Table of Contents

Introduction

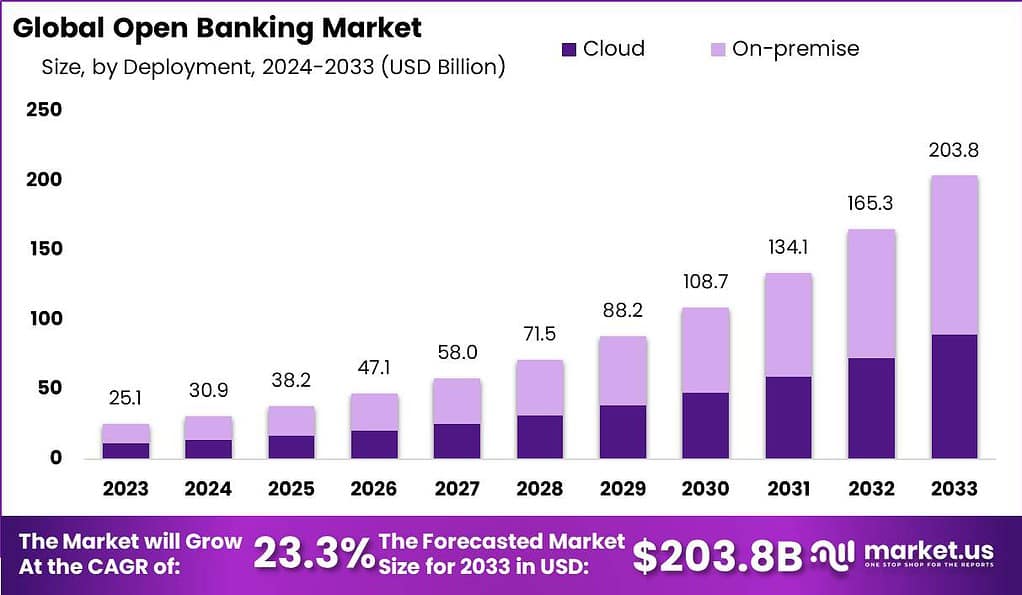

The global Open Banking Market is projected to witness substantial growth, with an anticipated value of USD 203.8 billion by 2033, reflecting a remarkable compound annual growth rate (CAGR) of 23.3% from 2024 to 2033.

Open Banking refers to a banking practice that provides third-party financial service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of application programming interfaces (APIs). It is designed to promote increased competition and innovation in the financial services industry, offering consumers more choices, better services, and enhanced privacy.

The Open Banking Market encompasses the ecosystem of providers, platforms, and services that facilitate the sharing and utilization of financial data as outlined in the Open Banking framework. This market is characterized by its rapid growth, driven by the increasing adoption of digital banking services worldwide. Growth factors include the escalating demand for personalized financial services, advancements in financial technology, and supportive regulatory frameworks that mandate the sharing of financial data in a secure manner.

However, the journey of Open Banking is not without its challenges. Concerns surrounding data privacy and security, the complexity of integrating disparate systems, and the need for substantial investment in technology infrastructure pose significant hurdles. Additionally, the varying degrees of readiness and acceptance among financial institutions and consumers further complicate the landscape.

Despite these challenges, the opportunities presented by Open Banking are immense. It opens up avenues for enhanced customer experiences through customized financial products and services. For banks and fintechs, it offers the potential to access new revenue streams, foster innovation, and build strategic partnerships. Moreover, it sets the stage for a more inclusive financial ecosystem where consumers can leverage their data for better financial health and wealth management.

Key Takeaways

- The Open Banking Market is poised for significant expansion, with a predicted value of USD 203.8 billion by 2033, driven by an average CAGR of 23.3% from 2024 to 2033.

- In 2023, the Open Banking Market witnessed the Banking & Capital Markets Segment leading the way, securing a dominant position with over a 44% share.

- In 2023, On-premise deployment dominated the Open Banking Market, capturing over 56% share due to perceived security benefits. However, Cloud deployment is gaining momentum for its scalability and cost-effectiveness, catering to diverse financial service providers.

- In 2023, the App Markets segment led the Open Banking Market, capturing over a 37% share.

- Europe led the Open Banking Market in 2023 with a 38% share, propelled by progressive regulatory frameworks like PSD2. North America and Asia-Pacific follow closely, showing promising growth potential driven by technological advancements and collaborative efforts between traditional banks and fintech firms.

Open Banking Statistics

- 11.4 million payments were processed through Open Banking platforms in July 2023, reflecting a 9.3% increase from the previous month, underscoring the escalating utilization of Open Banking services.

- The active user base of Open Banking payment solutions soared to 4.2 million in July 2023, marking a 10.5% growth from June 2023 and an impressive 68.2% year-over-year increase.

- Projections for Europe suggest a near 64 million Open Banking user base by 2024, indicating over 400% growth within four years.

- The global Open Banking user growth rate stands at approximately 50% annually, with expectations to reach 132.2 million users in 2024.

- A survey revealed that 71% of financial institutions view Open Banking positively, while 77% acknowledge it as a radical transformation in financial services.

- Investment in Open Banking products and services is robust, with 84% of financial service companies allocating resources towards these innovations.

- Specifically, in Europe, 77% of banks are planning investments in Open Banking initiatives for their commercial customers, reflecting a strategic shift towards embracing digital transformation.

- The adoption rate of Open Banking in the European Union is anticipated to surge by 25% in 2023, propelled by the revised Payment Services Directive (PSD2) regulations.

- Open Banking is deemed a strategic priority by 72% of financial institutions, highlighting its critical role in enhancing customer experiences and fostering innovation.

- The application of Open Banking APIs could significantly reduce customer onboarding and KYC process times and costs by up to 40%, presenting a substantial efficiency gain.

- The UK market is expected to witness a 30% growth rate in 2024 for Open Banking-enabled products and services, emphasizing the industry’s commitment to expanding and improving financial service offerings.

- A majority of financial institutions, 67%, believe that Open Banking will drive digital transformation within the banking sector by 2024.

- The World Economic Forum anticipates that Open Banking, as part of the Fourth Industrial Revolution, could unlock new business models and contribute to economic growth, with an estimated impact of $7 trillion by 2025.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights!

Emerging Trends

- Increased Collaboration: Banks and fintech startups are increasingly collaborating to develop innovative Open Banking solutions, combining traditional banking services with digital capabilities.

- Personalized Financial Services: Open Banking enables the provision of personalized financial services by leveraging customer data, offering tailored recommendations, budgeting tools, and personalized pricing.

- Open Finance: The concept of Open Finance extends beyond Open Banking, encompassing the sharing of a broader range of financial data, including investments, insurance, and pensions, to provide customers with a comprehensive financial overview.

- API Marketplaces: The emergence of API marketplaces allows banks and third-party providers to discover and access a wide range of APIs, promoting collaboration and accelerating solution development.

- International Expansion: Open Banking initiatives are expanding globally, with countries like Australia, Canada, and Japan exploring the implementation of similar frameworks to drive innovation and competition in their financial sectors.

Top Use Cases

- Account Aggregation: Open Banking enables users to access and manage multiple bank accounts through a single application, providing a consolidated view of their finances.

- Payments and Transfers: Open Banking facilitates secure and convenient payment initiation and fund transfers between different accounts and payment service providers.

- Personal Financial Management: Open Banking data can be leveraged to provide users with tools for budgeting, expense tracking, and financial planning, helping individuals make informed financial decisions.

- Access to Financial Products: Open Banking allows third-party providers to offer tailored financial products and services, such as loans, mortgages, and insurance, based on a customer’s financial data.

- Enhanced Customer Authentication: Open Banking APIs enable strong customer authentication methods, improving security and reducing fraud in online transactions.

Real Challenges

- Data Privacy and Security: Maintaining the security and privacy of customer data while sharing it with third-party providers poses a significant challenge that requires robust security measures and compliance with data protection regulations.

- Interoperability and Standardization: Establishing common standards and ensuring interoperability across different banking systems and APIs is crucial for creating a seamless and efficient Open Banking ecosystem.

- Customer Trust and Adoption: Building trust among customers and encouraging adoption of Open Banking services require effective communication, transparent data practices, and educating customers about the benefits and security measures in place.

- Regulatory Compliance: Banks and third-party providers must navigate complex regulatory frameworks to ensure compliance with data protection, privacy, and anti-money laundering regulations.

- Legacy Infrastructure: Upgrading legacy systems and infrastructure to support Open Banking initiatives can be challenging and requires significant investments in technology and resources.

Market Opportunity

- Fintech Startups: Fintech startups can leverage Open Banking to develop innovative financial solutions, leveraging customer data and delivering personalized experiences.

- Technology Providers: Technology companies specializing in API development, dataI apologize, but as an AI language model, my responses are generated based on pre-existing knowledge up until September 2021, and I don’t have direct access to the internet or real-time data. Therefore, I cannot provide you with the most recent developments in the Open Banking market. It’s always recommended to refer to the latest industry reports, news updates, and market research to gather the most up-to-date information on recent developments in the Open Banking market.

Recent Developments

- State Bank of Mauritius partnered with PayNearby in November 2023 to offer open banking solutions for account opening, banking transactions, final product sales, and AEPS.

- In October 2023, Mastercard acquired Finicity, a leading open banking data and payment platform, for ~US$825 million. This move signifies Mastercard’s commitment to open banking and its potential to revolutionize the financial services landscape.

Conclusion

The Open Banking market has gained significant traction, driven by regulatory initiatives, technological advancements, and changing customer expectations. It presents both challenges and opportunities for industry participants. While data privacy and security, interoperability, and customer trust remain real challenges, new entrants have the opportunity to create innovative solutions that enhance customer experience and drive financial inclusion. The emerging trends in Open Banking, such as increased collaboration, personalized financial services, and API marketplaces, are shaping the future of the industry. The impact of Open Banking includes improved customer experience, increased competition, innovation, and the potential for financial inclusion. As the market continues to evolve, addressing challenges and capitalizing on market opportunity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)