Table of Contents

Introduction

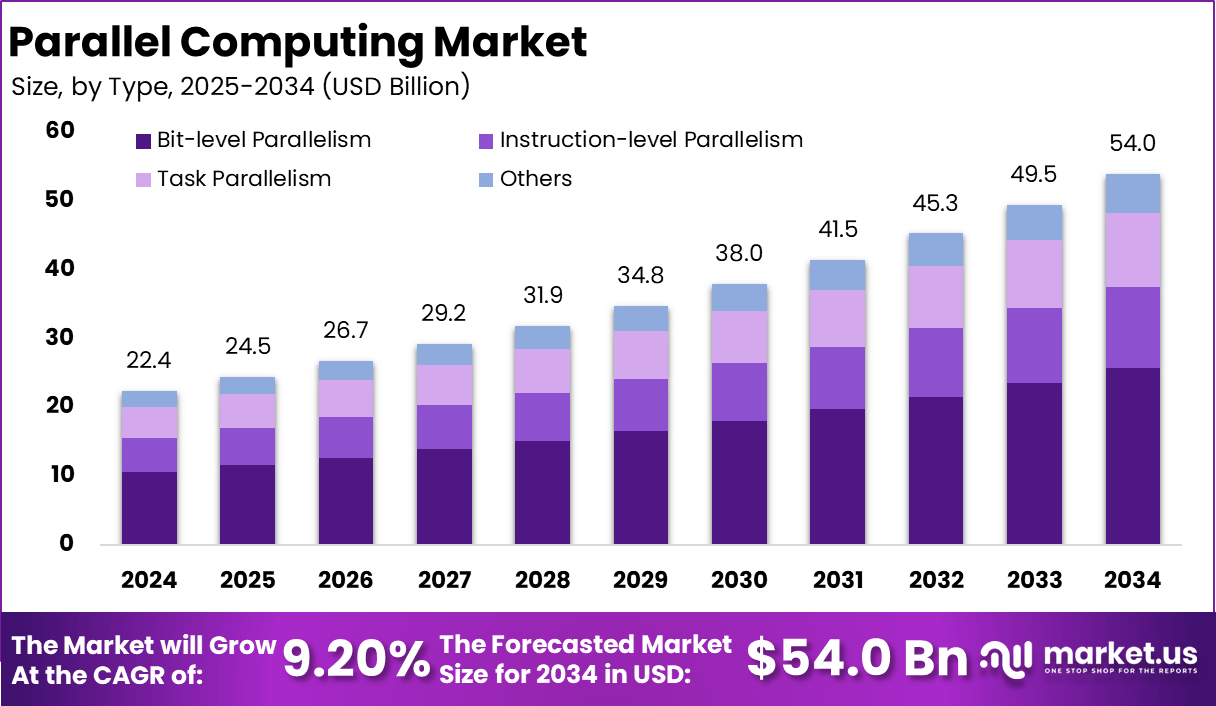

The global parallel computing market was valued at USD 22.4 billion in 2024 and is projected to reach approximately USD 54.0 billion by 2034, registering a CAGR of 9.2%. Growth is primarily driven by the expanding adoption of high-performance computing (HPC) for big data analytics, AI model training, and simulation-intensive applications across defense, aerospace, automotive, and healthcare industries.

North America accounted for 42.7% of the total market in 2024 (USD 9.56 billion), supported by strong government funding and the presence of major HPC technology developers. The US alone contributed USD 8.61 billion and is anticipated to reach USD 18.76 billion by 2034, highlighting the region’s technological leadership.

How Growth is Impacting the Economy

The rising adoption of parallel computing is expected to significantly impact the global economy by enhancing computational efficiency, enabling faster scientific discoveries, and supporting innovation across multiple industries. The technology optimizes data-intensive operations, which reduces project timelines in sectors like drug discovery, defense simulation, and automotive design. As organizations shift toward AI-driven predictive analytics, parallel processing infrastructure strengthens data-driven decision-making and productivity.

Economically, this growth fosters high-skilled employment in HPC engineering, data science, and software optimization. Government investments in national supercomputing initiatives and AI research centers are stimulating regional competitiveness, particularly in North America, Europe, and Asia Pacific. Over time, parallel computing is anticipated to become an integral part of global digital infrastructure, reducing R&D costs and accelerating advancements in smart manufacturing, sustainable energy modeling, and financial forecasting.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/parallel-computing-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Enterprises face rising hardware procurement and energy costs due to advanced GPU and CPU clusters needed for parallel computing. Supply chains are shifting toward localized production of semiconductors and high-end chips to reduce dependency on limited global suppliers. This transition is reshaping vendor networks and encouraging investment in chip fabrication within the US, Europe, and Asia.

Sector-Specific Impacts

In healthcare, parallel computing accelerates genomic analysis and personalized medicine. In aerospace and defense, it enhances real-time simulations and predictive modeling for mission-critical operations. Automotive firms use it for autonomous vehicle development, while financial institutions leverage it for algorithmic trading and risk modeling. Each sector experiences a surge in efficiency and innovation capacity, reinforcing the importance of computational power in modern industry.

Strategies for Businesses

Businesses should invest in scalable HPC infrastructure integrated with AI and cloud-based parallel computing frameworks to ensure agility. Forming partnerships with semiconductor manufacturers and cloud providers can mitigate hardware shortages. Emphasizing energy-efficient architectures and GPU virtualization reduces operational costs. Upskilling employees in parallel programming languages like CUDA and OpenMP is crucial for maximizing performance. Firms should prioritize workload optimization, invest in hybrid on-premises-cloud models, and adopt performance benchmarking to stay competitive in the evolving computational landscape.

Key Takeaways

- Market projected to reach USD 54.0 billion by 2034 at 9.2% CAGR

- North America dominates with a 42.7% share in 2024

- Rising demand for HPC in AI, aerospace, and defense drives adoption

- Supply chains are shifting toward localized chip manufacturing

- Energy-efficient and scalable architectures are key to sustainable growth

- Workforce upskilling in parallel programming languages is crucial

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=162358

Analyst Viewpoint

Currently, the parallel computing market is experiencing rapid advancement as industries integrate HPC to handle complex workloads and real-time analytics. The market outlook remains highly positive, driven by exponential data growth, AI integration, and national-level supercomputing initiatives. Over the next decade, democratized access through cloud-HPC services will accelerate adoption among SMEs. Analysts anticipate sustained demand as enterprises modernize infrastructure and governments prioritize digital sovereignty. The fusion of parallel computing with quantum acceleration and edge computing will define the future of computational innovation globally.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Aerospace & Defense simulations | Rising need for real-time mission analytics and predictive modeling |

| Healthcare genomic sequencing | Growing demand for fast bioinformatics and precision medicine |

| Automotive autonomous systems | Increased data processing for AI-based driving algorithms |

| Financial risk modeling | Expanding algorithmic trading and real-time portfolio simulations |

| Climate & energy modeling | Government-funded sustainability research using HPC clusters |

Regional Analysis

North America accounted for 42.7% of the global share in 2024 due to significant federal R&D funding and the presence of advanced HPC centers. Europe continues to expand through initiatives like EuroHPC JU aimed at developing exascale systems. Asia Pacific is poised for the fastest growth, led by China, Japan, and India’s increasing investments in supercomputing and AI research infrastructure. Latin America and the Middle East are gradually adopting cloud-based parallel computing for industrial automation and energy projects, expanding the technology’s global footprint.

Business Opportunities

The market presents opportunities in cloud-HPC platforms, edge-to-cloud integration, and energy-efficient chip design. Startups offering parallel programming toolkits, workload orchestration software, and GPU-optimized frameworks can tap into high-growth segments. Service providers delivering HPC-as-a-Service (HPCaaS) will see strong demand from SMEs lacking in-house infrastructure. Collaboration among universities, government institutions, and private firms for supercomputing research will foster new revenue streams. The transition toward sustainable computing solutions offers scope for green data-center innovations and carbon-neutral computing models.

Key Segmentation

The parallel computing market is segmented by component (hardware, software, services), by architecture (shared memory, distributed memory, hybrid), by application (scientific research, weather forecasting, data analytics, AI model training, engineering simulation, financial modeling), and by end-user (aerospace & defense, healthcare, automotive, BFSI, academia, energy). Hardware remains the dominant segment due to continual advancements in GPUs and processors, while the services segment is projected to grow steadily through managed cloud deployments.

Key Player Analysis

Leading market participants are emphasizing product innovation, performance optimization, and partnership expansion to strengthen HPC ecosystems. Companies are focusing on developing multi-node clusters, GPU-accelerated systems, and AI-integrated computing platforms. Strategic collaborations with academic and defense institutions enhance R&D capabilities, while joint ventures with chip manufacturers ensure supply chain stability. The competitive focus remains on reducing energy consumption, improving scalability, and offering cost-effective solutions for global enterprises and research institutions seeking computational efficiency.

- Dell

- Hewlett Packard Enterprise (HPE)

- Amazon (AWS)

- Lenovo Group Ltd

- International Business Machines Corporation

- Sugon

- Inspur

- Microsoft Corporation

- Atos

- Huawei

- Alibaba Cloud

- Others

Recent Developments

- April 2025: A new exascale supercomputer achieved record simulation performance for climate modeling.

- February 2025: A major cloud provider launched HPC-as-a-Service to support AI model training.

- July 2024: Government agencies announced funding for national HPC research centers.

- September 2024: Semiconductor firms partnered to co-develop energy-efficient GPU clusters.

- December 2024: Universities integrated AI-driven workload schedulers to optimize parallel computing efficiency.

Conclusion

The global parallel computing market is expanding steadily, transforming industries through computational acceleration and AI integration. Sustained innovation, regional investments, and energy-efficient architectures are expected to define the market’s next phase, solidifying parallel computing as the foundation of advanced digital transformation worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)