Table of Contents

Market Overview

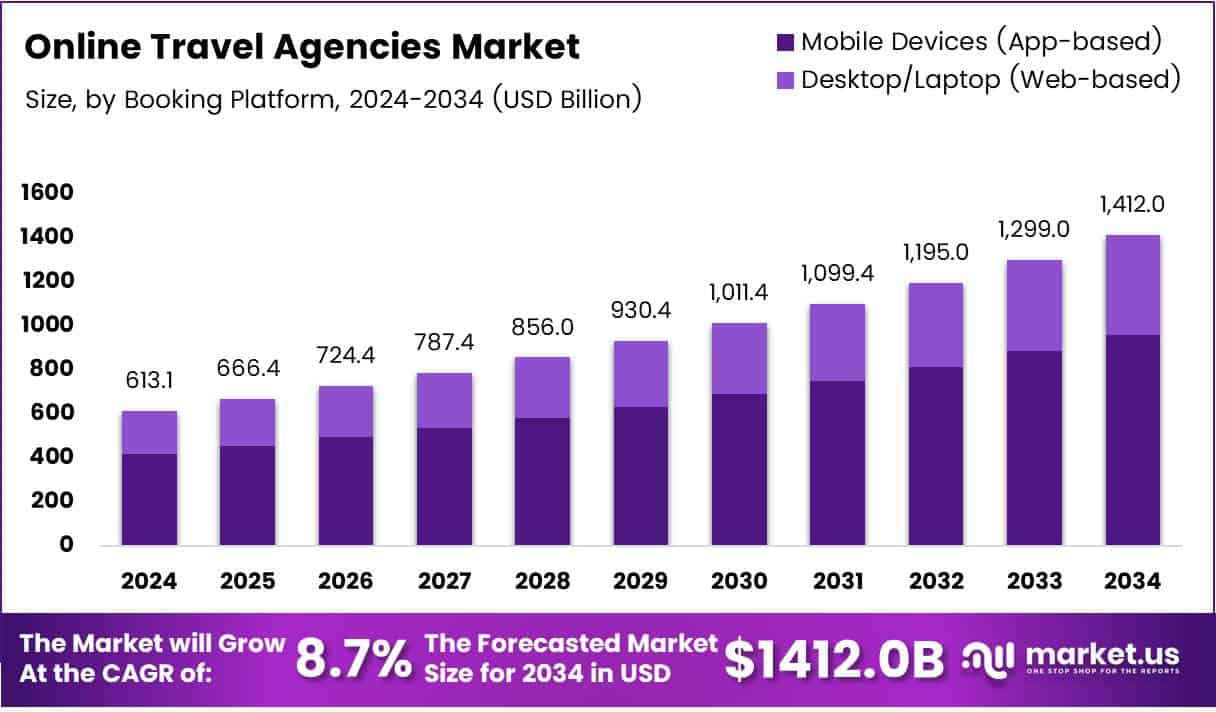

The Global Online Travel Agencies Market size is expected to be worth around USD 1412.0 Billion by 2034, from USD 613.1 Billion in 2024, growing at a CAGR of 8.7% during the forecast period.

The Online Travel Agencies (OTA) market is undergoing significant transformation, driven by digital adoption and changing travel behavior. With 72% of travelers preferring to book travel arrangements online, OTAs have become a central part of the digital travel booking ecosystem. Consumers are increasingly relying on AI-driven tools to simplify their planning experience 33% of consumers now use virtual travel assistants to organize trips, highlighting a growing reliance on automation and personalization in the travel sector. This trend presents a major growth opportunity for OTA platforms that invest in user-friendly, AI-powered solutions.

Mobile engagement is also rising rapidly. According to Adjust, travel app logins surged by 87% in June 2023, signaling a strong shift toward mobile-first travel behavior. As a result, OTAs optimizing for mobile usability and seamless booking flows are poised to capture more market share. Governments are also fueling market expansion by investing in smart tourism infrastructure and digital travel ecosystems. However, increased government regulations on data privacy and consumer rights mean that OTAs must prioritize compliance and transparency. With online travel sales now reaching 65%, the OTA market is set for continued growth especially for businesses that embrace innovation, mobile-first strategies, and regulatory alignment.

Key Takeaways

- The Global Online Travel Agencies Market to hit USD 1412.0 Billion by 2034, growing at an 8.7% CAGR from 2025.

- Mobile Devices (App-based) dominated the booking platform segment in 2024, holding a 52.4% market share.

- Leisure Travelers led the traveler type segment in 2024, capturing a 63.2% share.

- Transportation Booking was the top service category in 2024, accounting for 41.2% of the market.

- The 30 to 44 Years age group made up 42.8% of OTA bookings in 2024.

- Europe led the regional market with a 32.2% share, valued at USD 196.2 Billion in 2024.

Drivers of Growth

- Increased Mobile Usage and Internet Penetration: Smartphones have become a key booking tool for travelers. Rising mobile app usage for bookings has boosted OTAs’ global market position.

- Digital Transformation: As travel firms go digital and adopt AI, OTAs lead with personalized services, smart marketing, and better support.

- Shifting Preferences: Millennials and Gen Z favor OTAs for easy booking, peer reviews, and user-generated content.

- Wider Range of Offerings: OTAs continue to expand their portfolios, offering everything from low-cost travel options to luxury packages. Their ability to bundle services like combining flights and hotel stays offers convenience and cost savings for customers.

Challenges and Restraints

- Intense Competition and Price Wars:

The OTA space is highly competitive, with key players constantly battling to offer the lowest prices. This price sensitivity can affect margins and profitability for both the agencies and service providers. - Dependency on Third-Party Providers:

OTAs rely heavily on third-party suppliers such as airlines and hotels. Any disruption or pricing dispute in these relationships can impact OTA service continuity and user satisfaction. - Security and Privacy Concerns:

With the rise in online bookings, customer data security has become a crucial issue. OTAs must continually invest in advanced cybersecurity measures to ensure safe transactions and build consumer trust. - Regulatory Challenges:

As OTAs operate across borders, they face varied regulatory environments. Issues such as local taxation, data protection laws, and licensing requirements can pose hurdles to smooth operations.

Segmentation Insights

Booking Platform (2024):

Mobile apps lead with 52.4% share, driven by smartphone use, simple interfaces, and quick payments.

Traveler Type (2024):

Leisure travelers dominate with 63.2%, fueled by rising vacations, income, and online budget options.

Service Type (2024):

Transportation tops at 41.2%, as users prefer OTAs for flights, trains, and price bundling.

Age Group (2024):

Ages 30–44 lead with 42.8%, favoring fast, flexible app bookings for work and travel.

Regional Insights

Europe:

Leads with 32.2% share (USD 196.2B) due to strong digital infrastructure, high smartphone use, and mature tourism.

U.S.:

Fast growth driven by digital adoption, AI personalization, and mobile booking among tech-savvy users.

North America:

Advanced tech and rising demand for personalized travel boost mobile bookings and engagement.

Asia Pacific:

Rapid growth from rising incomes, smartphone use, and government support for tourism and digital access.

Middle East & Africa:

Steady rise with better internet, digital investments, and growing tourism.

Latin America:

Growth backed by improved internet, mobile access, and demand for flexible, multilingual travel options.

Competitive Landscape

The OTA market includes key players enhancing digital tools, expanding services, and entering new markets through AI, data analytics, and partnerships.

Innovation is key to staying competitive. Many OTAs are investing in chatbots, voice-based search, AR/VR-based travel previews, and predictive analytics to stay ahead. Loyalty programs, frequent flyer partnerships, and user reward systems are also common strategies used to retain customers.

Moreover, some OTAs have started vertical integration, owning parts of the supply chain such as hotel properties or exclusive transportation services, to increase control and profitability.

Trends Shaping the Future

- Sustainability in Travel: OTAs now highlight eco-friendly options to meet demand for sustainable tourism.

- AI and Personalization: AI powers smarter suggestions, dynamic pricing, and personalized content.

- Voice and Visual Search Integration: OTAs adopt voice and visual search for easier travel planning.

- Hyper-Local Experiences: OTAs offer curated tours and cultural packages for local immersion.

Recent Developments

June 2025: Maples Group advised Prosus on its $1.7B acquisition of Despegar, expanding its travel-tech presence in Latin America.

Feb 2025: Hyatt acquired Apple Leisure Group to boost its global resort portfolio and strengthen luxury offerings.

Jan 2023: RateGain acquired ADARA to enhance data analytics and improve travel marketing solutions.

Conclusion

The online travel agencies market is undergoing rapid transformation fueled by technology, evolving traveler expectations, and global digital trends. While it faces challenges such as competitive pressure and regulatory complexities, its growth trajectory remains strong. With continued innovation and strategic expansion, OTAs are poised to further disrupt and shape the future of global travel.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)