Table of Contents

Introduction

According to Payment Processing Solutions Statistics, Payment processing solutions are pivotal in today’s financial systems, acting as the foundation for safe and efficient money transfers among individuals, enterprises, and financial institutions. They facilitate the convenience of cashless transactions, simplify global trade, and prioritize safeguarding data in our increasingly digital world.

The evolution of payment processing, progressing from primitive barter systems to contemporary innovations like mobile payments and cryptocurrencies, has reached significant milestones while consistently adjusting to meet the evolving needs of both consumers and businesses.

In the current digital era, payment processing solutions are continually progressing, incorporating state-of-the-art technologies to guarantee the smooth and secure movement of funds, effectively reshaping our approach to managing financial transactions.

Editor’s Choice

- In 2020, the point of sale (POS) software market generated approximately USD 15.57 billion in revenue, and this upward trajectory continued into 2021 when it reached USD 17.66 billion.

- The global online payment gateway market is poised for significant expansion, projected to surge from USD 26.79 billion in 2022 to USD 198.9 billion by 2032, maintaining a consistent annual growth rate of 22.2% throughout the forecast period.

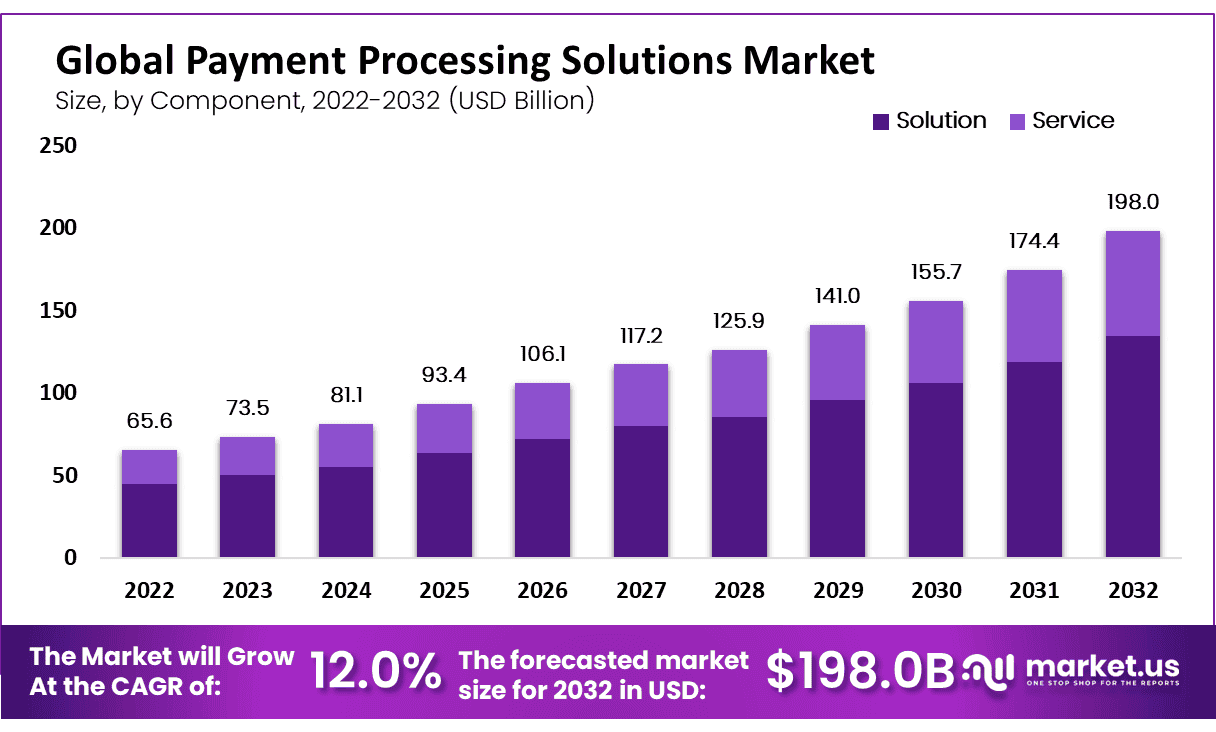

- The payment processing solutions market is experiencing robust growth, evidenced by its steady CAGR of 12.0%.

- In 2022, the payment processing solutions market generated a substantial revenue of USD 65.6 billion.

- The global non-cash transaction volume increased from 471.2 billion in 2018 to 539.6 billion in 2019, emphasizing the growing shift towards digital transactions.

- By 2028, business-to-business (B2B) payments will reach $200 trillion. This indicates a significant transformation in how businesses handle transactions.

- The United States faced payment fraud losses totaling $8.14 billion in 2020, highlighting the importance of security in payment processing.

- China led the way with mobile payments, reaching a staggering $178 trillion in 2020, showcasing the shift towards cashless transactions.

- Nearly 70% of consumers in the United States used mobile banking in 2020, reflecting the trend toward digital financial services.

- Digital wallets are predicted to make up 52% of global e-commerce transactions by 2023, indicating a growing preference for this payment method.

Types of Payment Processing Solutions

Point of Sale (POS) Systems

- The point of sale (POS) software market has shown remarkable growth in recent years, as reflected in its revenue figures.

- In 2020, the market generated approximately USD 15.57 billion in revenue, and this upward trajectory continued into 2021 when it reached USD 17.66 billion.

- The year 2022 saw further expansion, with revenue climbing to USD 20.13 billion.

- Projections for the following years indicate a continued upward trend, with the market expected to generate USD 23.07 billion in 2023, USD 26.59 billion in 2024, and USD 30.86 billion in 2025.

- As we look ahead, the POS software market is anticipated to experience substantial growth, with revenue forecasts reaching USD 36.07 billion in 2026 and USD 42.50 billion in 2027.

Online Payment Gateways

- The global online payment gateway market is poised for significant expansion, projected to surge from USD 26.79 billion in 2022 to USD 198.9 billion by 2032, maintaining a consistent annual growth rate of 22.2% throughout the forecast period.

- In the realm of global online payments for the year 2022, digital wallets emerged as the dominant player, commanding a significant share of 49%.

- Credit cards followed at 20%, while debit cards accounted for 12% of online transactions.

- Account-to-account (A2A) payments claimed a 9% share, reflecting their growing popularity.

- The “Buy now, pay later” (BNPL) model contributed 5%, offering consumers flexible payment options.

- Cash on delivery (COD) and PrePay comprised 2% and 7% of the online payment landscape.

Mobile Payment Solutions

- In the mobile contactless payments market, the adoption rates in various countries witnessed notable changes between 2019 and 2022.

- China led the pack with a significant increase, soaring from 81.1% in 2019 to 87.3% in 2022.

- India, too, experienced more modest growth, with adoption rising from 37.6% to 40.1%.

- South Korea saw a noteworthy increase from 36.7% to 45.6%, demonstrating a growing affinity for mobile contactless payments.

- The United States and Canada showcased substantial jumps from 29% to 43.2% and 26% to 29.1%, respectively.

- Japan and Italy followed suit, with adoption rates climbing from 25.3% to 34.9% and 21.1% to 25.9%, respectively.

Contactless Payments

- According to RBR Global’s forecast, over 80% of consumer credit cards will incorporate contactless payment technology by 2026.

- However, this represents a growth rate of approximately 119% from the current usage level, notably lower than the projected 221% increase in overall contactless payments during the same period.

- Payments-enabled wearable devices are anticipated to drive significant growth in contactless adoption.

- Furthermore, a projected increase in payments-enabled smartphones will be 99% by 2027.

Global Payment Processing Solutions Market Size

- The payment processing solutions market is experiencing robust growth, evidenced by its steady CAGR of 12.00%.

- In 2022, the market generated a substantial revenue of USD 65.6 billion.

- This positive momentum is expected to continue, with projected revenues of USD 73.5 billion in 2023, USD 81.1 billion in 2024, and USD 93.4 billion in 2025, reflecting a clear upward trajectory.

- The market is anticipated to reach USD 155.7 billion in 2030, USD 174.4 billion in 2031, and a remarkable USD 198 billion in 2032.

Transaction Volume Statistics

- Global revenue and transaction growth bounced back from the 5% decline caused by the pandemic in 2020 and reached a new high, totaling $2.1 trillion.

- When considering the 11% increase in 2021, the overall revenue growth over the past two years averaged 3%, which, while below the long-term trend, exceeded the concerns of many.

- This resilience in the payments industry was evident as electronic payment transactions increased by 19% in 2021, aligning with the growth rates seen before the pandemic.

- Global e-commerce, mainly driven by China, witnessed substantial growth of around 17%, making up approximately half of global retail e-commerce sales.

Regional Variances in Payment Processing Solutions

Asia Pacific

- The Asia Pacific region is poised to witness a substantial surge in real-time payment transactions, with volumes expected to grow significantly from 49.2 billion in 2022 to 96.2 billion by 2027.

- This growth reflects a noteworthy compound annual growth rate (CAGR) of 14.1%.

- Globally, 2022 saw a remarkable increase in real-time payment transactions, totaling 195 billion, marking an impressive year-on-year growth of 63.2%.

- Particularly noteworthy is Indonesia, a major country in the region, which has recently embraced real-time payments (RTP) and is set for rapid expansion with an exceptional CAGR of 81.9% anticipated between 2022 and 2027.

- This positions Indonesia’s BI-FAST as one of the world’s fastest-growing and most successful RTP systems, with crucial ISO 20022-based real-time infrastructure provided by ACI.

- In Malaysia, the RTP volume is projected to grow substantially, with a CAGR of 19.7% expected from 2022 to 2027.

North America

Payment Methods for Online Purchases in North America

- Online shoppers in North America utilize various payment methods to purchase online.

- The most prevalent method is card-based payments, accounting for 63% of all online transactions. E-wallets are also widely used, comprising 27% of online purchases, providing consumers with a convenient and secure digital payment option.

- Bank transfers are chosen for 6% of transactions, offering an alternative to traditional card payments.

- Though less common, cash payments still contribute to 1% of online purchases.

Credit Card Market Share in North America

- Within North America’s credit card market, there is a market share distribution among various providers.

- Visa is dominant, commanding 56% market share, making it the region’s most widely used credit card provider.

- Mastercard follows with a 24% market share, also holding a significant presence in the North American credit card landscape.

- American Express captures a noteworthy 9% market share, catering to a specific segment of consumers who value its premium services.

- Furthermore, local and specialist credit card providers collectively contribute 11% of the market share, offering specialized options and catering to niche markets.

Europe

- In 2021, the Eurozone witnessed a substantial rise in non-cash transactions, marked by a 12.5% increase in the total number of transactions, reaching 114.2 billion, and a remarkable 18.6% surge in the total value, which amounted to €197.0 trillion compared to the previous year.

- Card payments notably constituted 49% of the total transactions, while credit transfers and direct debits accounted for 22% and 20%, respectively.

- More specifically, credit transfers within the Eurozone grew by 8.6% to 25.1 billion, amassing a total value of €184.2 trillion, with electronic initiation becoming increasingly prevalent.

- Direct debits also saw an uptick of 5.8% to 23.2 billion, totaling €7.3 trillion.

- Card transactions similarly experienced a substantial increase of 17.3% to 56.3 billion, with a cumulative value of €2.3 trillion, resulting in an average of approximately €40 per card transaction.

Middle East & Africa

- Even before the outbreak of the COVID-19 pandemic, digital payments were on a rapid rise in the United Arab Emirates (UAE) and Saudi Arabia.

- In the UAE, consumer digital payment transactions grew by over 9% annually between 2014 and 2019, outpacing Europe’s average yearly growth of 4 to 5%.

- Saudi Arabia witnessed even more astonishing growth, with card payments surging by a staggering 70% between February 2019 and January 2020.

- The pandemic further fueled this trend. According to a survey conducted by McKinsey among payment experts, 80% of respondents estimated that non-cash payments in the region had surged by more than 10% due to the pandemic, with 43% believing that the increase exceeded 20%.

- Notably, in some countries like Saudi Arabia, digital point-of-sale (POS) transactions doubled in the year leading up to January 2021.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)