Table of Contents

- Introduction

- Editor’s Choice

- Global Online Video Platform Market Overview

- Global Video Streaming Market Overview

- Global OTT Video Market Overview

- Time Spent on Online Video Platforms

- Percentage of Internet Users Who Watch Online Video Content – By Country

- Devices Used to Watch Online Videos Worldwide

- Most Popular Video Streaming Services

- Online Video Platform Statistics – By Age

- Online Video Platform Statistics – By Gender

- Impact of COVID-19

- Consumer Preferences and Trends

- User Preference On Video Streaming Platforms – By Category

- Laws and Regulations for Online Video Platforms

Introduction

According to Online Video Platform Statistics, An Online Video Platform (OVP) is a crucial digital infrastructure for hosting, managing, and delivering video content online.

It facilitates content uploading, organization, and playback across various devices with adaptive streaming capabilities.

OVPs support monetization through advertising, subscriptions, or pay-per-view models alongside robust analytics for tracking viewer engagement and performance metrics.

They offer customization options for branding and player interfaces, ensuring a seamless user experience. Security features like encryption and DRM safeguard content, while integration with other platforms and APIs enables extended functionality and automation.

OVPs also cater to live streaming needs, making them versatile tools for media, entertainment, education, and corporate sectors seeking reliable video distribution solutions.

Editor’s Choice

- The global online video platform market revenue is expected to reach USD 57.2 billion by 2033.

- The market share distribution within the global online video platform market reveals notable leadership by several key companies. Brightcove Inc. holds the largest share at 18%.

- The regional market share distribution within the global online video platform market highlights North America as the leading region, commanding 37.2% of the market.

- The OTT video market revenue by country highlights the dominance of the United States, which leads with USD 132,900 million.

- The average weekly time spent with online video increased to 14 hours in 2019 and further to 16 hours in 2020, reflecting a growing engagement with online video content.

- As of November 2019, Netflix led the video streaming market with 151.6 million subscribers.

- In the fourth quarter of 2023, the most popular video content type worldwide by weekly usage reach was any video, with an overwhelming 92.30% of respondents reporting they watched this category.

Global Online Video Platform Market Overview

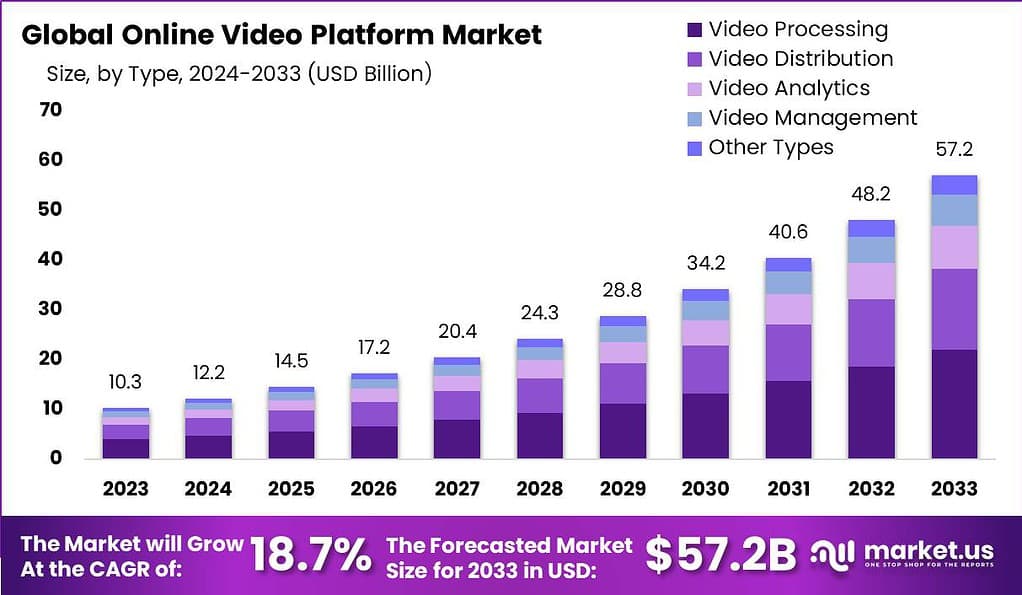

Global Online Video Platform Market Size

- The global online video platform market has demonstrated significant growth at a CAGR of 18.7%, with revenue figures reflecting a steady upward trajectory.

- In 2023, the market revenue stood at USD 10.3 billion.

- By 2032, the market is expected to reach USD 48.2 billion, culminating in an impressive USD 57.2 billion by 2033.

Competitive Landscape of the Global Online Video Platform Market

- The market share distribution within the global online video platform market reveals notable leadership by several key companies.

- Brightcove Inc. holds the largest share at 18%, followed closely by Akamai Technologies with 17%.

- MediaMelon Inc. accounts for 9% of the market, while both Endavo Media and Frame.io, Inc. each hold an 8% share.

- Kaltura, Inc. contributes 7% to the market, and Limelight Networks holds a 6% share.

Regional Analysis of the Global Online Video Platform Market

- The regional market share distribution within the global online video platform market highlights North America as the leading region, commanding 37.2% of the market.

- Europe follows with a significant 27.0% share.

- The Asia-Pacific (APAC) region accounts for 21.0%, reflecting its growing influence in the industry.

- South America holds a 10.0% share, while the Middle East and Africa (MEA) region represents 4.8% of the market.

Global Video Streaming Market Overview

Global Video Streaming Market Size

- The global video streaming market is poised for substantial growth at a CAGR of 20.3%, with revenue figures showcasing a robust upward trend.

- In 2023, the market revenue was recorded at USD 540.5 billion.

- By 2032, revenue is projected to climb to USD 2,852.4 billion, ultimately reaching USD 3,431.4 billion by 2033.

Market Share of Leading Video Streaming Platforms

- The market share distribution among leading video streaming platforms highlights Netflix as the dominant player, commanding 34% of the market.

- YouTube follows with a significant 20% share, while Hulu holds 11%.

- Amazon captures 8% of the market, and Disney+ accounts for 4%.

- The remaining 23% of the market is distributed among various other platforms, indicating a competitive landscape with multiple players contributing to the industry.

Global OTT Video Market Overview

Global OTT Video Market Size

- The global over-the-top (OTT) video market has exhibited remarkable growth over recent years at a CAGR of 6.30%.

- In 2017, the market revenue was USD 72.70 billion, increasing significantly to USD 98.90 billion in 2018 and USD 131.38 billion in 2019.

- The market is anticipated to expand further, reaching USD 386.01 billion in 2027, USD 407.66 billion in 2028, and USD 429.41 billion by 2029.

Key Players in the Global OTT Video Market

- The significant presence of several key players characterizes the global OTT video market.

- Netflix leads the market with a 16% share, followed closely by Disney+ at 14% and Amazon Prime Video at 13%.

- YouTube holds a 10% share, while HBO Max commands 8%.

- Hulu contributes 6% to the market, with Paramount+ and Tubi each holding a 5% share.

- Pluto TV accounts for 4% of the market, and Crunchyroll has a 2% share.

- The remaining 17% of the market is distributed among various other platforms.

Regional Analysis of the Global OTT Video Market

- The OTT video market revenue by country highlights the dominance of the United States, which leads with USD 132,900 million.

- China follows as the second-largest market with USD 76,110 million.

- The United Kingdom ranks third with USD 15,860 million, while Japan and Germany have revenues of USD 9,887 million and USD 8,888 million, respectively.

- Canada contributes USD 6,803 million to the market, with France at USD 5,634 million and Australia at USD 5,108 million.

- Brazil and India also represent significant markets, generating USD 4,296 million and USD 4,064 million, respectively.

Time Spent on Online Video Platforms

- The average weekly time spent with online video worldwide has shown notable fluctuations over recent years.

- In 2018, viewers spent an average of 10.5 hours per week watching online videos.

- This increased to 14 hours in 2019 and further to 16 hours in 2020, reflecting a growing engagement with online video content.

- The trend continued upward in 2021, with an average of 18 hours per week, and peaked in 2022 at 19 hours.

- However, in 2023, there was a slight decline, with the average weekly time spent dropping to 17 hours.

Percentage of Internet Users Who Watch Online Video Content – By Country

- As of January 2018, the percentage of internet users who watch online video content every day varied significantly across selected countries.

- Leading the list are Saudi Arabia and Turkey, with 64% of respondents in each country reporting daily online video consumption.

- Brazil follows closely with 62%, while New Zealand and Australia report 61% and 60%, respectively.

- Mexico sees 56% of its internet users engaging in daily video viewing, and Spain records a 53% share.

- In both Canada and the United States, 50% of respondents watch online videos daily.

- In South Korea, the figure stands at 44%, while France reports 42%.

- The Philippines has a 34% share, with India at 33% and both Germany and Japan at 32%.

- China reports that 30% of its internet users watch online video content daily, followed by Indonesia at 21%, South Africa at 19%, and Nigeria at 16%.

Devices Used to Watch Online Videos Worldwide

- As of August 2019, the devices used to watch online videos worldwide were rated on a scale from 0 to 4.

- smartphones emerged as the most frequently used device, scoring 2.08.

- Computers followed with a rating of 1.87, indicating substantial usage.

- Smart TVs or connected devices were also popular, with a score of 1.64.

- Tablets were less commonly used, scoring 1.09, while other devices had the lowest usage rating at 0.75.

Most Popular Video Streaming Services

Most Popular Video Streaming Services – By Number of Subscribers

- As of November 2019, Netflix led the video streaming market with 151.6 million subscribers.

- China’s iQiyi followed with 100.0 million subscribers, and Tencent Video closely trailed with 94.0 million.

- Youku, another Chinese platform, had 82.1 million subscribers.

- Amazon Prime Video boasted 75.0 million subscribers, while Viu, popular in Asia, had 30.0 million.

- Hulu, a major player in the United States, had 28.0 million subscribers.

- India’s Alt Balaji and Eros Now reported 20.0 million and 18.8 million subscribers, respectively.

- Iflix, targeting emerging markets, had 15.0 million subscribers.

Online Video Platform Statistics – By Age

Devices Used to Watch Online Video Content Among Viewers

- As of March 2024, the weekly usage of devices to watch online video content among viewers in the United States shows distinct preferences across different age groups.

- Among the 18-34 age group, 79% used smartphones, 55% watched on a TV set connected to the internet, 37% used computers or laptops, and 23% used tablets.

- In the 35-54 age group, 70% watched on smartphones, 63% on TV sets connected to the internet, 36% on computers or laptops, and 31% on tablets.

- For viewers aged 55 and older, 60% used TV sets connected to the internet, 43% used smartphones, 36% used computers or laptops, and 24% used tablets.

Time Spent on Video Streaming Devices

- The share of time spent on streaming video by different age groups experienced notable shifts between Q2 2019 and Q2 2020.

- The 2 to 11 age group maintained a consistent share of 16% across both periods.

- The 12 to 17 age group saw a decline, from 8% in Q2 2019 to 5% in Q2 2020.

- The 18 to 24 age group remained steady at 8% in both quarters.

- The 25 to 34 age group experienced a slight decrease, from 19% to 18%.

- The 35 to 54 age group also saw a reduction, from 30% in Q2 2019 to 27% in Q2 2020.

- In contrast, the 55+ age group increased its share of time spent on streaming video significantly, from 19% in Q2 2019 to 26% in Q2 2020.

Online Video Platform Statistics – By Gender

Most Popular Online Video Categories – By Gender

- As of February 2017, the popularity of online video categories in the United States showed notable differences by gender.

- Among men, sports videos were the most popular, with 45% reporting watching this category, compared to only 13% of women.

- Animation and cartoon videos were watched by 20% of men and 15% of women.

- Adult content attracted 24% of male viewers, while only 9% of female viewers engaged with this category.

- Commercials and ads were watched by 15% of men and 9% of women.

- A small percentage of both genders watched other types of videos, with 3% of men and 6% of women reporting this preference.

- Additionally, 16% of men and 20% of women indicated that they did not watch any of the above categories.

Most Popular Video Streaming Platforms – By Gender

- The popularity of video streaming platforms varies by gender, with both women and men showing preferences for different services.

- Netflix leads among both genders, with 26.69% of women and 26.33% of men using the platform.

- Amazon Prime Video is the second most popular, with 21.19% of users being women and 18.61% of men.

- Disney+ follows, with 16.53% of women and 16.99% of men engaging with the service.

- JioTV is more popular among men (16.64%) than women (10.81%).

- Alt Balaji has a smaller user base, with 2.75% of women and 3.65% of men using the platform.

Impact of COVID-19

- During the coronavirus (COVID-19) lockdown, the time dedicated to audio and video streaming saw notable changes among different genders.

- Among males, 17% reported a significant increase in their streaming time, compared to 13% of females.

- Additionally, 42% of males and 39% of females indicated that their streaming time had increased.

- For 34% of males and 38% of females, the amount of time spent streaming remained unchanged.

- A small percentage of both genders experienced a decrease in streaming time, with 2% of males and 2% of females reporting a decrease and 1% of males and 2% of females noting a significant decrease.

- Finally, 5% of males and 6% of females were unsure about any changes in their streaming habits.

Consumer Preferences and Trends

Most Popular Video Content Type Worldwide – By Weekly Usage Reach

- In the fourth quarter of 2023, the most popular video content type worldwide by weekly usage reach was any video, with an overwhelming 92.30% of respondents reporting they watched this category.

- Music videos were the next most popular, engaging 49.60% of respondents.

- Comedy, meme, or viral videos were watched by 35.20% of users, while 28.50% engaged with video live streams.

- Educational videos and sports clips or highlights were each viewed by 26.40% of respondents.

- Product review videos reached 25.70% of the audience, closely followed by tutorial or how-to videos at 25.50%.

- Influencer videos and vlogs were popular among 23.80% of viewers, and gaming videos were watched by 23.10%.

User Preference On Video Streaming Platforms – By Category

- In 2022, user preferences for video streaming platforms in China varied significantly by content category.

- For TV dramas, Mango TV emerged as the most preferred platform, with 64.50% of users favoring it, followed by Tencent Video with 57.70% and iQIYI with 45.90%.

- Youku Video and Migu Video were less popular for TV dramas, with 37.30% and 35.20% of users preferring these platforms, respectively.

- In the category of variety shows, iQIYI led with 70.40% user preference, closely followed by Tencent Video at 66.10%.

- Mango TV was preferred by 58.70% of users for variety shows, while Youku Video and Migu Video were chosen by 50.70% and 43.60% of users, respectively.

Laws and Regulations for Online Video Platforms

- The laws and regulations governing online video platforms vary significantly across different countries, each aiming to address specific issues related to content, user protection, and platform accountability.

- In the European Union, the Digital Services Act (DSA) and Digital Markets Act (DMA) set comprehensive rules for online platforms. These regulations mandate mechanisms to counter illegal content, ensure transparency in content moderation and advertising, and impose obligations on large platforms to manage risks and conduct independent audits.

- In the United Kingdom, the Online Safety Act focuses on protecting users from illegal and harmful content. Platforms are required to take proactive measures to prevent the appearance of such content and to remove it promptly when it does occur.

- In Saudi Arabia, the recently introduced Digital Content Platforms Regulations require video streaming platforms, such as Netflix and Amazon Prime Video, to obtain licenses and comply with stringent content moderation and local presence requirements.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)