Table of Contents

- Introduction

- Editor’s Choice

- Global Online Video Platform Market Statistics

- Global Video Streaming Market Overview

- Global OTT Video Market Overview

- Time Spent on Online Video Platform Statistics

- Percentage of Internet Users Who Watch Online Video Content – By Country

- Devices Used to Watch Online Videos Worldwide

- Popular Video Streaming Services

- Online Video Platform Statistics – By Age

- Online Video Platform Statistics – By Gender

- Impact of COVID-19

- Consumer Preferences and Trends

- User Preference On Video Streaming Platforms – By Category

- Laws and Regulations for Online Video Platform Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Online Video Platform Statistics: An Online Video Platform (OVP) is a crucial digital infrastructure for hosting, managing, and delivering video content online.

It facilitates content uploading, organization, and playback across various devices with adaptive streaming capabilities.

OVPs support monetization through advertising, subscriptions, or pay-per-view models alongside robust analytics for tracking viewer engagement and performance metrics.

They offer customization options for branding and player interfaces, ensuring a seamless user experience. Security features like encryption and DRM safeguard content, while integration with other platforms and APIs enables extended functionality and automation.

OVPs also cater to live streaming needs, making them versatile tools for media, entertainment, education, and corporate sectors seeking reliable video distribution solutions.

Editor’s Choice

- The global online video platform market revenue is expected to reach USD 57.2 billion by 2033.

- The market share distribution within the global online video platform market reveals notable leadership by several key companies. Brightcove Inc. holds the largest share at 18%.

- The regional market share distribution within the global online video platform market highlights North America as the leading region, commanding 37.2% of the market.

- The OTT video market revenue by country highlights the dominance of the United States, which leads with USD 132,900 million.

- The average weekly time spent with online video increased to 14 hours in 2019 and further to 16 hours in 2020, reflecting a growing engagement with online video content.

- As of November 2019, Netflix led the video streaming market with 151.6 million subscribers.

- In the fourth quarter of 2023, the most popular video content type worldwide by weekly usage reach was any video. With an overwhelming 92.30% of respondents reporting they watched this category.

Global Online Video Platform Market Statistics

Global Online Video Platform Market Size Statistics

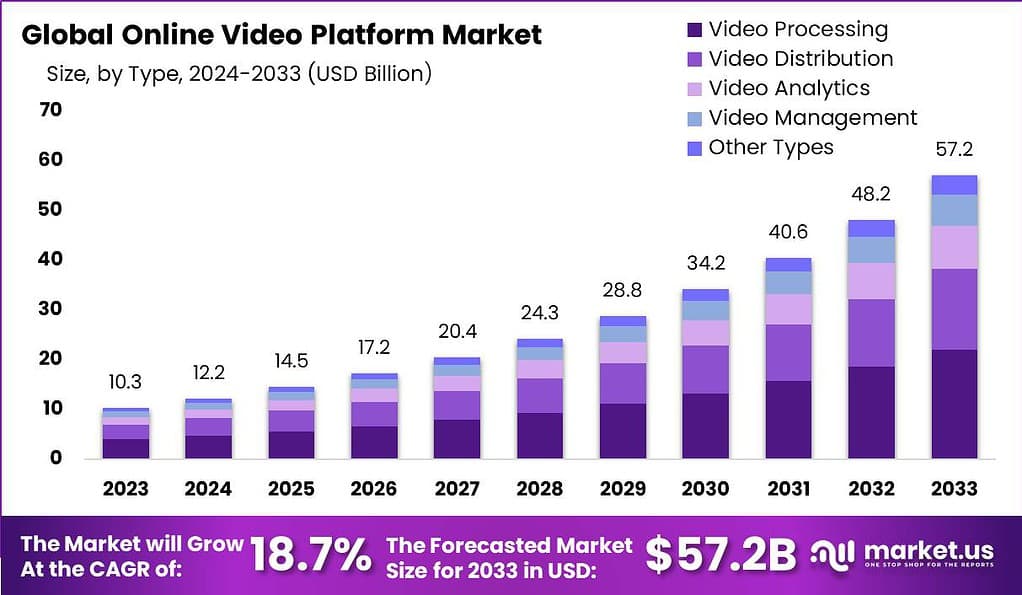

- The global online video platform market has demonstrated significant growth at a CAGR of 18.7%, with revenue figures reflecting a steady upward trajectory.

- In 2023, the market revenue stood at USD 10.3 billion.

- Projections indicate a continual rise, reaching USD 12.2 billion in 2024 and USD 14.5 billion in 2025.

- This growth trend is expected to persist, with revenues increasing to USD 17.2 billion by 2026 and USD 20.4 billion by 2027.

- By 2028, the market is anticipated to generate USD 24.3 billion, followed by USD 28.8 billion in 2029.

- The revenue is forecasted to further escalate to USD 34.2 billion in 2030 and USD 40.6 billion in 2031.

- By 2032, the market is expected to reach USD 48.2 billion, culminating in an impressive USD 57.2 billion by 2033.

- This robust growth underscores the expanding influence and penetration of online video platforms globally.

(Source: market.us)

Competitive Landscape of the Global Online Video Platform Market Statistics

- The market share distribution within the global online video platform market reveals notable leadership by several key companies.

- Brightcove Inc. holds the largest share at 18%, followed closely by Akamai Technologies with 17%.

- MediaMelon Inc. accounts for 9% of the market, while both Endavo Media and Frame.io, Inc. each hold an 8% share.

- Kaltura, Inc. contributes 7% to the market, and Limelight Networks holds a 6% share.

- The remaining 27% of the market is distributed among other key players. Highlighting a diverse and competitive landscape within the industry.

(Source: market.us)

Regional Analysis of the Global Online Video Platform Market Statistics

- The regional market share distribution within the global online video platform market highlights North America as the leading region, commanding 37.2% of the market.

- Europe follows with a significant 27.0% share.

- The Asia-Pacific (APAC) region accounts for 21.0%, reflecting its growing influence in the industry.

- South America holds a 10.0% share, while the Middle East and Africa (MEA) region represents 4.8% of the market.

- This distribution underscores the varied regional contributions to the global market, with North America and Europe leading the way.

(Source: market.us)

Global Video Streaming Market Overview

Global Video Streaming Market Size

- The global video streaming market is poised for substantial growth at a CAGR of 20.3%, with revenue figures showcasing a robust upward trend.

- In 2023, the market revenue was recorded at USD 540.5 billion.

- This figure is projected to rise significantly to USD 650.3 billion in 2024 and USD 782.3 billion in 2025.

- By 2026, the market is expected to reach USD 941.1 billion, with further growth to USD 1,132.1 billion in 2027.

- The upward trajectory continues with an anticipated revenue of USD 1,361.9 billion in 2028, followed by USD 1,638.4 billion in 2029.

- The market is forecasted to achieve USD 1,971.0 billion in 2030 and USD 2,371.1 billion in 2031.

- By 2032, revenue is projected to climb to USD 2,852.4 billion, ultimately reaching USD 3,431.4 billion by 2033.

- This impressive growth trajectory underscores the expanding dominance and increasing adoption of video streaming services on a global scale.

(Source: marketresearch.biz)

Market Share of Leading Online Video Streaming Platform Statistics

- The market share distribution among leading video streaming platforms highlights Netflix as the dominant player, commanding 34% of the market.

- YouTube follows with a significant 20% share, while Hulu holds 11%.

- Amazon captures 8% of the market, and Disney+ accounts for 4%.

- The remaining 23% of the market is distributed among various other platforms. Indicating a competitive landscape with multiple players contributing to the industry.

- This distribution underscores the significant influence of major platforms like Netflix and YouTube while also reflecting the diversity within the video streaming market.

(Source: Nielsen)

Global OTT Video Market Overview

Global OTT Video Market Size

- The global over-the-top (OTT) video market has exhibited remarkable growth over recent years at a CAGR of 6.30%.

- In 2017, the market revenue was USD 72.70 billion, increasing significantly to USD 98.90 billion in 2018 and USD 131.38 billion in 2019.

- The upward trend continued, with revenues reaching USD 180.33 billion in 2020 and USD 237.23 billion in 2021.

- By 2022, the market had grown to USD 255.85 billion, and it is projected to reach USD 288.19 billion in 2023.

- Future projections indicate continued growth, with revenues expected to climb to USD 316.36 billion in 2024, USD 341.42 billion in 2025, and USD 364.36 billion in 2026.

- The market is anticipated to expand further, reaching USD 386.01 billion in 2027, USD 407.66 billion in 2028, and USD 429.41 billion by 2029.

- This consistent growth trajectory highlights the increasing adoption and penetration of OTT video services globally.

(Source: Statista)

Key Players in the Global OTT Video Market

- The significant presence of several key players characterizes the global OTT video market.

- Netflix leads the market with a 16% share, followed closely by Disney+ at 14% and Amazon Prime Video at 13%.

- YouTube holds a 10% share, while HBO Max commands 8%.

- Hulu contributes 6% to the market, with Paramount+ and Tubi each holding a 5% share.

- Pluto TV accounts for 4% of the market, and Crunchyroll has a 2% share.

- The remaining 17% of the market is distributed among various other platforms.

- This distribution underscores the competitive nature of the OTT video market. With multiple major players vying for market share alongside a diverse array of other platforms.

(Source: Statista)

Regional Analysis of the Global OTT Video Market

- The OTT video market revenue by country highlights the dominance of the United States, which leads with USD 132,900 million.

- China follows as the second-largest market with USD 76,110 million.

- The United Kingdom ranks third with USD 15,860 million. While Japan and Germany have revenues of USD 9,887 million and USD 8,888 million, respectively.

- Canada contributes USD 6,803 million to the market, with France at USD 5,634 million and Australia at USD 5,108 million.

- Brazil and India also represent significant markets, generating USD 4,296 million and USD 4,064 million, respectively.

- This distribution illustrates the substantial revenue generated by the OTT video market across different regions. With the United States and China leading by a significant margin.

(Source: Statista)

Time Spent on Online Video Platform Statistics

- The average weekly time spent with online video worldwide has shown notable fluctuations over recent years.

- In 2018, viewers spent an average of 10.5 hours per week watching online videos.

- This increased to 14 hours in 2019 and further to 16 hours in 2020, reflecting a growing engagement with online video content.

- The trend continued upward in 2021, with an average of 18 hours per week, and peaked in 2022 at 19 hours.

- However, in 2023, there was a slight decline, with the average weekly time spent dropping to 17 hours.

- This data indicates a strong upward trajectory in online video consumption. Albeit with a minor decrease in the most recent year.

(Source: Statista)

Percentage of Internet Users Who Watch Online Video Content – By Country

- As of January 2018, the percentage of internet users who watch online video content every day varied significantly across selected countries.

- Leading the list are Saudi Arabia and Turkey, with 64% of respondents in each country reporting daily online video consumption.

- Brazil follows closely with 62%, while New Zealand and Australia report 61% and 60%, respectively.

- Mexico sees 56% of its internet users engaging in daily video viewing, and Spain records a 53% share.

- In both Canada and the United States, 50% of respondents watch online videos daily.

- In South Korea, the figure stands at 44%, while France reports 42%.

- The Philippines has a 34% share, with India at 33% and both Germany and Japan at 32%.

- China reports that 30% of its internet users watch online video content daily. Followed by Indonesia at 21%, South Africa at 19%, and Nigeria at 16%.

- This data highlights significant regional variations in daily online video consumption habits among internet users.

(Source: Statista)

Devices Used to Watch Online Videos Worldwide

- As of August 2019, the devices used to watch online videos worldwide were rated on a scale from 0 to 4.

- Smartphones emerged as the most frequently used device, scoring 2.08.

- Computers followed with a rating of 1.87, indicating substantial usage.

- Smart TVs or connected devices were also popular, with a score of 1.64.

- Tablets were less commonly used, scoring 1.09, while other devices had the lowest usage rating at 0.75.

- This data underscores the dominance of smartphones and computers in online video consumption. Smart TVs and tablets also play significant roles.

(Source: Statista)

Popular Video Streaming Services

Most Popular Video Streaming Services – By Number of Subscribers

- As of November 2019, Netflix led the video streaming market with 151.6 million subscribers.

- China’s iQiyi followed with 100.0 million subscribers, and Tencent Video closely trailed with 94.0 million.

- Youku, another Chinese platform, had 82.1 million subscribers.

- Amazon Prime Video boasted 75.0 million subscribers, while Viu, popular in Asia, had 30.0 million.

- Hulu, a major player in the United States, had 28.0 million subscribers.

- India’s Alt Balaji and Eros Now reported 20.0 million and 18.8 million subscribers, respectively.

- Iflix, targeting emerging markets, had 15.0 million subscribers.

- This data illustrates the substantial subscriber bases of major global and regional video streaming services, with Netflix maintaining a significant lead.

(Source: Statista)

Most Popular Video Streaming Services – By Mobile Reach

- As of September 2019, YouTube dominated the video streaming landscape in the United States by mobile reach, with an impressive 88% of mobile users accessing the platform.

- Netflix followed with a significant, yet markedly lower, mobile reach of 25%.

- Hulu and Amazon Prime Video were also popular, with mobile reaches of 14% and 11%, respectively.

- Vimeo rounded out the list with an 8% mobile reach.

- This data highlights YouTube’s overwhelming dominance in the mobile video streaming market. Netflix, Hulu, and Amazon Prime Video also maintain substantial user bases.

(Source: FIPP’s Global Digital Subscription Snapshot)

Online Video Platform Statistics – By Age

Devices Used to Watch Online Video Content Among Viewers

- As of March 2024, the weekly usage of devices to watch online video content among viewers in the United States shows distinct preferences across different age groups.

- Among the 18-34 age group, 79% used smartphones, 55% watched on a TV set connected to the internet, 37% used computers or laptops, and 23% used tablets.

- In the 35-54 age group, 70% watched on smartphones, 63% on TV sets connected to the internet, 36% on computers or laptops, and 31% on tablets.

- For viewers aged 55 and older, 60% used TV sets connected to the internet, 43% used smartphones, 36% used computers or laptops, and 24% used tablets.

- This data highlights the varying device preferences for online video consumption across different age demographics.

(Source: Statista)

Time Spent on Video Streaming Devices

- The share of time spent on streaming video by different age groups experienced notable shifts between Q2 2019 and Q2 2020.

- The 2 to 11 age group maintained a consistent share of 16% across both periods.

- The 12 to 17 age group saw a decline, from 8% in Q2 2019 to 5% in Q2 2020.

- The 18 to 24 age group remained steady at 8% in both quarters.

- The 25 to 34 age group experienced a slight decrease, from 19% to 18%.

- The 35 to 54 age group also saw a reduction, from 30% in Q2 2019 to 27% in Q2 2020.

- In contrast, the 55+ age group increased its share of time spent on streaming video significantly, from 19% in Q2 2019 to 26% in Q2 2020.

- This data indicates a growing engagement with streaming video among older age groups, while younger age groups showed varied trends in their streaming habits.

(Source: Nielsen)

Online Video Platform Statistics – By Gender

Most Popular Online Video Categories – By Gender

- As of February 2017, the popularity of online video categories in the United States showed notable differences by gender.

- Among men, sports videos were the most popular, with 45% reporting watching this category, compared to only 13% of women.

- Animation and cartoon videos were watched by 20% of men and 15% of women.

- Adult content attracted 24% of male viewers, while only 9% of female viewers engaged with this category.

- Commercials and ads were watched by 15% of men and 9% of women.

- A small percentage of both genders watched other types of videos, with 3% of men and 6% of women reporting this preference.

- Additionally, 16% of men and 20% of women indicated that they did not watch any of the above categories.

- This data highlights distinct preferences in online video content between men and women in the United States.

(Source: Statista)

Most Popular Video Streaming Platforms – By Gender

- The popularity of video streaming platforms varies by gender, with both women and men showing preferences for different services.

- Netflix leads among both genders, with 26.69% of women and 26.33% of men using the platform.

- Amazon Prime Video is the second most popular, with 21.19% of users being women and 18.61% of men.

- Disney+ follows, with 16.53% of women and 16.99% of men engaging with the service.

- JioTV is more popular among men (16.64%) than women (10.81%).

- Alt Balaji has a smaller user base, with 2.75% of women and 3.65% of men using the platform.

- This data highlights gender-based preferences in video streaming, with Netflix maintaining a slight edge in popularity among women and Amazon Prime Video and Disney+ also being widely used by both genders.

(Source: Finder Survey)

Individuals Who Use Video Sharing Services – By Gender

- The share of individuals using video-sharing services, such as YouTube, in Belgium has shown a steady increase from 2016 to 2021 across both genders.

- In 2016, 44% of females and 52% of males reported using these services.

- By 2018, this had risen to 48% for females and 56% for males.

- The upward trend continued in 2019, with 50% of females and 56% of males using video-sharing services.

- In 2020, usage further increased to 54% among females and 61% among males.

- By 2021, 55% of females and 62% of males were engaging with video-sharing services.

- This data indicates a growing adoption of video-sharing platforms in Belgium, with a consistently higher usage rate among males compared to females.

(Source: Statista)

Impact of COVID-19

- During the coronavirus (COVID-19) lockdown, the time dedicated to audio and video streaming saw notable changes among different genders.

- Among males, 17% reported a significant increase in their streaming time, compared to 13% of females.

- Additionally, 42% of males and 39% of females indicated that their streaming time had increased.

- For 34% of males and 38% of females, the amount of time spent streaming remained unchanged.

- A small percentage of both genders experienced a decrease in streaming time, with 2% of males and 2% of females reporting a decrease and 1% of males and 2% of females noting a significant decrease.

- Finally, 5% of males and 6% of females were unsure about any changes in their streaming habits.

- This data reveals a general trend of increased streaming during the lockdown, with variations in the extent of this increase between genders.

(Source: Statista)

Consumer Preferences and Trends

Most Popular Video Content Type Worldwide – By Weekly Usage Reach

- In the fourth quarter of 2023, the most popular video content type worldwide by weekly usage reach was any video, with an overwhelming 92.30% of respondents reporting they watched this category.

- Music videos were the next most popular, engaging 49.60% of respondents.

- Comedy, meme, or viral videos were watched by 35.20% of users, while 28.50% engaged with video live streams.

- Educational videos and sports clips or highlights were each viewed by 26.40% of respondents.

- Product review videos reached 25.70% of the audience, closely followed by tutorial or how-to videos at 25.50%.

- Influencer videos and vlogs were popular among 23.80% of viewers, and gaming videos were watched by 23.10%.

- This data highlights the diverse range of video content that attracts global audiences, with a particular emphasis on general video consumption and music videos.

(Source: Statista)

User Preference On Video Streaming Platforms – By Category

- In 2022, user preferences for video streaming platforms in China varied significantly by content category.

- For TV dramas, Mango TV emerged as the most preferred platform, with 64.50% of users favoring it, followed by Tencent Video with 57.70% and iQIYI with 45.90%.

- Youku Video and Migu Video were less popular for TV dramas, with 37.30% and 35.20% of users preferring these platforms, respectively.

- In the category of variety shows, iQIYI led with 70.40% user preference, closely followed by Tencent Video at 66.10%.

- Mango TV was preferred by 58.70% of users for variety shows, while Youku Video and Migu Video were chosen by 50.70% and 43.60% of users, respectively.

- This data highlights the diverse preferences among Chinese users for different types of video content across various streaming platforms.

(Source: Statista)

Laws and Regulations for Online Video Platform Statistics

- The laws and regulations governing online video platforms vary significantly across different countries, each aiming to address specific issues related to content, user protection, and platform accountability.

- In the European Union, the Digital Services Act (DSA) and Digital Markets Act (DMA) set comprehensive rules for online platforms. These regulations mandate mechanisms to counter illegal content, ensure transparency in content moderation and advertising, and impose obligations on large platforms to manage risks and conduct independent audits.

- These rules apply uniformly across the EU to reduce regulatory fragmentation and ensure a fair and transparent online environment.

- In the United Kingdom, the Online Safety Act focuses on protecting users from illegal and harmful content. Platforms are required to take proactive measures to prevent the appearance of such content and to remove it promptly when it does occur.

- Specific protections are also in place to safeguard children from harmful content and to ensure age-appropriate experiences online.

- In Saudi Arabia, the recently introduced Digital Content Platforms Regulations require video streaming platforms, such as Netflix and Amazon Prime Video, to obtain licenses and comply with stringent content moderation and local presence requirements.

- These regulations aim to enhance content oversight and protect users while also imposing annual fees on service providers based on their revenues within the Kingdom.

- These varied regulatory approaches reflect each region’s priorities and challenges in managing the digital landscape, ensuring that online video platforms operate in a safe, fair, and accountable manner globally.

(Source: European Commission, Government of U.K, Arab News)

Recent Developments

Acquisitions and Mergers:

- Vimeo acquires Wibbitz: In late 2023, Vimeo acquired Wibbitz, an AI-powered video creation platform, for $150 million. This acquisition aims to enhance Vimeo’s capabilities in automated video production and expand its suite of tools for content creators.

- Kaltura merges with Newrow: In early 2024, Kaltura merged with Newrow, a company specializing in virtual classrooms and interactive video experiences, for $200 million. This merger is expected to bolster Kaltura’s offerings in the education and corporate training sectors.

New Product Launches:

- YouTube Shorts: In mid-2023, YouTube launched YouTube Shorts, a short-form video platform designed to compete with TikTok. This platform allows creators to produce and share 60-second videos, with a focus on engaging and quick content.

- Facebook Watch Parties: Facebook introduced Watch Parties in late 2023, a feature that allows users to watch videos together in real-time, creating a more interactive and social viewing experience on the platform.

Funding:

- Twitch secures $300 million: Twitch, the leading live-streaming platform, raised $300 million in a funding round in 2023 to expand its infrastructure, enhance user experience, and invest in new content initiatives.

- Vimeo raises $500 million: Vimeo secured $500 million in funding in early 2024 to accelerate its growth, focusing on expanding its video tools for businesses and investing in AI-powered video Editing and production technologies.

Technological Advancements:

- AI-Powered Video Analytics: Advances in AI are being integrated into online video platforms to provide detailed video analytics, including viewer engagement, sentiment analysis, and real-time feedback, enhancing content strategy and audience targeting.

- Improved Streaming Quality: Online video platforms are adopting new technologies to improve streaming quality, including 4K resolution, HDR support, and adaptive bitrate streaming, ensuring a better viewing experience across devices.

Market Dynamics:

- Growth in Online Video Market: The global online video platform market is projected to grow at a CAGR of 18.5% from 2023 to 2028, driven by increasing demand for video content, the rise of OTT services, and the proliferation of mobile devices.

- Rise of User-Generated Content: User-generated content continues to rise in popularity, with platforms like YouTube, TikTok, and Instagram seeing significant growth in user engagement and content creation, driven by the ease of video production and sharing.

Regulatory and Strategic Developments:

- Content Moderation Policies: Online video platforms are enhancing their content moderation policies to comply with global regulations and address issues related to misinformation, harmful content, and copyright infringement. These efforts aim to create a safer and more reliable environment for users.

- Advertising Standards: New advertising standards are being implemented to ensure transparency and compliance with data privacy laws. Platforms are adopting stricter guidelines for ad targeting and measurement to protect user privacy and enhance advertiser trust.

Research and Development:

- Interactive Video Experiences: R&D efforts are focusing on developing interactive video experiences, such as clickable videos, live polls, and real-time audience interactions, to increase viewer engagement and provide more immersive content.

- Virtual and Augmented Reality: Online video platforms are exploring the integration of virtual and augmented reality to offer new ways of consuming content. These technologies aim to provide more immersive and engaging video experiences.

Conclusion

Online Video Platform Statistics – Online video platforms have transformed global content consumption, offering extensive access to diverse videos across various genres.

They generate revenue through subscriptions, ads, and pay-per-view models. Regulatory frameworks like the EU’s Digital Services Act, the UK’s Online Safety Act, and Saudi Arabia’s Digital Content Platforms Regulations ensure safe and fair operation by addressing content moderation and user protection.

As the market grows with technological advances and increasing internet access, these platforms will continue evolving, requiring adaptable strategies to thrive in a competitive, regulated environment.

FAQs

An online video platform is a service that allows users to upload, share, view, and stream videos over the internet. Examples include YouTube, Netflix, and Vimeo.

Online video platforms generate revenue primarily through subscriptions, advertisements, and pay-per-view models. For instance, Netflix relies on subscription fees, while YouTube earns through ad placements.

Regulations vary by region. In the EU, the Digital Services Act and Digital Markets Act impose rules on transparency, content moderation, and user protection. The UK’s Online Safety Act focuses on removing illegal and harmful content, especially protecting children. Saudi Arabia’s Digital Content Platforms Regulations require licensing and local presence for foreign platforms.

Platforms use a combination of automated systems and human moderators to detect and remove harmful content. They also provide tools for users to report inappropriate content and have policies in place to handle these reports promptly.

Many platforms offer parental controls and age-restricted content filters. Regulations like the UK’s Online Safety Act require platforms to take additional steps to prevent children from accessing harmful content and ensure age-appropriate experiences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)