Table of Contents

Introduction

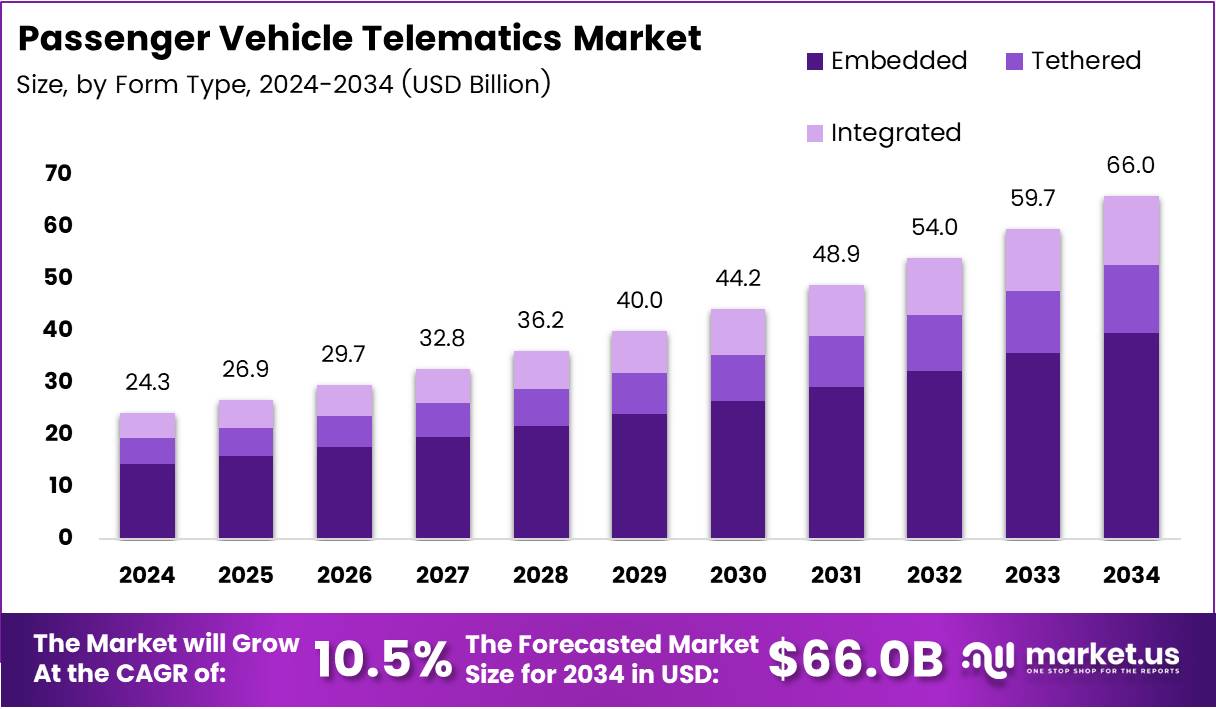

The Global Passenger Vehicle Telematics Market is on a transformative journey, projected to reach USD 66.0 Billion by 2034, up from USD 24.3 Billion in 2024. With a robust CAGR of 10.5% during the forecast period (2025–2034), the market is witnessing unprecedented adoption across vehicle categories.

Driven by increasing consumer demand for connected services, telematics systems are becoming an integral part of modern vehicles. Automakers are incorporating these technologies to enhance safety, improve navigation, and deliver real-time data insights. Furthermore, regulatory mandates and safety standards continue to strengthen telematics adoption globally.

As smart mobility and connected ecosystems evolve, the telematics industry is entering a new phase of growth. Continuous innovation, AI integration, and the shift toward autonomous vehicles are set to redefine the passenger vehicle landscape, ensuring smarter, safer, and more efficient driving experiences worldwide.

Key Takeaways

- The Global Passenger Vehicle Telematics Market is projected to reach USD 66.0 Billion by 2034, growing at a CAGR of 10.5% from 2025 to 2034.

- In 2024, Embedded systems lead the By Form Type Analysis segment with a 48.3% market share.

- Automatic Crash Notification services dominate the By Service Analysis segment with a 23.1% market share in 2024.

- The Telematic Control Unit holds a 43.4% share in the By Hardware Analysis segment in 2024.

- Satellite connectivity leads the By Connectivity Analysis segment, accounting for 68.9% of the market share in 2024.

- North America dominates the Passenger Vehicle Telematics market with a 34.9% share, valued at USD 8.4 Billion in 2024.

Market Segmentation Overview

By Form Type

In 2024, Embedded systems led with a 48.3% share due to their seamless integration and enhanced security. Automakers prefer these systems for reliability and control over hardware and software. Tethered solutions appeal to cost-conscious consumers, while Integrated systems are emerging as unified platforms for connected mobility.

By Service

Automatic Crash Notification held a 23.1% share in 2024, driven by safety regulations and rapid emergency response features. Navigation and Remote Diagnostics enhance convenience and vehicle performance, while UBI, Driver Behavior, and Vehicle Tracking services boost insurance and fleet management efficiency.

By Hardware

The Telematic Control Unit (TCU) dominated with a 43.4% share, serving as the brain of telematics systems. Navigation Systems, Communication Devices, and CAN Bus play crucial roles in delivering real-time insights and reliable connectivity, supporting advanced driver assistance and smart vehicle operations.

By Connectivity

Satellite connectivity commanded 68.9% of the market in 2024, offering unmatched global coverage and reliability. Meanwhile, Cellular networks continue to expand with 4G and 5G technologies, ensuring high-speed data transmission and supporting next-generation telematics and autonomous driving applications.

Drivers

1. Rising Demand for In-Vehicle Safety and Navigation

Consumers are prioritizing safety and convenience, leading to widespread integration of telematics for collision detection, real-time navigation, and emergency assistance. As vehicles become smarter, these systems play a crucial role in enhancing driver awareness, reducing accidents, and improving road safety standards.

2. Government Regulations and Connected Vehicle Adoption

Governments globally are mandating telematics-based solutions to ensure compliance with road safety and emission regulations. These policies are pushing automakers to adopt advanced telematics, accelerating innovation in autonomous driving, V2V communication, and intelligent transportation systems.

Use Cases

1. Usage-Based Insurance (UBI)

Telematics enables data-driven insurance models, rewarding safe driving with lower premiums. In 2024, 35% of consumers enrolled in UBI programs, reflecting the growing appeal of personalized, cost-effective insurance supported by real-time driving data and behavior analytics.

2. Fleet and Vehicle Management

Fleet operators leverage telematics for route optimization, vehicle tracking, and driver behavior monitoring. These insights lead to reduced operational costs, improved fuel efficiency, and enhanced safety compliance, positioning telematics as a critical tool in commercial and passenger fleets.

Major Challenges

1. Data Privacy and Security Concerns

With vast data collection—including location, behavior, and personal details—privacy breaches remain a significant threat. Cybersecurity risks can hinder user trust, compelling manufacturers to invest heavily in encryption and data protection protocols.

2. Infrastructure Limitations in Emerging Markets

Regions with limited network coverage and technological readiness face slower telematics adoption. The lack of affordable solutions, coupled with low consumer awareness, restricts market expansion across developing economies, creating barriers to full-scale implementation.

Business Opportunities

1. Growth of Electric Vehicle (EV) Telematics

The surge in EV adoption creates strong demand for telematics that manage battery performance, charging schedules, and energy optimization. These integrations empower consumers with real-time insights, fostering efficient and sustainable vehicle operation.

2. AI-Driven Telematics and OTA Upgrades

Artificial intelligence enhances telematics through predictive maintenance, route optimization, and personalized driver support. Meanwhile, Over-the-Air (OTA) updates enable automakers to remotely upgrade software, improve functionality, and introduce new services without physical intervention.

Regional Analysis

1. North America

With a 34.9% share valued at USD 8.4 Billion, North America leads the global market. Strong automotive infrastructure, high connected car adoption, and government mandates for safety and emissions propel regional growth, supported by key players and advanced R&D initiatives.

2. Asia Pacific

The Asia Pacific region is witnessing rapid expansion, fueled by technological advancements, rising automotive production, and growing consumer demand in China, Japan, and India. The integration of telematics into mass-market vehicles reflects the region’s transition toward smart mobility ecosystems.

Recent Developments

- Jun 2025: Vela acquired Redd to expand asset management capabilities and enhance service offerings.

- Jan 2025: Netradyne raised USD 90 million in Series D funding to strengthen AI-powered fleet management and safety solutions.

- Feb 2024: Haomo.ai secured USD 14 million in Series B funding for autonomous driving technology development.

- Apr 2023: LightMetrics raised USD 8.5 million to scale its video telematics platform for fleet safety.

- Mar 2024: Targa Telematics launched enhanced post-acquisition fleet solutions, boosting market competitiveness.

- Feb 2025: Karma Automotive acquired Airbiquity assets to bolster connected vehicle capabilities.

Conclusion

The Global Passenger Vehicle Telematics Market is entering a high-growth era, driven by technological innovation, regulatory mandates, and consumer demand for connectivity. With AI integration, 5G connectivity, and EV expansion, telematics is shaping the future of mobility. As automakers and tech providers collaborate, the market is poised to deliver smarter, safer, and more efficient transportation experiences worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)