Table of Contents

Introduction

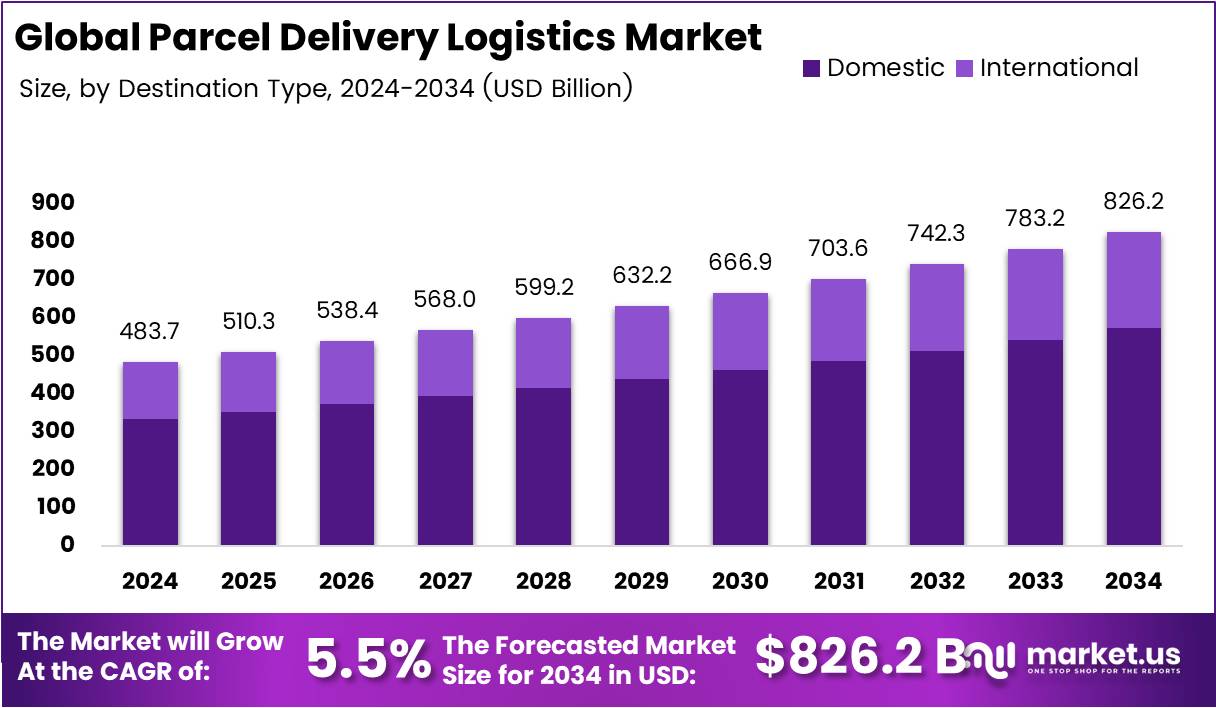

The Global Parcel Delivery Logistics Market is projected to reach USD 826.2 Billion by 2034, up from USD 483.7 Billion in 2024, growing at a compound annual growth rate (CAGR) of 5.5% from 2025 to 2034. This market encompasses the transportation, management, and distribution of parcels, including small packages and bulk shipments, with a key focus on enhancing operational efficiency.

The ongoing rise of e-commerce and a growing consumer expectation for fast, reliable delivery services are fueling the growth of this market. As technology evolves, parcel delivery logistics companies are increasingly investing in automated processes, advanced tracking systems, and sustainable delivery solutions to meet the rising demand and ensure faster service.

Key Takeaways

- The Global Parcel Delivery Logistics Market is expected to reach USD 826.2 Billion by 2034, a significant increase from USD 483.7 Billion in 2024, growing at a CAGR of 5.5% from 2025 to 2034.

- The Asia Pacific region dominates the market with a market share of 41.7%, valued at USD 201.7 Billion in 2024.

- Road transportation remains the leading mode of delivery, accounting for 61.8% of the market share in 2024.

- Domestic parcel deliveries dominate the destination type segment with a 69.3% share.

- Business-to-Consumer (B2C) is the largest business type, holding 56.4% of the market share.

- Retail remains the top end-use sector, contributing 36.7% of the market share.

Market Segmentation Overview

The parcel delivery logistics market is segmented by mode, destination type, business type, and end-use. These segments help in understanding the diverse needs of businesses and consumers, as well as identifying the key trends that influence the logistics landscape.

By Mode

- Road transportation leads the market with a 61.8% share, owing to its well-established infrastructure network that supports cost-effective, door-to-door services.

- Air transport, which is essential for time-sensitive deliveries, ranks second.

- Sea freight caters to bulk shipments for international trade, while Rail transportation focuses on intercity bulk parcel movements where cost efficiency is prioritized.

By Destination Type

- Domestic deliveries hold a dominant share of 69.3% due to mature infrastructure and lower operational complexity compared to international shipments.

- International parcel delivery is growing steadily, driven by cross-border e-commerce and global trade.

By Business Type

- Business-to-Consumer (B2C) is the dominant segment, accounting for 56.4% of the market share. The rise of online retail, fueled by consumer demand for home deliveries, has made this segment the most dynamic in the parcel delivery logistics market.

- Business-to-Business (B2B) deliveries represent a significant portion of the market, especially for inter-company logistics and industrial shipments.

- Consumer-to-Consumer (C2C) is emerging, driven by peer-to-peer platforms and individual shipping needs.

By End-use

- Retail dominates the end-use sector with a 36.7% market share, supported by the widespread adoption of e-commerce and omnichannel shopping strategies.

- Defense, Chemical, Wholesale, and Logistics & Shipping are the other sectors contributing to the growth of the market.

Drivers

Surge in E-commerce and Online Shopping

The rapid growth of e-commerce is one of the primary drivers of the parcel delivery logistics market. With the pandemic accelerating the shift to online shopping, consumers now expect faster delivery services, such as same-day or next-day delivery. This surge in parcel volume is forcing logistics companies to innovate and expand their delivery networks.

Technological Advancements

The adoption of smart technologies such as automated sorting systems, smart routing, real-time package tracking, and artificial intelligence (AI) for route optimization is improving delivery efficiency and reducing costs. These advancements enable parcel delivery companies to meet the increasing demand for quicker and more reliable services.

Consumer Expectations for Faster Deliveries

In the U.S., 90% of online shoppers expect two- to three-day shipping, with nearly half of consumers stating they will shop elsewhere if delivery times exceed expectations. This has prompted companies to adopt new delivery solutions and optimize their logistics networks.

Global Trade and Cross-Border E-commerce

International trade continues to expand, leading to an increase in cross-border deliveries. As businesses sell products globally, the need for efficient international shipping solutions has become more critical.

Use Cases

Retail and E-commerce

Parcel delivery logistics plays a vital role in the retail and e-commerce sectors. With the rise of digital shopping, businesses need reliable logistics partners to ensure timely and efficient deliveries. Companies like Amazon, Walmart, and eBay rely heavily on parcel delivery services to meet customer expectations.

Medical and Pharmaceutical Deliveries

Cold chain logistics for perishable goods, such as pharmaceuticals and medical supplies, is rapidly growing. Temperature-controlled deliveries are essential to maintaining the integrity of medicines and vaccines, which are in high demand due to the global healthcare crisis.

Food and Groceries

With the rise of online grocery shopping, parcel delivery logistics has expanded into the food sector. Companies are investing in refrigerated delivery solutions to transport perishable items, meeting the demand for convenience in everyday shopping.

Major Challenges

Rising Fuel Prices

One of the most significant challenges faced by the parcel delivery logistics market is the increasing cost of fuel. Higher fuel prices lead to increased transportation expenses, which may be passed on to consumers in the form of higher shipping fees. This can reduce demand for delivery services, especially for price-sensitive consumers.

Regulatory Compliance

Parcel delivery companies must comply with strict regulations regarding package handling, security screening, and delivery processes. These regulations often require substantial investments in technology, staff training, and equipment, which can increase operational costs.

Environmental Concerns

As governments and consumers demand more sustainable practices, parcel delivery logistics companies must find ways to reduce their carbon footprint. This has led to the adoption of electric vehicles, drones, and bicycle deliveries, but the transition to greener technologies comes with high initial investments.

Delivery Challenges in Rural and Remote Areas

Rural areas, with limited infrastructure and greater distances between delivery stops, present significant challenges for parcel delivery companies. Delivering to these regions is often expensive and time-consuming, with many logistics providers struggling to offer cost-effective solutions.

Business Opportunities

Artificial Intelligence for Route Optimization

AI-powered route optimization solutions offer a massive opportunity for companies in the parcel delivery logistics market. By analyzing traffic patterns, weather conditions, and delivery priorities, AI can help companies optimize delivery routes, reduce fuel consumption, and improve delivery efficiency.

Last-Mile Delivery Solutions

Last-mile delivery remains one of the most expensive components of the parcel delivery process. Companies are exploring innovative solutions, including local pickup points, smart lockers, and autonomous vehicles, to reduce costs and improve delivery times.

Green Logistics

The increasing demand for environmentally friendly logistics practices is creating opportunities for companies to invest in electric vehicles, bicycle deliveries, and carbon-neutral shipping solutions. These efforts not only cater to the growing demand for sustainability but also help reduce operational costs in the long run.

Drone and Autonomous Delivery Systems

Drone and autonomous vehicles represent a transformative solution for the parcel delivery industry, especially in hard-to-reach locations. Early adopters are already experimenting with these technologies for specific applications, such as medical deliveries and rural areas.

Regional Analysis

Asia Pacific Dominates the Parcel Delivery Logistics Market

The Asia Pacific region holds the largest market share of 41.7%, valued at USD 201.7 Billion in 2024. The region benefits from rapid urbanization, robust e-commerce growth, and expanding digital economies. Countries like China and India are at the forefront of market expansion, with improvements in logistics infrastructure fueling further growth in parcel delivery services.

North America is another key player in the parcel delivery logistics market, primarily driven by the U.S. and its advanced logistics infrastructure. The demand for faster, more efficient deliveries is expected to grow as e-commerce continues to thrive. The U.S. also benefits from strong technological advancements that enhance delivery speeds.

Europe remains a critical region in the parcel delivery logistics market, driven by an increasing e-commerce presence, improvements in infrastructure, and a focus on sustainable logistics solutions. Cross-border e-commerce expansion and growing urbanization are expected to propel further market growth in Europe.

Latin America is an emerging region in the parcel delivery logistics market, driven by the rise in e-commerce activities in Brazil and Mexico. While challenges such as infrastructure gaps and currency fluctuations persist, the market is expected to expand as digital retail penetration increases.

Recent Developments

- July 2025: HIVED secured USD 42 Million to revolutionize the parcel delivery landscape with an all-electric logistics network, improving sustainability and efficiency.

- February 2025: Relay raised €33.4 Million to innovate parcel delivery services, optimizing technology for faster, more cost-effective delivery solutions.

- April 2025: Delhivery acquired a controlling stake in Ecom Express to strengthen its last-mile delivery capabilities and expand its footprint in India.

Conclusion

The Global Parcel Delivery Logistics Market is on a robust growth trajectory, with significant opportunities arising from the expansion of e-commerce, technological advancements, and increasing consumer demands for faster delivery services. Despite challenges like rising fuel prices and regulatory requirements, the market presents numerous avenues for innovation, particularly in AI, sustainable practices, and last-mile delivery solutions.

As regional markets continue to develop, especially in Asia Pacific and North America, parcel delivery logistics companies are poised for sustained growth. With strategic investments in technology and infrastructure, businesses can capitalize on the increasing demand for efficient and reliable delivery services.