpoint

The On-demand Insurance Market’s rapid expansion presents numerous opportunities, especially for businesses ready to adopt flexible, digital solutions. In the present, technology and consumer trends are driving rapid growth, and future prospects look positive with increasing consumer interest in on-demand services. As the market matures, businesses will see enhanced customer engagement and service customization, further fueling growth.

Use Case & Growth Factors

| Use Case | Growth Factors |

|---|---|

| Travel insurance on-demand | Increased travel bookings, digital convenience |

| Short-term auto insurance | Rise of car-sharing platforms |

| Custom health insurance | Growing awareness of personalized health needs |

| Property insurance for renters | Increased rental market expansion |

| Business liability on-demand | Rise in gig economy and freelance workers |

Regional Analysis

In 2024, North America is the leading market for on-demand insurance, holding a dominant share of over 31.2%. This is due to the region’s advanced digital infrastructure, widespread adoption of tech-driven solutions, and a high demand for personalized insurance policies. Following North America, Europe and the Asia Pacific region are showing significant potential, particularly with the rise of tech-savvy consumers and regulatory advancements in digital insurance offerings. The shift towards on-demand services is expected to boost market penetration in emerging economies, particularly in Latin America and the Middle East, where digital adoption is increasing.

➤ Don’t Stop Here—check Our Library

- Generative AI Software Platforms Market

- Natural Language Processing APIs Market

- Luxury Pet Accessories Insurance Market

- Content Services Platforms Market

Business Opportunities

The global On-demand Insurance Market offers significant opportunities for new entrants and established players looking to innovate. Insurers can target niche segments, offering customized insurance policies for industries such as travel, healthcare, and logistics. Partnerships with fintech companies can enable insurers to tap into a wider customer base, especially in underserved markets. Furthermore, the increasing demand for micro-insurance products provides a new growth avenue for companies to explore. Investing in AI, data analytics, and machine learning will enable insurers to offer better customer experiences, streamline operations, and improve risk management.

Key Segmentation

The market is segmented by product, application, and region. Key segments include:

- By Product: Auto, Health, Property, Business Liability, Life

- By Application: Travel, Healthcare, Auto, Property, Business

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

The On-demand Insurance Market sees involvement from a wide range of players including traditional insurers transitioning to digital solutions and new-age tech companies providing innovative services. Key strategies include leveraging AI for risk assessment, adopting blockchain for claims processing, and collaborating with digital platforms to offer real-time insurance coverage. Players are focused on enhancing customer experience by offering tailored policies that meet specific consumer needs, contributing to the market’s robust growth.

- Slice Insurance Technologies Inc.

- VSure.life

- Xceedance, Inc.

- SkyWatch Insurance Services, Inc.

- Zuno General Insurance Limited

- JaSure

- Thimble

- JAUNTIN

- Cuvva

- Snap-it Cover

Recent Developments

- Jan 2024: Major insurer launches a mobile app to provide on-demand coverage for travelers.

- Mar 2024: Tech company partners with insurance firms to offer on-demand auto policies through a new platform.

- May 2024: Insurer introduces customizable short-term health coverage, expanding market reach.

- Jun 2024: Insurtech startup raises USD 25 million to enhance AI-based claims management for on-demand policies.

- Aug 2024: Leading insurer pilots blockchain technology to streamline claims processing for on-demand policies.

Conclusion

The On-demand Insurance Market is on an upward trajectory, offering new opportunities for both insurers and consumers. As the market evolves, technological advancements and consumer demand for flexible solutions will continue to drive growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)