Table of Contents

Market Overview

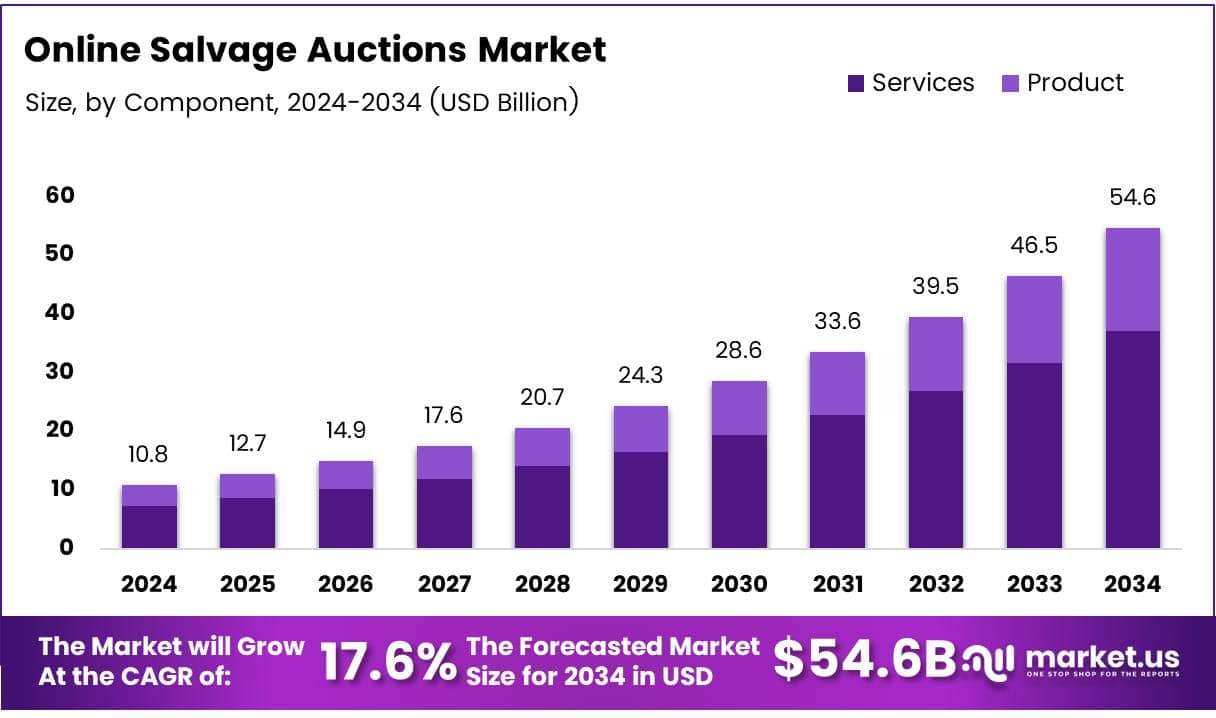

The Global Online Salvage Auctions Market size is expected to be worth around USD 54.6 Billion by 2034, from USD 10.8 Billion in 2024, growing at a CAGR of 17.6% during the forecast period.

The Online Salvage Auctions Market is growing steadily due to rising digital adoption in automotive resale and recycling. Salvage platforms now process around 50,000 vehicles annually, showing strong market traction. Cost-effective vehicle ownership is fueling demand, especially in emerging markets.

Online auctions simplify processes, reduce admin costs, and connect global buyers and sellers. This improves transparency and drives market efficiency. Growth is supported by smartphone usage, better internet access, and AI-based tools for bidding and valuation.

Insurance firms now use digital platforms to sell total-loss vehicles faster and at higher recovery value. This boosts liquidity and benefits institutional sellers. Government investments in digital infrastructure also support the sector’s growth.

New regulations ensure compliance and transparency in salvage operations worldwide. The U.S., Canada, and Germany lead with better salvage certification and cross-border trade policies. Green laws push for eco-friendly auto recycling and circular economy goals.

Online salvage auctions now support sustainable practices and reduce automotive waste. As digital tools evolve, this market is set to expand rapidly. The future holds major opportunities for platforms driving innovation and compliance in the salvage value chain.

Key Takeaways

- Online Salvage Auctions Market to hit USD 54.6 Billion by 2034, growing at 17.6% CAGR from 2025.

- Services segment led in 2024 with 60.2% share, boosted by auction and logistics solutions.

- Banks and Financial Institutions dominated 2024 use, driving asset recovery and repossession.

- North America held 39.5% share, valued at USD 4.2 Billion, due to tech growth and demand.

Market Drivers

- Cost Savings for Buyers

Salvage vehicles are often priced significantly lower than new or used cars in traditional dealerships. This cost advantage attracts individual buyers looking for cheap alternatives as well as repair shops seeking affordable parts or vehicles for refurbishment and resale. - Digital Platforms and Mobile Integration

The emergence of mobile apps and responsive websites allows users to participate in auctions anytime and from anywhere. Real-time bidding, vehicle inspection reports, and high-quality images have made online transactions more secure and trustworthy. - Growth of E-commerce and Online Bidding Culture

The comfort with online transactions has translated into the auction sector. As consumers grow accustomed to buying everything from electronics to real estate online, the transition to vehicle auctions is a natural evolution. - Insurance and Fleet Companies as Key Suppliers

Many salvage vehicles come from insurance companies that write off totaled vehicles or large fleets retiring aged assets. These consistent vehicle inflows maintain strong inventory levels, supporting the platform’s operations and supply-demand balance.

Challenges and Restraints

- Regulatory Hurdles

The sale of salvage vehicles is tightly regulated in many regions. Issues such as titling, environmental compliance, and eligibility of repair may complicate transactions or limit cross-border trade. - Fraud and Transparency Concerns

Although platforms have improved security, online auctions still face skepticism regarding the authenticity of listings. Some buyers are concerned about hidden damage, odometer fraud, or misrepresented conditions. - Limited Technical Understanding

Many potential customers may lack the technical know-how to evaluate the extent of vehicle damage and determine repair feasibility. This limits participation to more experienced buyers or auto professionals.

Market Segmentation

Component Analysis: In 2024, the Services segment led the Online Salvage Auctions Market with 60.2% share. Services offer full solutions like auction setup, logistics, and support. Businesses prefer seamless platforms over standalone tools. Online platforms drive demand for efficient services. Secure payments and delivery add more value. Services ensure better buyer and seller experience. Product segment is growing but slower. Services remain top choice in the auction process.

Application Analysis: Banks and financial institutions dominated the market in 2024. They manage asset liquidation and repossession efficiently. Banks sell defaulted vehicles through online auctions. Their trusted systems support high-volume auctions. Strong networks increase auction reach and speed. OEMs and dealers are also active but smaller. Banks offer structured and large-scale auction handling. This makes them leaders in the application segment.

Regional Insights

North America

North America leads the online salvage auctions market with 39.5% share, worth USD 4.2 Billion. Strong digital platforms drive growth. High asset liquidation needs boost demand. Many auction platforms operate in this region. Consumer awareness is rising fast.

Europe

Europe holds a strong market share. Online vehicle auctions are growing. Sustainability focus drives salvage resale. E-commerce adoption supports growth. Government support strengthens the market.

Asia Pacific

Asia Pacific shows rapid market growth. Urbanization fuels online salvage demand. Rising incomes support vehicle buying. E-commerce and online bidding are rising. Infrastructure gaps remain a challenge.

Middle East & Africa (MEA)

MEA has small but growing market share. Economic change boosts salvage demand. Online platforms are gaining users. Infrastructure issues limit fast growth. Market awareness is still low.

Latin America

Latin America holds a modest market share. Interest in auctions is increasing. Demand for low-cost vehicles grows. E-commerce is expanding fast. Market is developing steadily.

Competitive Landscape

The market is competitive, featuring a mix of established players and emerging platforms. These companies focus on expanding inventory, integrating advanced technology like AI-powered search, improving vehicle inspection tools, and enhancing customer experience. Partnerships with insurance companies and logistics providers help in ensuring a seamless transaction from bidding to delivery.

Some platforms also offer value-added services such as vehicle transportation, documentation assistance, and repair estimations. This full-service model boosts customer confidence and encourages repeat business.

Technological Trends

- AI and Machine Learning: Used to match buyers with suitable listings and predict bidding patterns.

- Blockchain: Introduced by some platforms to enhance transaction transparency and reduce fraud.

- Augmented Reality (AR): Helping buyers visualize vehicle damage more clearly.

- Big Data Analytics: For inventory management, buyer behavior analysis, and pricing optimization.

Future Outlook

- Growing consumer trust in digital transactions

- Rising demand for affordable vehicle options in emerging economies

- Strong B2B participation from repair and refurbishment companies

- Improvements in inspection technology and documentation systems

Recent Developments

- In January 2025, America’s Group acquired AuctionVcommerce, a strategic move to expand its footprint in the growing online auction market. This acquisition enhances its digital auction capabilities, positioning the company for stronger market leadership.

- In October 2024, Copart Muscat Auctions partnered with Al Madina Takaful to strengthen its service offerings in Oman. The partnership enables comprehensive insurance solutions, delivering added value and trust to its customer base.

- In February 2023, Ritchie Bros. Auctioneers announced plans to acquire AssetNation, reinforcing its presence in the industrial asset auction segment. This move boosts its equipment auction portfolio and supports broader global expansion.

Conclusion

The Online Salvage Auctions Market is rapidly expanding due to rising demand for affordable vehicles, digital convenience, and strong supply from insurers and fleet operators. While challenges like fraud and regulatory hurdles remain, advances in technology and growing consumer trust are driving continued growth. With increasing global participation and innovation, the market is well-positioned for a strong and sustained future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)