Table of Contents

- Introduction

- Editor’s Choice

- Passenger Information System Market Overview

- Passenger Information System Solutions for Rail Transport

- Passenger Information System Solutions for Buses Statistics

- Passenger Information System Solutions for Airlines Statistics

- Role of Smartphone Adoption in the Use of PIS

- Utilization of Cloud and Big Data Technologies in PIS

- Recent Developments

- Conclusion

- FAQs

Introduction

Passenger Information System Statistics: Passenger Information Systems (PIS) play a vital role in contemporary transportation. Providing instant updates and direction to travelers across diverse transit modes.

Further, with hardware, software, communication networks, and user interfaces, PIS ensures passengers promptly access information on timetables, disruptions, and directions via screens, announcements, and mobile applications.

These systems elevate the travel experience and streamline operational effectiveness while fostering passenger safety and contentment.

Upcoming trends, such as the amalgamation of IoT and AI, mobile connectivity, and smart infrastructure solutions. Promise to bolster service dependability and tailor the passenger journey.

Moreover, with technological advancements, PIS will evolve to address travelers’ changing demands and bolster transportation network efficiency.

Editor’s Choice

- The Global Passenger Information System Market revenue reached USD 30.0 billion in 2023.

- Solutions revenue is expected to grow from USD 22.50 billion in 2023 to USD 69.23 billion in 2033, indicating a substantial increase.

- North America commands the largest share, accounting for 32.1% of the market.

- Advantech Co., Ltd. and Alstom lead the pack with 17% and 18% market shares, respectively. Showcasing their significant presence in the industry.

- BUSE‘s onboard computers, the BS 300 and BS 100 are engineered explicitly for utilization on buses, trolleybuses, trams, and trains. These highly dependable devices manage and interconnect electronic systems within and outside the vehicle.

- Delhi’s Transport Minister unveiled a revamped ‘One Delhi‘ app on November 2, 2022, to enhance bus services.

- Further, DXC Technology recently inked a multiyear deal with Copa Airlines, a major Latin American carrier, in December 2021 to modernize Copa’s mainframe-based Passenger Service System (PSS) by transitioning it entirely to the public cloud without disrupting operations.

Passenger Information System Market Overview

Global Passenger Information System Market Size Statistics

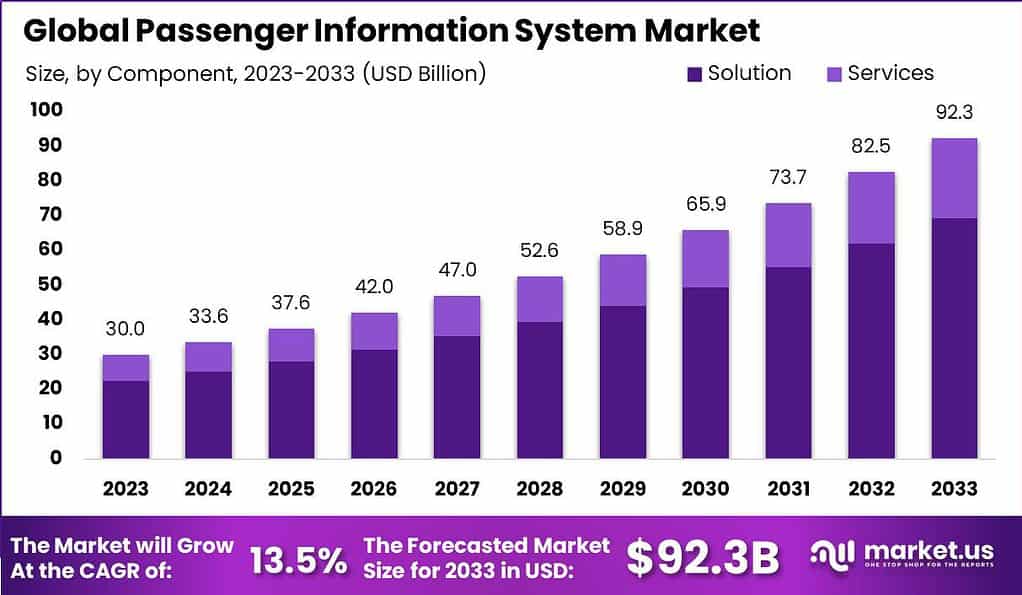

- The Global Passenger Information System Market has witnessed steady growth in revenue over the years, with a trajectory poised for continued expansion at a CAGR of 13.5%.

- Starting at USD 30.0 billion in 2023, the market’s revenue increased to USD 33.6 billion in 2024 and is projected to reach USD 37.6 billion by 2025.

- This growth trend is expected to accelerate, with revenues estimated to reach USD 42.0 billion in 2026 and USD 47.0 billion in 2027.

- By 2028, the market is anticipated to surpass USD 50 billion, with revenues reaching USD 52.6 billion.

- As the demand for efficient passenger information systems continues to rise, revenue projections indicate a significant uptick. The market is expected to exceed USD 58.9 billion by 2029 and USD 65.9 billion by 2030.

- By 2031 and 2032, revenues are forecasted to climb to USD 73.7 billion and USD 82.5 billion, respectively.

- The upward trajectory is expected to persist, with revenues reaching USD 92.3 billion by 2033, reflecting sustained growth and robust market dynamics.

(Source: Market.us)

Global Passenger Information System Market Size – By Component Statistics

- The Global Passenger Information System Market size, segmented by component, showcases a robust growth trajectory across solutions and services.

- In 2023, the total market revenue stood at USD 30.0 billion, with solutions contributing USD 22.50 billion and services USD 7.50 billion.

- Over the subsequent years, this upward trend continued, with revenues increasing steadily. By 2033, the market will reach USD 92.3 billion in total revenue.

- Solutions revenue is expected to grow from USD 22.50 billion in 2023 to USD 69.23 billion in 2033, indicating a substantial increase.

- Similarly, services revenue is forecasted to rise from USD 7.50 billion in 2023 to USD 23.08 billion in 2033.

- This growth trajectory underscores the increasing demand for solutions and services in the passenger information system market. Driven by technological advancements and a focus on enhancing passenger experience and operational efficiency within the smart transportation sector.

(Source: Market.us)

Regional Analysis of Global Passenger Information System Market Statistics

- The market share distribution in the Global Passenger Information System Market reveals varying regional contributions.

- North America commands the largest share, accounting for 32.1% of the market.

- Europe follows closely behind with an 18.0% share, while the Asia-Pacific (APAC) region holds a significant portion at 22.0%.

- South America and the Middle East & Africa (MEA) regions contribute 16.0% and 11.9%, respectively.

- This distribution highlights North America and APAC as dominant players in the market, with Europe also holding a substantial position.

- South America and MEA, while representing smaller shares, still play significant roles in the overall market landscape.

(Source: Market.us)

Competitive Landscape of the Global Passenger Information System Market Statistics

- Several vital companies vie for market dominance in the competitive landscape of Passenger Information Systems (PIS) providers.

- Advantech Co., Ltd. and Alstom lead the pack with 17% and 18% market shares, respectively, showcasing their significant presence in the industry.

- Following closely are Cisco Systems, Inc., Cubic Transportation Systems, and Hitachi, Ltd. Each captured 9%, 8%, and 8% of the market, demonstrating their notable contributions to the sector.

- Huawei Technologies Co., Ltd. and Siemens AG also hold substantial shares at 7% and 6%, respectively.

- TE Connectivity rounds out the list of major players with a 6% market share.

- Despite the dominance of these leading companies, the market remains diverse, with other vital players collectively contributing 22% of the market share.

- This competitive landscape underscores the dynamic nature of the PIS market, characterized by innovation, strategic partnerships, and ongoing efforts to meet the evolving needs of transportation management networks worldwide.

(Source: Market.us)

Passenger Information System Solutions for Rail Transport

- A railway in-vehicle computer tailored for Passenger Information Systems (PIS) boasts extensive input and output capabilities for handling media data and high-performance processing for real-time information management.

- Lanner’s R6S stands out as a trained computer designed to withstand shock and vibration. Offering a customized configuration featuring the appropriate processor, memory, and various I/O options.

- Equipped with a powerful Intel Core i7-7600U CPU, it excels in audio and video control.

- The device features multiple I/O ports, including removable drive bays, COM ports, dual video ports, USB, and DIDO ports, with expansion options via Mini-PCIe Sockets and SIM card readers for LTE/WiFi connectivity.

- Furthermore, it includes 10 M12 PoE ports for cameras, actuators, and sensors.

- Engineered to endure harsh conditions, the R6S boasts rugged construction. Resistance to vibration and extreme temperatures (-40°C to 70°C), and features a fanless corrugated aluminum case for efficient cooling.

- Urban Rail Transit Market size is expected to be worth around USD 63.55 Billion by 2033, From USD 46.38 Billion by 2023.

(Source: Lanner)

Passenger Information System Solutions for Buses Statistics

- The passenger information system delivers visual and auditory updates to passengers aboard buses.

- BUSE‘s onboard computers, the BS 300 and BS 100 are engineered explicitly for utilization on buses, trolleybuses, trams, and trains. These highly dependable devices manage and interconnect electronic systems within and outside the vehicle.

- BUSE also produces energy-efficient flip DOT-LED signs, monochrome LED signs with various color choices, and competitively priced full LED signs.

- These include the Flip DOT-LED BS 210 signs, LED monochrome signs BS 310, and LED full-color and combined signs BS 410 and BS 414.

- The interior LED signs have demonstrated their dependability and resilience, remaining in use on public transport vehicles. They are well-suited for compact areas where LCDs are unsuitable or where budget constraints prevent the use of LCD signs.

- BUSE offers interior LCDs under the designation BS 370 and LED interior signs under the designation BS 120.

(Source: BUSE)

Passenger Information System Solutions for Airlines Statistics

- The Advance Passenger Information System (APIS) is established by the U.S. Customs and Border Protection (CBP) to exchange electronic data with commercial airlines and vessel operators.

- Private aircraft pilots began providing information to CBP in May 2009.

- Regulations were implemented in December 2008 with a 180-day voluntary compliance period.

- Electronic APIS (eAPIS) is a public website allowing small commercial carriers to transmit data to CBP electronically.

- Passengers traveling to or from certain countries must provide advance passenger information (API) before check-in to be allowed to fly.

- This requirement applies to various countries, including the United States, United Kingdom, Australia, Canada, and more.

(Source: U.S. Customs and Border Protection (CBP)

Role of Smartphone Adoption in the Use of PIS

- Apple’s mobile ecosystem generates substantial profits, boasting high margins and returns on invested capital.

- Profits soared from $67.1 billion globally in 2020 to $109.2 billion in 2021, driven by the increasing use of smartphones. Information systems, particularly mobile applications, are rapidly gaining traction.

- Transit authorities leverage PIS mobile apps to engage users, offering quick, accurate, real-time information via smartphones.

- For instance, Delhi’s Transport Minister unveiled a revamped ‘One Delhi‘ app on November 2, 2022, to enhance bus services.

- In collaboration with the Indraprastha Institute of Information Technology (IIIT) Delhi, the app enables live tracking of over 7300 buses. Provides precise waiting times at bus stops, and offers reliable bus route information for efficient journey planning.

(Source: Apple, Dialogue and Development Commission of Delhi)

Utilization of Cloud and Big Data Technologies in PIS

- Additionally, Cloud computing facilitates the automation of transportation modes like trains and airplanes, with the passenger information system leveraging cloud technology to track bus locations for real-time display at bus stops.

- Cloud solutions and data analytics tools enable cost-effective passenger monitoring and efficient resource allocation.

- Moreover, several companies are heavily investing in R&D to develop advanced passenger information systems compatible with existing infrastructures of various sizes.

- For example, DXC Technology recently inked a multiyear deal with Copa Airlines, a major Latin American carrier, in December 2021.

- Further, the agreement aims to modernize Copa’s mainframe-based Passenger Service System (PSS) by transitioning it entirely to the public cloud without disrupting operations.

- DXC, in collaboration with Microsoft and Copa, spearheads this transformation. Ensuring seamless integration of third-party applications into Copa’s IT ecosystem to enhance both customer and employee experiences.

(Source: DXC Technology)

Recent Developments

Acquisitions and Mergers:

- Thales Group’s Acquisition of Guavus: In June 2020, Thales Group acquired Guavus, a big data analytics company, for approximately $215 million. This acquisition bolstered Thales’ portfolio in the PIS market, enhancing its ability to process real-time data and deliver improved passenger services.

- Siemens Mobility’s Acquisition of Railigent: In August 2020, Siemens Mobility acquired Railigent for $150 million, aiming to strengthen its predictive analytics capabilities within the PIS sector. This acquisition supports Siemens’ goal of improving data-driven decision-making for transit authorities globally.

New Product Launches:

- Siemens Mobility’s New PIS Platform: In June 2020, Siemens Mobility introduced a new PIS platform featuring predictive analytics. designed to reduce delays and enhance passenger satisfaction. The platform is expected to contribute to a 15% improvement in operational efficiency for transit operators.

- Thales Group’s Advanced PIS: Thales launched a new global PIS platform in August 2020, integrating AI and big data analytics. This system aims to boost passenger engagement by 20% through personalized real-time updates.

Funding:

- Cubic Corporation’s Umo Platform Expansion: In January 2022, Cubic Corporation invested $30 million to roll out its Umo platform, which supports over 900 buses across 30 transit systems. This platform incorporates contactless payment and real-time information services.

Technological Advancements:

- Integration of Real-Time Information and Digital Signage: PIS providers are increasingly adopting real-time information systems, with a 35% annual growth in digital signage implementations in 2023. These advancements aim to enhance the passenger experience by delivering timely updates and improving transit safety.

Conclusion

Passenger Information System Statistics – In summary, the Passenger Information System (PIS) is integral to modern transportation, providing real-time updates and guidance to passengers across various travel modes.

Technological advancements like cloud computing, data analytics, and mobile apps have made PIS more efficient and accessible.

Integration of IoT and AI enhances PIS capabilities for predictive analytics and personalized recommendations.

Ongoing R&D efforts aim to develop advanced PIS solutions meeting evolving passenger and authority needs.

Collaborations like DXC Technology’s partnership with Copa Airlines highlight the industry’s commitment to innovation and passenger satisfaction.

As demand for efficient transportation grows, PIS will evolve, driving industry advancements for seamless passenger experiences worldwide.

FAQs

A PIS is a system designed to provide real-time updates and guidance to passengers across various modes of transportation, such as buses, trains, and airplanes.

PIS utilizes various technologies, including sensors, communication networks, and software applications, to collect and disseminate information on schedules, delays, routes, and other relevant travel details to passengers via displays, announcements, and mobile applications.

PIS enhances the overall travel experience by providing passengers with timely and accurate information, optimizing operational efficiency for transportation providers, improving passenger safety and satisfaction, and facilitating better resource allocation and planning.

PIS leverages various technologies to gather, process, and disseminate information to passengers in real time, including cloud computing, data analytics, mobile applications, IoT, AI, and communication networks.

PIS is evolving to incorporate advanced features such as predictive analytics, personalized recommendations, and seamless integration with other transportation systems. Additionally, there is a growing emphasis on accessibility, sustainability, and user-centric design in PIS development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)